Sentiment stayed pinned in Extreme Fear with the Fear and Greed Index at 24.

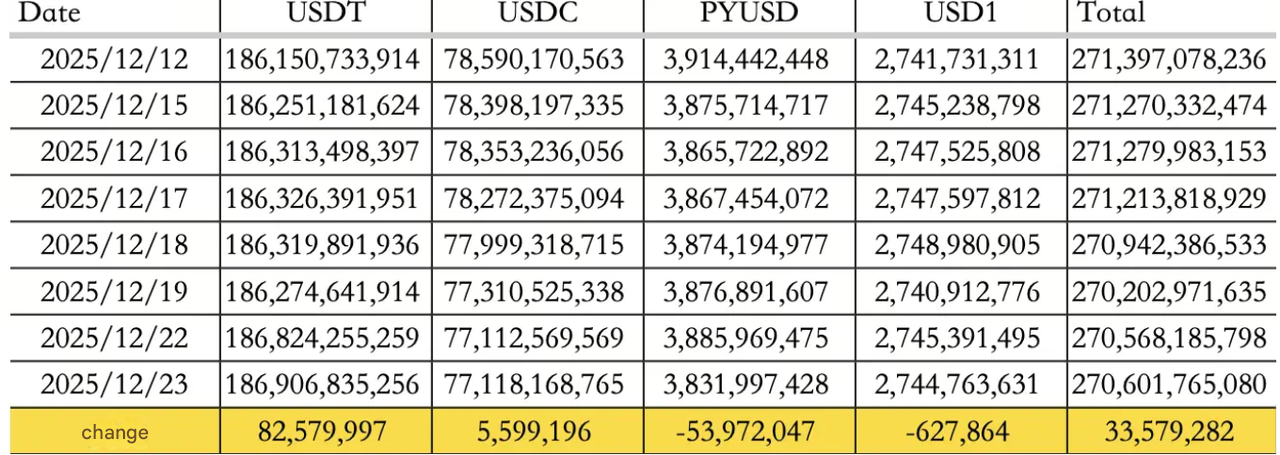

At the same time, stablecoin tape improved, with net inflows around $33.58M on the day, keeping total stablecoin supply near $270.60B. The split matters: USDT +$82.58M and USDC +$5.60M offset PYUSD -$53.97M and USD1 -$0.63M, a reminder that liquidity is rotating, not surging.

The other signal was narrative, not price: Prediction markets are no longer being treated as a small add-on inside a bigger product but a core pillar that shapes the strategy of a business. This shift in prediction markets is starting to show up in deal flow and infrastructure roadmaps.

Traditional markets

US equities pushed higher into a holiday-shortened week:

-

The S&P 500 up about 0.64%

-

The Dow up 0.47%

-

The Nasdaq up roughly 0.52%

Rates were steadier than the headlines felt, with the 10Y near 4.16%, while gold continued gaining strength around record-high territory in some measures.

Macro policy updates

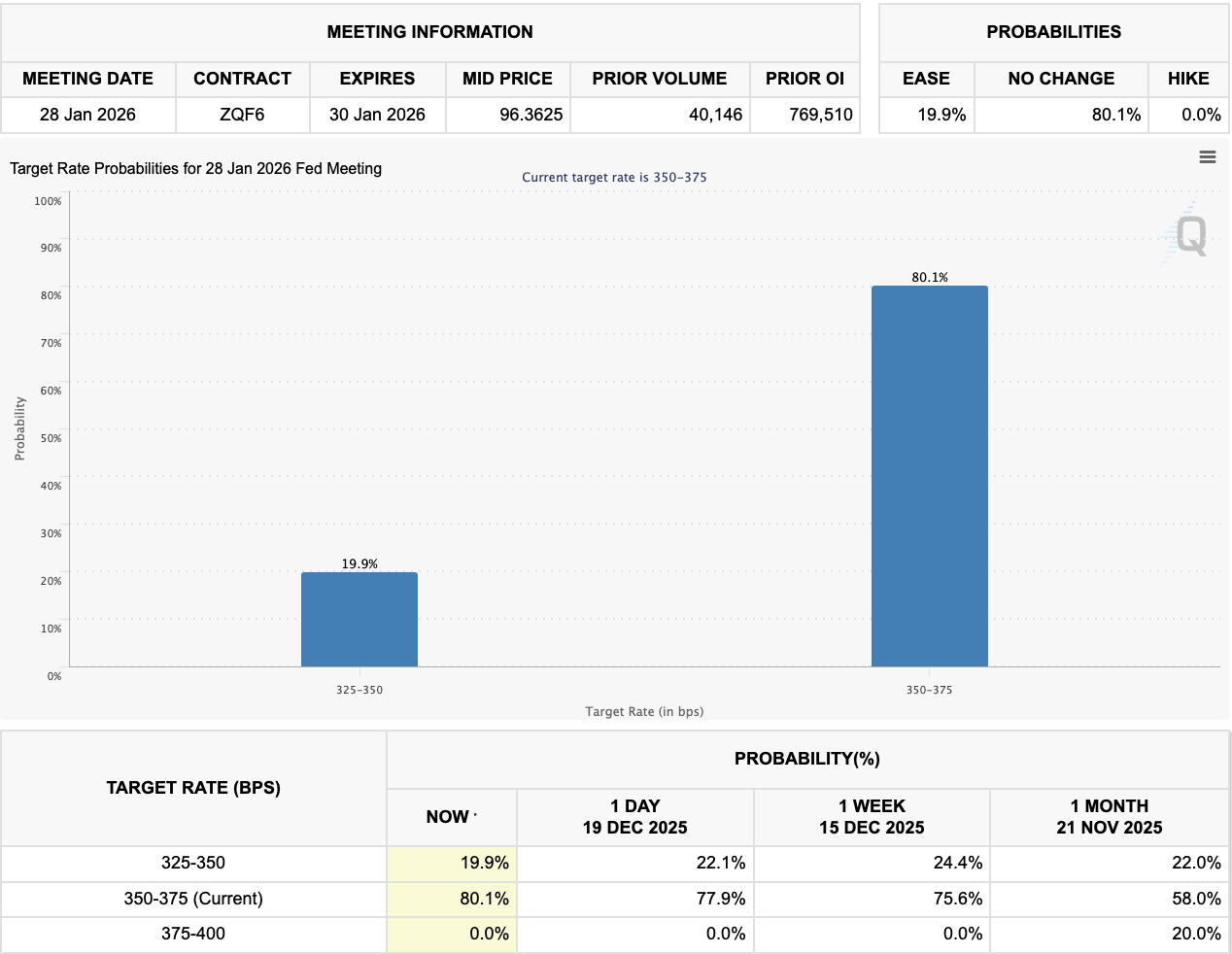

Rate expectations remain the market's guardrail. The read-through from FedWatch pricing still leans toward a hold at the next meeting, with "no cut" odds around 80.1% for next January.

On December 18, the American Bankers Association and 52 state bankers associations urged Congress to close what they call a GENIUS Act rewards loophole, pushing to ban stablecoin issuers and related platforms from offering yield, rewards, or interest to stablecoin holders.

The gap is that the Act targets issuers paying interest directly, but it does not clearly restrict affiliates or exchanges from layering rewards on top. For example, PayPal has marketed PYUSD rewards of 3.70% annually, even though it is positioning the payout as a platform reward rather than issuer-paid interest.

Industry highlights

Prediction markets are accelerating on two fronts. A major exchange signed an agreement to acquire prediction-markets startup The Clearing Company, framing it as a step toward regulated on-chain market expansion and broader "everything exchange" ambitions.

Polymarket, meanwhile, is reportedly preparing to migrate away from Polygon and prioritize launching its own Ethereum L2, POLY, alongside new formats like 5-minute markets.

Payments and settlement rails also kept building. RWA-focused PayFi protocol Velo announced a strategic integration of WLFI's regulated USD stablecoin USD1 into its ecosystem, aimed at liquidity and settlement support.

Finally, new issuance reality is getting harder to ignore: a recent analysis shows 84.7% of 118 2025 TGEs now sit below their initial FDV, with median FDV down 71% and median market cap down 67%. The takeaway is simple: launch is not the finish line, it is the stress test.

Alpha watch

Two "valuation by narrative" threads stood out.

-

Lighter's range-making has started: commentary linked to Polymarket comps, points pricing, and pre-market token references floated a wide band from $1.50B on the low end to $12.50B+ in optimistic cases.

-

Lighter also said it is in the final phase of Season 2 data analysis, targeting sybil addresses, self-trading, and volume-wash behavior, with removed points set to be redistributed back to the community. That is a credibility lever if executed cleanly, especially in a year where most TGEs have struggled post-launch.

Concluding note

2025 is closing with the market's priorities getting clearer.

Liquidity is still selective, but stablecoin flows and rewards programs are forcing regulators and banking lobbies into a faster policy response, which could reshape how "cash on-chain" is distributed in 2026.

At the same time, prediction markets are graduating into full-stack roadmaps, from acquisitions to new rails. And with most 2025 TGEs still underwater, the next wave of announcements will be judged less on launch hype and more on whether teams can hold attention, liquidity, and real usage into year-end and beyond.