Here's what's happening today:

Tuesday’s headlines came in hot, but market reactions stayed cool. CPI met expectations, Powell’s grip on the Fed continues to weaken, and three major crypto bills just got booted from the House floor.

Meanwhile, stablecoins saw massive outflows, ETH whales shuffled their positions, and the penguins returned to Twitter—again. Let’s walk through it.

Crypto legislation stalls in Congress

In a disappointing but not entirely unexpected turn, the US House failed to pass a procedural vote that would have allowed three key crypto bills to move forward.

The Clarity Act, GENIUS Act, and the Anti-CBDC Surveillance State Act were all included in the package, but the vote came in at 196 in favor and 222 against.

That means no formal debate, no floor vote, and no progress, at least for now.

This sets back hopes for a clearer digital asset framework in the United States. Stablecoin regulation, securities classification, and CBDC guardrails were all on the table, and for now, all are off it.

CPI meets expectations, Powell sidelined

June’s CPI print came in right on target. Headline inflation matched estimates year-on-year and month-on-month, while core CPI actually came in slightly lower than forecast. It wasn’t exactly a bullish catalyst, but it confirmed what the market already suspected: the disinflation trend is still intact, and rate cuts are inching closer.

Meanwhile, political pressure on Fed Chair Jerome Powell continues to build. Treasury Secretary Bessent is now being floated as a potential replacement. Trump publicly said he was happy with Bessent’s current role but hinted the Fed chair transition would happen “at Trump speed.”

Translation? Powell’s days may be numbered.

DOJ closes investigation into PolyMarket

In what could be seen as a small regulatory win for DeFi, the US Department of Justice has officially ended its investigation into prediction market platform PolyMarket.

While this doesn’t necessarily mean open season for other decentralized betting platforms, it does suggest regulators are shifting their attention toward broader infrastructure issues and away from niche players.

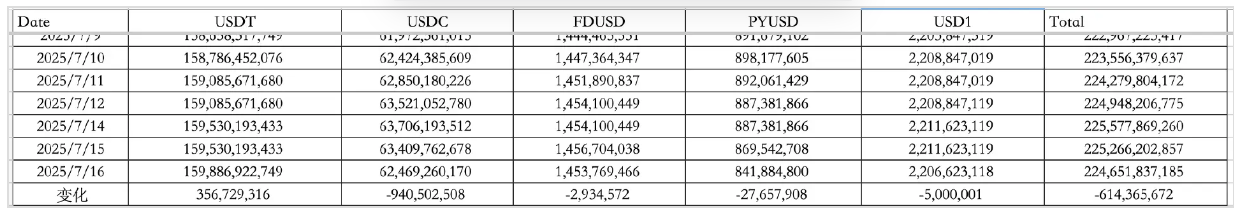

Stablecoin outflows accelerate

Stablecoin markets had a rough day. July 16 saw net outflows of 614 million dollars across the sector. USDT actually posted a healthy 357 million in inflows, but it was drowned out by a massive 941 million dollar outflow from USDC.

Traders may be rotating into other assets, or simply fleeing volatility ahead of legislative uncertainty.

ETH whales rotate, leverage unwinds

Several major institutional players are shuffling their ETH bags—and unwinding leverage while they’re at it. LD Capital’s Trend Research reportedly moved 17,289 ETH to centralized exchanges. Founder JackYi later clarified that they’re de-leveraging with profits intact, having previously bought 182,000 ETH using 2x leverage at an average cost of $2,250. With ETH now above $3,100, they’re sitting on around 160 million dollars in unrealized gains.

At the same time, crypto fund LD Capital has been selling ETH to unwind their own leveraged position, reducing exposure and paying back loans. Meanwhile, SharpLink Gaming continues to gobble up ETH, recently adding another 5,188 ETH (worth around $15.9M). Since June, they’ve bought nearly 300,000 ETH at an average of $2,701, sitting on profits of over 130 million dollars.

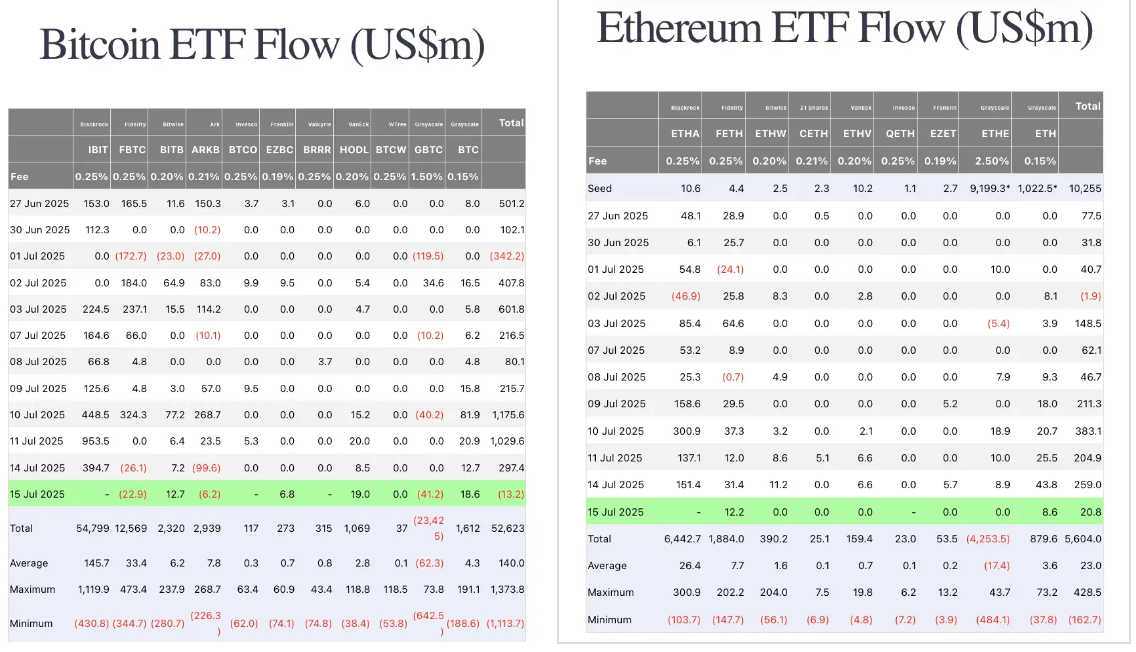

BTC ETF inflows, ETH keeps pace

ETF inflow data from July 14 shows Bitcoin ETFs taking in 297 million dollars, while ETH ETFs added 259 million.

The continued parallel flow suggests that institutions aren’t dropping ETH exposure even as the BTC narrative dominates headlines.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Pump and penguins

Pump.fun has officially begun its $PUMP token buyback, adding 16 million dollars’ worth of SOL to the repurchase wallet. Its FDV has now surged past 6.5 billion dollars, reclaiming top spot in the Solana launchpad wars and surpassing LetsBonk.

On the meme side of the street, several platforms including Gate, OpenSea, Coinbase, and OKX briefly changed their profile pictures back to the infamous “fat penguin” theme. Gate is still rocking the look, hinting the joke might be sticking around a little longer.

Bitcoin whale wakes up

In one of the more dramatic on-chain events of the week, a dormant Bitcoin whale just moved 16,800 BTC to Galaxy Digital’s OTC desk. The same address is still sitting on over 71,000 BTC, worth around 8.3 billion dollars. That’s a lot of ammo for someone who hasn’t blinked since the early cycles.

Alpha radar

Backpack is stepping into the bond market. The platform is working to absorb distressed debt from Chinese and Russian FTX users, a niche but potentially high-yield secondary market play.

Meanwhile, Plasma’s IDO opens on July 17 at 9 a.m. ET and will run until July 28. The sale will offer 10 percent of the total supply at a fully diluted valuation of 500 million dollars. US participants will face a full one-year lockup, while international buyers will receive full token unlock on mainnet launch.

Also worth noting: Farcaster Pro users can now claim $NOICE through airdrop tasks, and several Solana wallet users are eligible for $WCT tokens via WalletConnect.

Final word

Macro data is cooling, leverage is unwinding, and crypto legislation just tripped on its own shoelaces. Despite that, ETH is holding strong, whales are quietly repositioning, and institutional flows remain steady. With political pressure mounting on the Fed and the penguin memes refusing to die, expect this week to stay weird.

How to buy crypto on Toobit

Buying and trading crypto on Toobit is easy. Check out our page on how to buy crypto to start your trading journey today.