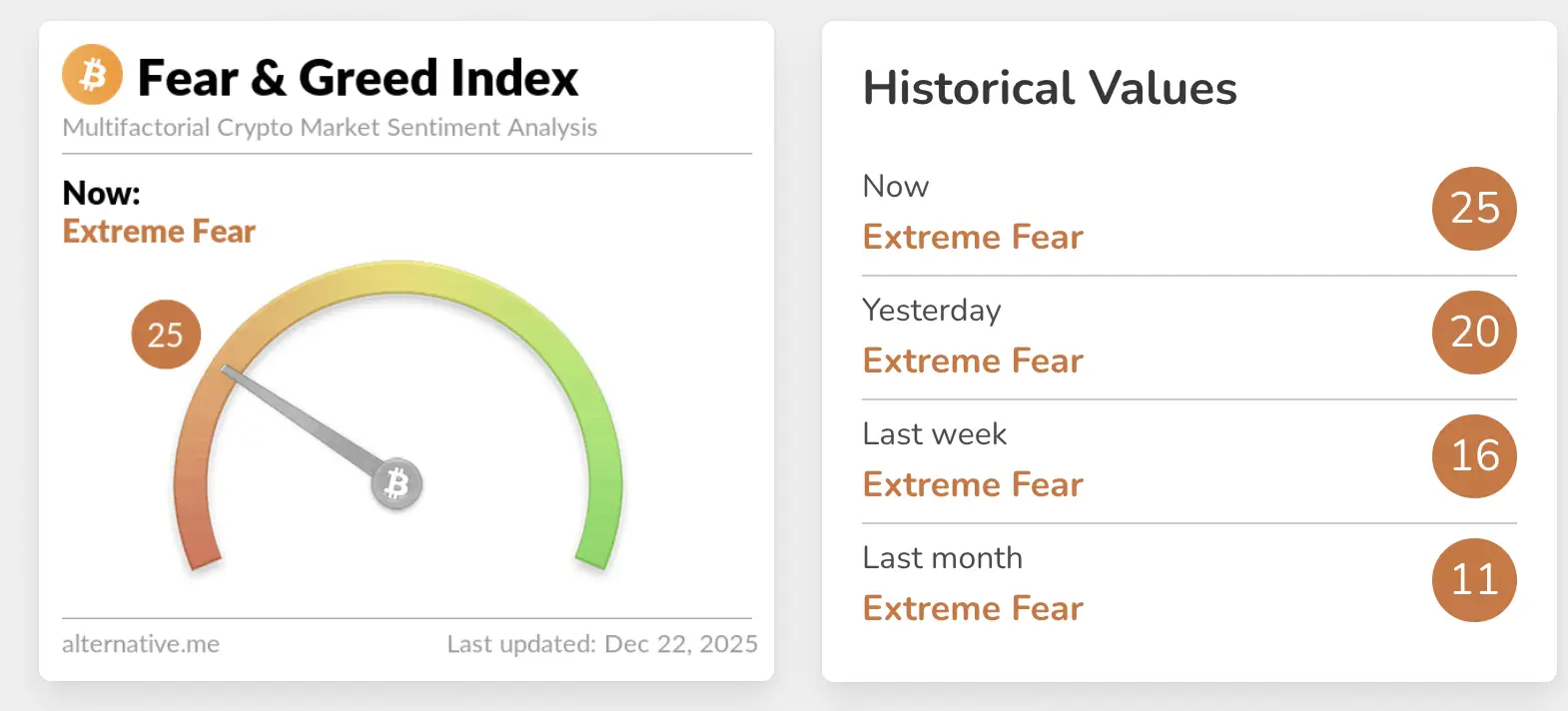

Risk sentiment remains fragile as capital continues to rotate cautiously across asset classes. The Crypto Fear and Greed Index sits at 25, keeping the market firmly in fear territory.

Bitcoin dominance slipped slightly by 0.05% to 59.98%, signaling mild pressure rather than a decisive shift toward altcoins.

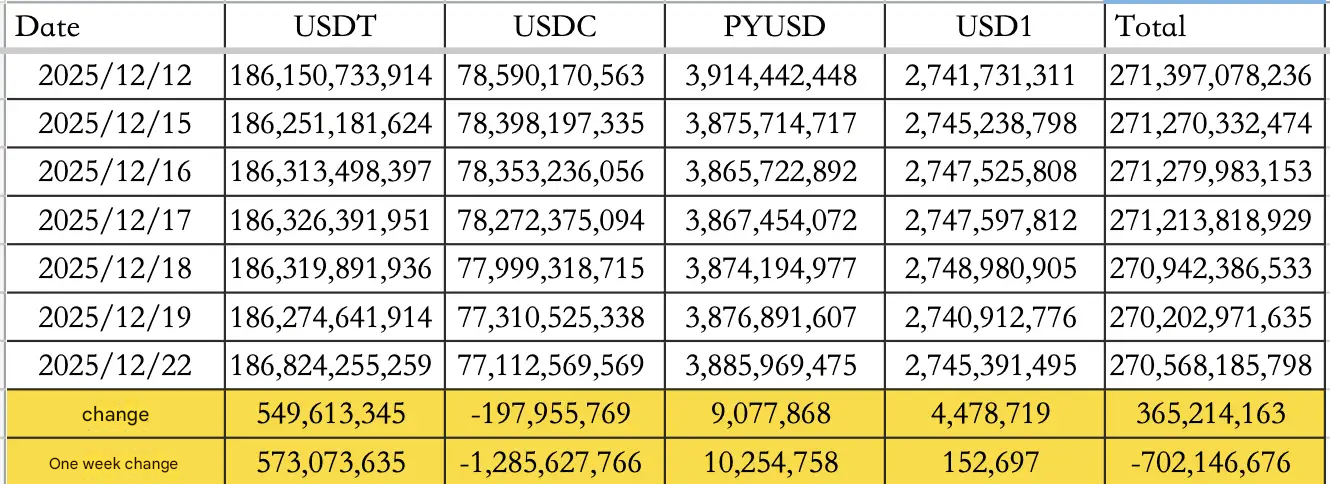

Stablecoin data points to continued liquidity leakage. Between December 15 to 22, total stablecoin supply declined by approximately $702.15M.

In the same period, USDT recorded net inflows of $573.07M, while USDC saw significant outflows totaling $1.29B. Combined stablecoin supply now stands at $270.57B.

The divergence highlights selective positioning rather than broad risk appetite, with capital favoring liquidity flexibility over deployment.

Traditional markets

While crypto consolidation persists, traditional hedges moved sharply. Gold rose 1.04% to $4,383.55, breaking to a new all-time high and reinforcing demand for defensive assets amid lingering macro uncertainty.

Macro policy updates

MicroStrategy's supply grab gets pricier

Michael Saylor provided updated insight into large scale Bitcoin accumulation. He noted that MicroStrategy has spent roughly $50B to acquire 3.2% of Bitcoin's circulating supply, currently totaling 671,268 BTC.

Saylor added that deploying another $50B may only secure about 1% of supply due to Bitcoin’s rising price. His stated long term objective remains acquiring between 5% and 7.5% of circulating BTC, underscoring continued conviction from high profile institutional allocators even as near term conditions remain cautious.

Polymarket wraps a breakout year

Polymarket released its 2025 annual recap, now accessible directly from the platform’s homepage. The summary highlights the platform’s rapid growth and expanding market relevance over the past year.

High risk strategies chase short-term volatility

Separately, trading strategies tied to short term Bitcoin prediction markets drew attention. One widely discussed example claimed that a strategy starting with $2,000 generated roughly $300,000 over two months, a reported 150x return.

The approach relied on neutral grid style positioning across Yes and No outcomes in 15 minute Bitcoin markets, exploiting short term volatility while remaining vulnerable during strong directional moves.

Industry highlights

Token launches keep disappointing

Token launch performance continues to weigh on sentiment. A review of 118 token generation events (TGE) this year found that 84.7% of tokens are trading below their fundraising valuations.

Only about 15% of new launches remain profitable, reinforcing investor skepticism toward early stage pricing.

Uniswap fee switch nears finish line

On the governance front, Uniswap's fee switch proposal entered its final voting phase, with approval support currently near 100%. Voting concludes on December 25 at 1:11 PM in Eastern US time (EST/EDT).

If passed, 100M UNI will be burned following a two day timelock, and fee switches on v2 and v3 will activate on mainnet, initiating both UNI and Unichain fee burns.

How to start trading Bitcoin

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Alpha watch

Rainbow Wallet eyes February TGE

Rainbow Wallet is reportedly planning a TGE around February.

Lighter airdrop registration goes live

Meanwhile, Lighter has opened registration for its airdrop program. Eligible users can distribute allocations across up to four addresses, though participation is optional.

Concluding note

Liquidity remains selective, sentiment stays defensive, and risk appetite is restrained.

Gold's breakout contrasts sharply with crypto’s consolidation, while stablecoin outflows reinforce a wait and see posture.

For now, patience continues to outperform prediction as markets look for a clearer catalyst to reset direction.