Altcoins are roaring back. BTC dominance slipped 0.82% to 58.98%, while the Altcoin Index jumped to 40, extending the sharp rebound that began late last week.

Analysts caution, though, that this rally looks like a positioning squeeze rather than a confirmed trend shift.

Stablecoins kept the liquidity flowing. On October 14, inflows reached $100M, led by $116M into USDC, partially offset by a $20M USDT outflow, pushing the total stablecoin supply to $261.98B.

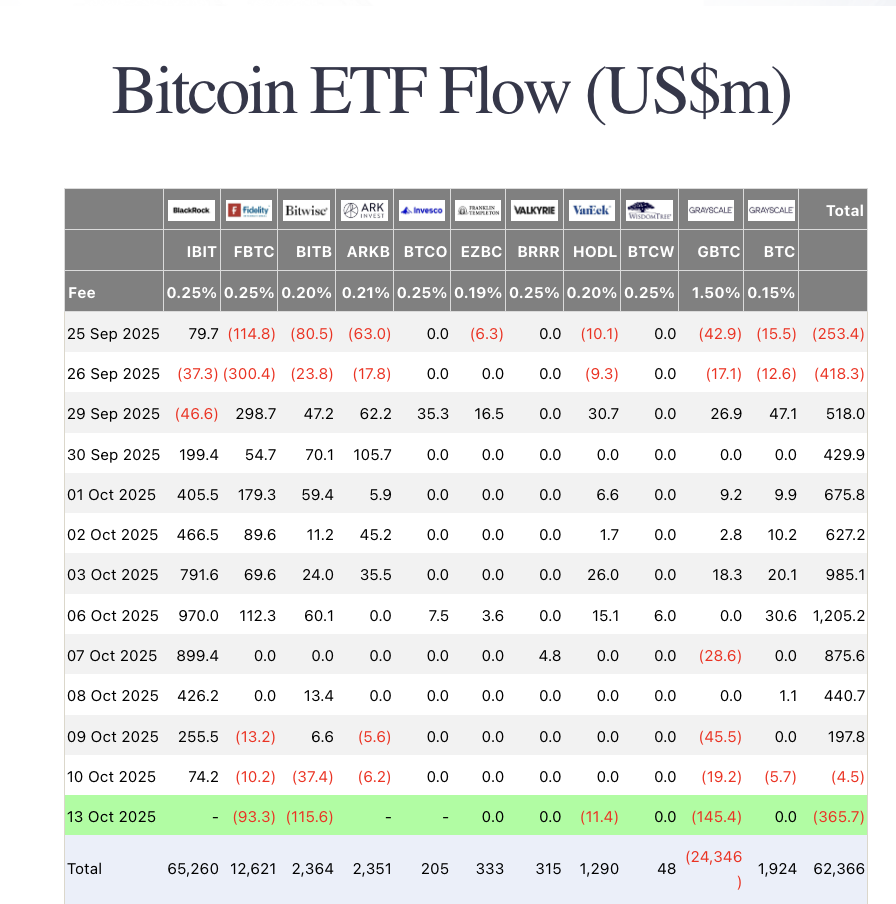

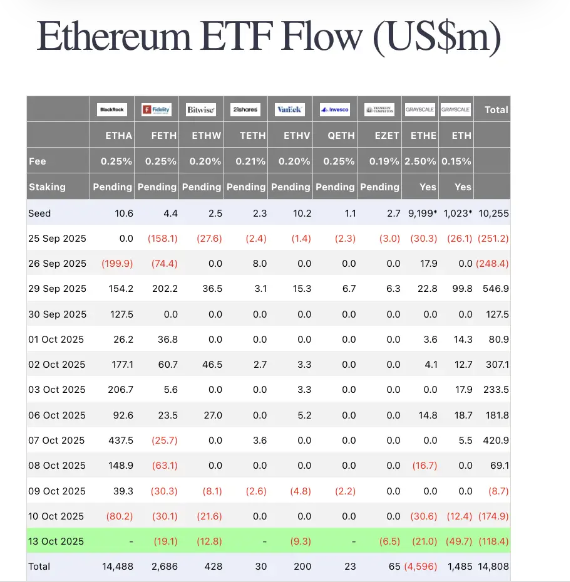

ETF activity stayed risk-off. On October 13, excluding BlackRock data, BTC ETFs saw $365.7M in outflows, while ETH ETFs lost $118.41M, another sign of institutional caution as regulatory processes stall.

Macro and policy

Global risk appetite improved, with the Dow up 1.29%, Nasdaq up 2.21%, and S&P 500 up 1.56%. The 10-year Treasury yield fell 2 bps to 4.06%, while the dollar index climbed 0.4% to 99.29. Gold surged 2.75% to $4,127.26, extending its breakout above $4,000.

In Washington, the government shutdown continues to paralyze the SEC’s review of pending crypto ETF filings. According to @xethalis, while 19b-4 approvals remain unaffected, fund issuers must still file registration statements under the 1933 and 1934 Acts.

With the SEC on pause, several issuers, including Bitwise and Grayscale, have withdrawn their latest amendments, meaning their 20-day clocks will automatically resume once operations restart. Once the government reopens or exchanges resume independent processing, SOL and LTC ETPs are expected to be among the first to list.

Meanwhile, political drama continues: multiple U.S. outlets report that the White House is actively debating a possible presidential pardon for Changpeng Zhao (CZ).

Sources close to the matter say Trump is inclined to support it, though advisors warn of backlash given his family’s growing crypto ventures through World Liberty Financial.

Finally, analysts at TD Cowen say the Senate’s crypto market structure bill is unlikely to pass before the 2026 midterms. The report cites deep partisan splits over DeFi oversight and a proposed ban on government officials owning digital assets, a clause directly tied to Trump-linked financial disclosures.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Market movers

Bloomberg revealed that China Renaissance Holdings is raising $600M for a BNB-focused strategic investment vehicle, with CZ’s YZi Labs co-participating.

According to sources, YZi Labs hosted a private “BNB Vision Circle” dinner earlier this month at Singapore’s Shangri-La Hotel. The event, attended by China Renaissance executives and several partner funds, centered on BNB’s role in the next trillion-dollar market cycle.

China Renaissance, one of China’s top investment banks, confirmed it is expanding into Web3 and digital asset reserves, with plans to invest $200M jointly with YZi Labs in a new U.S.-based crypto treasury company.

Industry highlights

-

Kalshi has partnered with Pyth Network to bring real-time prediction data on-chain across 100+ blockchains, the first major bridge of regulated market data into DeFi.

-

Bhutan announced its national identity system migration from Polygon to Ethereum, covering 800,000 citizens. The rollout was inaugurated by Ethereum Foundation chair Aya Miyaguchi, Ethereum co-founder Vitalik Buterin, and Bhutanese Prime Minister Tshering Tobgay. This marks the world’s first national Ethereum identity integration.

Alpha watch

-

BNB Chain’s “Rebirth Airdrop” launched to help meme traders hit by recent market swings, distributing $45M in rewards to over 160,000 users, supported by PancakeSwap and Trust Wallet.

-

Monad confirmed its airdrop claim portal opens October 15 at 21:00 Beijing time.

-

ZeroBase released its ZBT tokenomics: 43.75% to node staking, 11.25% to investors, 8% to airdrops, 15% to the ecosystem fund, 20% to the team and advisors (locked 1 year, then vested over 48 months), and 2% for initial liquidity (fully unlocked at TGE).

-

Solana’s synthetic stablecoin protocol Solstice reached $200M TVL within two days of launch. Its delta-neutral USX stablecoin maintains full USDT and USDC collateralization, generating yield through arbitrage and staking via YieldVault.