When utility meets momentum

While speculative tokens often dominate headlines, Chainlink (LINK) has quietly built one of the strongest utility narratives in cryptocurrency. Its decentralized oracle network powers countless decentralized finance (DeFi) applications, bridging on-chain and real-world data.

What is happening to Chainlink lately?

On January 20, 2026, Chainlink announced the launch of "Chainlink 24/5 U.S. Equities Streams", pitching it as infrastructure for always-on equity perps and other on-chain products, ensuring price integrity.

According to Chainlink's announcement, this is the first time that DeFi has "secure access to U.S. equity market data that also includes after-hours and overnight sessions".

This upgrade is major, as it turns fragmented stock market sessions into continuous, cryptographically signed data streams that can be consumed on-chain, instead of leaving builders stuck with a single "regular-hours" price that goes stale the moment the market clock changes.

Another headline is the planned launch of LINK futures and Micro LINK futures on leading derivatives exchange, Chicago Mercantile Exchange (CME) Group, on February 9, pending regulatory review.

CME Group's X announcement on launching Chainlink futures.

That matters, because regulated futures often expand access, improve hedging, and can increase both liquidity and volatility around the listing window. Additionally, markets sometimes "front-run" listings, then re-price once products are live, so this is a real date to watch.

As LINK prices consolidate, traders are watching closely for a breakout that could define the next leg of momentum for the LINK/USDT pair.

What is Chainlink (LINK)?

Chainlink is a decentralized oracle network designed to connect smart contracts to off-chain data, APIs, and payment systems. It acts as the backbone for many of today's most active crypto trading ecosystems.

LINK is the network's native token. It serves two key purposes: securing oracle data and rewarding node operators. This dual-utility model has positioned Chainlink as an essential part of blockchain infrastructure, a "middleware" layer bridging blockchains and the real world.

LINK price history and performance overview

LINK price history

According to CoinMarketCap, the price of LINK hit an all-time high (ATH) of $52.88 on May 10, 2021 before cooling off alongside the wider market. Since then, LINK prices have stabilized in a long consolidation range, with renewed momentum emerging in 2025.

LINK price plunged to a historical low of $0.1263 on September 24, 2017 after early buyers sold the majority of their tokens for profit after Coinlink's Initial Coin Offering (ICO) on September 22, 2017.

LINK's latest performance

LINK price from Toobit, as of February 3, 2026, 08:10 UTC

LINK is currently trading around $9.72, up 3.18% on the day. Despite the positive intra-day increase and overall constructive ecosystem headlines, LINK is fighting macro conditions of de-risking, and drawing down as a result.

Current market snapshot (February 3, 2026, 08:10 UTC)

Risk appetite continues to be extremely cautious as we enter February.

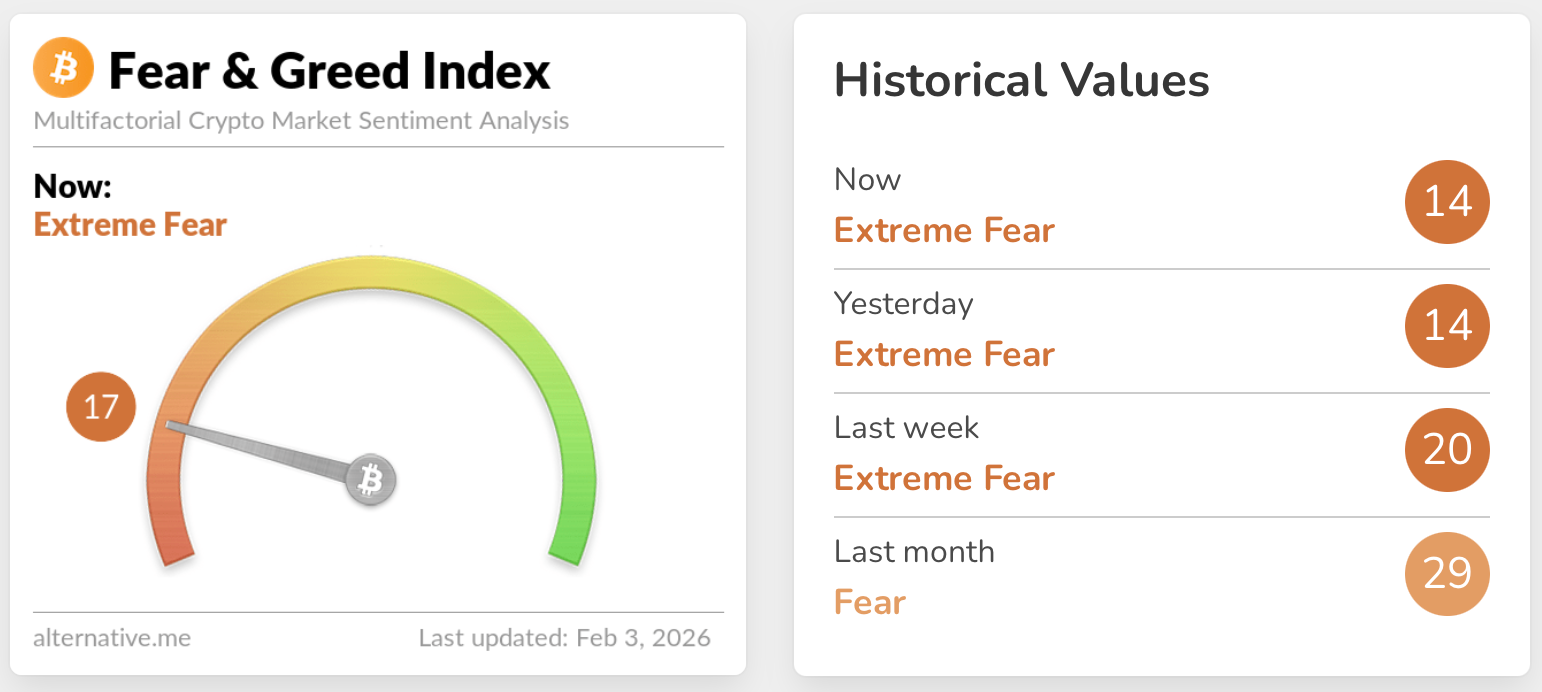

Crypto Fear and Greed Index from Alternative.me

Fear & Greed Index prints 17 (Extreme Fear), which is the kind of mood where breakouts are harder, bounces fade faster, and the market demands proof before it pays you for optimism.

U.S. market structure remains an active volatility driver. Barron's reports that the White House met with crypto firms and banking groups on February 2, 2026 to push a compromise, with stablecoin yield language still the main point of contention.

In this kind of tape, LINK can absolutely move on headlines, but sustained upside usually needs both a catalyst and a market willing to take risk.

On-chain and technical analysis

LINK price movement across a year (Feb 2025 to present)

Support and resistance

LINK is trading like a market that broke its range and has not rebuilt a floor yet.

Support is starting to form around the $9.50–$9.70 range. If it fails, the next target level is $9, and below that, the chart starts looking for liquidity closer to the high-$8s.

Resistance is more clearly defined: $10.70–$10.80 is the first lid (where the short-term average sits), then $12.40–$12.50is the real checkpoint (the 50-day zone), and anything above that still runs into a much heavier ceiling around $17.30 (the 200-day), which is why the broader structure still reads as repair, not trend.

Momentum indicators

Momentum is stretched, not stabilised.

Relative Strength Index (RSI) is sitting around 27.5, which typically signals oversold conditions. That often means downside has been aggressive, but it does not promise an immediate reversal.

Moving Average Convergence/Divergence (MACD) remains negative, which keeps the pressure tilted to the downside. In practice, that setup usually produces short bounces that still need confirmation, with upside only getting credible if LINK can hold above resistance rather than tagging it and rolling over.

Moving averages and volume

LINK is still trading below its key moving averages, which is why rebounds have looked heavy.

The short-term average is up near $10.70, acting like a lid. The mid-term average sits higher around $12.50, and the longer-term average is much higher near $17, reinforcing that LINK is still in repair mode on a broader timeframe.

Until LINK can reclaim and hold above that $10.70 to $12.50 band, the market is likely to keep treating upside as rebound risk, not trend.

On-chain cues

On-chain activity supports the idea of cooling participation rather than a new demand wave.

The holder base is large at roughly 842,000, but transfers in the last 24 hours are lower at around 13,400, which fits the price action. That combination is not panic, but it also is not the kind of rising activity that usually drives durable repricing.

LINK price prediction and outlook

The clean way to frame LINK from here is to treat $10.70 to $12.50 as the decision zone, then think in 3 simple cases.

Base case

The most natural band is $8.80 to $12.50, with the midpoint fight happening near $10.70, where price keeps running into short-term supply and moving-average friction.

In a Fear tape, that is usually how it goes: chop first, conviction later.

Bull case

A daily reclaim and hold above $12.50, followed by higher lows, opens a path toward $17 (the heavier longer-term ceiling on your moving averages).

That move gets more believable if participation and narrative demand pick up around Chainlink's "onchain equities" push, because it is not just another data feed launch. Chainlink explicitly positioned the 24/5 U.S. Equity Streams as the missing infrastructure for equity perps and always-on real-world assets (RWA) markets, which is the kind of plumbing that can pull in real volume if it sticks.

Bear case

A clean loss of $9.50 to $9.70 increases the odds of a move toward $9, and below that you are back in damage-control territory with the high $8s as the next visible shelf.

In that scenario, oversold signals can flash all they want, but price usually waits for broader risk appetite to stop leaking before it rewards dip buyers.

The key twist for 2026

Instead of a plain bullish or bearish prediction, here is the more realistic take on LINK's CME catalyst.

CME's planned LINK futures launch on February 9, 2026 is a milestone, but it can be bearish first and bullish later. These listings do not only add new buyers, they make two-way positioning easier, including hedges, basis trades, and cleaner short exposure than most offshore venues.

That tends to professionalize price discovery, which often looks like a headline pop into the launch window, then choppier action as the market stress-tests spot demand against fresh hedging flow.

The interesting part is what comes after: Chainlink is trying to turn LINK into the "market data and settlement rail" for tokenized finance, not just an oracle token.

If 24/5 equities streams and Cross-Chain Interoperability Protocol (CCIP)-style integrations keep expanding, LINK can eventually trade less like a hype proxy and more like infrastructure that gets repriced when usage becomes undeniable. The market will not front-run that forever, but it also will not ignore it once volumes show up consistently.

This is market commentary, not financial advice.

Key milestones for Chainlink

-

Launch (2017): LINK introduced as the native token for Chainlink's decentralized oracle protocol.

-

Mainnet launch (2019): Integration with Ethereum marked the start of real-world data connectivity.

-

DeFi expansion (2020 – 2022): LINK adoption accelerated as DeFi protocols used Chainlink oracles for price feeds and automation.

-

CCIP rollout (2023): Enabled cross-chain messaging and data transfer between blockchains.

-

Staking v0.2 (late 2023): Strengthened token economics through staking rewards and node security participation.

Community sentiment and LINK news

Social chatter around LINK has stayed elevated since Chainlink's 24/5 U.S. Equities Streams announcement, with Santiment noting a five-week high in social volume even as the broader tape stayed weak.

The tone is mostly constructive on the long-term story, with holders leaning back into the "infrastructure" framing as CCIP keeps landing serious distribution.

Short-term, the community is watching a cleaner calendar catalyst: CME's planned LINK futures launch on February 9, which can tighten positioning and add two-way flow right when spot is trying to stabilize.

The bottom line

LINK's value proposition lies in being the data backbone of decentralized systems.

Unlike many speculative tokens, Chainlink provides a tangible service that underpins the DeFi ecosystem. Its mix of real-world integrations, strong partnerships, and disciplined tokenomics gives it staying power amid market cycles.

Near term, keep an eye on CME's planned LINK futures launch because it can widen two-way positioning and make price action noisier before it becomes clearer.

Stay alert and track LINK price charts on Toobit for real-time insights.

How to start trading Chainlink (LINK)

Chainlink powers real-world data for the entire industry. If you're ready to trade the backbone of modern smart contracts, Toobit makes it smooth from start to finish.