What is happening to Cardano today

Cardano (ADA) is entering 2026 with familiar tension. The fundamentals are getting more "institution-ready," but price action still looks like it is waiting for confirmation.

The headline catalyst is the planned launch of Cardano futures on leading derivatives exchange Chicago Mercantile Exchange (CME) Group, pending regulatory review.

CME Group's X announcement on launching Cardano futures

That matters, because not only does this launch bring increased exposure, it represents growing mainstream acceptance for Cardano, with CME Group being the first traditional derivatives exchange outside of crypto-native platforms to offer ADA.

At the same time, ADA is still trading in a recovery posture on the chart, with overhead supply sitting where short- and mid-term moving averages cluster.

This is the setup. Better rails, improving narratives, and a chart that still wants proof.

What is Cardano (ADA)?

Cardano is a proof-of-stake (PoS) Layer-1 built around security, scalability, and governance. It is designed to support smart contracts and settlement, while shifting more decision-making into structured governance and treasury funding over time.

ADA is the network's native token. It is used for fees, staking participation, and governance-related activity as Cardano's on-chain decision layer matures.

Cardano’s appeal is its slow-burn approach. In a market that often rewards hype, ADA can behave more like long-duration infrastructure exposure than a short-term momentum token.

ADA price history and performance overview

ADA price history

According to CoinMarketCap, ADA hit an all-time high (ATH) of $3.10 on September 2, 2021, marking the peak of its last major cycle acceleration. At the other extreme, ADA's all-time low (ATL) was recorded around $0.01735 on October 2, 2017, a reminder that its long-term chart has been built through distinct liquidity cycles.

Cardano's prior cycle peak still frames expectations for longer-term upside. Since then, ADA has traded through a long reset period that has forced the market to focus less on hype and more on execution.

ADA's latest performance

ADA price from Toobit, as of January 20, 2026, 08:53 UTC

ADA is currently trading around $0.3591, down 2.55% on the day. The bigger takeaway is not today's candle, it is positioning. Recent price action has been compressed into the high $0.30s, where buyers keep showing up, but rallies still run into supply near the same zone

Current market snapshot (January 20, 2026, 08:53 UTC)

Risk appetite is still cautious.

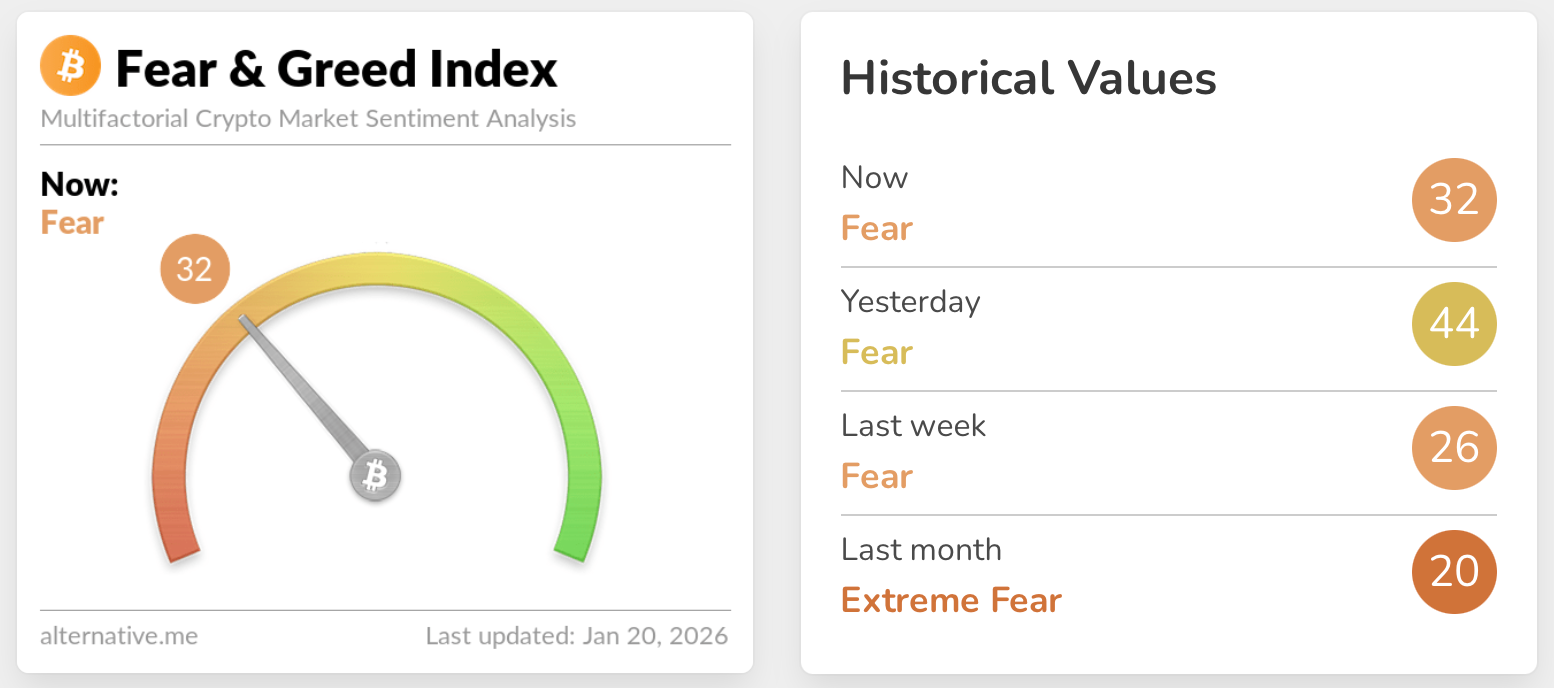

Crypto Fear and Greed Index from Alternative.me

Fear & Greed Index prints 32 (Fear), which tends to keep breakouts harder and follow-through less reliable.

U.S. market structure debates remain an active volatility driver. According to Reuters, senators introduced draft legislation to define crypto market rules and clarify regulator roles, including stablecoin-related provisions.

In this kind of tape, ADA can move on headlines, but sustained upside usually needs both a catalyst and a market willing to take risk.

On-chain and technical analysis

ADA price movement across a year (Jan 2025 to present)

Support and resistance

ADA is trading like a market that has found a base, but has not reclaimed the ceiling yet.

Support begins around $0.36, with the next layer near $0.34. If that band fails, the chart starts looking back toward the $0.30 psychological zone.

Resistance sits where recent rebounds keep stalling, in the $0.39–$0.40 area. That level matters because it is also where short- and mid-term moving averages converge. Above that, $0.45 is the next visible checkpoint that would need to flip from supply into support before sentiment really improves.

Momentum indicators

Momentum is soft, not broken.

Relative strength index (RSI) is sitting in the low-40s range, which typically signals weak trend strength but not an overheated market. Moving average convergence/divergence (MACD) remains slightly negative, with the pressure looking more like a slow bleed than a sharp impulse.

In practice, that often shows downside momentum fading, while upside still needs a catalyst to spark acceleration.

Moving averages and volume

ADA is still trading below its key moving averages, which is why rallies have felt "heavy."

Shorter averages are clustered near $0.39, acting like a lid. The longer moving average sits much higher around the mid $0.60s, reinforcing that ADA is still in repair mode on a broader timeframe. Until ADA can reclaim and hold above that $0.39–$0.40 band, the market will keep treating upside as rebound risk, not trend.

On-chain cues

On-chain activity supports the idea of a base-building phase rather than a frenzy. According to DeFiLlama's public chain dashboard, Cardano shows Total Value Locked (TVL) around $171.78 million, decentralized exchange (DEX) volume around $3.43 million (24h), and active addresses around 20,815 (24h).

That combination is not "euphoria," but it is also not dead. It reads like a network that is active enough to matter, while still needing stronger liquidity and application pull to drive a more durable repricing.

ADA price prediction and outlook

The clean way to frame ADA from here is to treat $0.39–$0.40 as the decision zone, and analyze this from 3 simple cases.

Base case

ADA continues ranging while the market waits for clearer risk appetite. The most natural band is $0.33–$0.45, with the mid-point battle happening around the moving-average ceiling near $0.39–$0.40.

Bull case

A daily reclaim and hold above $0.40, followed by higher lows, opens a path toward $0.45, then $0.50. That move becomes more credible if participation strengthens and the market mood shifts away from Fear.

Bear case

A clean loss of $0.34 increases the odds of a move toward $0.30. Below that, the market usually stops talking about range and starts talking about damage control.

The key twist for 2026

Instead of a plain bullish or bearish prediction, we think there is a more realistic take on the CME catalyst:

-

CME's planned ADA futures launch is a milestone, but it can be bearish first and bullish later.

-

These listings not only add new buyers, but they also make two-way positioning easier, including hedges, basis trades, and short exposure that is cleaner than offshore venues.

A plausible path is a headline pop into the launch window, then choppy price action as new hedging pressure appears. Only after that does the market decide whether spot demand is strong enough to absorb it and turn the catalyst into a durable uptrend.

That is not a bearish call. It is a "price discovery gets more professional" call. And in markets, that often comes before sustained upside.

This is market commentary, not financial advice.

Key milestones for ADA

- Mainnet launch (Sep 29, 2017)

Cardano mainnet launches in the Byron era and ADA goes live. - Shelley hard fork (Jul 29, 2020)

Staking and decentralization features go live, shifting Cardano toward a more decentralized network. - Mary hard fork (Mar 1, 2021)

Native tokens arrive, enabling custom assets on Cardano without smart contracts. - ADA cycle peak (Sep 2, 2021)

ADA reaches its ATH around $3.10, setting the reference point for long-horizon upside expectations. - Alonzo hard fork (Sep 12, 2021)

Smart contracts go live via Plutus, unlocking decentralized applications (dApps) and decentralized finance (DeFi) on Cardano - Vasil hard fork (Sep 22, 2022)

Scalability and performance improvements land, supporting more efficient block production and app performance. - Chang 1 upgrade (Sep 1, 2024)

The first batch of CIP-1694 governance features rolls out, starting the shift into deeper decentralized governance. - Plomin upgrade (Jan 29, 2025)

The second governance batch enables a fuller set of governance actions and introduces the DRep role. - CME futures planned (Feb 9, 2026, pending review)

CME Group announces plans to launch Cardano (ADA) futures, expanding regulated derivatives access.

Community sentiment and ADA news

ADA sentiment is split into two storylines.

One group is focused on legitimacy rails. CME futures are exactly the kind of milestone that changes who can trade ADA and how risk is managed.

Another group is focused on "plumbing," which is less exciting, but often more important. The ₳70M treasury push has been framed as funding critical integrations and ecosystem infrastructure that make Cardano easier to build on and easier to use.

Then there is the regulatory noise layer. Reuters notes the introduction of draft U.S. market structure legislation designed to clarify oversight and token classification, which keeps policy headlines in the price mix.

On the community side, Charles Hoskinson's comments around the Clarity Act debate and related industry tensions have added extra heat to an already sensitive policy cycle.

The bottom line

ADA has credible catalysts in 2026, but the chart is still the gatekeeper. CME futures expand access, governance funding supports execution, and NuNet’s Cardano payments add practical utility. Together, they make the ADA story easier to justify.

The near-term reality is simpler. ADA needs to reclaim and hold the $0.39–$0.40 zone to turn recovery into trend. And even the most bullish catalyst on the list, CME, may make the market more two-sided before it makes it more bullish.

If ADA can prove demand above resistance, the upside path opens. If not, range conditions remain the default, with $0.34 and $0.30 as the levels the market will keep respecting.

How to start trading Cardano (ADA)

Cardano is where research meets real-world application. If you're ready to dive into a future-focused ecosystem, Toobit gives you a clean, streamlined way to take action.