Here's what's happening today:

The tariff chronicles now feature Canada

President Trump has officially slapped a 35% tariff on Canadian imports. Because why stop at one trade war when you can juggle two? Markets barely flinched, but expect more noise if the maple syrup starts flowing backward.

DeFi is off the hook (for now)

In a rare moment of clarity, the US Treasury has cancelled the crypto broker reporting rule. The now-defunct rule would have required DeFi platforms to report user profits and identities (yes, including your name and address). After fierce pushback from privacy advocates, the regulation was officially axed—good news for DeFi projects, shady wallets, and anyone still allergic to form 1099.

ETH flippening?

The real jaw-dropper? Ethereum surpassed Bitcoin in 24-hour futures volume, hitting $62.1B vs Bitcoin’s $61.7B.

Glassnode called it rare—and rightly so. Traders are clearly front-running an ETH-specific catalyst. 👀 We’re not saying the ETH ETF is coming... but we’re also not not saying that.

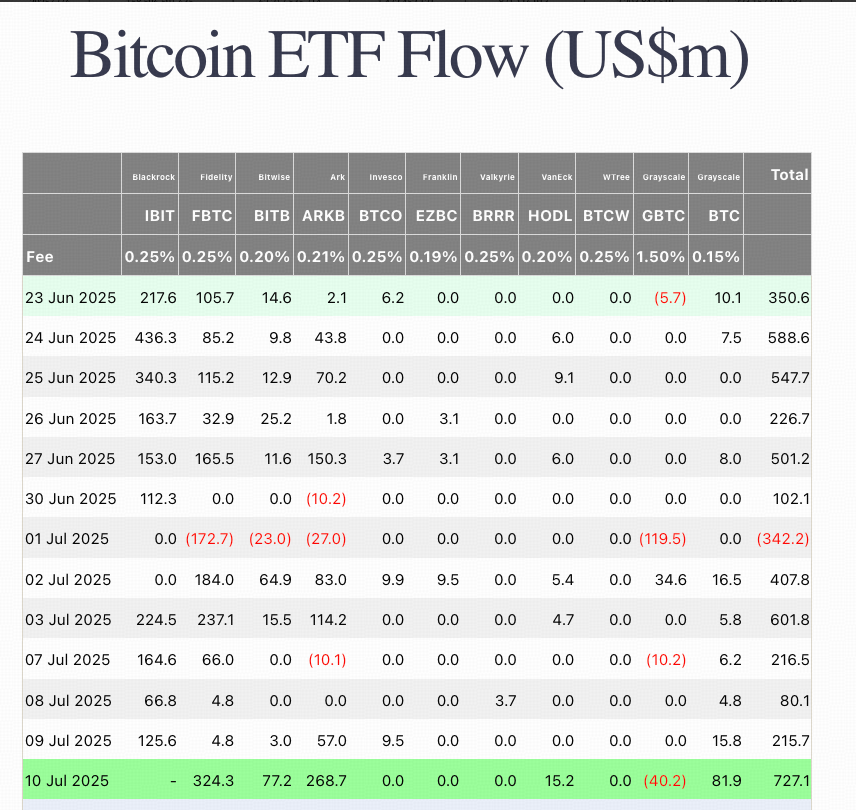

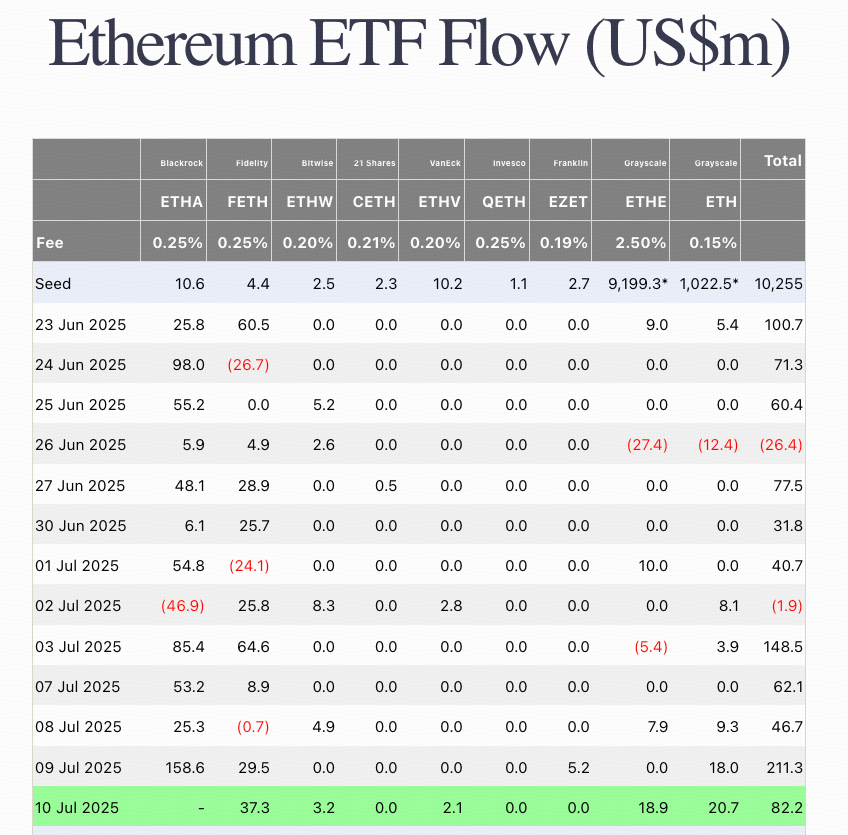

ETF flow watch

ETF flow activity has been heating up, with ETH ETFs pulling in $211 million on July 9, followed by a massive $727 million inflow into BTC ETFs on July 10—and that’s without even factoring in data from BlackRock.

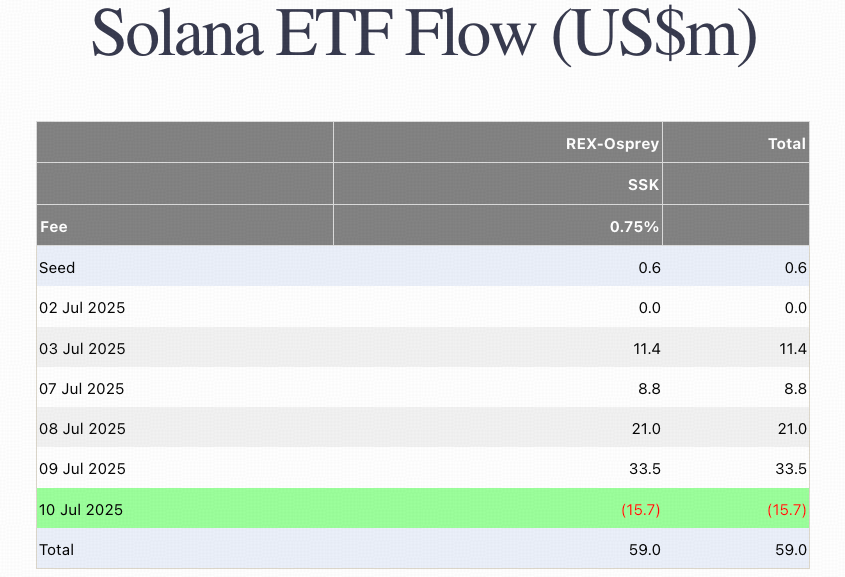

Meanwhile, SOL ETFs bled out $15.7 million, raising eyebrows across the board. SOL, baby… what is you doing?

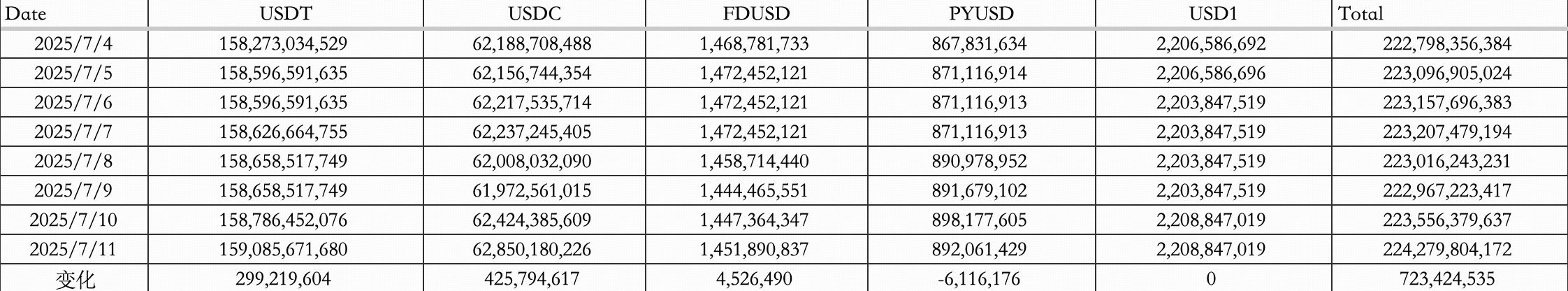

Stablecoin whales are back

Stablecoin whales are officially back in action. Inflows surged across the board, with a total of $723 million pouring in—$299 million into USDT and a hefty $425 million into USDC. This isn’t your average sector rotation—this is a full-on reload. Someone’s gearing up for something big.

Institutions are still buying the top

Bitwise reports that 125 listed companies now hold BTC, totalling 847,000 coins (~4.03% of total supply), worth around $91B.

-

+46 companies joined in Q2

-

GameStop (yes, that GameStop) made its first BTC buy

-

Trump Media is reportedly trying to raise $2.5B to stack sats

Not to be outdone, $DFDV bought another 153K SOL, and BIT Mining Ltd is going full SOL maximalist—ditching BTC holdings and raising $200M–$300M to double down on the Solana ecosystem.

Pump v. Bonk, round 2

Remember when Pump.fun was the king of the launchpad hill? Yeah, about that—not anymore. In a surprise flip, @BONK_FUN just out-earned @PUMPDOTFUN, raking in $6.23 million in 7-day revenue compared to Pump’s $4.23 million. That’s a 47% lead—in pure, unfiltered dog-money terms.

Meanwhile, the Pump.fun public sale officially kicks off July 12, with varied contribution caps depending on the platform:

-

Bitget: $1 million

-

Gate.io: $100K (plus rebate perks)

-

Bybit: $500K

Some devs are already floating an arbitrage play: short the overpriced contract and scoop up tokens cheaper during the public sale. But beware—this is degen territory, where high funding rates, bad timing, or missing your allocation entirely could leave you wrecked.

Watch ETH. Watch Linea. And watch for the rug.

If LineaBuild announces a TGE during this ETH pump, it could be fireworks—or disaster. Meanwhile, HYPER just jumped 385% in 24h. Alt season might be peeking through.

DeFi just dodged a bullet. ETH’s got the mic. The cycle is far from over.