Year-end trading tends to reward clarity and punish overconfidence. Liquidity is often thinner, order books can be less forgiving, and headlines can move prices faster than expected because it takes less volume to shift the tape.

That is why the BTC price remains the starting point. Bitcoin shapes overall market sentiment, and the key question for the final stretch of the year is whether DOGE price and XRP price can rebound alongside BTC, not just bounce on their own.

This outlook blends the macro backdrop with each asset's fundamentals, including Exchange Traded Funds (ETFs) developments for XRP and community-driven narratives for Dogecoin (DOGE), plus a practical read on positioning as the calendar turns.

Macro still sets the boundaries in December

In December, macro is rarely neutral. Central bank guidance, inflation data, and rate expectations can change risk appetite quickly, especially when markets are already managing year-end positioning.

When macro uncertainty rises, capital often concentrates on BTC first because it is the most liquid market benchmark and the easiest place to size risk quickly. When macro pressure eases, DOGE and XRP usually get a cleaner window to catch up.

If you are tracking BTC-USDT's current price day to day, do not treat it like a standalone number. Pair it with what the market is pricing for rates and liquidity conditions, because those inputs often determine whether rallies extend or stall.

BTC leads even without fireworks

BTC does not need a vertical rally to lead. It can pull the market higher simply by staying orderly, holding key zones, and avoiding sharp downside breaks that flip sentiment.

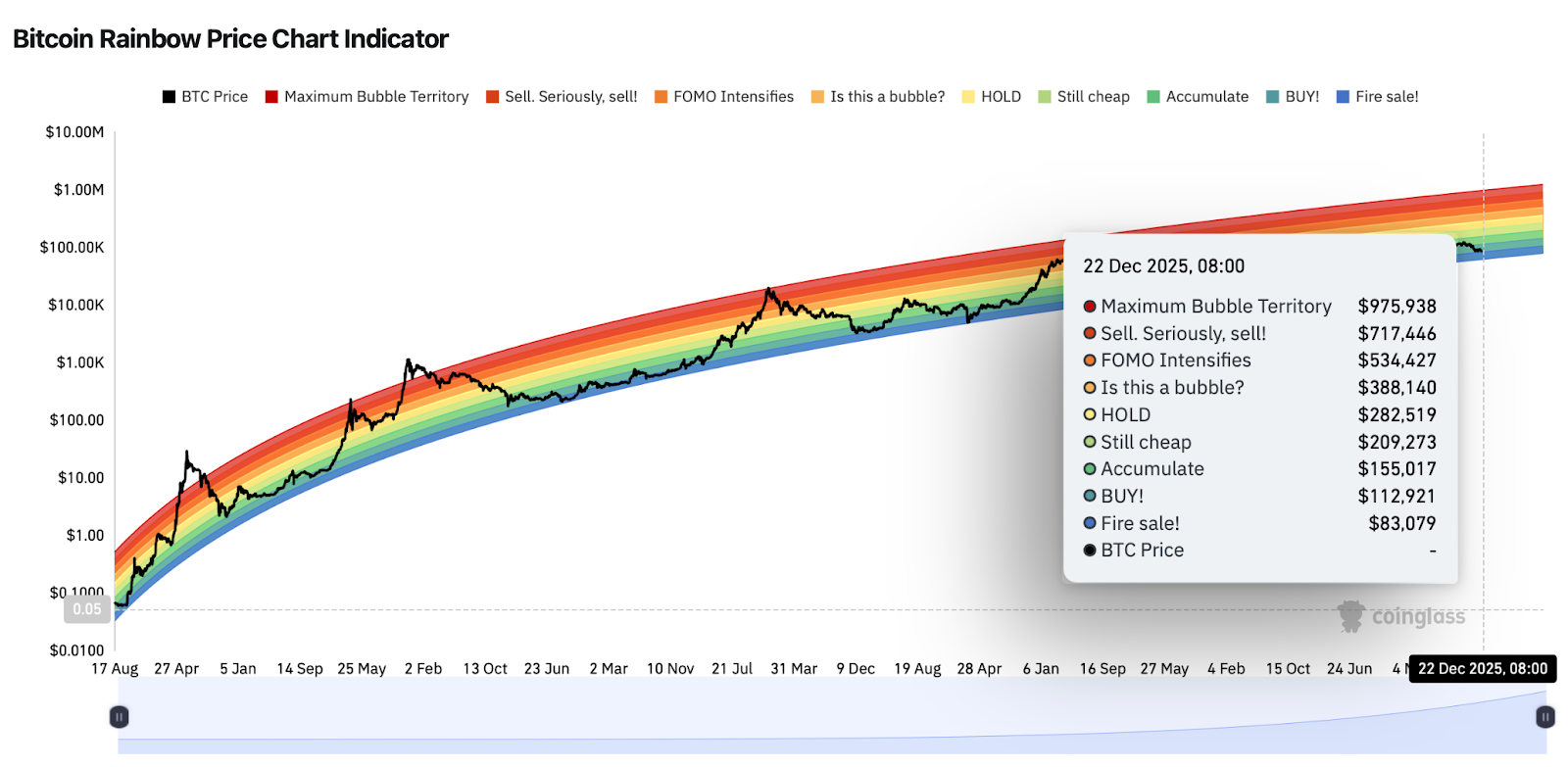

This is where long-term sentiment tools like the BTC rainbow chart can help, as long as you use it correctly.

The BTC rainbow chart is not a timing tool, and it is not a signal to buy or sell on its own. What it does well is frame where BTC sits in a broad cycle context, from cooler zones that suggest subdued long-term sentiment to warmer zones that reflect increasingly stretched optimism.

Here is how that matters for 2025 year-end:

-

On BTC-USDT, the BTC-USDT current price was $88,475 (as of 22 Dec, 03:00 UTC). On the BTC rainbow chart, that places BTC in cooler bands (teal and blue), which historically aligns with more conservative long-term positioning and slower, grindier rallies.

-

If the BTC-USDT trend pushes into hotter rainbow bands (yellow to red), upside can accelerate, but the move typically becomes more sensitive to negative macro headlines. Late-year strength can still reverse quickly when positioning is crowded.

For most readers, the practical play is to monitor BTC's direction and stability first, then decide whether DOGE and XRP have the conditions to move in coordination. In spot terms, many people also watch USDT BTC conversions as a simple proxy for whether sidelined liquidity is rotating back into BTC.

How to start trading Bitcoin

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

DOGE is driven by attention and timing

DOGE is not a balance-sheet story. It is a story about community sentiment, and it moves best when the market wants high-beta exposure again.

That is why Dogecoin price prediction content often misses the point when it tries to force DOGE into a purely technical framework. The cleaner question is whether attention, liquidity, and risk appetite are aligned.

With BTC-USDT down about 1% over 7D, DOGE tracked the same swing points but with bigger moves. That left Dogecoin price now around $0.13066 and -4.61% on the week, with Doge token price reacting more sharply whenever BTC softened.

In year-end conditions, that is a common pattern: DOGE needs BTC to be stable first, otherwise rallies tend to lose traction.

How to start trading Dogecoin

Dogecoin isn't just a meme — it's a movement. If you're ready to ride the DOGE wave with style, Toobit gives you everything from Spot to Futures to make every move count.

XRP is about catalysts, access, and correction risk

XRP tends to respond to a different mix than DOGE.

BTC provides the market direction, while XRP often needs a specific catalyst to outperform, whether that is regulatory clarity, institutional positioning, or ETF-related progress that strengthens XRP's cross-border payments narrative and keeps catalyst-driven positioning active.

Over the past week, XRP reflected a macro backdrop that turned less supportive, fast.

XRP peaked at $1.98 last week and dropped sharply to $1.77 mid-week. It was soon followed by a rebound back toward the $1.90s and the latest price settled at $1.9215 (-3.63% 7D).

The pressure point was tighter financial conditions, with long-end yields still pushing higher and curves steepening even after policy easing headlines, which tends to drain risk appetite and raises XRP price correction potential after earlier strength.

At the same time, global central bank signals added volatility, including the Bank of Japan's rate hike to 0.75%, which fed into broader rates and FX sensitivity. Layer in year-end fiscal and inflation concerns, and the result is a tape where XRP token price can bounce on relief, but struggles to hold follow-through when macro uncertainty keeps positioning cautious.

How to start trading Ripple (XRP)

XRP is built for fast, efficient settlement — no drama, just momentum. If you're ready to tap into one of the most established ecosystems, Toobit has the full suite lined up.

Can BTC, DOGE, and XRP rebound together?

A coordinated rebound is less about perfect chart patterns and more about alignment.

It usually requires:

-

BTC stability first: A market that stops lurching and starts behaving consistently would be necessary.

-

A reason for each asset to move: BTC follows liquidity, DOGE follows narrative momentum, XRP follows catalysts and access headlines.

-

Enough liquidity to sustain the move: Late December can produce fast upside, but durability matters more than speed.

If those three line up, you often see a familiar sequence: BTC firms up, DOGE draws fresh risk appetite, and XRP either follows with the group or briefly outperforms if catalysts land at the right time.

Bottom line

For year-end, keep the hierarchy clear. BTC price sets the ceiling and the floor for sentiment. DOGE tends to perform when the market is willing to take risks again, and XRP tends to perform when its catalysts have room to matter.

If BTC holds steady and the macro backdrop does not reintroduce fear, the odds of a coordinated rebound for DOGE price and XRP price improve. If BTC slips into greater instability, expect more fragmented moves, more false starts, and a higher chance that short-lived rallies fail to hold.

How to buy crypto on Toobit

To buy crypto on Toobit, create an account, complete verification, and go to Buy Crypto.

Choose a token, select a payment method, and confirm the purchase. Your assets will appear in Spot Account once the transaction settles.

Congratulations, you now know how to purchase crypto on Toobit!