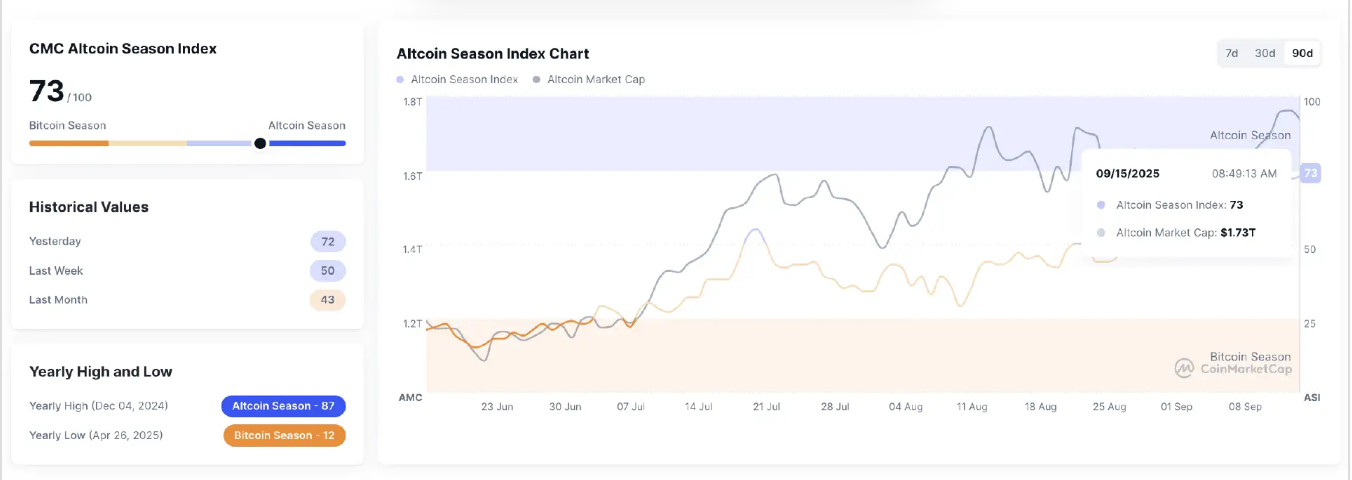

Bitcoin’s share of total market capitalization stood at 57.72%, while the Altcoin Index hit 73, pushing firmly into overheated territory.

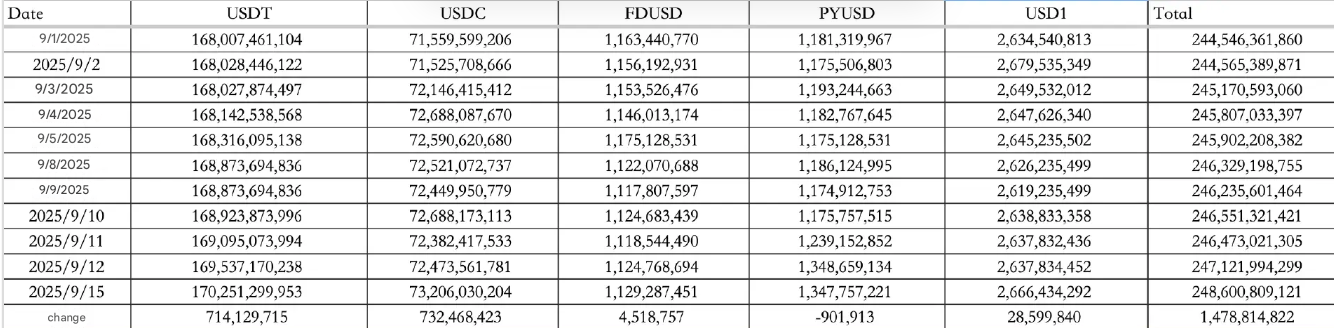

Stablecoins saw strong inflows between September 12 and 15, totaling $1.48B. USDT contributed $714M and USDC added $732M, bringing the total stablecoin supply to $248.60B.

Stablecoins saw strong inflows between September 12 and 15, totaling $1.48B. USDT contributed $714M and USDC added $732M, bringing the total stablecoin supply to $248.60B.

Institutional moves

Institutional activity remains centered on Solana. Since Forward Industries announced a $1.65B fundraising, Galaxy has accumulated roughly 6.5M SOL, valued at $1.55B. It is not yet clear whether all of these purchases are tied directly to Forward’s Solana liquidity pool.

Market observers point out that while Solana’s DeFi activity still lags Ethereum, deploying these treasury funds into DeFi protocols could be a powerful catalyst. Commentators also note that projects like PUMP signal fresh momentum across Solana’s broader ecosystem, not just in meme tokens.

Macro and policy

Global macro dynamics are in focus this week. U.S. President Trump reiterated expectations that the Federal Reserve will deliver significant rate cuts. Meanwhile, markets are preparing for the Fed’s rate decision and Chair Jerome Powell’s press conference on September 17 to 18.

On September 19, the Bank of Japan will announce its own rate decision. Meanwhile, U.S. and Chinese officials met in Madrid on September 14 to discuss tariffs, export controls, and the ongoing dispute over TikTok, underscoring the geopolitical backdrop that continues to influence global markets.

Altcoin chaos: UNI and Yala

Not all altcoins are participating evenly in the rally. UNI briefly dropped 10% despite broader gains across the sector.

In another development, hackers exploited Yala by minting 90M counterfeit tokens on Polygon, then bridging 30M of them via LayerZero into Solana’s legitimate contract. The attacker has already sold $14M worth, with another $16M yet to be offloaded.

WLFI community chooses the burn path

Separately, the WLFI community voted on a proposal to direct 100% of treasury liquidity fees toward market buybacks of WLFI tokens across multiple chains, with all repurchased tokens permanently burned. The proposal underscores growing momentum toward deflationary mechanics in tokenomics.

How to start trading WLFI

WLFI is the new kid on the block, built to shake up the tokenized finance game. If you want in early, Toobit gives you the simplest way to trade WLFI. Spot, Futures, and the full suite of tools are ready to go.

Industry highlights

Meme-driven platforms are attracting unusual attention. PUMP’s recent surge has many in Chinese-language communities leaning bullish, citing optimism around its livestreaming division.

In a recent interview, one of the project's anonymous co-creators made it clear that PUMP intends to be more than a meme platform.

The vision is to become a hybrid of TikTok, Twitch, and Instagram, underpinned by digital assets and aimed at growing into a trillion-dollar company.

While that ambition may raise eyebrows, its ability to draw attention highlights how narratives and community energy can drive adoption in ways that pure financial products often cannot.