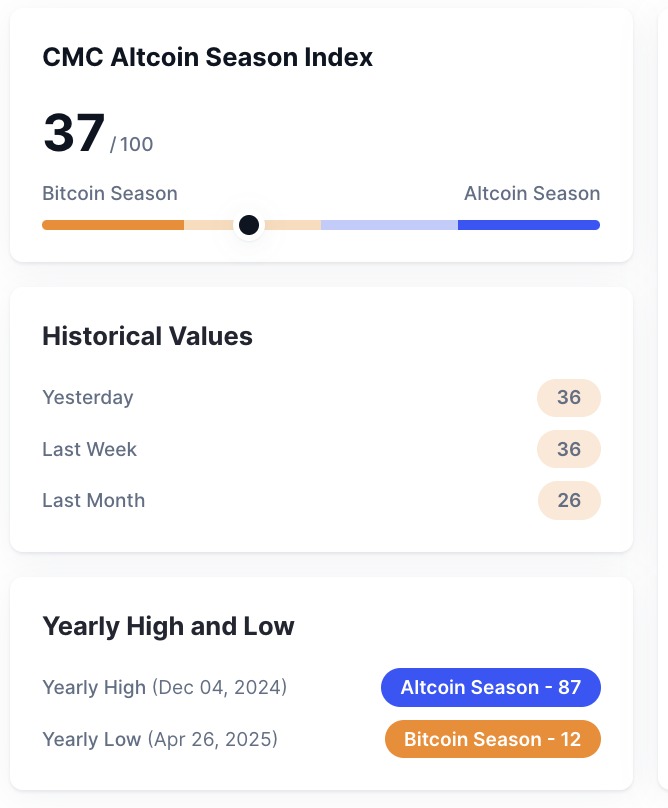

The markets are tense, the macros are murky, and the whales are starting to split again. Bitcoin dominance fell slightly to 61.67 percent, while the Altcoin Index held at 37, keeping most majors pinned in range-bound limbo.

But behind the scenes, liquidity is moving fast.

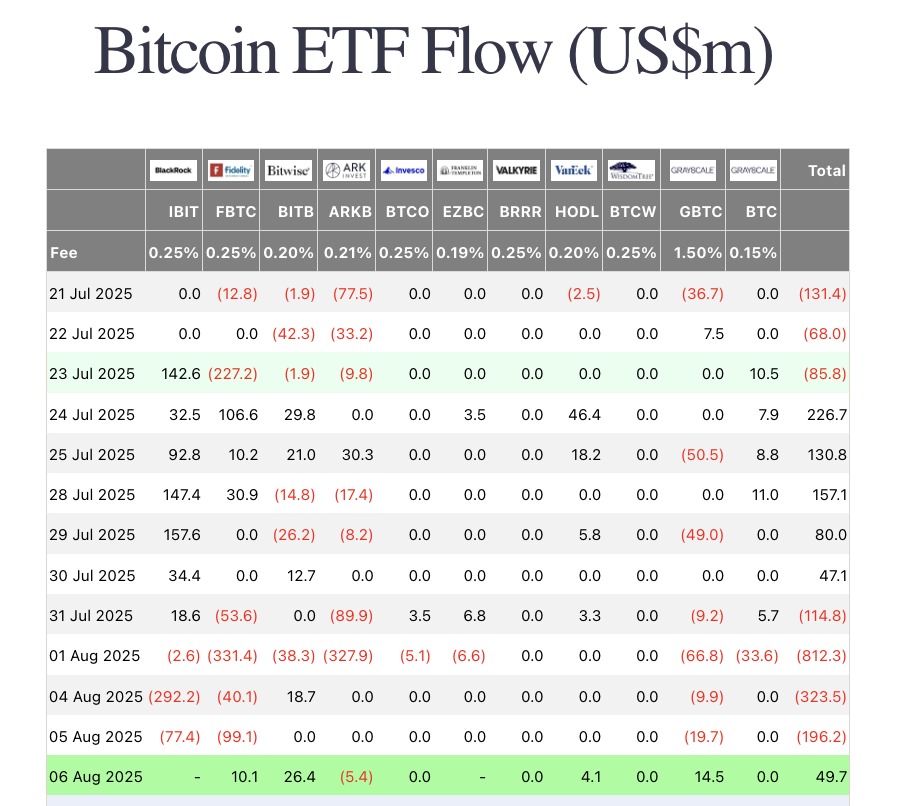

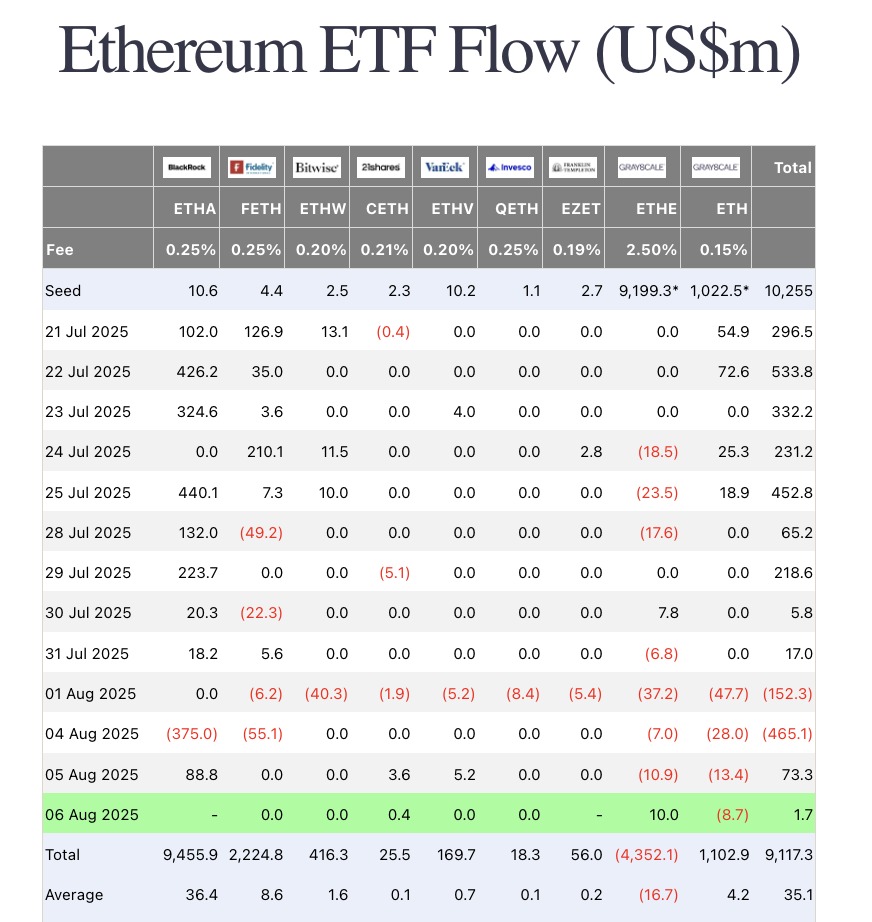

ETH ETFs bounce back while BTC flows reverse

On August 5, BTC ETFs saw $196M in outflows, while ETH ETFs brought in $73M in inflows, marking a pivot in risk appetite. ETH may not be pumping yet, but institutions are clearly back on the prowl.

Stablecoin inflows also surged, with $239M entering the system, driven by $145M from USDT and $88M from USDC, bringing total stablecoin supply to $230.95B.

ETH bulls like LD Capital's Yi Lihua say this is the pre-game. They expect a rally into September as rate cut speculation builds. LD’s Trend Research team still holds over 105,000 ETH, worth more than $354M.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Oh, and if you start trading ETH now, you get 2.7% APR. Run, don't walk.

Apple pumps, tariffs escalate, and GPT-5 arrives tonight

U.S. equities surged after Apple rallied 5 percent, announcing a new domestic manufacturing plan. Nasdaq rose 1.21 percent, while S&P and Dow also closed green.

Meanwhile, Trump slapped India with a second wave of 25 percent tariffs, raising the total to 50 percent on key imports. And in another power play, GPT-5 will officially launch at 1 AM Beijing time, with Truth Social now testing its own “truth-seeking AI” as well.

Because of course it is.

PancakeSwap lists U.S. stock perps

The story of the day? PancakeSwap launched U.S. stock perps, starting with AAPL, AMZN, and TSLA, tradable during U.S. market hours with up to 25x leverage.

Wall Street is now fully onchain. Trade accordingly.

SEC clears Lido and hints at broader LST expansion

In a move that could reshape staking in the U.S., the SEC clarified that stETH and similar receipt-style LSTs are not securities, removing a key barrier for centralized integrations.

Lido quickly responded, calling this “long overdue clarity.” Expect more fintech apps and CEXs to integrate stETH now that regulatory fog is lifting.

Also worth noting: Linea’s native ETH staking rewards are handled via Lido, meaning more institutional flow could quietly enter through these Layer 2 yield pipes.

Alpha watch: Linea hints, Orca moves, Vitalik declares ZK victory

Vitalik just called for the industry to abandon Optimistic rollups, stating that the cost and maturity of ZK tech has caught up. In his words, we are heading toward L1-to-L2 native asset transfers in near real time, without the current multi-day withdrawal delays.

Joseph Lubin, speaking on the Linea podcast, teased that Linea’s TGE date may be “42”, likely a Hitchhiker’s joke. Still, he hinted that more Consensys-backed tokens are coming. Holders may get staking features when the token launches.

In the meantime, Linea’s daily spin-to-earn reward game is live, giving users one free chance per day to earn ETH, USDC, and more.

Orca’s council also dropped a vote to use 55,000 SOL to buy back ORCA and restake it with validator nodes. If passed, this could drive sustained yield boosts and new governance control over liquidity.

Also on radar: Kaito’s launchpad wars, backpack’s SEI airdrop, and the ongoing market-wide arms race around future staking yields.

Final word

ETH ETF flows are back. Stables are flowing. GPT-5 launches in a few hours. And Vitalik just declared Optimistic rollups obsolete.

Stay nimble. Stay weird. This week is not going to be boring.