Today: Uniswap plots DUNI

2025-08-12

Bitcoin’s dominance ticked up 0.4 percent to 60.67 percent, while the Altcoin Index slid to 30 — the lowest in months. Translation: alts are still bleeding, but the majors are holding the line.

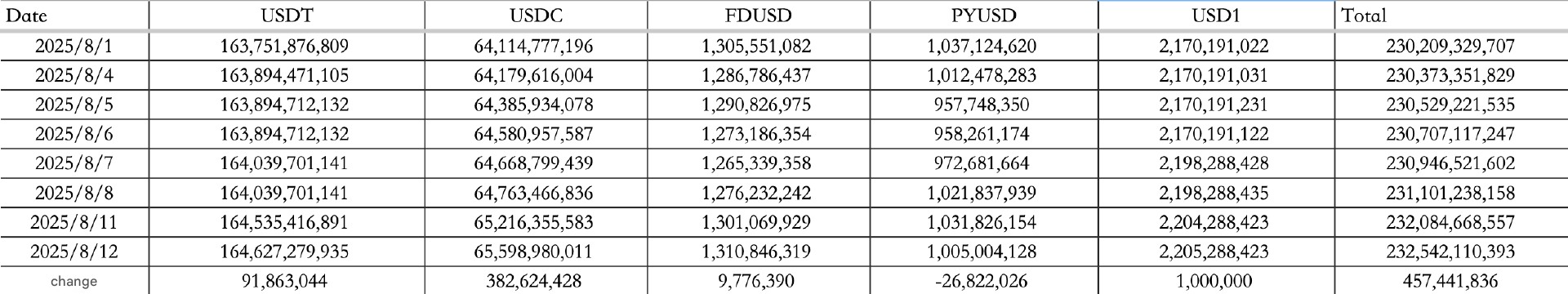

Stablecoins saw $457M in inflows, with USDT adding $92M and USDC adding $383M, bringing the total to $232.542B.

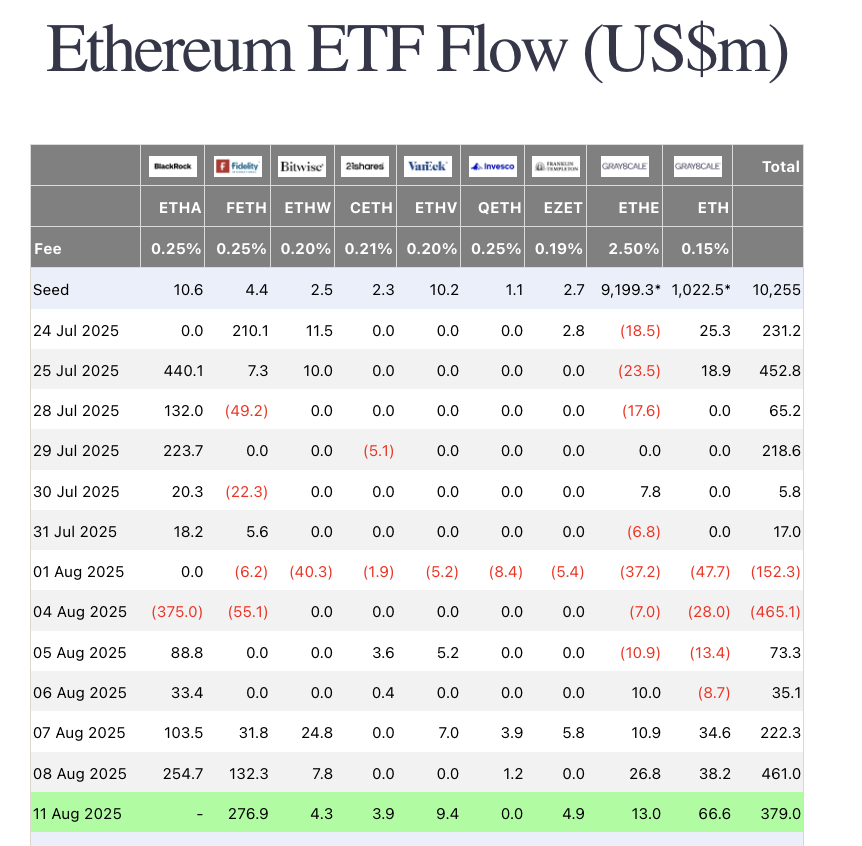

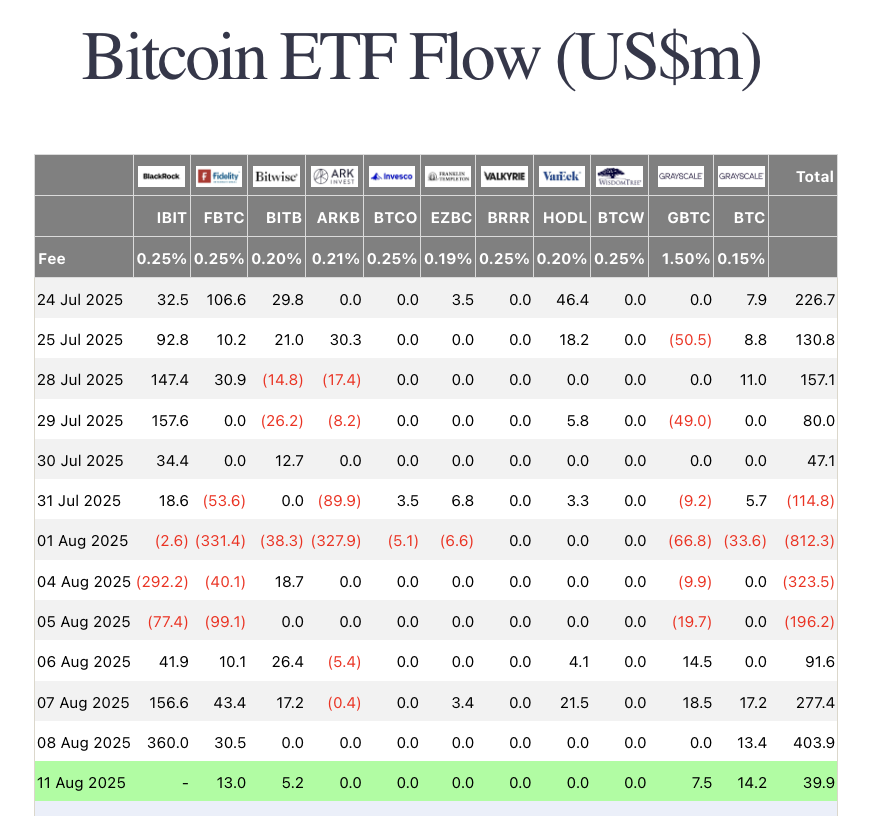

ETF flows were mixed. Without BlackRock data, BTC ETFs still managed $40M in inflows on August 11, while ETH ETFs brought in $379M. Ethereum’s treasury holdings across strategic funds now total 3.04M ETH (2.51 percent of supply), and ETH ETFs themselves hold 5.91M ETH (4.89 percent of supply).

ETH whales get bolder

ATNF just closed a $425M private raise to fuel an ETH-heavy treasury strategy managed by Electric Capital, aiming to beat standard staking yields through a mix of staking, lending, and liquidity provision.

SBET locked in $400M from five global institutions, while BMNR claimed the crown as the largest ETH reserve holder in the world, sitting on 1,150,263 ETH. The signal is clear: big money still wants ETH exposure, and they are structuring it for yield.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Oh, and if you start trading ETH now, you get 2.7% APR. Run, don't walk.

Macro calm, policy moves

U.S.–China tariffs got a 90-day pause, pushing the next deadline to November 9. Meanwhile, NVDA and AMD agreed to hand over 15 percent of their China chip sales revenue to the U.S. government in exchange for looser export restrictions.

Peter Thiel-backed Bullish is also making moves, boosting its IPO target to $4.82B and aiming to raise nearly $1B in its latest filing.

WLFI’s $500M ambition and the alt ETF whisper

WLFI, the Trump-linked crypto project, is now openly courting institutional capital with a target to raise $500M for its own tokenized finance products. Insiders say part of the push is to position WLFI as the “RWA bridge” for politically aligned funds — and the SEC’s recent in-kind ETF approvals could fast-track that play.

Here we go!!! $ALTS 🚀🚀 https://t.co/FRMWfHxtVo

— Eric Trump (@EricTrump) August 11, 2025

WLFI already has strategic ties to Falcon Finance, and with tokenized dollar markets heating up, this is less a meme pump and more a potential front-run on altcoin ETF narratives. If they get even half the target, liquidity shockwaves could spill into LST, RWA, and DeFi yield markets tied to ETH.

Solana’s AI coins rip, BAGS beats Letsbonk

On August 11, old-guard Solana AI tokens like AVA, ARC, SWRAMS, and GRIFFAIN all pumped over 20 percent. The Solana meme launchpad BAGS pulled in $3.95M in revenue over the past week, beating Letsbonk’s $2.16M, though Pump.fun still dominates with $8.58M.

Alpha watch: Uniswap eyes fees

The Uniswap Foundation proposed creating a new Wyoming-based legal entity called DUNI under the state’s “Decentralized Unincorporated Nonprofit Association” framework. This could clear the path to turn on protocol fees, sending a cut of LP fees to the DAO treasury.

On the degenerate end, KOL Ansem says the meme crowd will not fully return until a fresh launch hits a $500M market cap within 48–72 hours of listing. His take: the trenches need a spark.