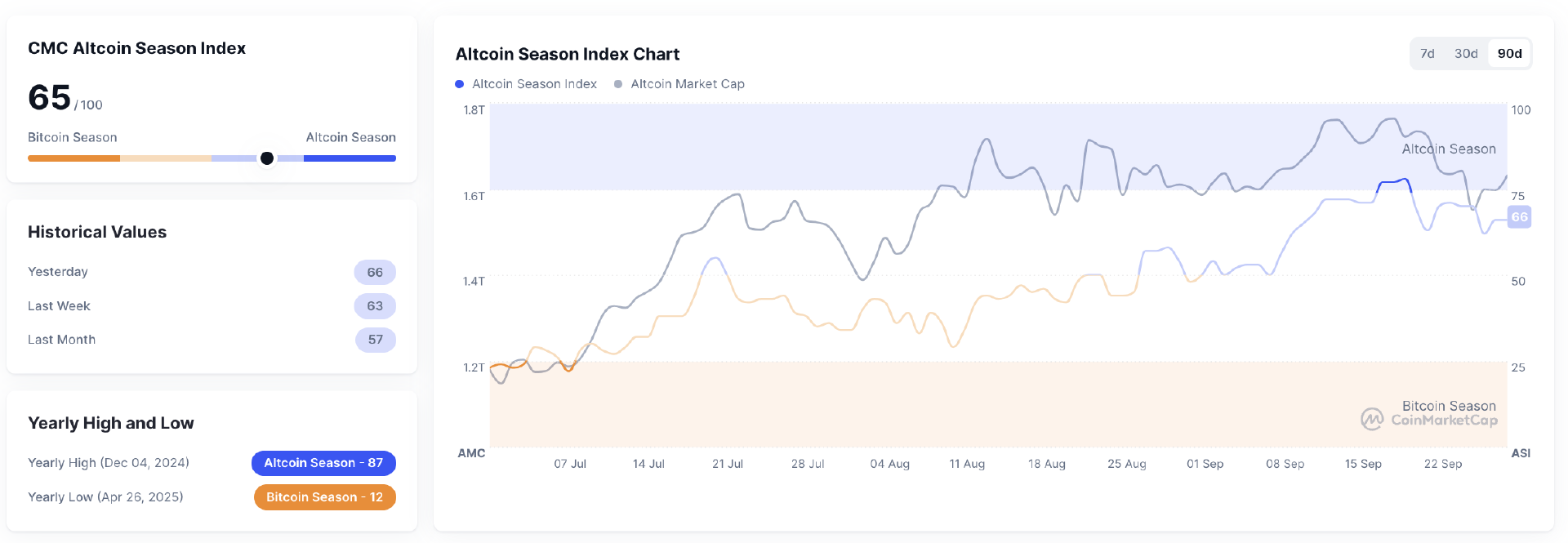

Bitcoin barely moved, with BTC dominance up 0.09% to 58.59%, while the Altcoin Index held at 65. Rotation chatter is alive, but momentum is subdued compared to last week’s highs.

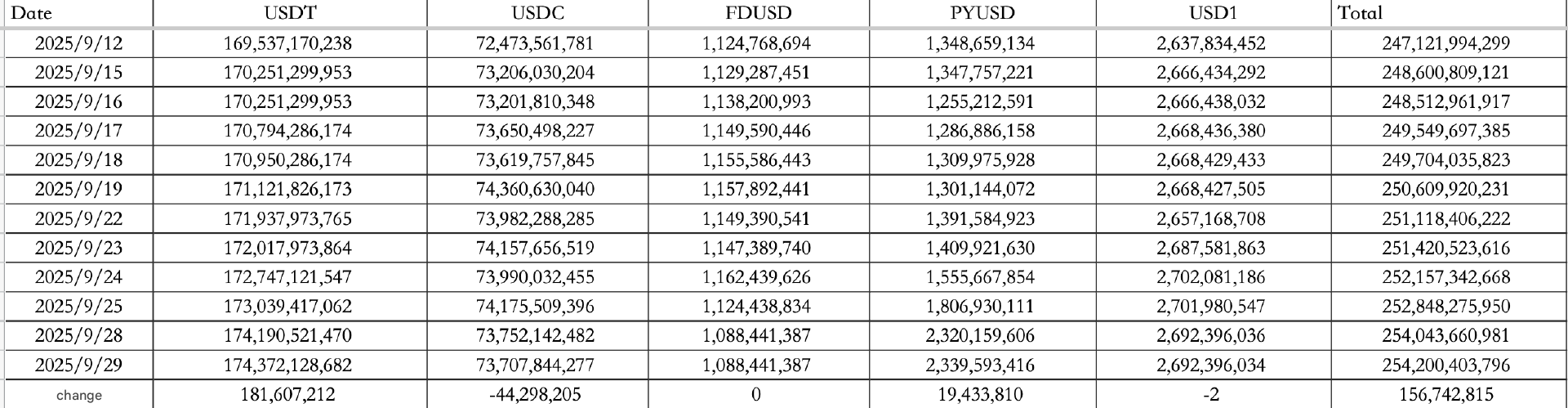

Stablecoins flowed in modestly. On September 29, the basket saw $156.74M of net inflows, with $181.61M into USDT offset by a $44.30M USDC outflow, lifting the total supply to $254.2B.

Macro and policy

Markets are bracing for a U.S. government shutdown, though odds are easing. Kalshi data puts the risk at 63%, down from 77.9% a day earlier, while Polymarket shows 67%. House Minority Leader Jeffries said there is “hope” for a temporary fix.

Still, the clock is ticking. Government funding runs out September 30, and Trump is scheduled to meet Schumer, Jeffries, Johnson, and Thune today.

Solana ETF watch

The big story is in Solana. Fidelity, Franklin Templeton, CoinShares, Bitwise, Grayscale, Canary Capital, and VanEck all updated their Solana ETF filings, adding staking language to allow SOL held in trusts to earn yield.

Bloomberg ETF analyst James Seyffart said the revisions suggest “positive dialogue” with the SEC, raising odds of a staking-enabled Solana ETF launch within weeks. If approved, Solana would become the first altcoin with a U.S.-listed staking ETF, a structural shift for institutional adoption.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry and alpha

The aster trade remains crowded. One large player admitted to spending $700K farming with hundreds of BTC/USDT accounts. Market data shows open interest rising, funding rates staying positive, but prices capped as market makers absorb buys, a setup that often ends with a downside flush before a sharp rebound.

Meanwhile, HyperLiquid rolled out Hypurr NFTs on HyperEVM, minting 4,600 units for genesis users, contributors, and the foundation. The floor price opened near $61,500.

On the dev side, Jump Crypto’s Firedancer team proposed removing Solana’s 60M compute-unit per block cap after the Alpenglow upgrade, letting blocks scale with validator hardware.

Alpha board

-

Stable pre-registration is open, with mass sign-ups encouraged for future airdrops.

-

Veteran traders warn the risk curve is steepening: better to lock profits and de-risk than gamble for more.

-

Aster Season 2 farming continues, but returns are expected to top out at just 1–2x fees unless new liquidity comes in.