Bitcoin’s dominance stayed near cycle lows at 58.99%, while the Altcoin Index sat at 51, reflecting strong rotation into meme-heavy plays.

Most of the action was concentrated on BSC-based meme tokens, which dominated social chatter and liquidity flows.

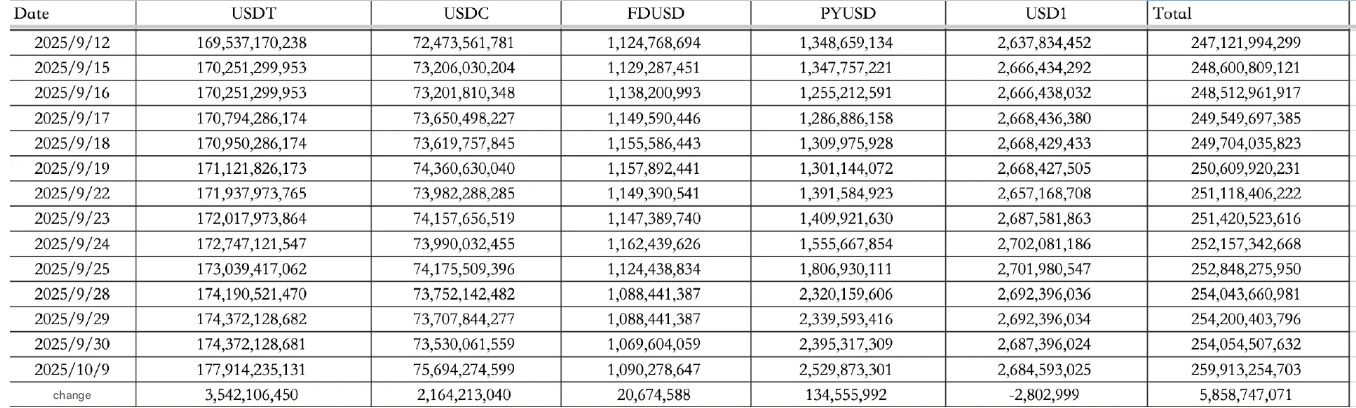

Stablecoins showed significant inflows over the past week, with a total of $5.86B entering markets between September 30 and October 9. USDT added $3.54B, USDC gained $2.16B, and the total stablecoin supply rose to $259.91B, marking another liquidity high for Q4.

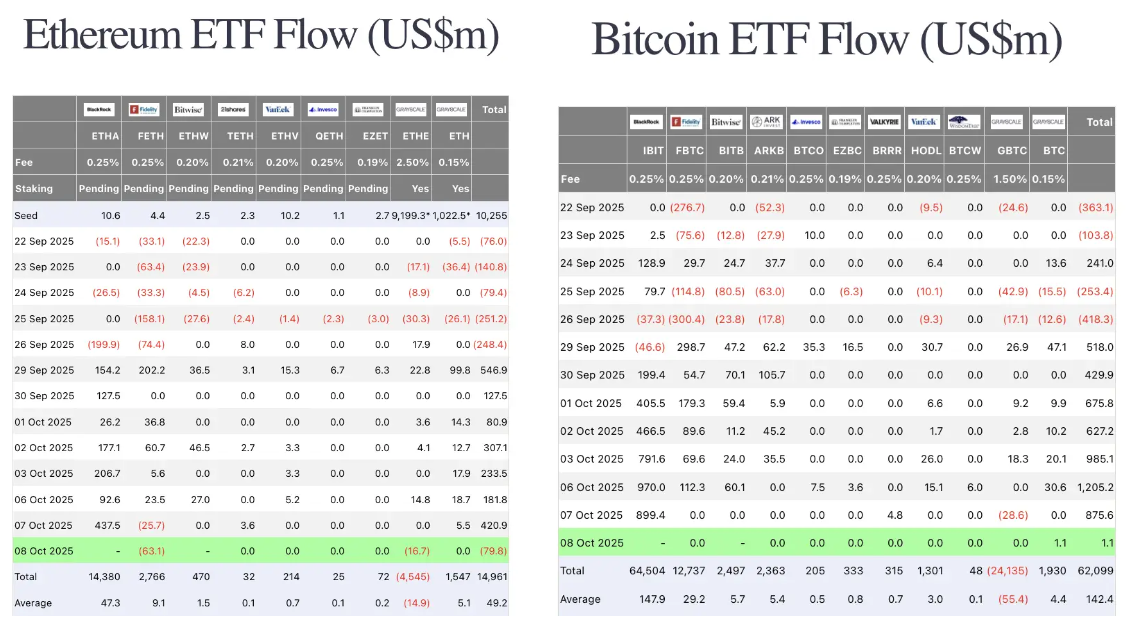

ETF flows were mixed. On October 8, excluding BlackRock data, BTC ETFs saw $1.1M in inflows, while ETH ETFs recorded $79.8M in outflows, showing a clear investor tilt back toward Bitcoin.

Macro and policy

Global equities rallied overnight, with the Dow flat, Nasdaq up 1.12%, and S&P 500 up 0.58%. Treasuries steadied, the 10-year yield dipped 0.05% to 4.11%, while the dollar index rose 0.25% to 98.77. Gold briefly topped $4,000 before easing 0.4% to $4,009.36.

In a warning that caught traders’ attention, the Bank of England cautioned that soaring valuations in AI-related stocks are creating conditions similar to the dot-com bubble, risking a “sudden correction” across global markets. The central bank also flagged rising defaults in U.S. auto loans and growing political tension in the Fed, France, and Japan as potential triggers for volatility.

How to start trading Bitcoin

Bitcoin’s the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Industry highlights

-

BSC meme tokens were the clear market driver, with daily trading volumes spiking and several new projects topping DEX rankings.

-

OKX quietly launched its CEX-integrated DEX trading function, offering gas-free swaps during beta, allowing users to buy tokens across all chains and secondary markets directly from a single account.

-

YZi Labs announced a $1B Builders Fund focused on the BNB Chain ecosystem, targeting early-stage projects and founders building core infrastructure.

-

GiggleFund confirmed a donation of over 7,800 BNB (worth over $10M) to Giggle Academy, a CZ-backed educational nonprofit offering free online schooling for children worldwide. The donation was funded through a 5% transaction tax on the $GIGGLE token.

-

Ethena and Jupiter revealed plans to co-launch JupUSD, a native Solana stablecoin, later this quarter. Jupiter intends to convert $750M of its USDC liquidity into JupUSD over time to bootstrap adoption.

Alpha watch

-

Meteora (MET) unveiled its tokenomics: 48% of supply will circulate at TGE. Distribution includes 20% for Mercurial stakers, 15% for Meteora users, and 3% each for Jupiter staking incentives, Launchpads, and Launchpool partners, with the rest vesting linearly over six years. A standout feature is the Liquidity Distributor, which lets users earn trading fees through liquidity positions instead of traditional airdrops.

-

MetaMask partnered with HyperLiquid to roll out on-wallet perpetuals, allowing users to fund contracts with any EVM token, auto-converted to USDC for trading.

-

Polymarket teased its long-awaited token launch with a cryptic post, sparking speculation about an airdrop announcement.

-

Arb traders were warned: “small-cap arbitrage risk is extremely high right now.”