Here's what's happening today:

The market woke up to another round of Powell whiplash, massive stablecoin inflows, and a report from ConsenSys that casually predicts ETH will hit $15,800 by 2028.

Meme tokens are branching into games, bonding curve IDOs are impossible to buy, and the Solana staking race just escalated. Oh—and House Republicans actually passed something.

Let’s dig in.

Powell in the crosshairs again

The drama around Jerome Powell’s job isn’t cooling off. Reports emerged overnight that Trump had already drafted a letter to remove the Fed Chair.

While Trump himself later walked that back, calling his stance “more conservative,” insiders confirmed that the idea of replacing Powell was discussed with House Republicans.

The justification, for now, hinges on allegations of fraud related to the Federal Reserve’s renovation project. Whether or not it sticks, the pressure campaign is clearly on—and markets are watching closely.

Crypto legislation limps forward

In a surprising turnaround, the House narrowly passed a procedural motion (217 to 215) that allows the crypto bills, including the Clarity Act and GENIUS Act, to move into formal debate. That doesn’t mean they’ll pass, but it does mean they’re alive.

Analysts expect a two-day voting window to work through the specifics. This is the first real chance the US has had in years to define stablecoins and digital asset structure. If it happens, it’ll be a milestone.

Stablecoins flood back in

After Monday’s massive outflows, stablecoins surged back with force. USDC led the way with an eye-popping $1.02 billion in inflows, while USDT added another $92 million. That’s a sharp pivot from the day prior, and likely driven by whales repositioning for what could be an explosive altcoin cycle.

BTC dominance collapses, alt season ignites

Bitcoin’s market dominance dropped 1.11% overnight, landing at 63.00%, its lowest in weeks. That’s the clearest signal yet that alt season is here, and likely to last into October if historical patterns hold.

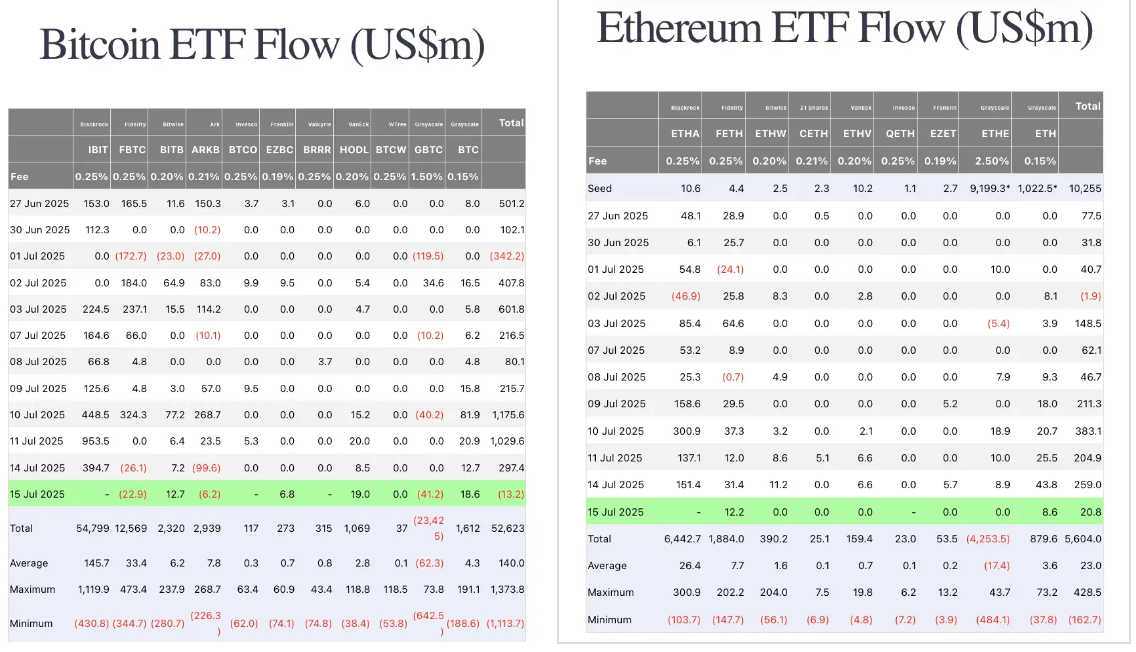

ETF flows back it up. On July 15, BTC ETFs brought in $403M, while ETH took in $192M, and Solana added another $3.3M. The ETH rotation continues, but SOL is getting louder.

ConsenSys sees $15,800 ETH by 2028

ConsenSys just dropped its most aggressive ETH thesis yet. In a new report, they frame Ethereum as “programmable trust,” arguing that it will replace banks, auditors, and legal institutions as the digital backbone of value.

Using a “cost-to-corrupt” model, the report estimates ETH should reach $15,800 by 2028 under conservative assumptions. The forecast is based on the idea that Ethereum’s market cap should scale with the value of assets it secures.

Whether that number sticks is debatable, but one thing is clear: the narrative around ETH as infrastructure, not just a smart contract platform, is gaining traction.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Institutions keep stacking ETH, while leverage exits

SharpLink Gaming isn’t slowing down. The company added 10,614 ETH (~$35.6M) this week, bringing its total stash to 296,508 ETH worth just under $1B.

They still have $257M in dry powder for future buys, and are now within inches of becoming the single largest institutional ETH holder on record.

On the flip side, Trend Research is still unwinding. They’ve sold 48,946 ETH to repay Aave loans, part of a broader deleveraging wave after having borrowed $390M to accumulate ETH at an average of $2,118.

With ETH over $3,200, they’ve locked in handsome profits—but clearly don’t want to risk riding the leverage too long.

Solana joins the institutional staking race

Solana’s liquid staking space is heating up. Liquid Collective, a staking platform built for institutions, just launched LsSOL, a yield-bearing Solana token designed for ETFs and large financial providers. This brings Solana closer to Ethereum in the staking infrastructure wars.

Meanwhile, DFDV has continued scooping up SOL aggressively, purchasing over 229,000 SOL (~$35M) in the last 10 days. But compared to ETH’s institutional surge, Solana’s microstrategy still has a ways to go.

Grok, WLFI, and the meme market weirdness

The Grok AI narrative exploded overnight. ANI’s market cap pushed past $50M, bringing AVA AI along with it. Meanwhile, the Trump family–affiliated token WLFI just spent $5M USDC buying 1,531 ETH at an average of $3,265. It’s also officially tradable now, following a successful governance vote.

Even TRUMP meme token appears to be pivoting. A new subdomain, trumpthegame, was registered, hinting at a potential gaming launch. Whether that means NFTs or something else entirely, we’ll know soon enough.

Alpha radar

-

Hyperion’s IDO on Binance Alpha sold out in under a minute, hitting a $20M FDV cap. It used a dynamic bonding curve pricing mechanism and immediately became one of the platform’s hottest launches. Buyers recommend avoiding round numbers for better entry odds.

-

Arthur Hayes made a rare on-chain appearance, switching his profile pic to a CryptoPunk and declaring “this is ETH’s era.” He says DeFi and NFT protocols will lead the next leg of the bull run—if ETH keeps running, everything else will follow.

Final word

The altcoin surge is real, ETH is gaining institutional clarity, and Powell may be closer to replacement than markets expected.

With ConsenSys dropping bold price targets, whales rotating into stablecoins, and meme projects evolving into product plays, this week is loaded.

Stay nimble, watch the votes in Washington, and remember—alt season never knocks, it breaks the door open.