The market continues its sideways shuffle, but don't let the quiet fool you. Underneath the surface, the tides are shifting.

Bitcoin is flexing its muscles again, with its market dominance climbing by 0.66% to a commanding 66.95%. While BTC reclaims its throne, the altcoin index sits at a modest 42, suggesting traders are feeling a bit risk-off.

The overall crypto market cap took a slight 1.60% dip, now resting at $3.71 trillion, though the 24-hour volume saw a healthy 6.49% pop to $146.29 billion.

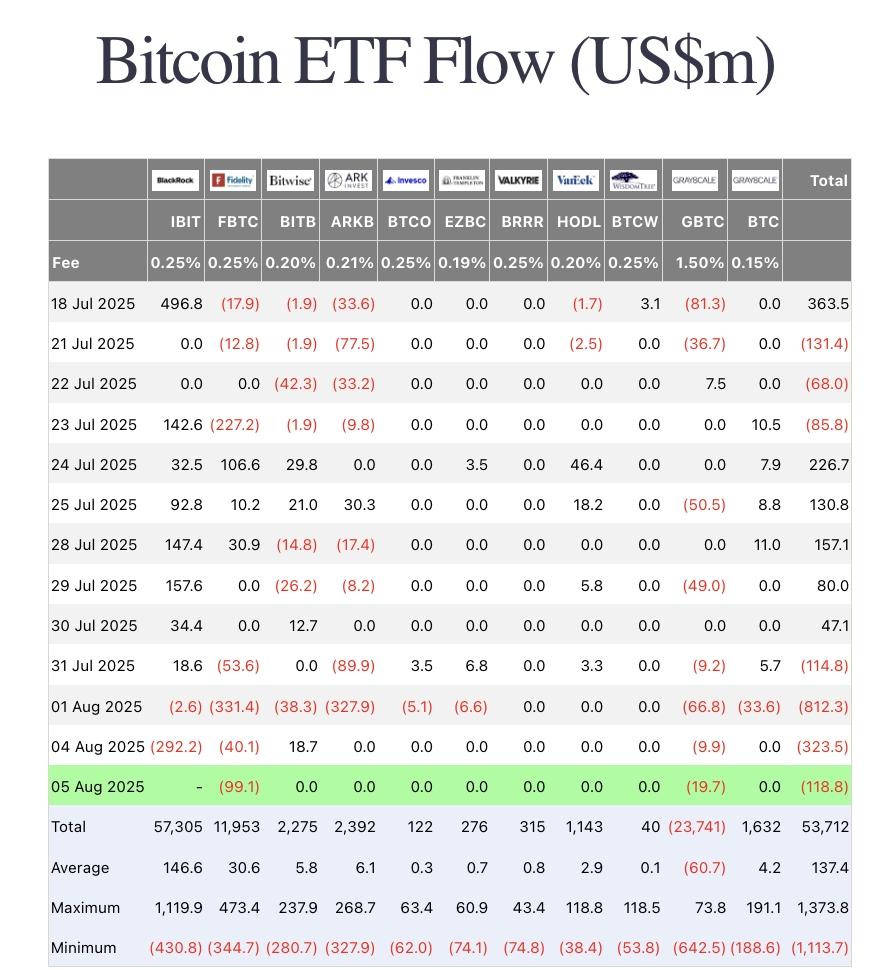

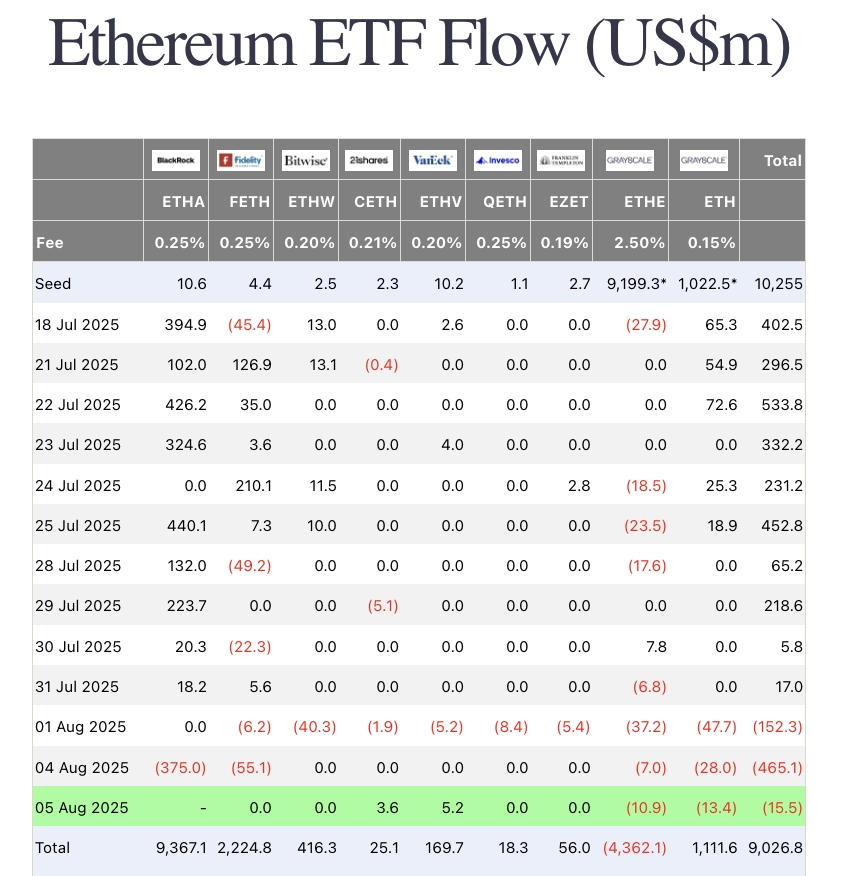

Meanwhile, the ETF story got a little less exciting. Both Bitcoin and Ethereum ETFs saw significant outflows on August 4, with $322 million leaving BTC products and a hefty $465 million exiting ETH funds.

It seems the initial hype is meeting the hard reality of traditional market sentiment. On the stablecoin front, however, there was a net inflow of $178 million on August 6, with USDC leading the charge by adding $195 million to its coffers.

How to start trading Bitcoin

Bitcoin’s the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Regulatory winds are changing, maybe

In a move that caught many by surprise, the SEC announced that liquid staking activities for crypto are not considered securities. This is a monumental clarification that could pave the way for long-awaited spot Ether and Solana staking ETFs.

Not to be outdone, the CFTC mentioned it's looking into allowing spot crypto trading on its registered futures exchanges, a move aimed at fulfilling President Trump's goals for the industry.

It appears the regulatory bodies are finally starting to provide some semblance of clarity, which is more than we could say a year ago.

In other policy news, the White House is now considering a change to how Bitcoin mining profits are taxed, potentially eliminating a pesky double tax situation.

What big money is doing

We saw institutional players making some moves today. Galaxy Digital posted a tidy net profit of $30.7 million for the second quarter, a significant turnaround from its previous losses. The firm is sitting on $1.2 billion in cash and stablecoins and saw its assets under management swell by 27% to $9 billion.

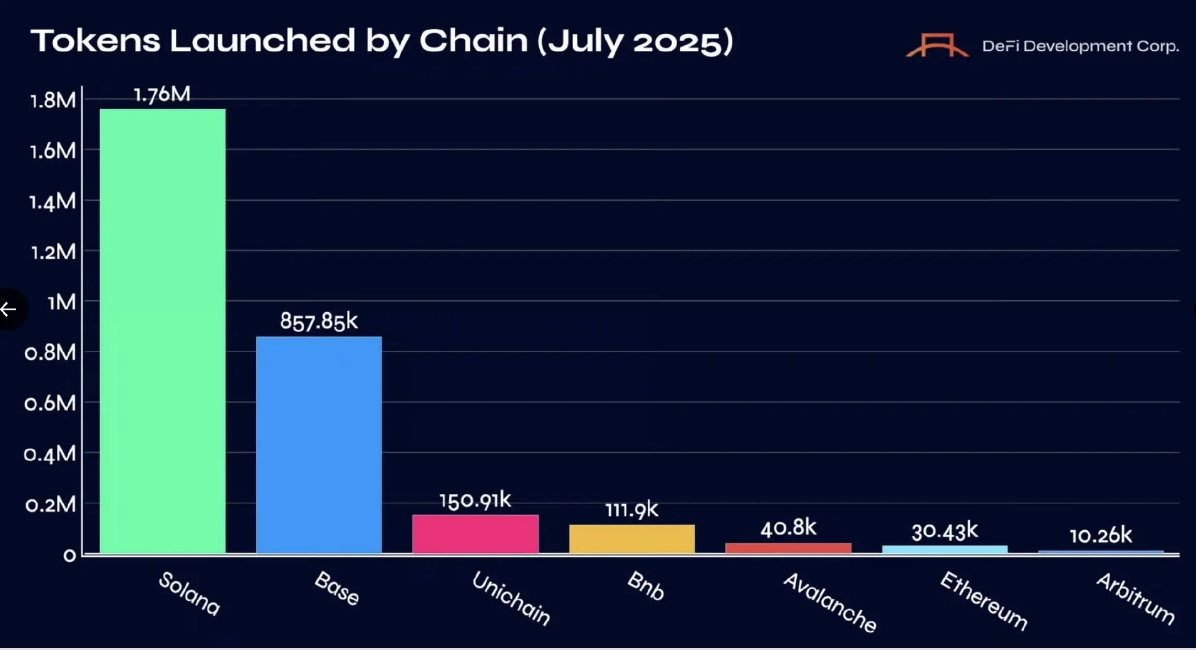

Solana remains the darling of token creation, launching a staggering 1.76 million new tokens in July, far outpacing the runner-up, Base, which saw 857,800.

Chain reactions