Markets turned risk-on after a weekend of political calm. BTC dominance fell 1.66% to 59.58%, while the Altcoin Index dropped to 39, showing traders rotated into high-beta tokens as confidence returned.

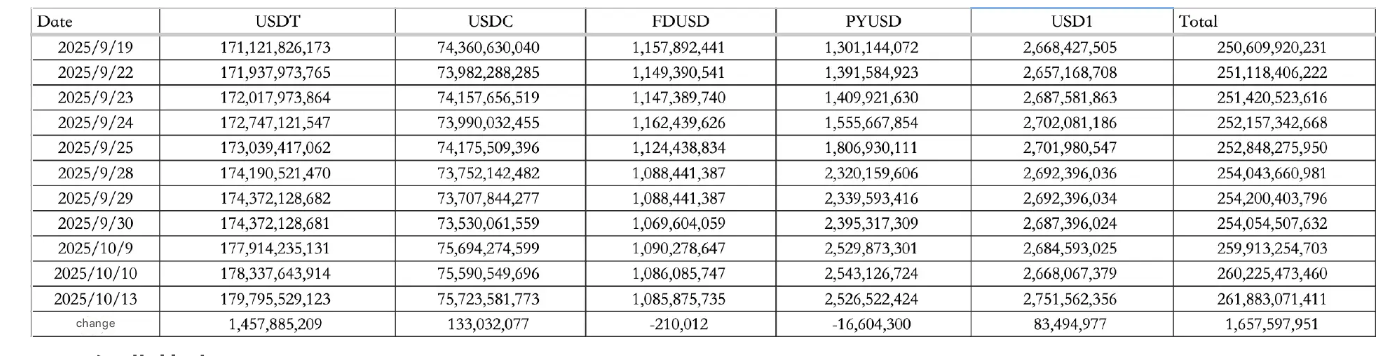

Stablecoin liquidity surged again. Between October 10 and 13, inflows hit $1.66B, including $1.46B into USDT and $133M into USDC, lifting the total stablecoin supply to $261.88B, a fresh cycle high.

Macro and policy

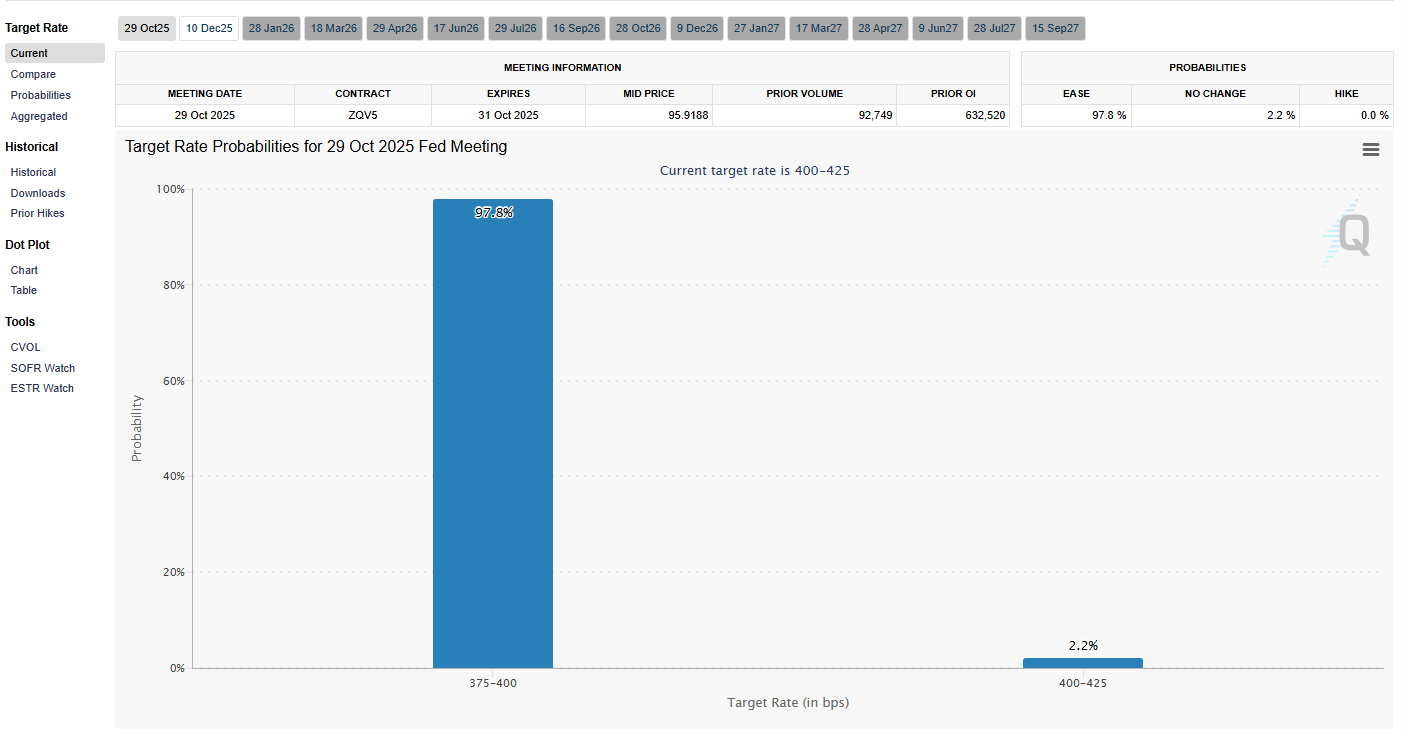

FedWatch now pegs a 97.8% chance of a 25 bp rate cut on October 25, reinforcing the dovish pivot narrative.

Meanwhile, politics lent the market some relief. U.S. Vice President Vance praised Trump’s diplomatic stance toward China, emphasizing dialogue over confrontation. The Commerce Department echoed this tone, saying the U.S. will “strengthen export-control communication” rather than escalate restrictions.

Together, the comments eased geopolitical anxiety and fueled the broad rebound across crypto majors.

Industry and market highlights

Glassnode reported crypto funding rates have dropped to their lowest levels since the 2022 bear market, marking one of the sharpest leverage resets in crypto history.

It suggests speculative excess has been flushed, leaving cleaner positioning across derivatives.

How to start trading Bitcoin

Bitcoin’s the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Alpha watch

The biggest Alpha event of the day is the YB token launch (TGE) from 16:00–18:00 (UTC+8). The sale will raise $2.5M for 25M YB tokens, with no Alpha points required.

Estimates based on prior TGEs:

-

If $60M in BNB participates: ~$162 per wallet.

-

If $120M in BNB joins: ~$82 per wallet.

-

If $180M in BNB joins: ~$52 per wallet.

Traders are already calling it “mandatory participation.”

Elsewhere, trader Eugene Ng Ah Sio warned that altcoin markets may remain damaged for the foreseeable future, calling this cycle’s leverage wipeout “a permanent scar” for many participants. He also said multi-strategy trading is no longer viable in crypto, and predicted “the end of treasury-based DeFi firms.”

Formula News founder Vida meanwhile said he closed his XPL long and halved his SOL exposure, keeping only $10M FDV meme positions for their “downside floor value.”

Finally, POLYMARKET confirmed via Decrypt that it will launch its native token once it officially enters the U.S. market, signaling a possible Q4 TGE timeline.