Toobit has launched a brand-new product - Event Contracts, offering a simpler and more intuitive way to trade market predictions. Enjoy a seamless trading experience with controlled risk, high efficiency, and no liquidation risk.

What are Toobit Event Contracts?

Toobit Event Contracts make short-term market predictions simple and risk-limited. Choose a time frame, pick higher or lower, and see how the market moves. Get a fixed payout if you're right - and if not, your loss is limited to your initial stake. No margin calls, no liquidations.

Why trade Event Contracts on Toobit?

Easy-to-use - Simple, intuitive trading for anyone

Controlled risk - No margin calls, no liquidation

Quick settlements - No long waits

How to use Toobit Event Contracts?

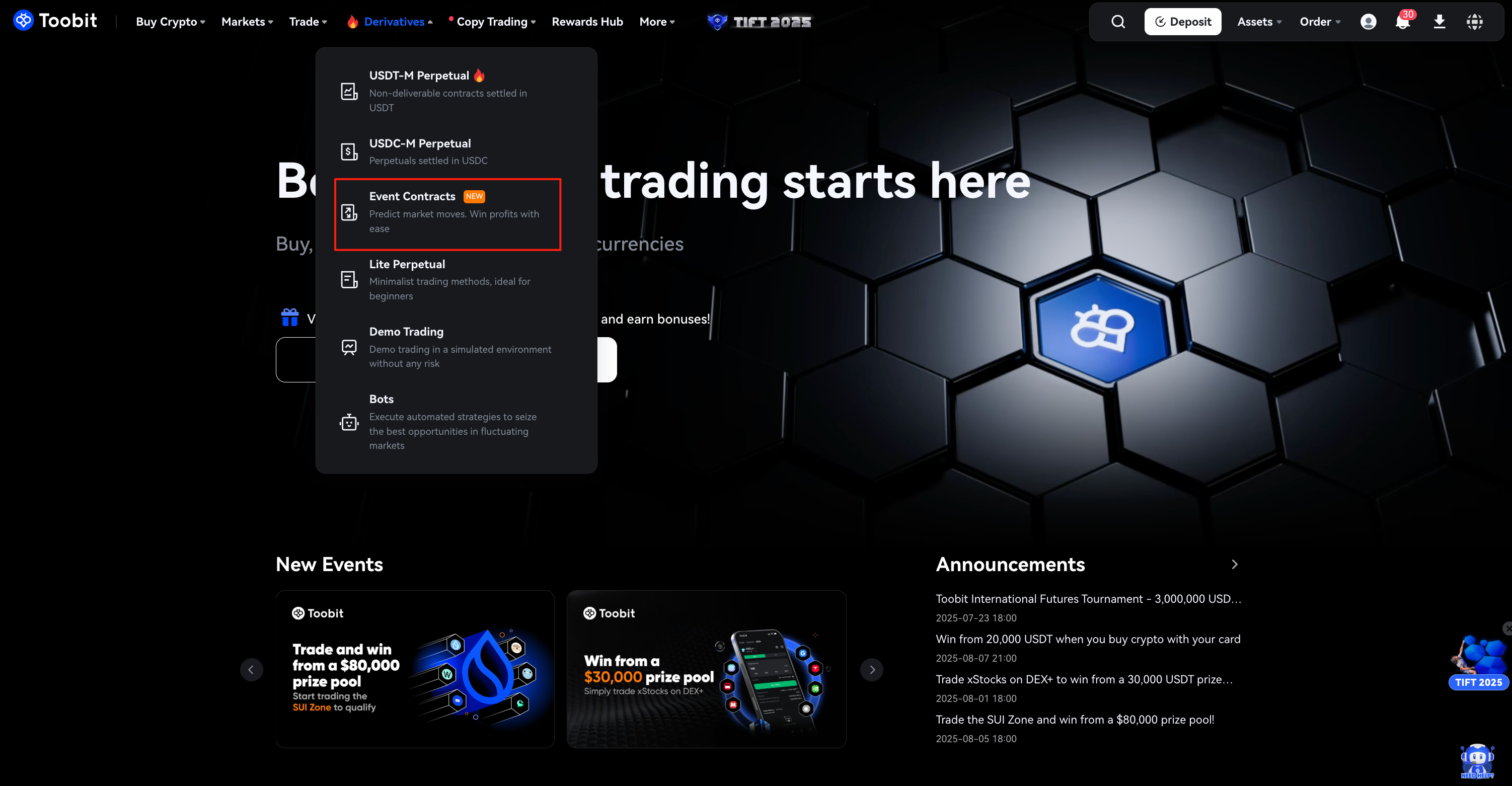

Step 1: Select an underlying asset

Log in to your Toobit account on the website and go to [Derivatives]. Choose the asset you want to trade.

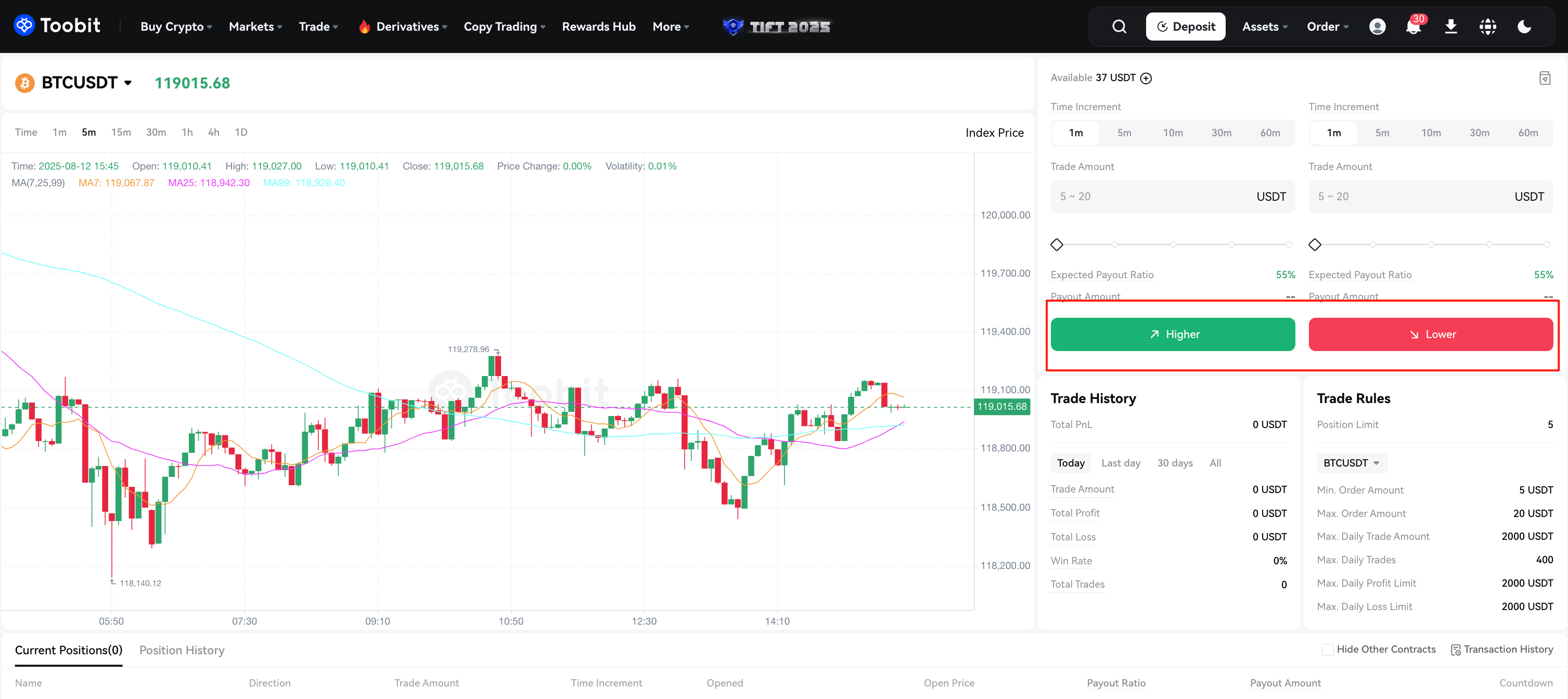

Step 2: Set the expiration time

Select when you want the contract to expire, including:

-

2 minutes;

-

5 minutes;

-

10 minutes;

-

30 minutes;

-

60 minutes;

Step 3: Enter the trade amount

Enter the amount you wish to trade - from 2 to 100 USDT.

This is the maximum amount you risk. You'll also see the potential payout before confirming.

Step 4: Choose the direction

Decide whether you expect the price to go higher or lower at expiration:

-

Choose [Higher] if you believe the Price Index will be higher at expiration; or

-

Choose [Lower] if you believe the Price Index will be lower at expiration.

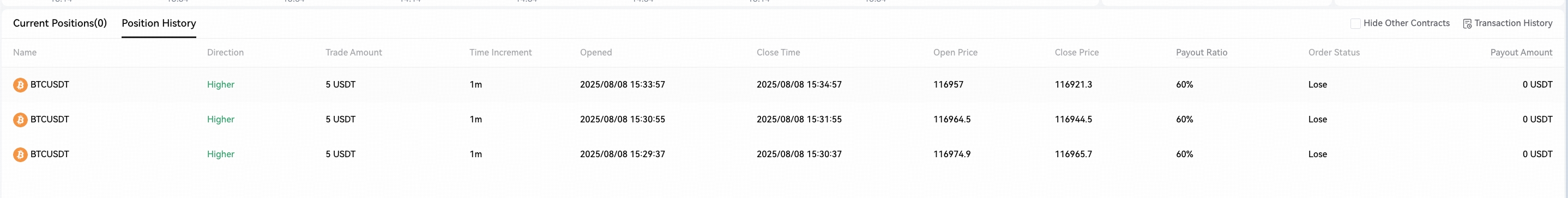

Step 5: Confirm the trade and wait for settlement

Once confirmed, the trade is locked in, and the countdown begins.

At expiration, the system automatically settles the result:

-

Correct prediction = fixed payout

-

Wrong prediction = loss limited to your stake

You can view all completed trades in [Position History], including entry/close prices, time, and P&L.

Frequently Asked Questions

1. What are Toobit Event Contracts?

Toobit Event Contracts make short-term market predictions simple and risk-limited. Choose a time frame, pick higher or lower, and see how the market moves. Get a fixed payout if you're right - and if not, your loss is limited to your initial stake. No margin calls, no liquidations.

2. How much does it cost to trade a Toobit Events Contract?

Each Toobit Events Contract ranges from 2 to 50 USDT. Traders only need to pay the contract premium upfront, with no additional fees and no margin requirements, making it a low-cost entry option.

3. What types of events can I trade on?

Toobit currently offers Event Contracts for major trading pairs like BTC/USDT.

4. How does the payout work?

In Toobit Event Contracts, your payout depends on whether your market prediction is accurate:

- Correct prediction

If you correctly predict the price direction of the underlying asset, you'll receive a fixed payout based on the payout ratio displayed at the time of order placement.

The payout amount is calculated using your order amount and the applicable payout ratio at entry.

- Incorrect prediction

If your prediction is incorrect, the contract will expire worthless, and no payout will be issued.

In this case, the amount you paid (Premium) will be counted as a loss and included in your daily loss cap.

- Flat price scenario

If the underlying asset's price at expiration is exactly equal to your entry price (i.e., no price movement), you'll receive a payout equal to your original order amount, meaning you won't lose anything in that trade.

- Payout mechanism

Payouts are dynamically calculated based on your order amount and the configured payout ratio.

The ratio may be fixed or adjusted automatically depending on the platform's P&L, helping maintain a balance between user returns and platform sustainability.

5. How is the payout ratio calculated?

The payout ratio is calculated internally based on asset volatility and market risk at any given time and could fluctuate. The payout ratio will be determined at the time of the trade and will remain fixed for that trade.

6. Are there limits to how much I can trade?

To ensure a safe and responsible trading environment for all users, Toobit Event Contracts come with built-in limits on trading frequency and potential risk:

- Daily loss cap

Each trader has a maximum daily loss cap of 10,000 USDT, which includes potential losses from any open contracts. The system will automatically prevent new orders if they would cause you to exceed this cap. In other words, the Premium paid for open positions will count toward your potential daily loss.

- User-defined daily loss limit

You can set your own daily loss threshold. Once your loss hits this limit, you won’t be able to place further orders. This limit resets daily at 00:00 UTC.

- Open position limit

There is a limit on the number of active (unsettled) contracts each user can hold. You can check the exact limit on the [Trading Rules] page within the platform.

- Price limit per contract

Each Event Contract also has a price movement limit to reduce potential risk. These limits are clearly displayed on the platform during order placement.

Toobit reserves the right to adjust the Daily Loss Cap, Open Position Limit, or Price Limit at any time, based on market conditions or risk management needs. Any changes will not affect your existing open positions.

- User cooling-off period

To promote responsible trading, users may voluntarily activate a cooling-off period, during which Event Contract trading is temporarily suspended. This feature is designed to help users pause and regain control during times of stress or consecutive losses.

- System-enforced cooling-off period

If a user accumulates total losses of over 50,000 USDT from settled contracts (excluding open positions), the system will automatically apply a 7-day cooling-off period. This mechanism is intended to give users time to review their strategies and avoid further loss escalation.

7. What is the benefit of trading Toobit Event Contracts compared to traditional options or futures?

Toobit Event Contracts provide users with a simple and intuitive way to express their views on market movements. Unlike traditional derivatives, like futures or options, they require no leverage or margin, and both the potential profit and maximum loss are clearly defined before placing an order, significantly lowering the barrier to entry. For users looking to participate in market volatility without navigating complex derivative structures, Event Contracts offer a more accessible and user-friendly option.

8. Can I close a contract before expiration?

No, Event Contracts cannot be closed before their expiration time. Once submitted, trades remain open until expiration.

9. How are the contracts settled?

Event Contracts are settled in USDT. When the contract expires, the system will automatically determine whether your prediction was correct based on the index price:

-

If your prediction is correct, the payout will be issued to your USDⓈ-M Futures Wallet based on the predefined payout ratio.

-

If your prediction is wrong, your loss will be limited to the fixed amount paid at the time of order placement. No additional fees will be charged.

10. How is the settlement value determined?

The settlement price of the contract is determined by the Toobit platform based on the index price of the corresponding underlying. The index price is sourced from multiple major exchanges and calculated using a weighted algorithm to ensure fairness, transparency, and resistance to manipulation.

11. How do I access Toobit Event Contracts?

Toobit Event Contracts are available to users in certain countries and regions only. You can trade these contracts on the Toobit website [Futures].

12. Do Event Contracts support subaccounts?

Subaccounts will automatically be able to trade Event Contracts if the main account is allowed and the same KYC method was used to validate the subaccount.

Disclaimers:

- These Event Contract FAQs may have been translated and published in different languages. In the event of any inconsistency, misstatements, omissions, or errors appearing in any translated version, the English language version shall prevail.

- Before using Event Contracts, you must read, understand, and accept the Event Contract Terms and any documents incorporated by reference therein. These Terms form a legally binding agreement. You may only engage in Event Contract trading if you fully agree to all applicable terms. The content on this page is provided for general informational purposes only and does not form part of any legal agreement.

- Trading Event Contracts involve significant risk. Prices of the underlying assets or markets can be highly volatile and may not be suitable for all investors. Toobit is not responsible for any losses you may incur - all investment decisions are made at your own discretion and risk.

- Market fluctuations are inherently unpredictable and may directly impact your contract outcomes. Past performance is not indicative of future results. Before trading, assess whether Event Contracts are appropriate for you, taking into account your financial situation, risk tolerance, and investment objectives. Where needed, consult independent financial or legal advisors.

- Toobit strongly encourages responsible trading. Never trade with funds you cannot afford to lose. The information provided here should not be considered financial or investment advice.