It’s not every day that a government agency lays out a welcome mat for crypto, but that’s what seems to be happening.

While the market sends mixed signals with money flowing out of Bitcoin ETFs, the U.S. Securities and Exchange Commission is busy drafting a plan to make America the “world’s crypto capital.”

The view from Washington

The biggest story is the SEC's "Project Crypto" initiative, announced by Chairman Paul Atkins. The goal is ambitious: to push all markets onto the blockchain.

This plan aims to transform the regulatory landscape with several key proposals:

-

Clearer rules for securities: The project will establish clear standards for classifying crypto assets, which should help new tokenized securities launch in a compliant manner.

-

Freedom for custody: It will safeguard the right for users to self-custody their assets and relax custody rules to create more choices in the market.

-

Smarter licensing: A new "Reg Super-App" license is being introduced to cut down on redundant regulatory processes.

-

Support for DeFi: The policy will distinguish between systems with and without intermediaries, offering protections for DeFi developers.

-

A space for innovation: An experimental pathway will be created to support the development of compliant token standards.

Adding to the political intrigue, President Donald Trump has indicated he will announce a candidate for a vacant Federal Reserve governor position in the coming days and a new head for the Bureau of Labor Statistics within three to four days.

Following the money

The on-chain data and fund flows paint a more complicated picture.

Last week, U.S. based spot Bitcoin ETFs experienced a cumulative net outflow of $642.9 million. In a surprising contrast, U.S. spot Ethereum ETFs saw a net inflow of $154.3 million over the same period.

This divergence comes as Bitcoin's market share has dipped to 62.06%. The altcoin season index has subsequently crept up to 41, suggesting some capital may be rotating away from the market leader.

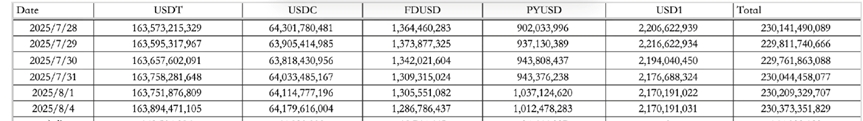

A look at stablecoins data shows the total supply increased by a modest $230 million over the past week.

How to start trading Bitcoin

Industry intel

Trump Media & Technology Group (TMTG) officially detailed plans for a Truth brand utility token and digital wallet in a recent SEC filing.

The token will initially be part of a rewards program and can be used for Truth+ subscriptions, with plans for broader use across the ecosystem later.

While not explicitly called a cryptocurrency, the filing's language suggests it will be built on blockchain infrastructure.

In legal news, a date has been set for the appeal of FTX founder SBF. The hearing will take place the week of November 3, 2025. SBF was previously convicted on seven counts and sentenced to 25 years in prison.