What is Bitcoin?

Bitcoin (BTC) is the world's first decentralized digital currency designed for peer-to-peer (P2P) value transfer without a central operator. Its core promise is simple: A public ledger anyone can verify, with a monetary policy nobody can "adjust", even if the global economic "vibe" changes.

Since its launch in 2009 by the pseudonymous Satoshi Nakamoto, BTC has evolved from a niche cryptography project into a foundational pillar of the global financial system.

As of early 2026, Bitcoin has reached several historic milestones:

-

2024: The approval of Spot Bitcoin exchange-traded funds (ETFs) in the U.S. brought trillions in potential institutional liquidity.

-

2025: Bitcoin reached an all-time high (ATH) of $126,198.07 on October 7, 2025, according to CoinMarketCap.

-

2026 status: Following a market correction, Bitcoin currently trades in the $65,000–$72,000 range, with a market capitalization exceeding $1.3 trillion.

How Bitcoin works

Bitcoin operates on a blockchain, a public distributed ledger that records every transaction. This ledger is maintained by a global network of computers (nodes). The system relies on three main roles: Market participants, miners, and nodes.

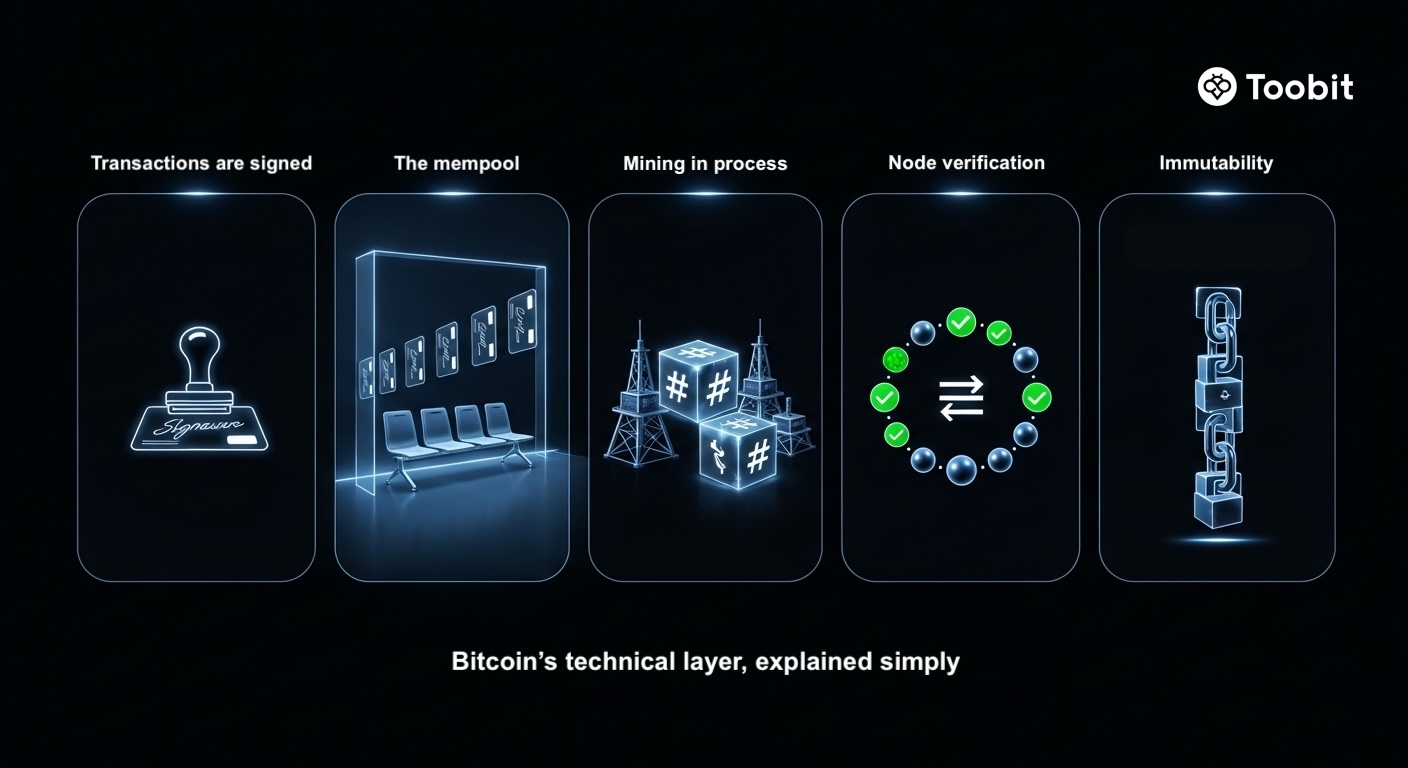

A simplified view of how BTC moves from signed transactions to the mempool, gets mined via Proof of Work, verified by nodes, and locked into an immutable chain.

The technical layer (simplified):

-

Transactions are signed: You send BTC by signing a transaction with your private key (i.e. your digital signature)

-

The mempool: Unconfirmed transactions sit in a public queue (i.e. the waiting room).

-

Mining: Miners bundle transactions into blocks and compete to solve a puzzle using Proof-of-Work (PoW).

-

Node verification: Thousands of independent nodes validate that the transaction follows the rules (no double-spending).

-

Immutability: Each new block references the previous one, creating an unbreakable chain.

Bitcoin ecosystem

Think of Bitcoin's ecosystem as layers, not "one chain does everything."

-

Base layer (Bitcoin): Maximum security, slower settlement, conservative changes.

-

Lightning Network: A payments layer optimized for speed and small transfers.

-

Mining and infrastructure: Public and private miners, hardware manufacturers, hosting, energy partnerships. Hashrate and difficulty are the heartbeat metrics here.

-

Custody and security tooling: Hardware wallets, multisig setups, institutional custody, and multi-party computation (MPC)-based key management are widely used for risk reduction.

-

Market structure: Spot markets, derivatives, ETFs, and on-chain liquidity all interact. When leverage builds, price can move fast in either direction.

If you are new here, just remember one thing: Bitcoin is the bedrock, and everything else is convenience, speed, or composability built on top with extra assumptions.

Bitcoin tokenomics

Bitcoin has a finite supply; there will only ever be 21 million BTC.

Around 19.98 million BTC are in circulation as of early February 2026.

To control inflation, the reward given to miners is cut in half every 4 years. After the April 2024 halving, the block subsidy is 3.125 BTC per block, and it is expected to halve again in 2028.

What keeps Bitcoin secure?

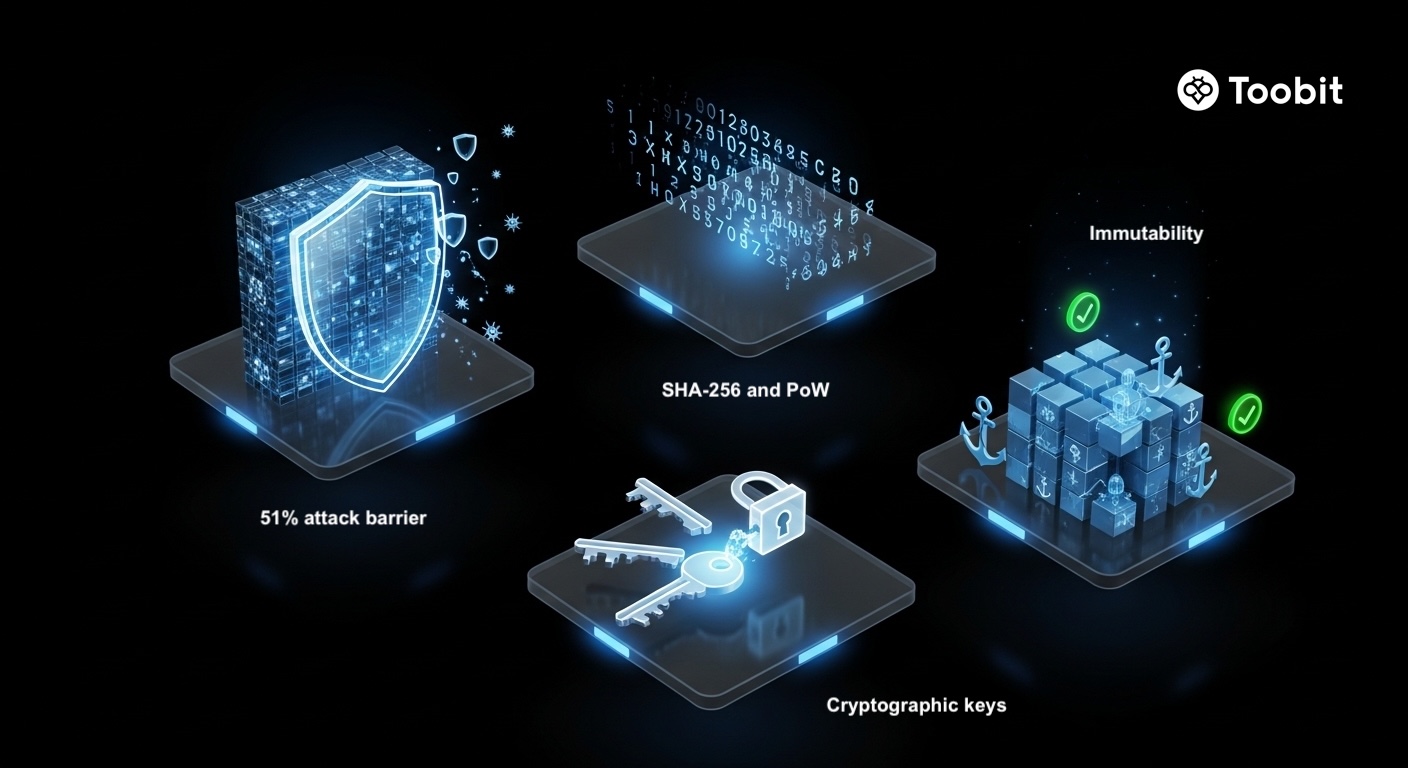

Bitcoin's security stack: Proof of Work cost, SHA-256 hashing, strong key control, and confirmation depth that makes history harder to rewrite.

Bitcoin's security is a mix of high-level math and real-world physics.

-

51% attack barrier: To reverse a transaction, an attacker would need to control more than 51% of the entire network's computing power. In 2026, the cost of the hardware and electricity required to do this exceeds the GDP of most small countries, making an attack economically suicidal.

-

SHA-256: Bitcoin uses the SHA-256 hashing algorithm. This cryptographic standard that ensures the "Work" in PoW cannot be faked.

-

Cryptographic keys: With growing concerns and evidence of hacking, there are more security protocols like multi-sig and MPC to ensure no single hack can drain their funds.

-

Immutability: Once a transaction is buried under a few blocks, it becomes immutable. It cannot be deleted, reversed, or edited by any government, bank, or CEO.

Why is Bitcoin valuable?

Bitcoin's "value" is not one magical feature. It is a bundle of properties that are hard to replicate together:

-

Digital scarcity: Only 21 million BTC will ever exist.

-

Censorship resistance (when self-custodied): If you control your keys, you control the asset.

-

Credible neutrality: No issuer, no CEO, no central bank, and no country can unilaterally change the rules.

-

Institutional integration: With the success of ETFs from firms like BlackRock, Bitcoin is now a standard "Risk-On" asset for pension funds and 401ks.

-

Sovereign adoption: Several nations now hold BTC as a Strategic Reserve asset

This is why Bitcoin often gets framed as a "digital commodity" or "digital gold." Not because it is shiny, but because it is hard, scarce, and operationally independent.

What is Bitcoin actually used for?

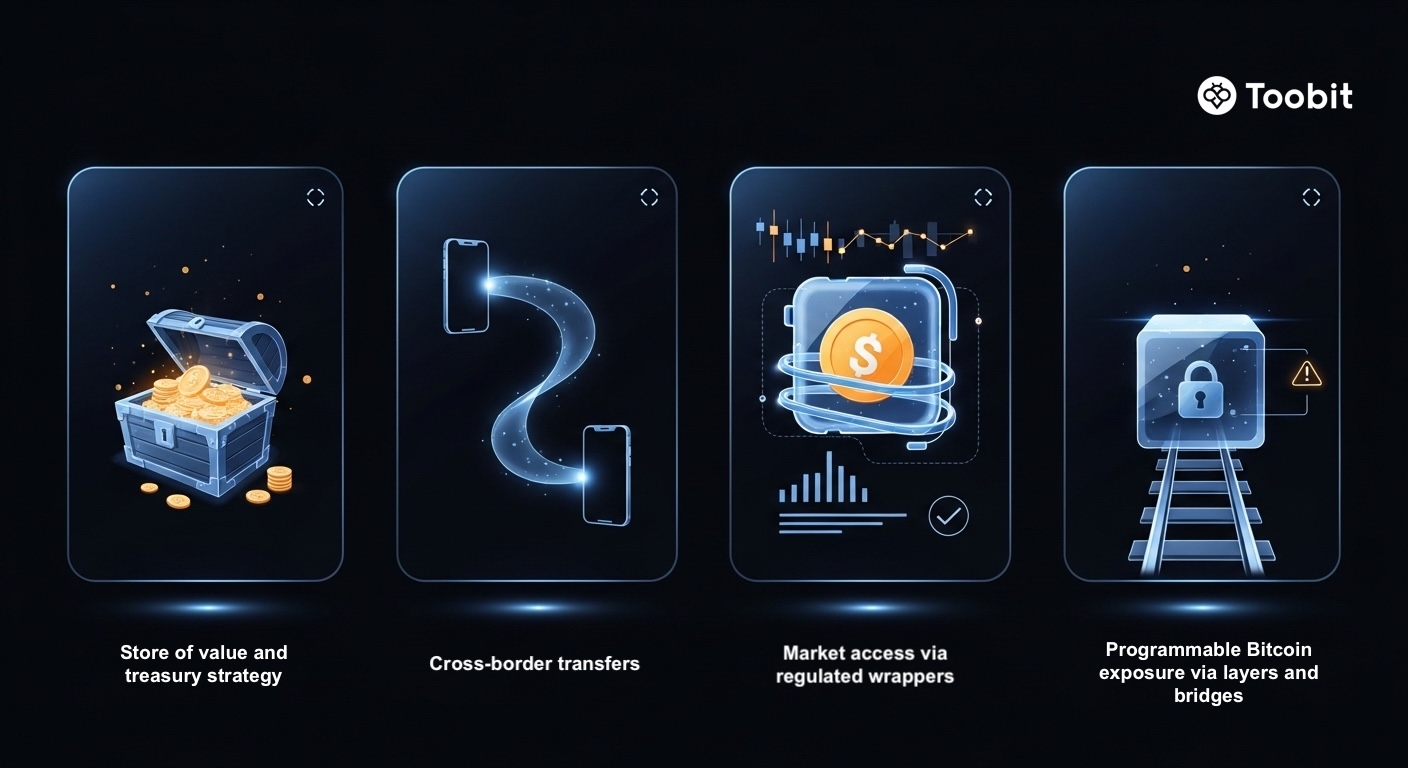

4 real-world uses in 2026: Treasury reserves, fast cross-border transfers via Lightning, market access through regulated wrappers, and added functionality through Layer 2 networks.

Bitcoin is no longer just for "buying coffee." Its utility has branched into 4 distinct sectors:

-

Store of value and treasury strategy

In 2026, Bitcoin is a legitimate treasury asset. According to Bitcoin Treasuries, over 170 public companies and several nation-states hold BTC on their balance sheets to hedge against the debasement of the USD and EUR.

-

Cross-border transfers (especially with Lightning)

Lightning can make cross-border transfers settle in seconds. According to Lightning Labs' LND documentation, Lightning can reduce cost and latency for small payments, though fees vary by route, liquidity, and congestion.

-

Market access via regulated wrappers

Spot Bitcoin ETFs became a major liquidity gateway, with Barron's reporting roughly $100 billion in assets under management across Bitcoin ETFs

-

Programmable Bitcoin exposure via layers and bridges

While the base Bitcoin layer is for security and settlement, Layer 2 (L2) networks have become more popular between 2025 to present to handle speed and smart contracts:

-

Lightning Network: Handles instant, near-free payments.

-

Stacks and Merlin Chain: These programmable layers allow decentralized finance (DeFi) on Bitcoin, enabling users to earn yield on their BTC.

However, the trade-offs for increased functionality are trust assumptions and smart contract risk.

What drives Bitcoin?

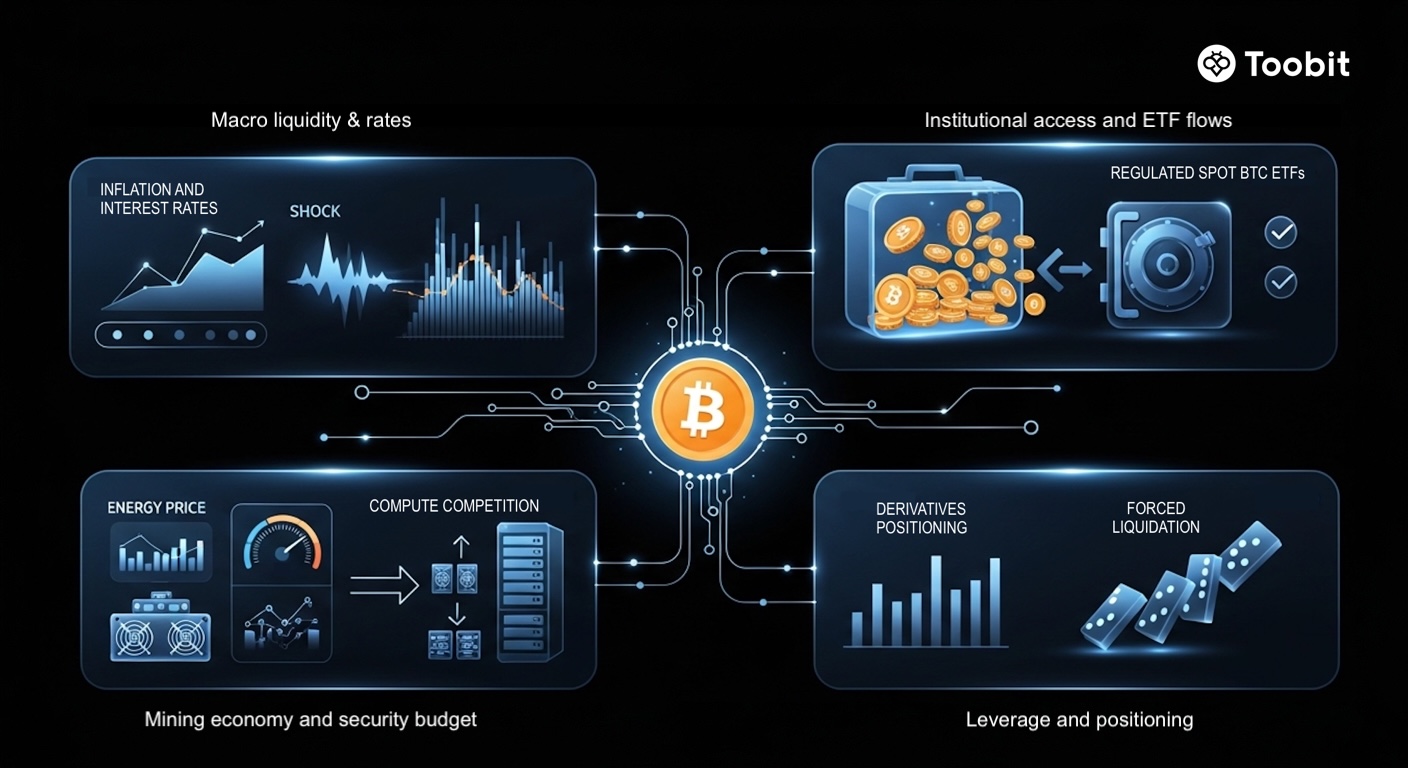

The biggest catalysts: Macro liquidity and rate expectations, institutional flows, mining economics, and leverage that can amplify moves in both directions.

-

Macro liquidity and rates

BTC tends to trade like a high-beta asset when markets reprice growth, inflation, and rate expectations, which is why drawdowns often cluster around macro shocks.

-

Institutional access and ETF flows

Spot ETFs have become a major demand and liquidity channel. One data point that captures the scale: Yahoo Finance reports that a single spot Bitcoin ETF held more than 800,000 BTC as of mid-October 2025, illustrating how quickly institutional wrappers can absorb supply.

-

Mining economics and security budget

Hashrate, difficulty, energy prices, and miner profitability influence both network security and potential sell pressure. VanEck reports that miners powering down rigs to service AI data center demand contributed to a short-term dip in hashrate and difficulty in January 2026.

-

Leverage and positioning

Big moves can get amplified by derivatives positioning and forced liquidations, which is why post-peak declines can feel disproportionate to the headline news

Bitcoin's challenges and criticisms

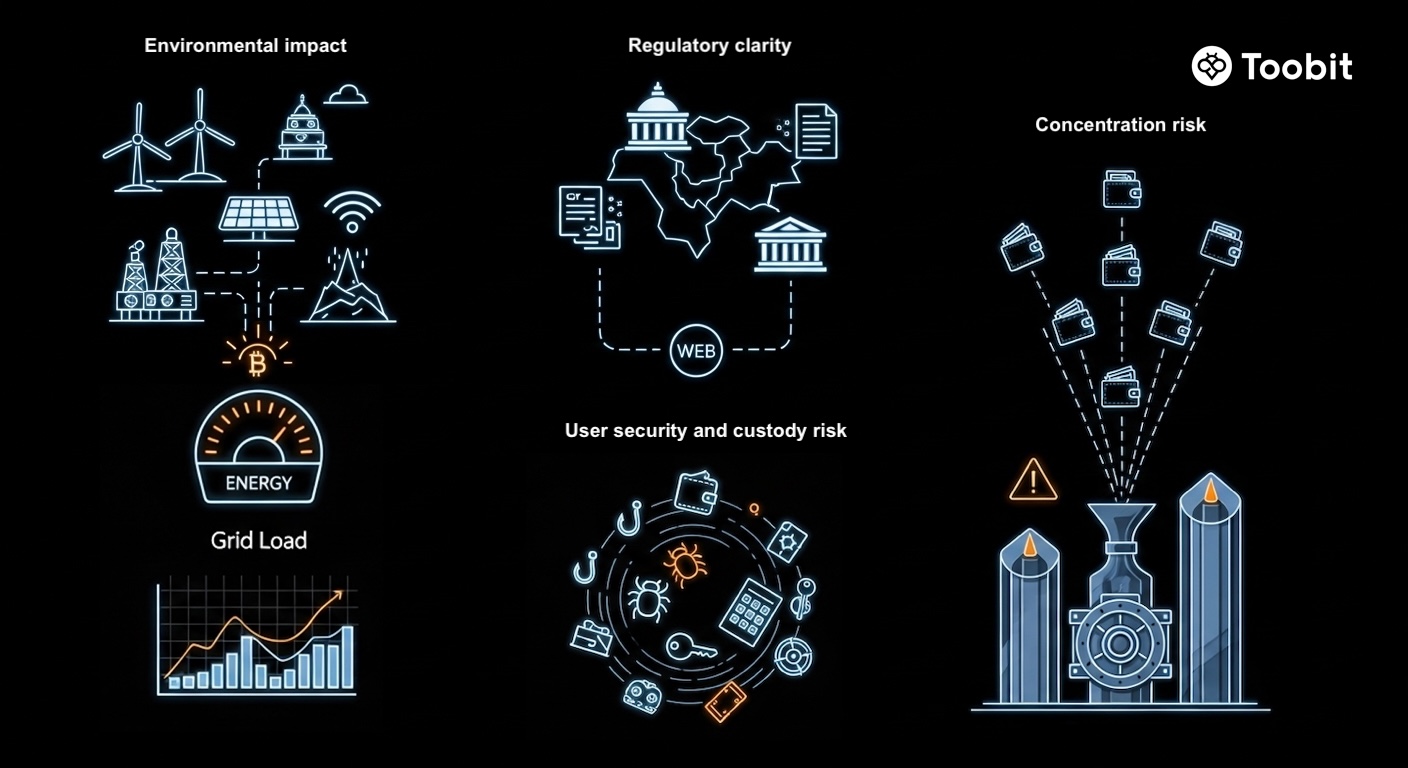

The main pressure points: Energy scrutiny, evolving regulation, custody concentration, and the human side of security (phishing, malware, and key management).

-

Environmental impact

Mining's energy mix is improving, but the total power draw keeps regulators watching. As of 2026, Cambridge reports 52.4% of mining energy came from "sustainable" sources (renewables plus nuclear) in its latest industry study.

-

Regulatory clarity

France's Autorité des Marchés Financier (AMF) notes European (EU) regulation, Markets in Crypto-Assets (MiCA), applies from December 30, 2024 (with stablecoin provisions applicable from June 30, 2024), creating a formal EU framework.

In the U.S., Reuters reports lawmakers introduced a draft bill in January 2026 aimed at defining market rules and regulatory jurisdiction.

While the EU's MiCA and new U.S. frameworks have provided "rules of the road," global tax compliance for BTC remains complex.

-

Concentration risk

ETFs and institutional custody can concentrate large amounts of BTC into a smaller number of operational chokepoints. TRM Labs reports that custodians supporting exchange-traded products (ETPs) hold roughly 5%–7% of BTC in circulation, which is meaningful enough to spark "single point of failure" debates.

-

User security and custody risk

Bitcoin itself is difficult to rewrite at scale, but most real-world losses still come from operational failures: phishing, malware, seed phrase exposure, and poor key management.

Institutional-grade custody reduces some risks while introducing counterparty and platform dependencies.

Due diligence checklist for beginners

Before you commit serious capital, do these 5 things to ensure your trade is safe:

-

Confirm the token and chain you are using match the official contract info.

-

Check current price, liquidity, and trading volume on multiple data sources.

-

Read the official docs for any product you plan to use, especially the bot and staking terms.

-

Treat bots and hot wallets as high-risk operational tools, not storage.

-

Decide your time horizon: quick trade, medium hold, or long-term utility thesis.

The bottom line

Bitcoin in 2026 looks less like a niche experiment and more like financial infrastructure with a very specific job description: neutral, scarce, globally transferable value.

That shift comes with a tradeoff. Exposure is easier than ever through regulated products and custodial platforms, but true ownership still means taking custody and security seriously.

Either way, treat Bitcoin like what it is: a high-volatility asset built on a high-integrity system.

This article is for informational purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any decisions.

Common Bitcoin FAQs

-

Who created Bitcoin?

Bitcoin was introduced in 2009 by Satoshi Nakamoto, a pseudonymous creator whose real identity remains unknown.

-

Is Bitcoin anonymous?

Not exactly. Bitcoin is pseudonymous: addresses are not names, but transactions are public and can sometimes be linked to identities through exchanges or analytics.

-

What is a Bitcoin halving?

A halving reduces the new BTC issued per block roughly every four years. After the April 2024 halving, the block subsidy became 3.125 BTC.

-

What is the biggest risk for most new Bitcoin users?

Custody mistakes. The most common failures are phishing, fake apps, bad backups, and sharing seed phrases. The protocol is resilient, but your operational security has to be, too.

Updated as of February 13, 2026.