A subtle shift in momentum marked the start of the session as BTC dominance held at 59.41%. Sentiment remained fragile with the Fear and Greed Index at 24, while the Altcoin Index at 19 signaled a muted rotation profile relative to majors.

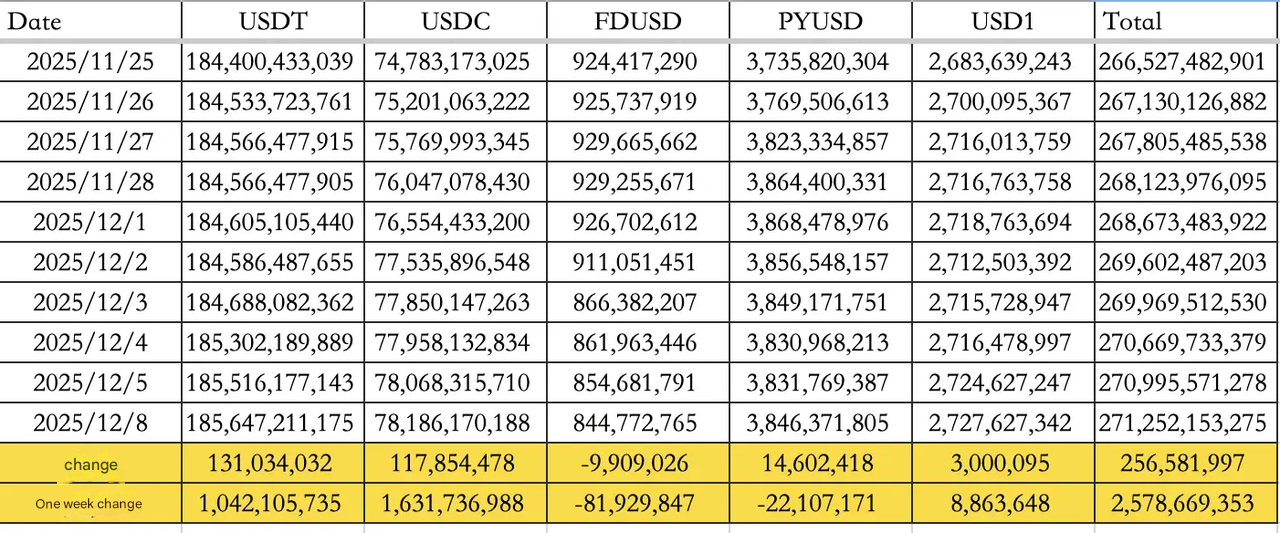

Stablecoin flows strengthened the liquidity backdrop. From 1 to 8 December, inflows reached $2.58B, with USDT contributing $1.04B and USDC adding $1.63B. Total circulating supply now sits at $271.25B.

Rumors about Strategy facing dividend payment shortfalls briefly pressured sentiment, though the CEO publicly refuted the claims and emphasized the company's fast $1.44B reserve build, helping to cool speculative anxiety.

Traditional markets

Wall Street steadied as US Treasury Secretary Scott Bessent projected full year GDP growth near 3%, reinforcing confidence in the US soft landing narrative.

Across Asia, elevated geopolitical friction between China and Japan added volatility to regional benchmarks, prompting a defensive tone in cross asset trading.

Gold held its footing as global participants weighed safe haven demand against improving US macro signals. FX markets showed mild caution as geopolitical tensions persisted.

Macro policy updates

Policy communication remained measured, with US officials expressing confidence in economic resilience and offering little deviation from prior guidance.

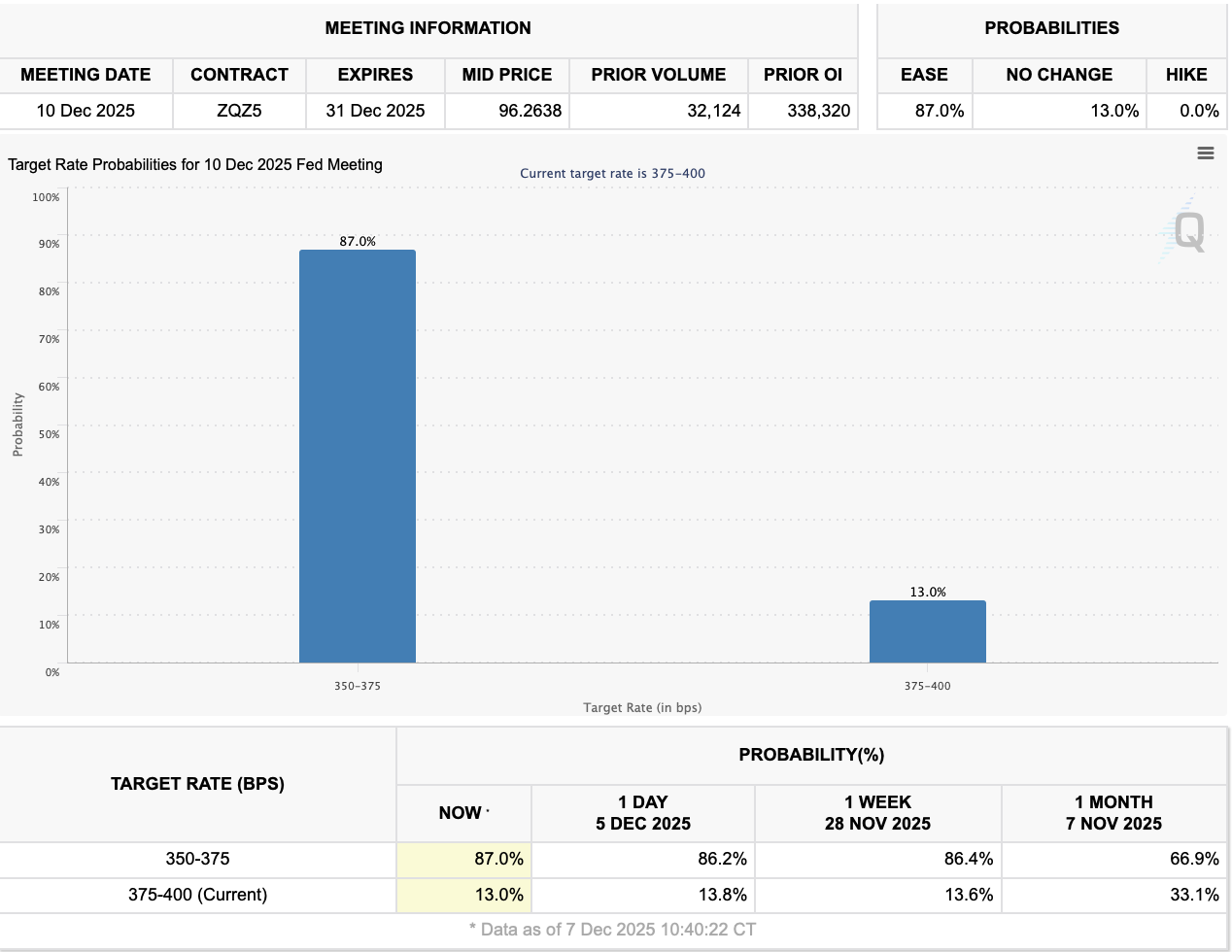

Rate expectations stayed stable, though sensitivities around fiscal posture and geopolitical complexity continued to shape positioning.

In Asia, observers monitored diplomatic developments after recent confrontations between China and Japan, noting potential spillovers into regional economic dialogue.

Industry highlights

Early stage capital and protocol activity

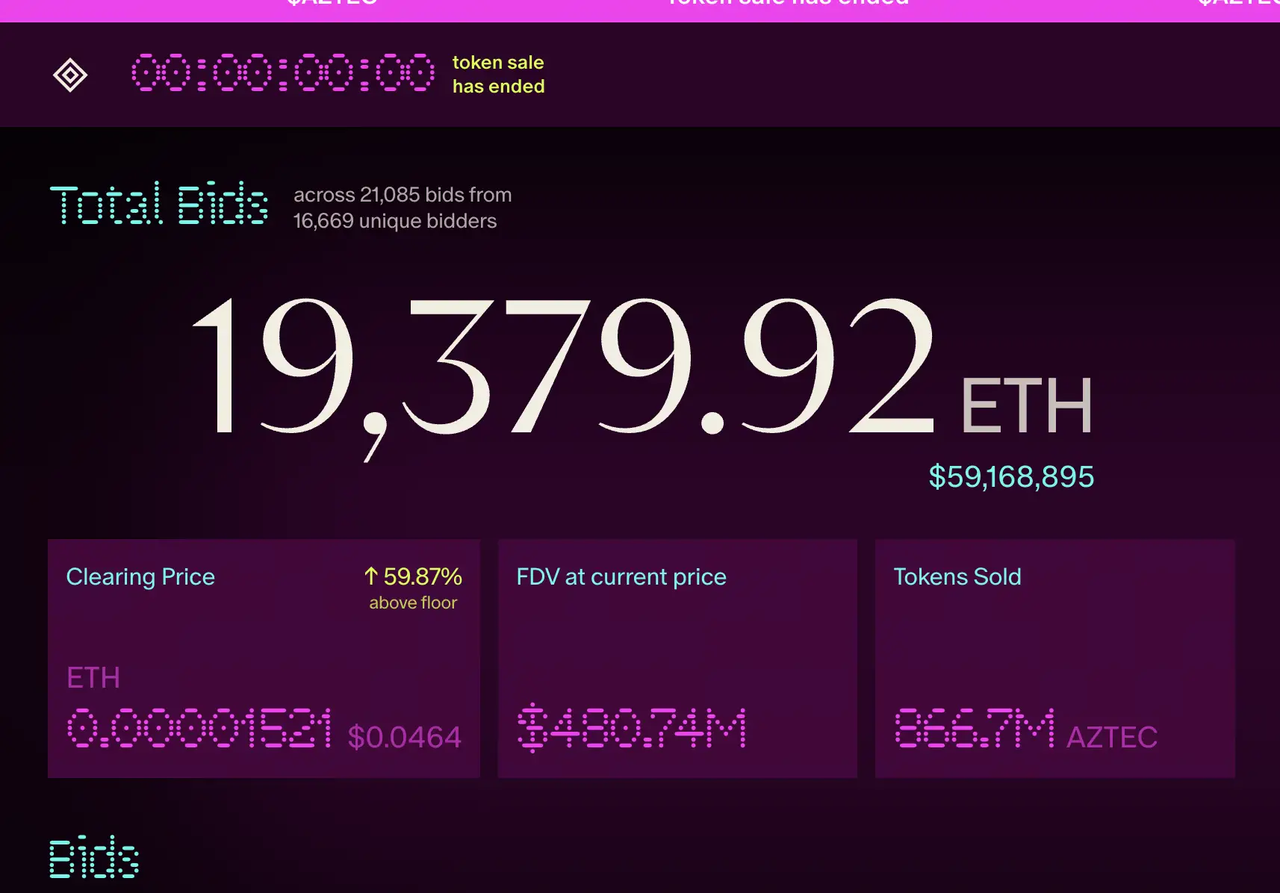

Uniswap's first launch project Aztec secured 19,379 ETH, closing at a clearing price of 0.048 ETH and implying an FDV near $490M. The scale of participation highlighted sustained interest in early ecosystem experimentation.

Ethereum balances on centralized platforms dropped to their lowest level on record, a signal of growing long term conviction and continued preference for self custody.

Sector movements and memecoin activity

Within memecoins, DOYR surged over 45% within two hours, taking its market cap to $15.38M and pushing cumulative volume past $41.4M. Commentary across social channels stressed caution as confusion around the DOYR versus DYOR acronym circulated widely.

Product direction and protocol strategy

Farcaster's founder noted the failure of prior social first strategies and confirmed a decisive pivot toward a wallet centric roadmap, guided by data showing wallet retention as the strongest driver of protocol adoption.

Alpha watch

New listings and ecosystem catalysts

The stable mainnet is scheduled to go live on 8 December at 1PM UTC (8AM EST), with key infrastructure integrations timed accordingly. No airdrop details have been released.

Smart money signals

Smart money tracking spotlighted the account 0xPickleCati, which publicly opened its performance history. The account has accumulated $45.46M in realized contract revenue, marking it as one of the top transparent performers in this cycle.

AI and consumer technology

A major Chinese smartphone manufacturer granted system level permissions to an on-device AI model for the first time, sparking renewed debate about what the next growth curve for AI agents in consumer hardware could look like.

Stablecoin and CRCL discussions

Weekend community debates on CRCL reinforced broad agreement that stablecoins remain the strongest real world adoption vector and the primary transactional layer at scale.

Concluding note

Improving liquidity, declining exchange balances, and sustained development activity supported a constructive tone across markets today.

While geopolitical tension kept cross asset risk appetite measured, underlying participation metrics and stablecoin inflows suggest that demand remains intact as markets prepare for their next directional cue.