Three coins, three jobs

Markets are diverging in a way that's hard to miss, with the Fear & Greed Index at 44.

Bitcoin (BTC) price is increasingly treated like a macro benchmark, moved by institutional access and policy mood swings. Meanwhile, Cardano (ADA) price is shifting into a "prove it" phase where governance decisions start to look like operational strategy. Lastly, Stellar Lumens (XLM) price is leaning into utility, with payments, distribution, and tokenization narratives doing more work than pure sentiment.

If you only had time to read one section, this is it:

-

BTC-USDT was around $92,650 after a pullback of roughly $600 million in long liquidations. Bloomberg also tracked a ~$760M single-day surge into the U.S. spot Bitcoin exchange-traded funds (ETFs), a reminder that flows can flip the tape fast.

-

Cardano is entering an execution phase. Major Cardano ecosystem groups backing a 70 million ADA treasury allocation aimed at filling core gaps like stablecoins, oracle feeds, bridges, custody integrations, and analytics tooling.

-

XLM's utility story is increasingly tied to settlement and tokenized assets, with RWA.xyz listing Stellar at about $1.01B in distributed tokenized asset value. Increased tokenization and cross-border payments are the main drivers for XLM price, rather than XLM acting as a beta to BTC.

Bitcoin slips back to the low $90Ks after a leverage unwind

This week opens with Bitcoin trading in the low $90,000s. The latest 7D chart shows BTC at $92,678 and slightly positive on the week, but that headline number hides a rough path to get here.

Earlier gains pushed BTC price to just under $98,000 before momentum cooled into a $95,000 to $96,000 range.

The sharp drop that followed looked less like a "random dump" and more like a classic risk-off trigger plus leverage cleanup. Reuters reported renewed tariff tensions and broader risk aversion across global markets, with BTC sliding more than 3% as investors moved defensively.

According to CoinGlass data, in the past 24 hours, over $780 million long positions were liquidated across markets, with $222.5 million of that being BTC. The move was amplified by forced exits rather than slow spot selling.

ETF demand rose even as conviction failed to stick

In mid-January 2026, Bloomberg reported a roughly $760 million daily net inflow into U.S. spot Bitcoin ETFs, the biggest single-day haul since October. That kind of demand can put a floor under dips, but it does not eliminate volatility. It can also cut both ways when macro headlines flip and risk appetite pulls back.

Fear and Greed Index stays cautious at 44

Currently, Bitcoin is still trading into an area where prior buyers have historically used strength to reduce exposure.

The U.S. market-structure legislation has become a near-term catalyst again, with debate around stablecoin rewards and oversight pushing key discussions off schedule. The Senate Banking Committee delayed its discussion after a major industry player pulled support, while Bloomberg highlighted how the delay is keeping markets sensitive to headlines while details are renegotiated.

Holder behavior looks calmer than the headlines suggest

Glassnode reports that note long-term holders are realizing around 12,800 BTC per week in net profit, far below prior cycle distribution spikes.

That is a quieter backdrop than a true cycle-top regime, but it still leaves BTC sensitive to liquidity. The message is simple: Spot demand is improving, long-term selling has cooled, yet leverage can still yank price around when macro risk shows up.

How to start trading Bitcoin (BTC)

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

ADA governance finally commits to critical ecosystem upgrades

If you have been seeing louder conversations about Cardano lately, it is not just price talk.

Cardano's community X account, @Cardanians_io, outlined 5 major developments for ADA since 2026 began, which includes the Cardano Improvement Proposal (CIP), Google Cloud launching an ADA stake pool on testnet, and ADA ETF applications.

The real catalyst out of all, is the Cardano governance finally putting real resources behind the ecosystem gaps builders have complained about for years.

The 70M ADA vote is a credibility test, not a hype cycle

Cardano's core ecosystem groups backed a 70 million ADA treasury allocation aimed at improving essential plumbing: stablecoins, reliable oracle feeds, cross-chain bridges, custody integrations, and analytics tooling.

Governance approval can be seen as a push to bring more stablecoins on-chain, reinforcing the idea that Cardano is trying to remove practical blockers rather than chase short-term narrative momentum.

Governance is now running in real time

Cardano's governance stack is also starting to look like a system that operates continuously.

Intersect, a member-based organization in the Cardano ecosystem, submitted a governance action proposing an increase to Plutus memory unit limits per transaction and per block on behalf of the Technical Steering Committee.

These changes are part of a 2-phase process, and the first phase is intended to reduce friction for smart contract development while maintaining network performance and security.

What this means for ADA-USDT price action

The key shift is that the ADA-USDT price now has more than macro drift to react to. ADA can still move with BTC on broad risk appetite, but this funding package gives ADA its own catalyst ladder, which includes integration timelines, stablecoin depth, custody support, and whether decentralized finance (DeFi) activity has fewer ceilings.

If you want a grounded way to frame ADA future price expectations, anchor it to what the treasury spend is supposed to unlock, then watch whether the network's on-chain activity and liquidity respond as those pieces go live.

How to start trading Cardano (ADA)

Cardano is where research meets real-world application. If you're ready to dive into a future-focused ecosystem, Toobit gives you a clean, streamlined way to take action.

XLM gets utility headlines, but macro still sets the tempo

Stellar is having a strong week... if you're tracking macro narrative. On closer look, XLM is still being traded like a risk asset, especially when macro stress spikes.

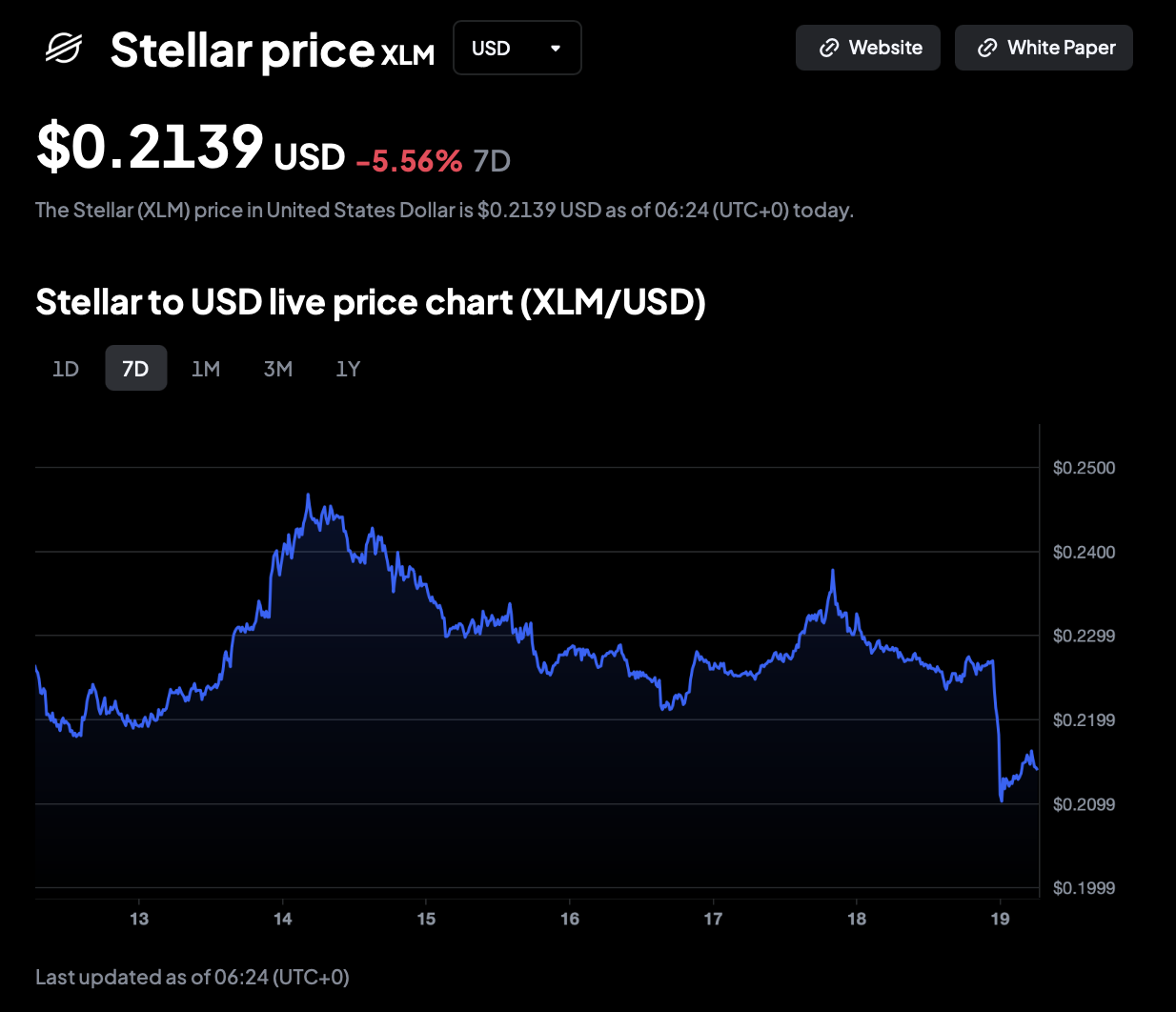

XLM price action shows a classic risk-off fade

On the 7D chart, XLM price is $0.2139, down 5.56% on the week. It rallied into the mid-$0.24s around the 14th, drifted lower through the week, then saw a sharp flush toward the low-$0.20s before a small bounce.

What caused the sharp drop?

Fresh U.S.-EU tariff tensions pushed markets into risk-off positioning, with BTC and ETH sliding, and volatility picking up across risk assets. Altcoins, like XLM, tend to absorb spillovers fast, lining up with the patterns in XLM's price chart.

Tokenization is the theme of 2026

Tokenization is looking to be the mainstay for 2026. Banks and institutions are exploring tokenized assets, despite adoption being uneven and operationally difficult. Just today, Bloomberg reports that State Street is rolling out a digital-asset platform aimed at tokenized deposits, stablecoins, and tokenized funds.

The rails story is real and it is getting louder

The utility narrative has been strengthening: Reuters reported that major central banks and commercial banks have moved deeper into BIS Project Agorá testing, a closely watched push to modernize cross-border payments with tokenized settlement concepts.

Though these initiatives are not Stellar-specific, they matter because they validate the broader direction of travel toward regulated tokenized finance.

So, should you invest in XLM?

The honest answer is that short-term direction often follows macro risk appetite, but the longer-term case depends on whether tokenization and cross-border settlement adoption keeps compounding.

That is also why a single XLM target price is less useful than a driver-based framework:

-

In the near term, tariff headlines and risk sentiment can overwhelm everything.

-

Over longer windows, the question is whether regulated tokenized finance keeps moving from pilots into real volume, because that is where XLM's utility narrative has the most leverage.

How to start trading Stellar Lumens (XLM)

Stellar moves value at lightspeed. If you're ready to explore a network built for real utility, Toobit keeps it simple with powerful, flexible trading tools.

Start trading Stellar Lumens now.

The bottom line

The market is rewarding specificity.

-

BTC is being priced like a macro instrument, where ETF flows, policy headlines, and leverage can overpower clean chart setups in a single session.

-

ADA is being repriced around execution, with governance decisions turning into a visible delivery scoreboard rather than a vague roadmap.

-

XLM sits in the utility lane, but it still feels macro shocks first, and only benefits later when settlement and tokenization momentum turns into measurable adoption.

If you want one framework going forward, stop looking for one "best coin" and start tracking three scoreboards: Flows for BTC, delivery for ADA, and real usage for XLM.

This is purely for educational purposes, not financial advice.

How to buy crypto on Toobit

To buy crypto on Toobit, create an account, complete verification, and go to Buy Crypto. Choose a token, select a payment method, and confirm the purchase. Your assets will appear in Spot Account once the transaction settles.

Congratulations, you now know how to purchase crypto on Toobit!