The market holds its breath

The crypto market is playing a waiting game, but underneath the surface, things are starting to stir.

While Bitcoin and Ethereum ETFs saw outflows of $30 million and $90 million respectively on August 4, it's worth noting BlackRock had the day off and wasn't part of that tally.

Bitcoin's dominance took a noticeable 1.18% dip, and the CMC Altcoin Season Index now sits at 43, suggesting a growing appetite for assets beyond the top dogs.

Adding to this, the stablecoin market saw a net inflow of $156 million, with USDC leading the charge by bringing in over $206 million. The total stablecoin supply is now a hefty $230.53 billion.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Oh, and if you start trading ETH now, you get 2.7% APR. Run, don't walk.

A look at the big picture

Wall Street had a stellar day, with the Dow Jones, Nasdaq, and S&P 500 all posting significant gains of 1.34%, 1.95%, and 1.47% respectively.

Nvidia even clawed its way back to the $180 mark with a 3.62% jump. In the background, all eyes are on the Federal Reserve.

The market is now pricing in a 94.4% chance of an interest rate cut this September, a development that has traders feeling optimistic.

Keep an eye on August 7, which is the deadline for tariff negotiations; a failure to reach an agreement could introduce some unwelcome volatility into the market.

Meanwhile, the 10-year US Treasury yield dipped slightly to 4.198%, and gold saw a modest increase of 0.52%.

Following the money in crypto

Institutional players are making some interesting moves. The so-called "SOL microstrategy" continues to gain traction. DeFi Dev Corp (DFDV) announced it has added another 110,466 SOL to its holdings, bringing its total to over 1.29 million SOL, valued at roughly $209 million.

Not to be outdone, Nasdaq-listed ARTL has raised $9.475 million to pursue its own SOL strategy. Ethereum also saw a significant vote of confidence, with one institutional address scooping up $50 million worth of ETH through OSL at an approximate price of $3,570 per coin.

Elsewhere, VERB experienced a massive trading volume surge, about nine times its circulating supply, after announcing it would build a $558 million treasury for TON.

Hot topics across the industry

Pump.fun is testing a new "rewards" feature and has a trading volume incentive program on the horizon.

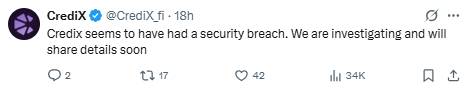

The DeFi platform Credix also suffered an attack, resulting in a loss of approximately $450 million.

What we are watching now

A few things on our radar for the alpha hunters. There's chatter that the Linea TGE and airdrop checker were slated for mid-August, potentially between the 15th and 22nd, though current market conditions might lead to a change in plans.

This has us thinking about the ve33 model, especially after the success of Aero on Base.

Finally, an interesting take is circulating that compares the recent institutional buying of ETH to a similar pattern seen in BTC before its run to $120k, suggesting the current market action is a large-scale shakeout and accumulation phase.