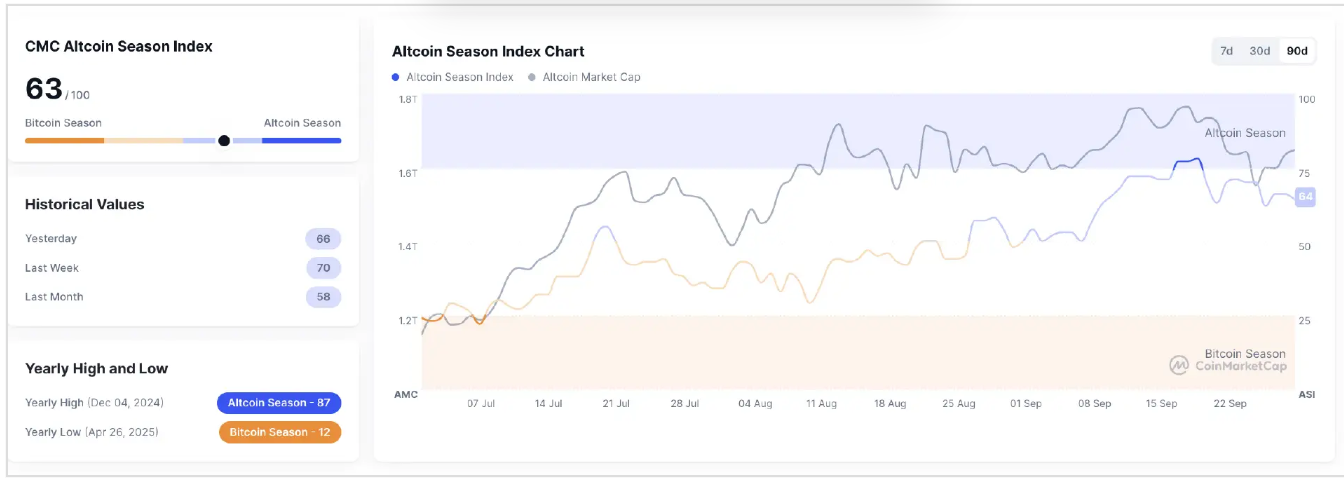

Bitcoin’s dominance ticked up 0.16% to 58.91% while the Altcoin Index sagged at 63, signaling that majors kept their grip on market attention.

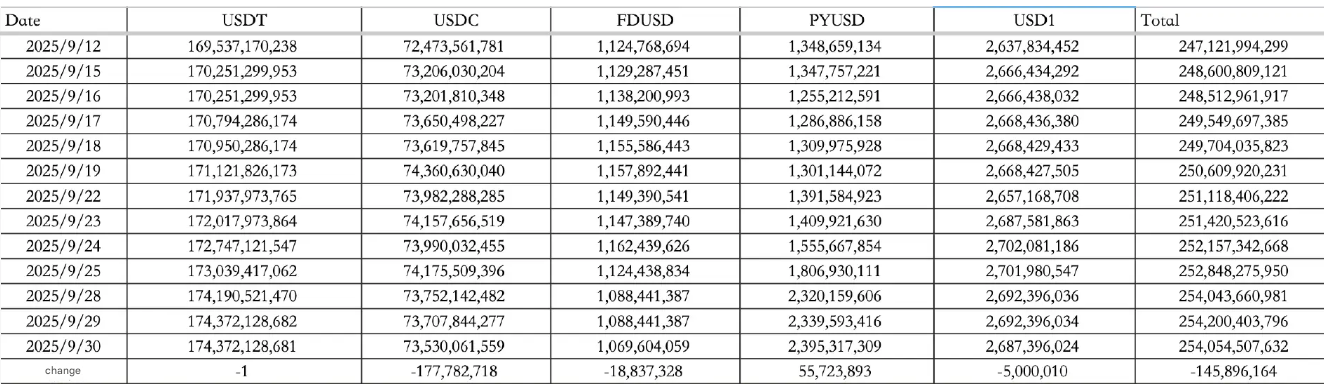

Stablecoins, however, told a different story. Outflows totaled $146M, driven by a hefty $177.78M drain in USDC, though some of this was offset across other stables. The total stablecoin supply now sits at $254.05B.

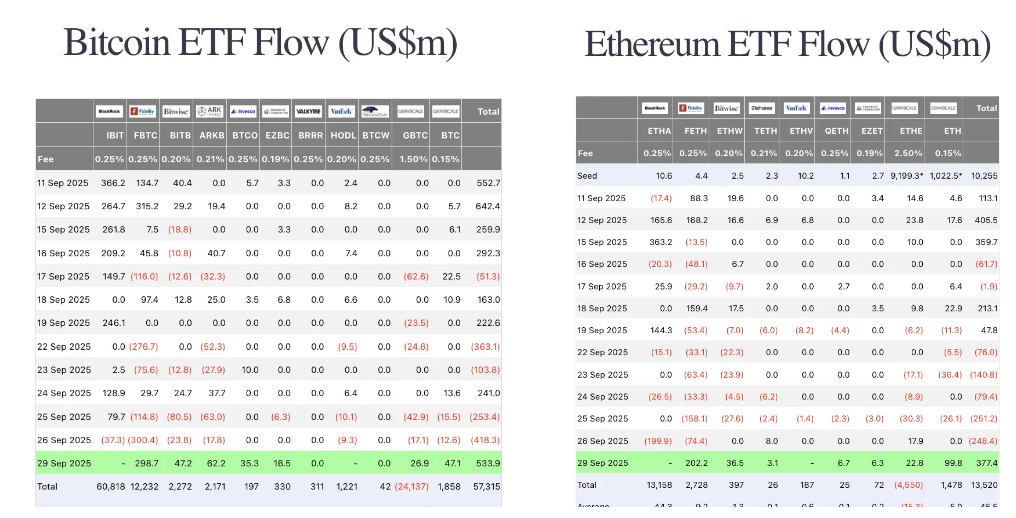

The ETF picture was more upbeat. On September 29, Bitcoin ETFs pulled in $533.9M and Ethereum ETFs attracted $377.4M, the largest inflows since September 16. The surge in institutional appetite highlights where the real capital rotation is headed.

Macro and policy

U.S. equities moved higher with the Dow up 0.15%, Nasdaq gaining 0.48%, and the S&P rising 0.26%.

Treasuries firmed as the 10-year yield fell 0.79% to 4.14%. The dollar index eased 0.25% to 97.95.

Gold jumped 2.23% to close at $3,842.40.

But markets are not free of political tension. With not much time before the October 1 deadline, Congress remains at a stalemate over extending healthcare subsidies and reversing earlier tax cuts.

Vice President Vance bluntly warned that the U.S. is “headed for a shutdown,” with hundreds of thousands of workers facing furloughs and key economic data releases set to stall if a deal fails.

Solana rises, Forward falls hard

Solana remains a battleground. Fitell Corp (NASDAQ: FTEL), Australia’s first Solana-focused asset manager, announced plans to launch a $PUMP token management platform after raising $100M and buying $10M in SOL.

On the flip side, Forward Industries, the largest Solana treasury player, saw its stock plunge over 10%, cutting its market cap to $2.236B. Forward has accumulated 6.822M SOL at an average price of $232, costing about $1.58B. Since peaking on September 12, its stock has slid 44%.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

ChatGPT turns shopfront

OpenAI is rolling out a new feature that lets ChatGPT users shop directly inside the chatbot, without switching platforms. Starting in the U.S., users will be able to buy products from Etsy’s local sellers and select Shopify merchants through ChatGPT.

The service, called “Instant Checkout,” currently supports single-item purchases only. Alongside this, OpenAI introduced an open-source standard called the “Proxy Commerce Agreement,” which allows merchants to integrate their products into ChatGPT and sell directly through the chatbot.

Industry highlights

Aster made headlines after racking up $23.25M in daily fees, briefly surpassing Tether. CEO Leonard outlined plans for Genesis Phase 2, which will distribute 4% of total supply in points, aimed at rewarding real traders while cracking down on sybil activity. To avoid overwhelming the market, rewards will be vested over time, with transparent rules expected after the phase concludes.

MetaMask confirmed it will integrate a Perp DEX and a points rewards program directly into its app. Meanwhile, HumidiFi, a Solana-based Prop AMM DEX, notched $5.57B in daily trading volume, rivaling Raydium and sitting just behind Meteora. Unlike traditional AMMs, HumidiFi runs solely on creator-owned liquidity pools, offering tighter slippage and MEV protection, and now accounts for nearly a third of Jupiter’s Prop AMM activity.

Regulatory watch

The SEC asked issuers of LTC, XRP, SOL, ADA, and DOGE ETFs to withdraw their 19b-4 applications under the new listing standards. At the same time, October is shaping up as a defining month for spot crypto ETFs. Deadlines are spread across the month, starting with Canary’s LTC ETF on October 2, followed by Grayscale’s Solana and LTC trust conversions on October 10, and WisdomTree’s XRP fund on October 24.