僅在2025年上半年,由於駭客攻擊和漏洞,約有21.7億美元從交易所和相關服務中消失。

因此,交易者們提出同樣的問題也就不足為奇了:“如果出現問題會怎樣?”這正是Toobit推出其5000萬美元Shield Fund的原因;這是一個內建的安全網,以在最壞情況下保護用戶。

更大的問題是:這是真正邁向交易所責任制的一步,還是僅僅是恢復信心的一種方式?

什麼是Toobit Shield Fund,為什麼它很重要?

Toobit Shield Fund是一個專門的儲備金,用於保護所有Toobit交易者免受意外的平臺相關損失。該基金由Toobit全額資助,為所有用戶提供自動保障,無論其資產是被交易、質押,還是存放在錢包中。

無需註冊、無需訂閱、無隱藏費用;保護對每個人都是標準配置,無論賬戶大小或交易量如何。簡而言之,Shield Fund作為平臺本身的保險政策,由Toobit直接資助,以確保用戶永遠不會承擔系統級故障的成本。

在一個經常受到駭客攻擊和交易所故障影響的行業中,這個基金顯示了Toobit對用戶安全的承諾。

基金的組成部分

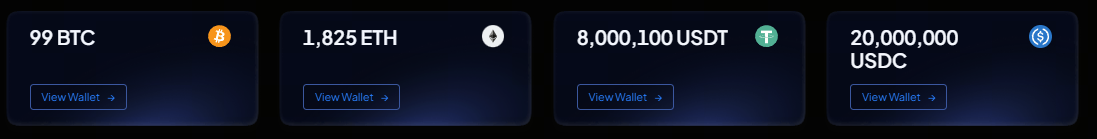

這些資金由以下組成部分組成(即支持5000萬美元保護基金的資產):

這些持有資產共同構成了用於在意外平臺事件中保護用戶的儲備池,確保在波動性(BTC,ETH)和穩定(USDT,USDC)資產之間的流動性和穩定性。

它如何運作?

簡單版本是:一旦您進行首次存款,Shield Fund保護就會立即生效。它涵蓋了由Toobit自身系統內的技術或安全故障引起的損失;想想罕見事件,如系統故障或內部漏洞。

然而,重要的是要注意Shield Fund不涵蓋的內容。由於糟糕的交易決策、市場波動或個人賬戶被破壞而造成的損失不在其範圍內。換句話說,它是為了防範平臺故障,而不是交易失誤。

為了保持透明,Toobit提供了一個實時的24/7公共儀表板,顯示基金總價值。用戶可以隨時監控基金的儲備,確保對平臺財務實力的完全可見性。

優勢

自動且免費的保護

每位用戶從第一天起就獲得全面保障,無需費心或支付費用。這是作為平臺標準的保護,而不是高級特權。

對所有人提供平等的保障

無論您是小型零售交易者還是機構大戶,Shield Fund提供相同級別的安全性。沒有等級,沒有優待;只有一個為所有人提供的保護。

通過實時報告實現透明

與模糊的保險索賠或細則承諾不同,Toobit讓您實時查看Shield Fund的價值。公共儀表板顯示任何時刻可用的保護金額。

主動防禦

Toobit建立Shield Fund作為預防性保障,而不是等待問題發生;這是一個在災難發生前就存在的基金,而不是之後。

這對Toobit的意義

Shield Fund的推出傳達了一個明確的信息:Toobit押注於長期信任,而非短期炒作。

這一舉措與平臺的更廣泛的安全優先策略一致,從完成Hacken審計到整合全球旅行規則合規框架。

更重要的是,Shield Fund符合更大的行業轉變;交易所不僅需要證明其合規性,還需要證明其準備就緒。

為什麼這對交易者來說意義重大

對於日常交易者來說,這個基金代表了一種簡單但強大的東西:信心。市場變化迅速,沒有人能控制所有風險。但有了Shield Fund,用戶知道即使在平臺層面出現問題,他們的資產也不會永遠消失。

這不是要完全消除風險;在金融中這是不可能的。這是關於知道您信任的交易所會支持您。