Today: ETH breaks $500B

2025-08-11

The market is flirting with $4T total cap, but the real story is Bitcoin’s grip loosening. Dominance has dropped to 60.42 percent, the lowest in weeks.

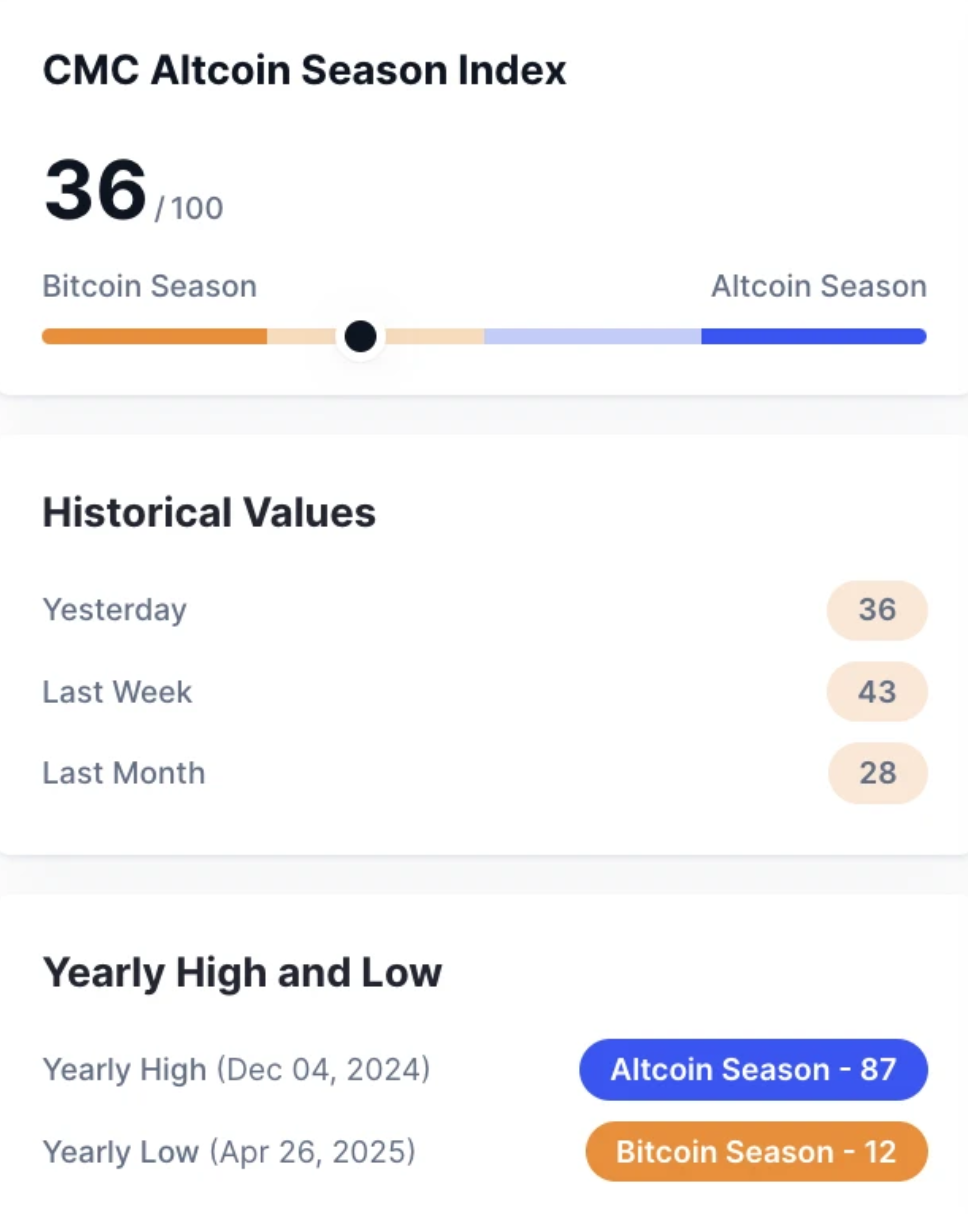

The Altcoin Index is holding at 36; not breakout territory, but definitely the quiet-loading zone before someone lights a match.

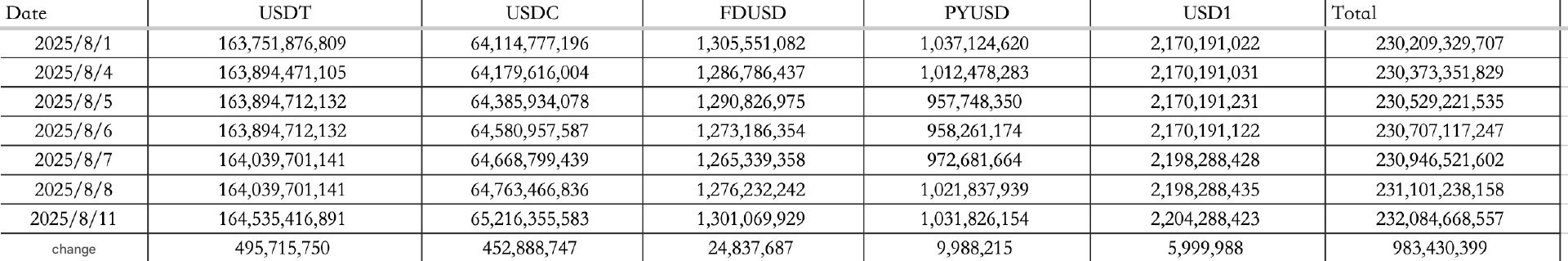

From August 8–11, stables came in hot with $983M in net inflows. USDT added $496M, USDC added $453M, bringing the total stablecoin pile to $232.085B.

That’s dry powder waiting for the right chart to smack.

ETH joins the $500B club

Ethereum just crossed half a trillion in market cap, which means certain U.S. states can legally start shoveling public funds into it. If Texas, Oklahoma, or New Hampshire decide to ape, we could see a quiet institutional wave forming.

On Polymarket, odds of ETH hitting a new ATH in 2025 are now 74 percent. The “ETH flippening” crowd is back in full cope mode, but Arthur Hayes just joined their side of the table.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Oh, and if you start trading ETH now, you get 2.7% APR. Run, don't walk.

Hayes goes from bear to buyer in two hours

Earlier this month, Hayes called for ETH to bleed to $3K. Now? He just redeployed $14.8M USDC, grabbing 1,250 ETH, 424K LDO, 420K ETHFI, and 92K PENDLE in a lightning raid.

Had to buy it all back, do you forgive me @fundstrat ?

— Arthur Hayes (@CryptoHayes) August 9, 2025

I pinky swear, I'll never take profit again.

😘😘😘😘😘 pic.twitter.com/jRWfaCEPE6

Not everyone’s playing bullish. 1inch’s fund hit the sell button on 5,000 ETH at $4,215 and 6.45M 1INCH at $0.28, banking clean profits from their 2024 buys.

Welcome back to casino mode

Traders are saying it out loud: “if there’s a narrative, it will pump.” Case in point: SOON doubled in 24 hours to $0.518, now sitting on a $124M market cap. The memescape feels forgiving again, which means it’s either early or dangerously late.

Under the hood, DeFi TVL tells a different story. Late 2021 ETH TVL was $11.1B with barely any staking. Today it’s $38.2B, and EigenLayer alone is $19.4B.

The structure of liquidity has changed — and so has what “high TVL” actually means.

Free money still exists (for now)

A Polymarket combo-arb strategy just printed $40M in profits in a year, proving the inefficiencies are still juicy if you’ve got the guts (and capital) to farm them.

On the flip side, trader James Wynn dropped a savage breakdown of turning $3M into $100M...then losing it all in public. His advice? Leverage and ego are a death combo. Survive long enough, and the money will always come back around.

There's no such thing as mistakes, only lessons.

— James Wynn (@JamesWynnReal) August 10, 2025

Absolutely anything in life that has been deemed as a mistake or failure for me, i have ALWAYS used them to learn from.

The greatest lesson recently was flipping $3m into $100m. And then losing it all for the world to see.

It…