Markets moved in sync when Bitcoin (BTC) fell below $70K, dragging majors like Avalanche (AVAX) and Dogecoin (DOGE) with it in a classic risk-off flush.

If you only had time to read one section, this is it:

-

BTC price: After the February 5 risk-off flush, BTC rebounded above $70,000 as tech and broader risk assets stabilized, but Reuters warned liquidity could stay thin.

-

AVAX price: Institutional participation headlines matter for Avalanche's real-world asset (RWA) narrative, with Sumitomo Corporation joining as a validator adding credibility to the "built for institutions" lane.

-

DOGE price: The DOGE-USDT price story is still sentiment-driven short term, but the GitHub reward reduction proposal adds a longer-term supply framework market participants can actually model.

Bitcoin is the macro anchor, even when it gets punched

This week's tape is a reminder that anchor does not mean stable.

On February 5, Reuters described Bitcoin's sharp drop as part of a broader risk unwind, with volatility, positioning, and liquidity all doing the usual damage.

Two things happened right after:

-

Fear spiked, and forced selling mattered more than spot conviction.

-

The rebound came fast once risk assets stabilized, with Reuters noting BTC climbing back above $70,000.

BTC-USDT current price reference. Source: Toobit

BTC's sell-off brought prices to the low $60Ks; that move looked less like orderly selling and more like a positioning reset, the kind of drop that often comes with forced unwinds and thin liquidity. BTC price is sitting near $70,982 today, with recovery being more choppy than clean.

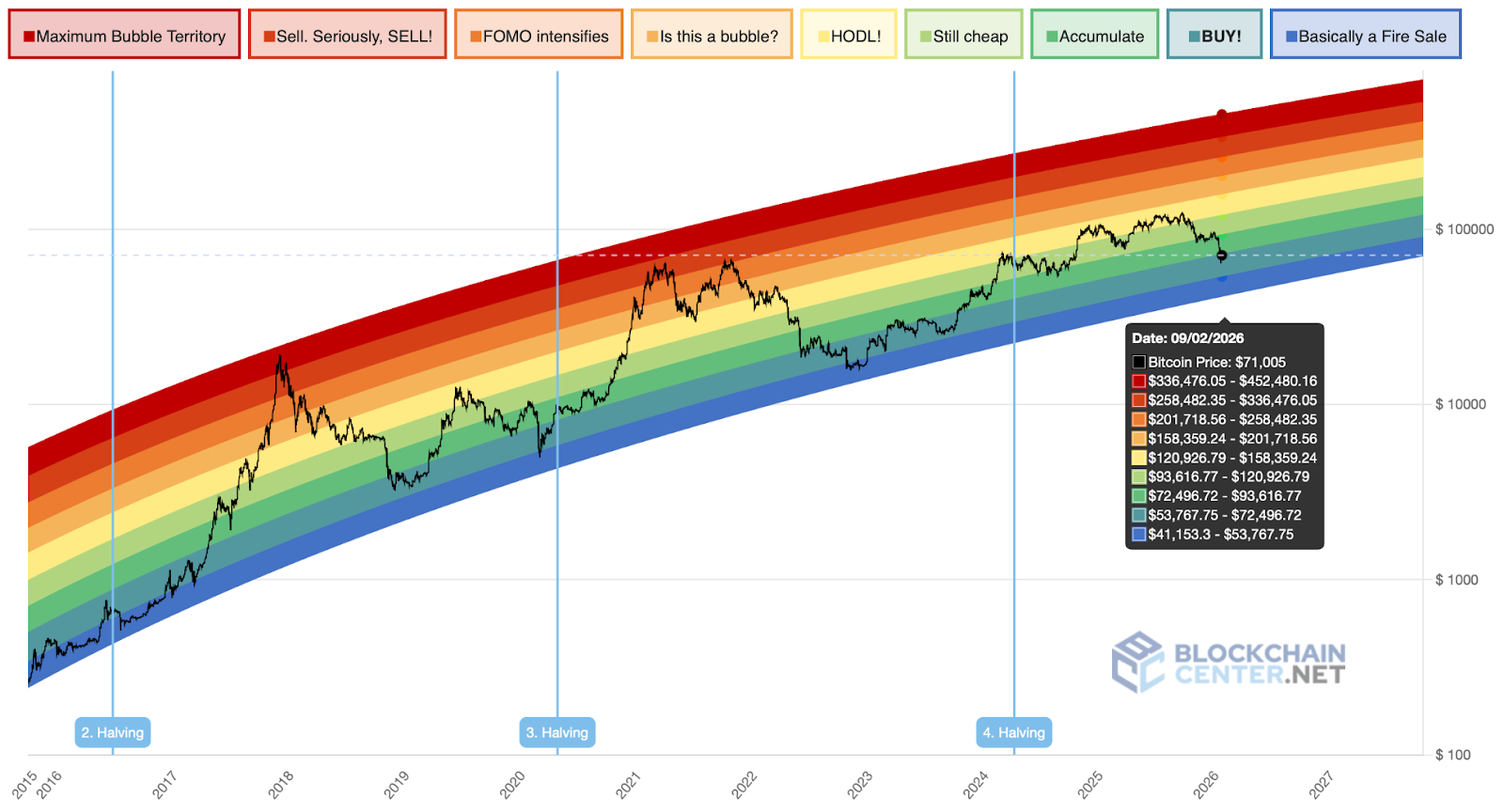

BTC Rainbow Chart as of February 9, 2026. Source: BlockchainCenter

The BTC Rainbow Chart is also another technical indicator one can refer to when understanding sentiment. This week's numbers point to BTC consolidating mostly in the high $60,000s to low $70,000s, in the bands of green and blue, which read like stabilization after a shock, not a full risk-on breakout.

Just a note: The BTC Rainbow Chart is a long-term visualization that places BTC prices into colored valuation bands on a log scale, not a prediction model. Use it to filter noise, not to outsource decision-making.

How to start trading Bitcoin (BTC)

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

AVAX price is tied to "institutional rails," not just narrative cycles

Avalanche's 2026 trajectory is defined by one goal: building infrastructure that institutions actually use.

The headline of Sumitomo Corporation joining as a validator is critical proof of concept. This is not just marketing; it is operational involvement from a Global 500 giant that reinforces Avalanche's lead in the RWA tokenization space.

AVAX-USDT current price reference. Source: Toobit

AVAX price today is about $9.12, down roughly 5.7% on the 7D view, and the chart tells a pretty clean story of "risk-off first, narrative second."

AVAX traded near the $10 area early in the week, then followed the broader market flush into February 5 to 6 with a sharp dip that briefly tagged the low-$8 range before snapping back. Since then, price action has looked more like stabilization than momentum, grinding sideways around the low-$9s with smaller, choppier swings.

Why this matters for the price of AVAX

In weeks where liquidity is fragile, AVAX can trade like a high beta asset and get pulled down with the tape. The core question for 2026 is not whether RWAs sound exciting. It’s whether real institutions keep moving from pilots to production.

-

If institutional participation keeps compounding, AVAX crypto price tends to benefit from credibility and ecosystem pull-through.

-

If markets flip back into pure risk-off, AVAX can still trade like a risk asset in the short run, even with a strong narrative.

That's the reality of 2026 sentiment: rails matter, but macro still sets tempo.

Is Dogecoin undergoing a fundamental shift?

Dogecoin's short-term moves are still driven by attention, liquidity, and risk appetite. But the long-term conversation is getting more structured, because supply is finally being debated in a way you can quantify.

A recent GitHub proposal recommends reducing block rewards from 10,000 DOGE per block to 1,000 DOGE per block. If adopted, this would substantially cut annual issuance, shifting DOGE from an inflationary meme to a potentially "harder" currency.

DOGE-USDT current price reference. Source: Toobit

DOGE price USD is around $0.09644 today, down about 4.4% on the 7D view, and the chart looks like a smaller echo of the week's broader risk-off move. DOGE traded closer to the $0.11 area earlier in the week, then slid sharply to the low-$0.08s on February 5 and 6, before rebounding.

Since then, DOGE has mostly gone sideways around the mid-$0.09 range, which reads like stabilization after a liquidity flush rather than a fresh momentum leg.

DOGE-USDT price: What changes if rewards tighten?

To be precise: a proposal is not a protocol change. But proposals can still move sentiment because they change what market participants expect the future could look like.

If the community ever adopted a tighter reward schedule, DOGE's long-term issuance would slow, which strengthens the "scarcity" narrative and can shift how longer-horizon holders think about dilution. Short-term price action may still be volatile, but the credible rewards path gives DOGE a more structured valuation debate.

Is Dogecoin a good buy?

There's no universal answer, but here’s a clean framework that matches current sentiment.

-

If you're asking "is Dogecoin a good buy" for a short trade, you're really trading attention and market mood.

-

If you're asking for a longer horizon, you're betting that DOGE keeps its cultural durability while improving its monetary story, including debates like reward reduction.

How to start trading Dogecoin (DOGE)

Dogecoin isn't just a meme — it's a movement. If you're ready to ride the DOGE wave in style, Toobit gives you everything from Spot to Futures to make every move count.

The bottom line

The market is rewarding specificity again. BTC provides the tempo, AVAX provides the institutional utility, and DOGE is finally providing a quantifiable supply debate.

This article is for informational purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any decisions.

How to buy crypto on Toobit

To buy crypto on Toobit, create an account, complete verification, and go to Buy Crypto.

Choose a token, select a payment method, and confirm the purchase. Your assets will appear in Spot Account once the transaction settles.

Congratulations, you now know how to purchase crypto on Toobit!