What is an OCO order?

A One-Cancels-the-Other (OCO) order combines a stop-limit order and a limit order, where if stop price is triggered or limit order is fully or partially fulfilled, the other is canceled.

An OCO order on Toobit consists of a stop-limit order and a limit order with the same order quantity. Both orders must be either buy or sell orders. If you cancel one of the orders, the entire OCO order pair will be canceled.

How to use OCO order?

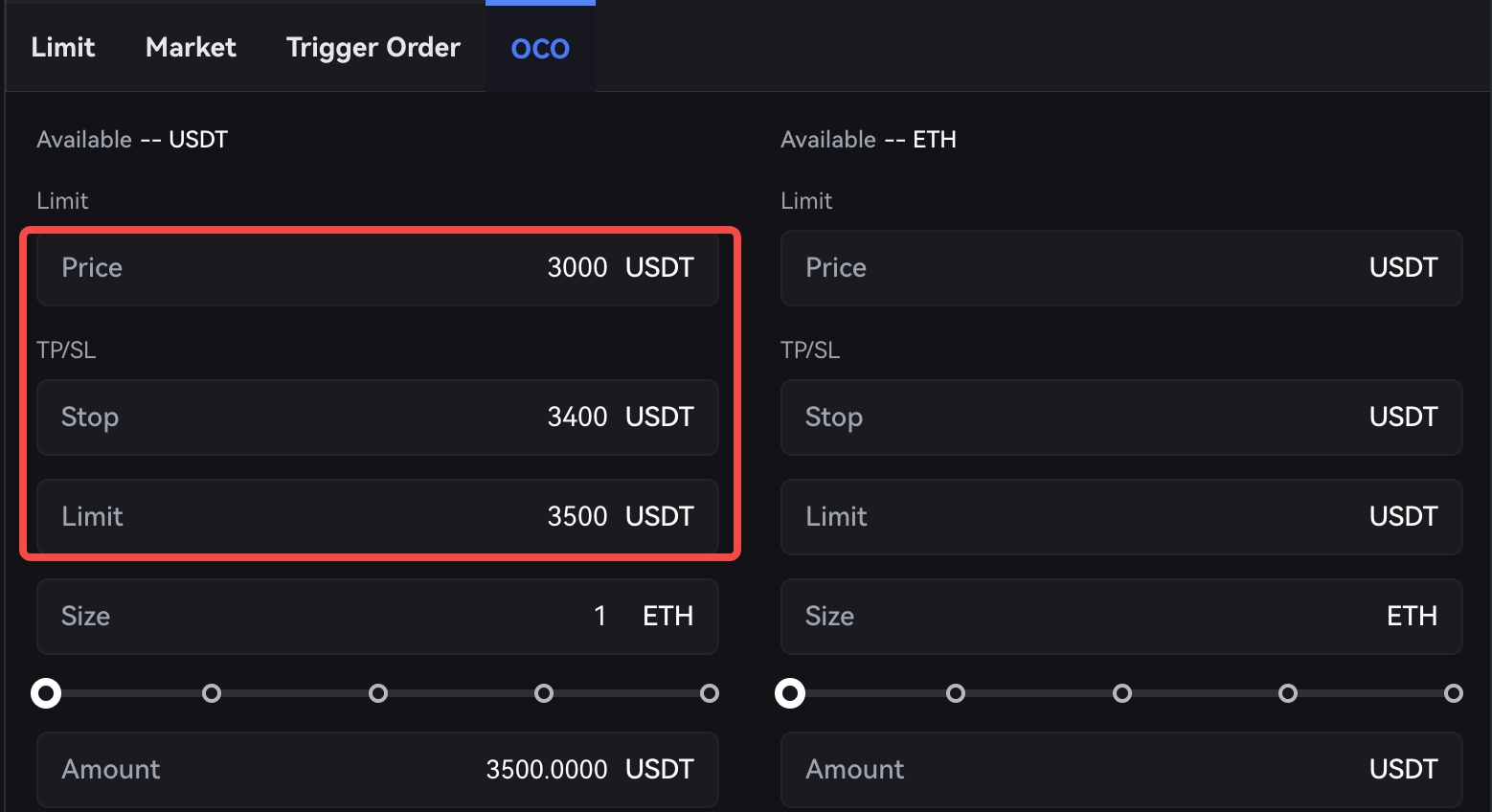

Suppose ETH is trading between 3200 USDT and its resistance price of 3400 USDT. You would like to buy ETH if the price drops to 3000 USDT or rises above 3400 USDT.

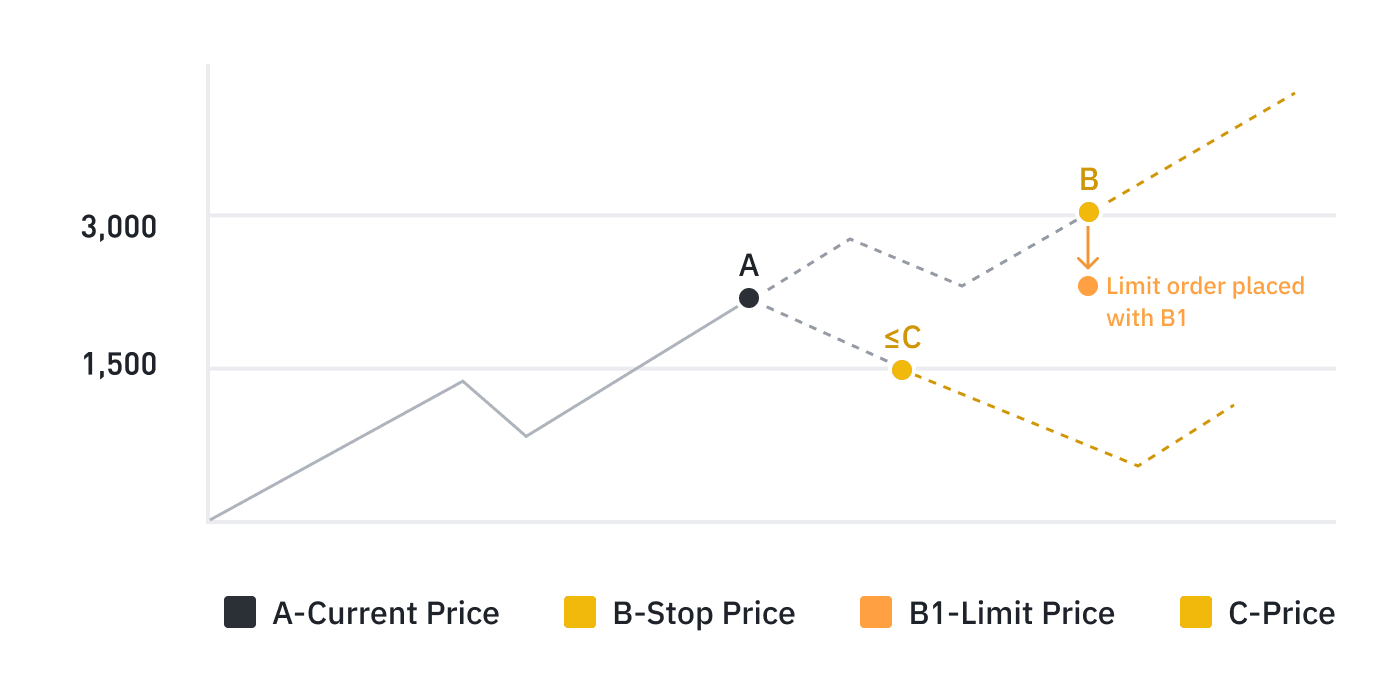

OCO buy order example

For buy orders, you can set the stop price (B) above the current price and the price (C) below the current price.

For example, the stop-limit order will be triggered when the price goes up to 3,000 (B), and the limit order will be simultaneously canceled. A limit order with limit price (B1) will be placed into the orderbook. However, if the price drops to 1,500 (C) or below, the limit order will be executed automatically with 1,500 (C) and the stop-limit order will be canceled.

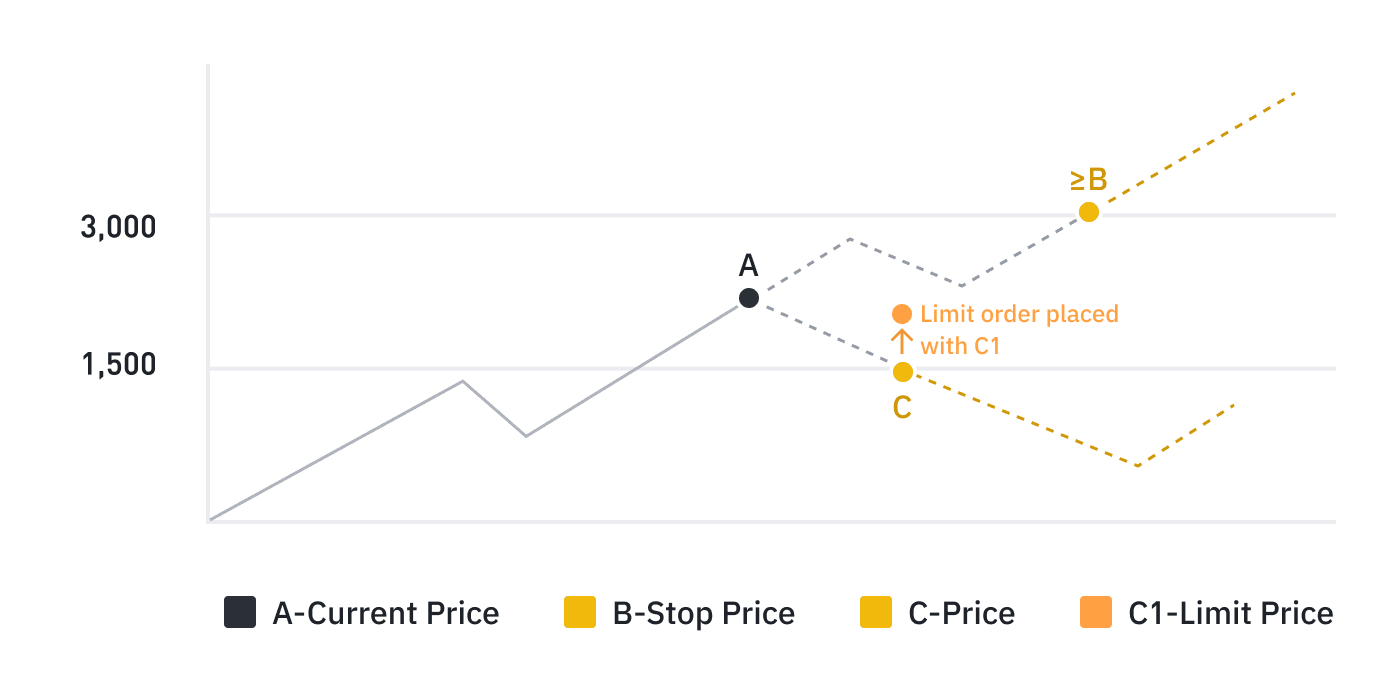

OCO sell order example

For sell orders, you can set the stop price (C) below the current price and the price (B) above the current price.

For example, the stop-limit order will be triggered when the price drops to 1,500 (C), and the limit order will be simultaneously canceled. The limit order with price C1 will then be placed into the orderbook. Otherwise, if the price goes up to 3,000 (B) or above, the limit order will be executed automatically with 3,000 (B) and the stop-limit order will be canceled.

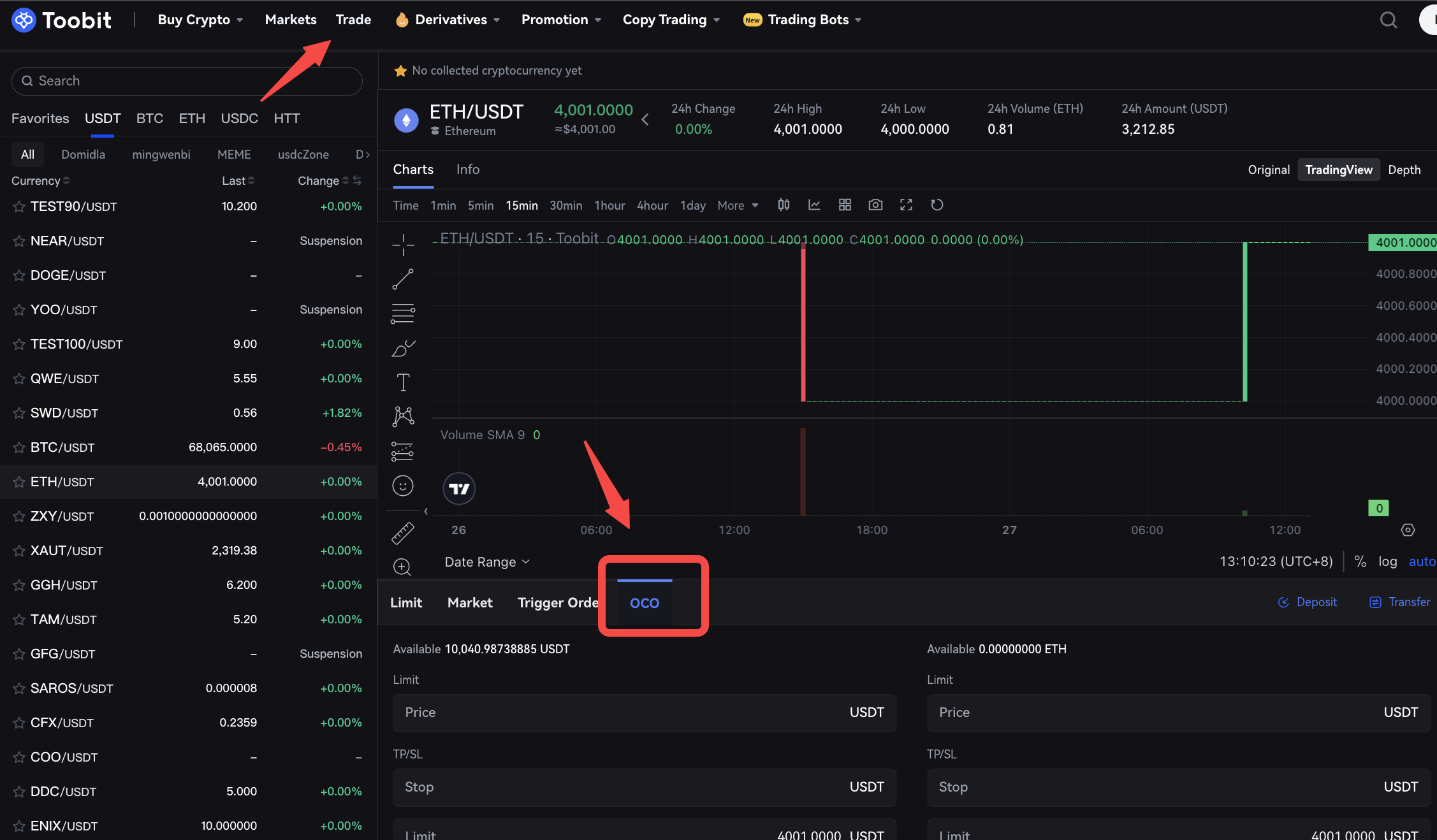

How to use OCO orders through Web

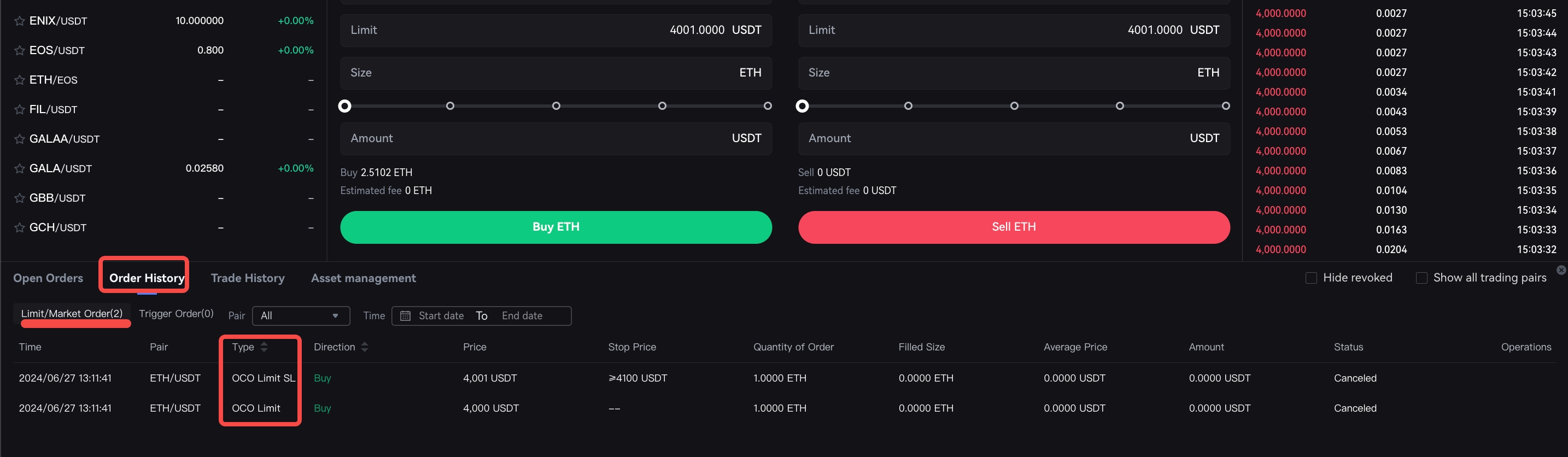

How to check OCO orders history?

OCO order setting conditions

For sell orders, you may try:

Price (limit order) > current market price > stop-loss trigger price (stop-limit order)

For buy orders, you may try:

Price (limit order) < current market price < stop-loss trigger price (stop-limit order)

*For stop-limit order, you may try setting the limit price closer to the stop-loss trigger price.