Here's what's happening today:

Another day, another round of ETF tease, whale games, and platform shenanigans. If you're feeling whiplashed, you're not alone. Today saw ETH holding steady near $3,500 and Solana getting dragged into meme territory, while whales tested the exits.

Let’s get into the mess.

Capitol Hill turns the page on crypto

In a rare show of bipartisan momentum, the U.S. House just passed a pair of major crypto bills aimed at providing regulatory clarity.

The Financial Innovation and Technology for the 21st Century Act (FIT21) seeks to establish clearer oversight between the SEC and CFTC, finally settling the turf war over who regulates what.

Meanwhile, the Blockchain Regulatory Certainty Act aims to protect developers and non-custodial wallet providers from being lumped in with financial intermediaries.

This could be the clearest signal yet that Washington is moving from "let's throw darts at crypto" to “maybe we regulate this properly.” For ETH and other smart contract platforms, that’s a big deal. Especially as institutions gear up post-ETF.

BlackRock’s ETF dance begins

After weeks of radio silence, the spot Ethereum ETF issuers are finally moving again. A quietly filed amendment in the dead of night shows the SEC is reviewing Form 8-A, a critical precursor to ETF listing.

Now, this doesn’t mean ETH ETFs go live tomorrow. But it does confirm that the clock is ticking. Once approved, listing could begin in a matter of days, not weeks. All eyes are on the SEC to make the next move.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Stablecoin market trembles—again

It’s a tale of two whales. USDC saw $723 million in inflows on July 17, while USDT recorded a modest $299 million bump. That’s significant not just for the raw size, but for what it implies, someone big is rotating into stables, likely to prep for buys or shield from volatility.

Meanwhile, market watchers are flagging a consistent pattern: every time whales front-run major inflows, retail gets caught flat-footed. So far, this rotation hasn’t translated into price explosions. Historically, this kind of capital flood is a prelude to action.

Solana gets memed into oblivion

Remember when Solana was supposed to be “the Ethereum killer”? Today, it feels more like the Dogecoin of Layer 1s. With Bonkfun overtaking Pump.fun in revenue, and NFT floors collapsing across the board, SOL’s cultural rep is on shaky ground.

The Bonk ecosystem is thriving. But it’s also triggering an existential identity crisis for Solana itself. Is it a serious financial layer, or just a place for launchpad loops and cartoon coins?.

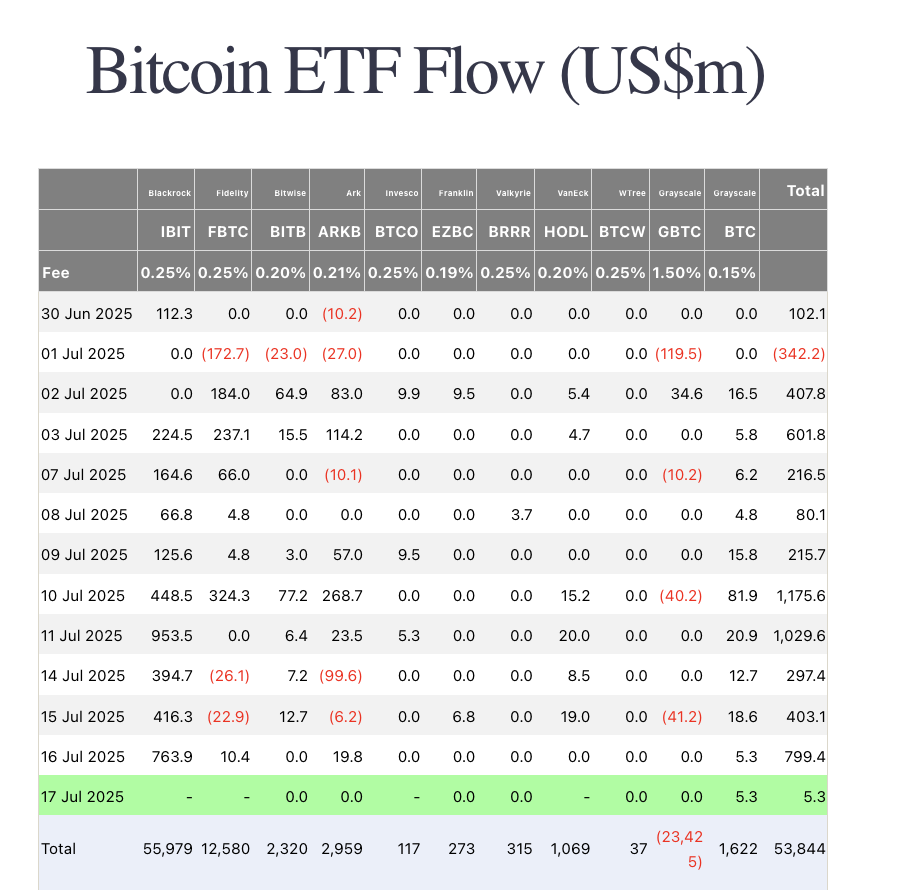

Bitcoin ETFs cool off

On July 17, BTC ETFs saw just $45.3 million in net inflows—down sharply from earlier in the week. Ethereum ETFs, meanwhile, added $13.2 million, and even Solana pulled in $8.8 million.

The drop in BTC inflows isn’t necessarily bearish, but it does suggest that institutional interest is broadening—and Bitcoin might not be the only show in town anymore.

Crypto faces macro tremors

Beyond the ETF headlines and meme noise, there’s real macro movement happening. The FedWatch tool now places a 65% chance on a rate cut in September, as inflation shows signs of cooling.

Simultaneously, rumours of Trump’s "final offer" tariff ultimatum are beginning to price into global equities, weighing on emerging markets and commodities alike. Crypto, ironically, looks increasingly insulated—at least for now.

Degen corner

Grok, WLFI, and Trumpcoin all made waves. WLFI executed a $5 million ETH buy, pushing average entry to $3,265 and triggering a small bounce. Meanwhile, memecoins are testing the limits of political theatre. This means "TrumpTheGame" domains, gaming NFTs, and DAO votes abound.

Elsewhere, Solana devs hinted at a new launchpad model aimed at deterring bot abuse, while Blur volume has quietly ticked up again. Just as it did before the last NFT crash.

Final thoughts

We’re deep in the lull before what could be a very noisy storm. BlackRock is moving. Whales are realigning. Memecoins are metastasizing. And the Fed is quietly shifting tone while politicians throw digital darts at policy boards.

This market doesn’t reward stillness. It rewards vigilance. So stay loud, stay sharp, and maybe—just maybe—ape responsibly.

Ready to start trading? Toobit will set you soaring. Sign up today and get access to spot, futures, DEX+, staking, and all the crypto opportunities you crave.