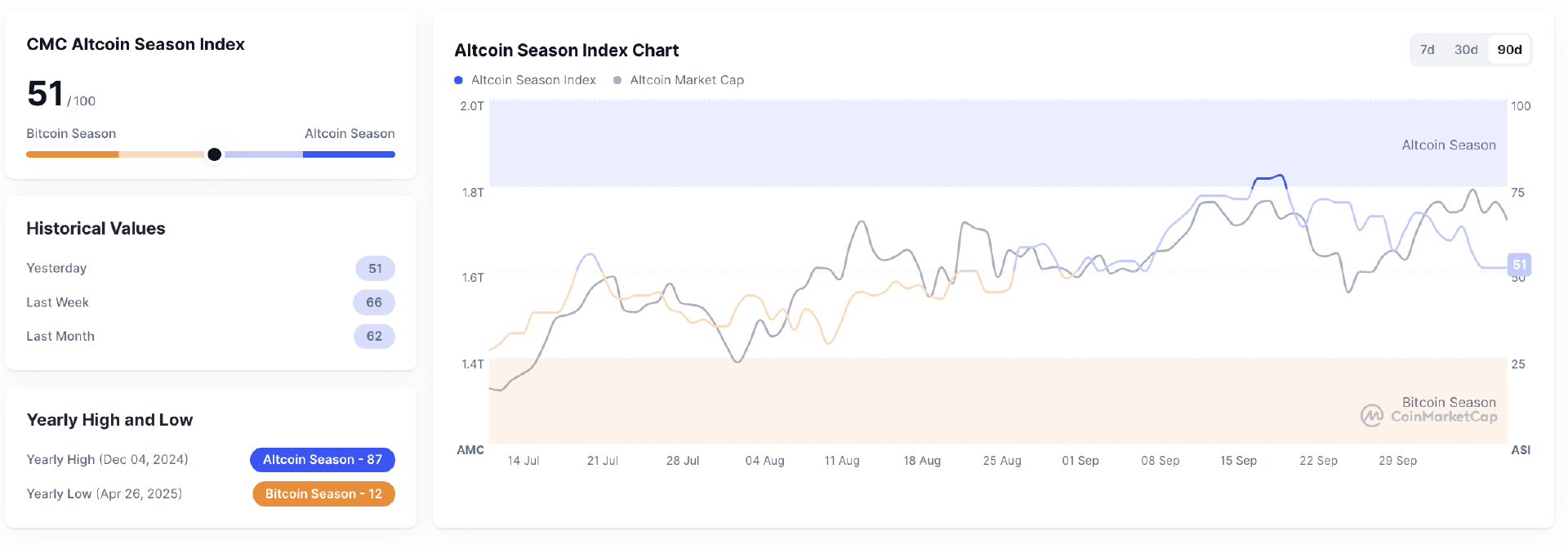

Bitcoin’s market share rose 0.57% to 59.30% as major tokens kept center stage. The Altcoin Index sits at 51, suggesting narrower breadth beneath the leaders.

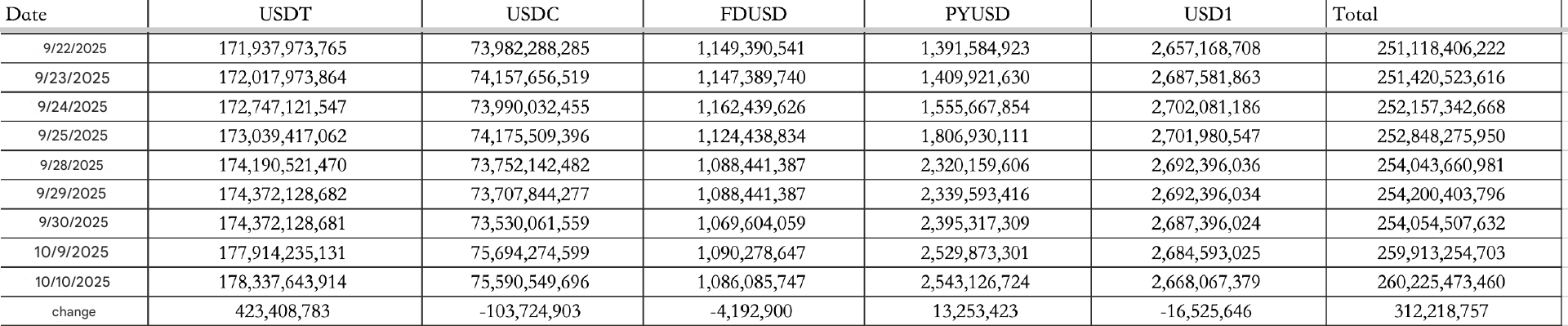

Stablecoins saw net inflows of $312.22M on October 10, led by a $423.41M inflow into USDT and offset by a $103.72M outflow from USDC. Total stablecoin supply now stands at $260.23B.

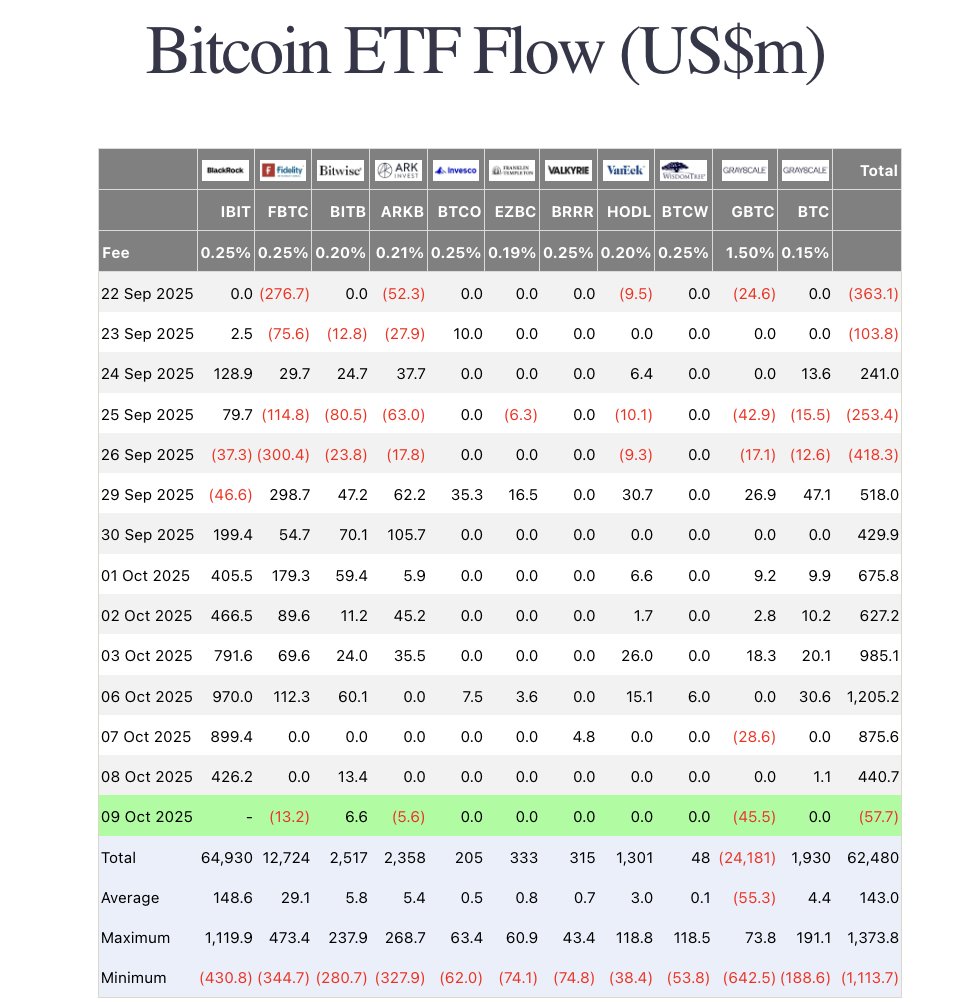

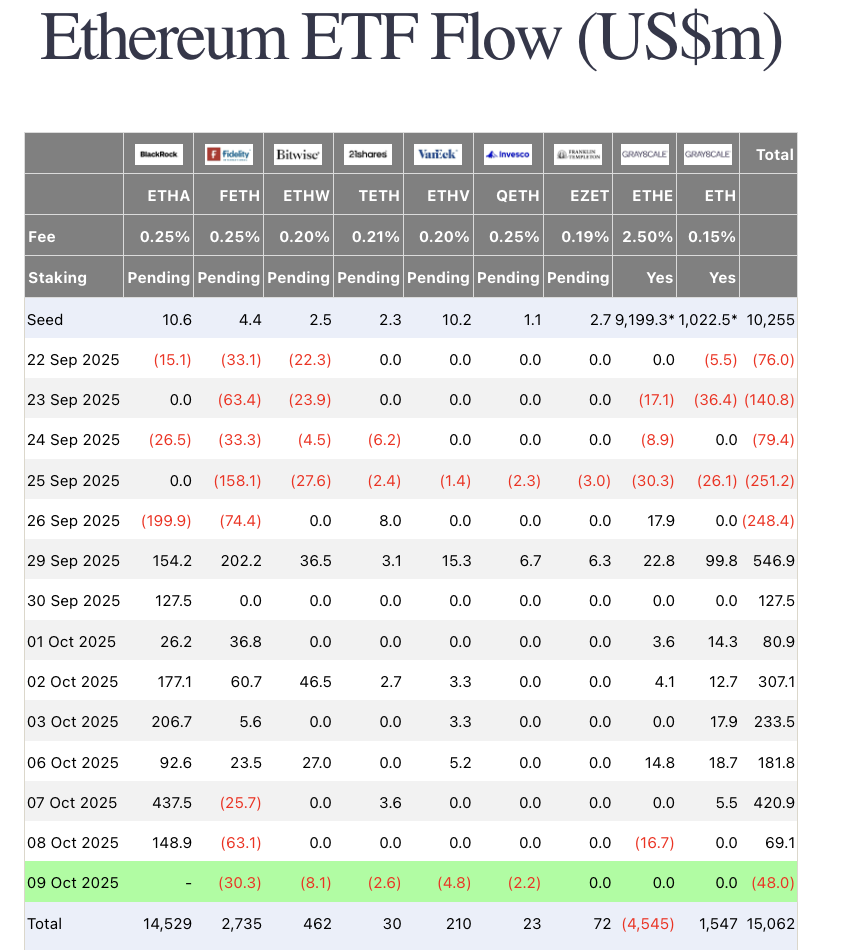

On October 9, excluding BlackRock data, Bitcoin ETFs recorded a $57.7M outflow while Ethereum ETFs saw a $48M outflow.

On October 9, excluding BlackRock data, Bitcoin ETFs recorded a $57.7M outflow while Ethereum ETFs saw a $48M outflow.

Macro backdrop

US equities slipped, with the Dow down 0.52%, the Nasdaq down 0.08%, and the S&P 500 down 0.28%.

The 10-year Treasury yield rose to 4.14%, and the dollar strengthened to a 99.37 index reading.

Gold ticked up 0.25% to $3,988.25.

The market is also watching Federal Reserve pricing closely, with CME metrics showing a 94.6% chance priced for a 25 basis point cut.

On the political front, the Senate failed to pass a Democratic stopgap to end the U.S. government shutdown, and voting continues on an alternative Republican funding bill. That uncertainty increases tail risk for economic data and market liquidity.

Institutional and corporate moves

Grayscale has chosen Figment as the staking provider for its Solana trust, $GSOL, and has launched staking services for U.S. investors, offering regulated access to staking rewards.

Meanwhile, Japan-based payments giant PayPay plans to acquire a 40% stake in Binance Japan.

Short seller Kerrisdale Capital revealed a short position in Bitmine, arguing that the digital asset treasury model has become overcrowded and that premiums are collapsing.

Separately, Liquid Capital founder Yi Lihua said a major buying window is approaching, pointing to three long-term asset classes worth watching: public blockchains like Bitcoin and Ethereum, exchange and platform tokens, and stablecoin-related assets.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Airdrops, listings, and fresh funding

Monad announced that its airdrop claim portal will open on October 14. The project said the distribution will follow a time-window plus task-based model instead of the usual eligibility check, aiming to curb automated claim farming. Pre-market pricing places $MON at $0.11, giving it a fully diluted valuation of around $12B.

At the same time, a major exchange introduced a new on-chain meme-wallet listing pathway. The initiative features a curated “Four Meme” zone, with token launches limited to the wallet platform and a leaderboard system that ranks projects based on user participation and holdings.

Those rankings will influence future listing decisions across the exchange’s ecosystem, turning wallet engagement into a gateway for broader market exposure.