Today: Alt season whispers again

2025-08-13

Ethereum just broke the ceiling. Price ripped to $4,868, setting a brand new all-time high and blowing past the previous $4,868 peak from the last cycle. That puts ETH up more than 40 percent in the past month and cements it as the cycle’s institutional darling.

Meanwhile, Bitcoin dominance hit its lowest point since February 2025 at 60.42 percent, only 7.67 percent away from the December 2024 bottom. The Altcoin Index nudged up to 34, still 43 points off last cycle’s peak.

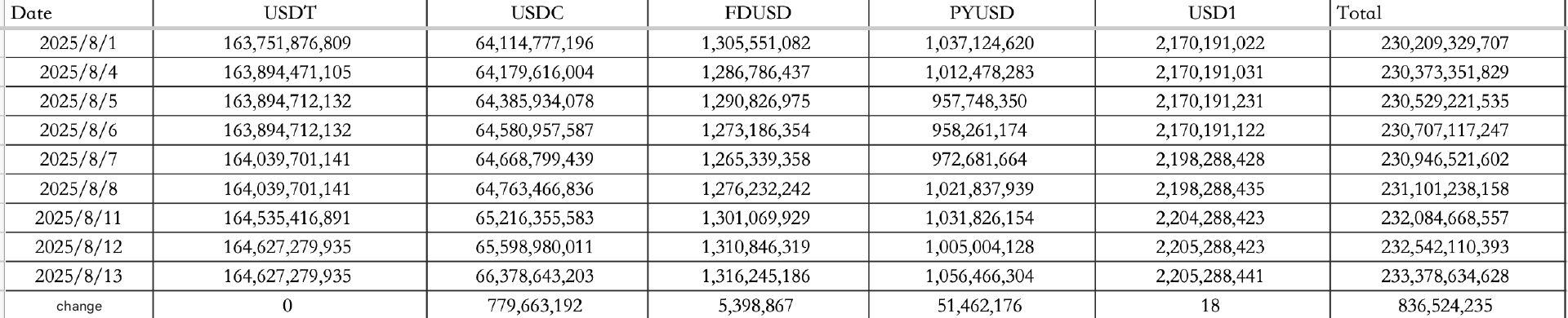

Stablecoins are pouring in. On August 13 alone, there was $837M in net inflows, with USDC accounting for $780M of that. Total stablecoin supply now sits at $233.78B.

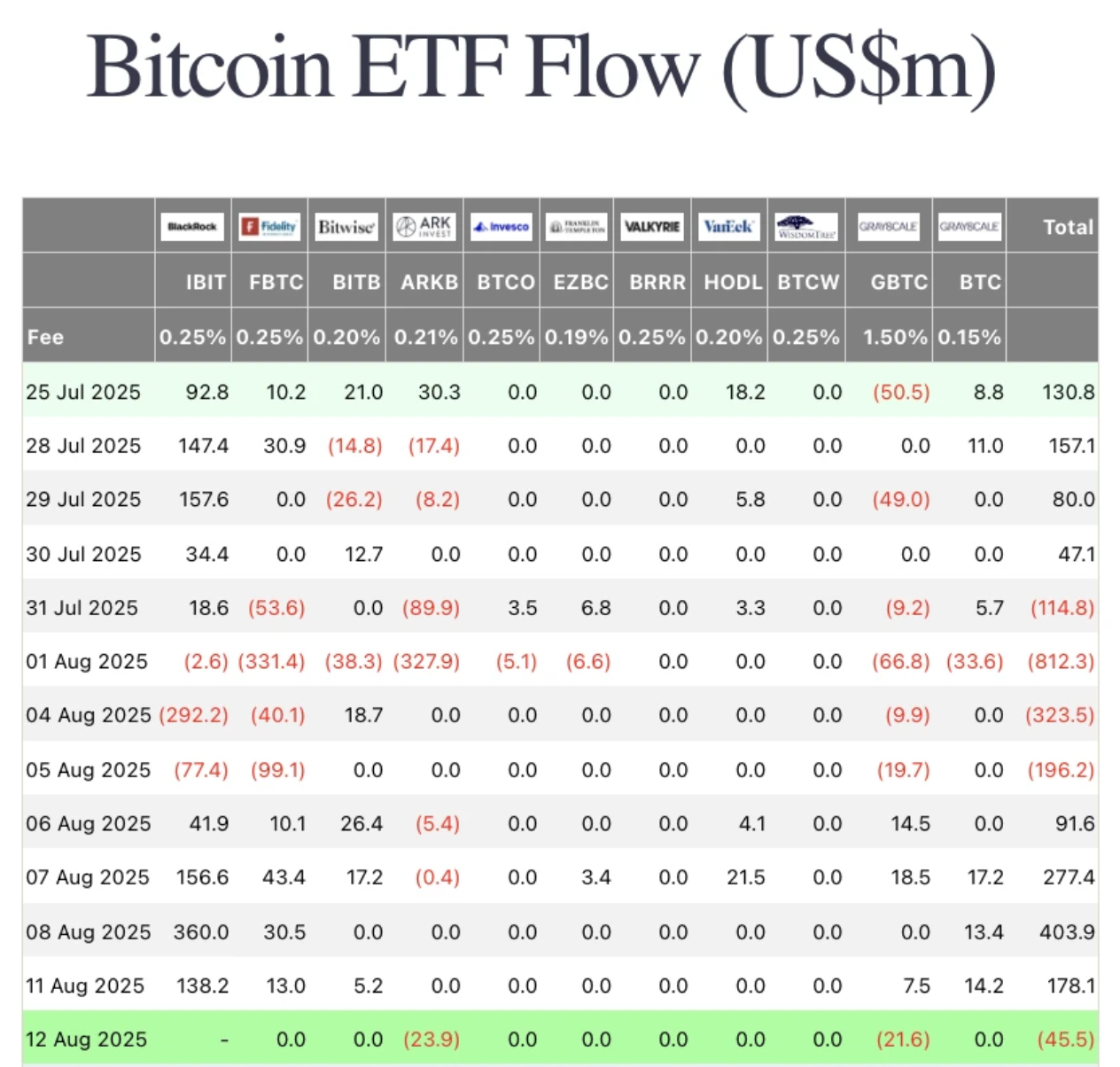

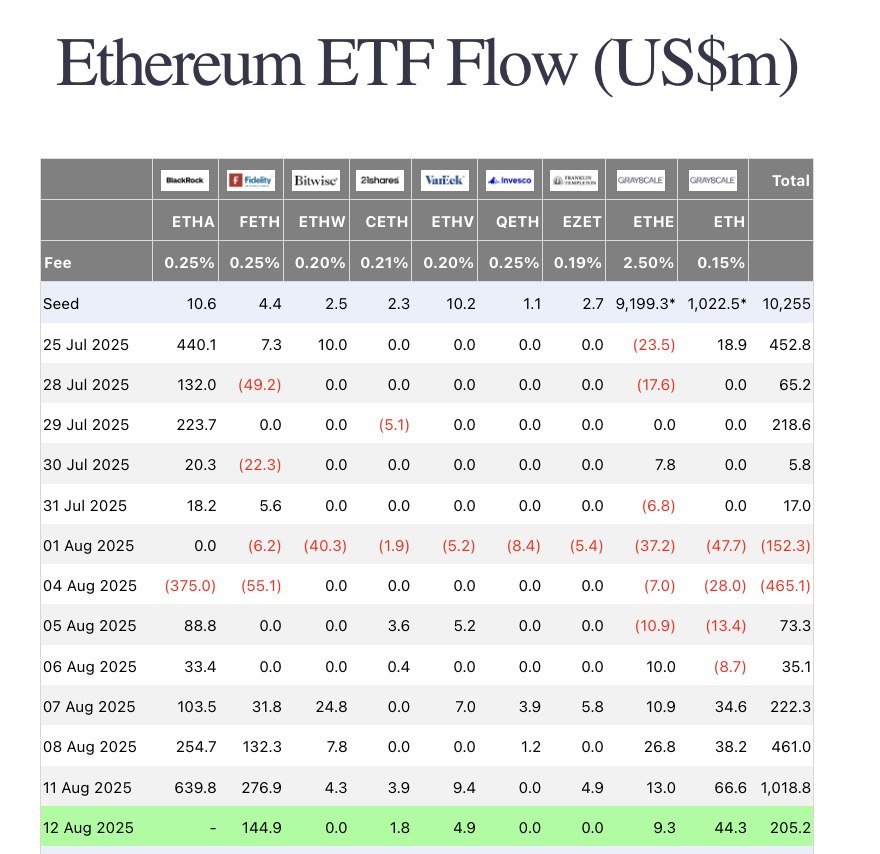

ETF flows were split. Without BlackRock’s numbers, BTC ETFs saw $45M in outflows, while ETH ETFs pulled in $205M.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Oh, and if you start trading ETH now, you get 2.7% APR. Run, don't walk.

Rates, lawsuits, and regulation

July CPI came in softer than expected, but core CPI matched forecasts, giving fresh ammo to the rate-cut crowd. U.S. Treasury Secretary Bessent said the Fed should consider a 50 bps cut in September, echoing sentiment from BlackRock’s latest report.

Treasury Secretary Scott Bessent suggested that the Fed ought to be open to a bigger, 50 basis-point cut in the benchmark interest rate next month, after having skipped a move at the last meeting https://t.co/7MsFWwLeyk

— Bloomberg (@business) August 12, 2025

Trump isn't backing down on his stance for Powell to cut. The President is now reportedly considering a lawsuit over the Fed chair’s handling of HQ renovations. Fed whisperer Nick Timiraos says a September cut is still on the table, unless inflation data suddenly flips.

On the regulatory side, SEC commissioner Hester Peirce said the agency is open to testing multiple tokenization models in live markets to see which sticks.

BMNR raises the stakes

Bitmine Immersion (BMNR) is going all in on ETH, boosting its raise to $20B to expand holdings. That’s on top of Arthur Hayes joining Solana treasury player Upexi’s advisory board, and Circle revealing that USDC circulation jumped 90 percent year-on-year in Q2 to $65.2B. Circle also teased its own Layer 1 blockchain, ARC, with native USDC gas and EVM compatibility, aiming squarely at Tether’s dominance.

51% attacks and NFT comebacks

Ethena became the sixth DeFi protocol to break $10B TVL, and the second non-staking protocol after Aave to do it. Meanwhile, Monero took a blow when the Qubic mining pool briefly controlled 52.72 percent of its hashrate, theoretically allowing double spends and censorship.

Over in NFTs, Moonbirds cracked the top 10 in Ethereum NFT market cap, with a floor price now over 3.2 ETH.

Alpha watch: Polymarket fixes, monad mainnet, and the countdown vibe

Polymarket rolled out a major oracle upgrade, replacing OOV2 with MOOV2 and introducing a whitelisted proposer system to reduce disputes and delays. Monad is prepping its mainnet, sparking speculation of retroactive rewards for early testers.

Veteran trader Eugene Ng Ah Sio says the vibe matches the late-stage Trump rally of last cycle: fast money, faster risk. “We’re close to the point where opportunities multiply by the day. The clock is ticking,” he warned.

Circle’s ARC testnet drops this fall, promising sub-second settlement, integrated FX engines, and optional privacy. With Tether moving on Stable and Plasma chains, the stablecoin Layer 1 arms race is officially on.