If you’ve spent any time in crypto circles, you’ve probably heard Ethereum Classic (ETC) mentioned with a mix of curiosity and eye rolls. Is it the same as Ethereum (ETH) or is it something else entirely?

While Ethereum keeps upgrading and smoothing out the rough edges, ETC sticks to the original rules.

Most traders see the ETC coin price and think it’s just a cheaper version of Ethereum. Supporters see something else: the original idea of a blockchain that doesn’t rewrite history, even when it’s uncomfortable.

So let’s unpack what Ethereum Classic actually is, how it works, and why it still matters, without getting lost in hype or buzzwords.

Why does Ethereum Classic exist?

To understand Ethereum Classic, you have to rewind to 2016. Ethereum had just launched and was home to one of the first major decentralized autonomous organizations (DAOs). Then, disaster struck. A vulnerability in the DAO’s code was exploited, and millions of dollars worth of ETH were drained.

The community faced a dilemma: should they roll back the blockchain to undo the hack or preserve immutability at all costs?

Ethereum’s developers decided to step in and change the blockchain to undo the damage. Most people agreed and moved to the new chain.

That decision created two blockchains:

-

Ethereum: The forked chain that rewrote the past.

-

Ethereum Classic: The original chain that refused to change, honoring the mantra code is law.

A smaller group didn’t follow. Their argument was straightforward: if you can change the ledger after the fact, it stops being immutable. They stayed on the original chain, which became Ethereum Classic.

The ‘Code is law’ argument behind Ethereum Classic

At the heart of Ethereum Classic is one rule: code is law. On ETC, the protocol is the final authority, not developers, voters, or committees.

If a smart contract has a flaw and someone exploits it, that outcome stands. No rollbacks. No exceptions. The network chooses machine rules over human judgment, even when that choice is uncomfortable.

That mindset shapes ETC price action in a way few other assets can match. While many chains tweak rules or narratives to stay market-friendly, ETC doesn’t budge. Its supply policy and chain history are fixed.

That stubbornness makes ETC appealing to anyone who cares about neutrality and censorship resistance more than trend-chasing.

How Ethereum Classic works

At its core, Ethereum Classic operates similarly to Ethereum’s early architecture. It’s a blockchain platform where transactions and smart contracts live in a distributed, public ledger.

Nodes around the world maintain and verify network activity so no single party can rewrite history.

Consensus mechanism: Proof of Work

Unlike Ethereum’s shift to Proof of Stake (PoS), Ethereum Classic has stuck with Proof of Work (PoW). It uses a modified Ethash algorithm called ETCHash, keeping GPU mining accessible and decentralized.

In PoW, “miners” compete to solve cryptographic puzzles. The first to solve the puzzle gets to add the next block and collect a reward.

This approach has pros and cons.

-

Pros: PoW is battle-tested and understood. It’s proven resilient over years of global attacks and stress.

-

Cons: PoW consumes more energy than PoS and depends on miners’ hardware and incentives to keep the network secure.

So when you look at ETC price action and ETC price charts, part of the story is how miners influence network stability and perception.

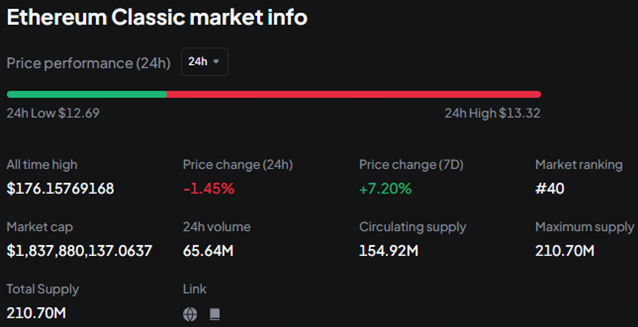

ETC also has a fixed maximum monetary supply, capped at about 210.7 million coins. Unlike ETH’s variable issuance, this gives ETC a “digital gold with smart contracts” angle.

Scarcity plus programmability drives the ETC cryptocurrency price and appeals to traders looking for a store of value with utility.

What makes ETC different

Here’s where Ethereum Classic truly diverges from its cousin.

-

Immutability above all

For ETC supporters, the blockchain is a ledger that should never change, even in crises. That’s why it refused to roll back after the DAO hack. If something goes on chain, that’s part of history, period.

-

Code is law

If a smart contract behaves in an unintended way, too bad, it’s still the contract’s output. ETC doesn’t prioritize human intervention over code execution.

-

Decentralization over everything

Rather than chase developer centralization or rapid upgrades, ETC’s community has emphasized decentralization and resistance to unilateral change.

These principles may seem old-school and they are. But they also attract a specific group of supporters and traders who value predictability over agility.

How the network stays secure

Network security for Ethereum Classic comes from its PoW consensus and a distributed set of miners. However, ETC has faced significant challenges:

-

51% attacks: Because ETC’s PoW has lower hash power than larger networks like Bitcoin or Ethereum (pre-Merge), it has been more vulnerable to chains of reorganizations and double-spend risks. The community and developers have worked on protections like checkpointing and other anti-reorg measures to strengthen the chain.

Security matters a lot when you watch the ETC price or track ETC coin price trends. Confidence in a chain’s integrity influences how institutions and retail traders value it.

What can you do on Ethereum Classic?

Ethereum Classic isn’t just a relic. It supports:

-

Smart contracts: Developers can deploy decentralized applications (dApps) just like on Ethereum.

-

Tokens: Standards like ERC-20 work on ETC too, though with less ecosystem depth.

-

Cross-chain bridges: Tools exist to move assets between ETC and other networks.

That said, ETC’s ecosystem is smaller and less active than Ethereum’s. If you’re looking at “ETC cryptocurrency price today” or researching ETC price prediction models, keep in mind that network activity and demand are key drivers of value, and ETC’s are modest compared to larger networks.

What traders see

Talking about ETC price without context is like talking about climate without seasons. Here are a few points traders often watch:

-

ETC price action tends to follow broader market trends. When Bitcoin and Ethereum rise, ETC often shows correlated movement.

-

ETC price charts reflect lower liquidity and thinner markets than major assets, meaning moves can be sharper and less predictable.

-

Long-term holders tend to frame ETC as a philosophical or hedge play, not a utility token with massive decentralized finance (DeFi) activity.

Looking ahead, ETC price predictions for 2026 are mixed. Analysts suggest a bullish scenario could push the ETC coin price to around $38.92, while a bearish view sees it near $9.42. At the time of writing, price of ETC is trading slightly below $13.

Speculation around ETC price prediction usually centers on macro conditions and risk appetite rather than network growth alone.

How Ethereum Classic stands today

Here’s the honest bottom line: Ethereum Classic is not Ethereum. It doesn’t have the same developer base, the same DeFi ecosystem, or the same institutional interest. But it has carved out a role:

-

A symbol of blockchain immutability

-

A PoW alternative for miners and decentralized purists

-

A niche piece of the broader crypto puzzle

For some traders, ETC is a philosophical bet. For others, it’s a technical trade. That’s why when you look at the ETC coin price or track ETC cryptocurrency price movements, you’re seeing both market mechanics and narrative sentiment at play.

So … Why does ETC still matter?

Ethereum Classic is a reminder of blockchain’s original promise: uncensored, unchangeable, and sometimes tough to deal with. Whether it becomes a key part of today’s crypto world or just a relic of 2016 is still unclear.

But as long as some people value “Code is law” over “Code is suggestions,” ETC will keep moving.

How to start trading Ethereum Classic

Ethereum Classic isn’t flashy, it’s principled. With its “Code is law” philosophy and steady PoW network, ETC attracts traders who value consistency and resilience.

Whether you’re looking at spot trades or want access to a full professional toolkit, Toobit makes trading Ethereum Classic simple.