The market’s risk appetite is tilting again. Bitcoin dominance fell 0.53 points to 58.01 percent, while the Altcoin Index printed 50. That reading means most alts are not ripping higher; they are simply dropping less than BTC on weak days, which still counts as rotation if it persists.

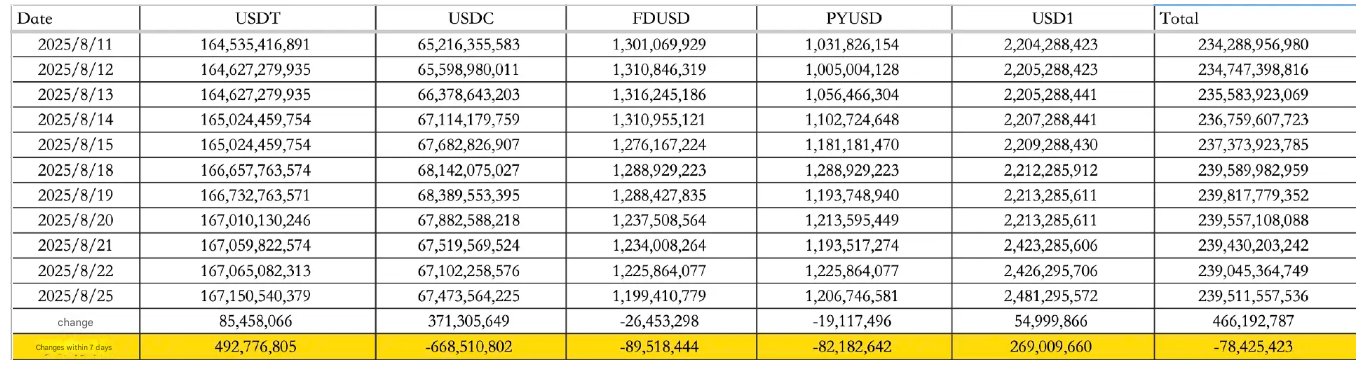

Stablecoin liquidity eased. From August 17–25, the basket saw a net outflow of 78 million dollars.

Flows under the hood were uneven: USDT added 493 million dollars, USDC lost 669 million, and USD1 added 269 million.

The total stablecoin float stands at 239.512 billion dollars. That is enough dry powder to move markets, but the weekly direction was a mild leak, not a refill.

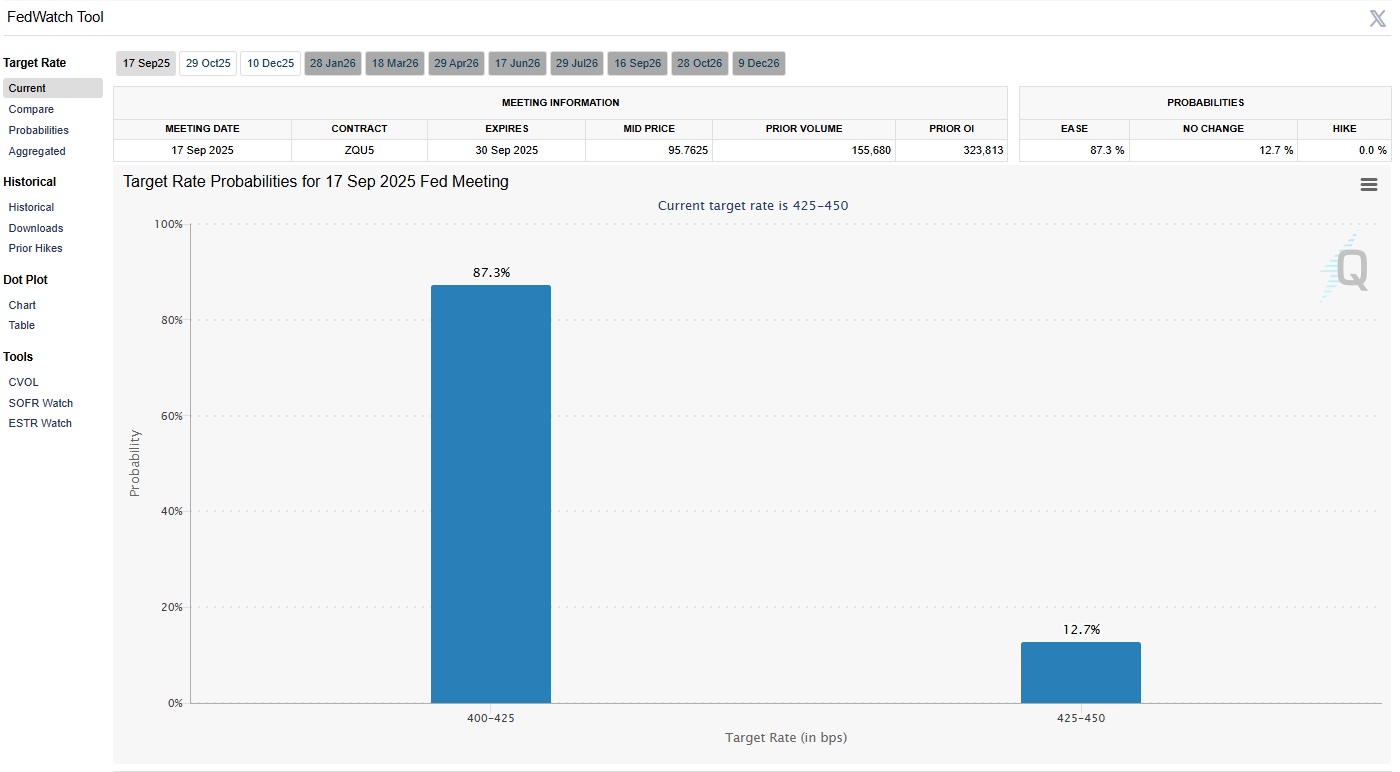

Rate‑cut odds remain supportive. By the latest Fed watch, the probability of a 25 basis point cut is 87.2 percent.

If confirmed, that is a tailwind for majors and a possible spark for a late‑summer rotation.

Whales: ancient BTC seller exits, ETH exposure explodes

Onchain monitors flagged a legacy BTC holder, possibly two addresses from the same entity, that sold 18,142 BTC with an approximate value of 2.04 billion dollars at current prices.

The entity is now selling the final 5,968 BTC and still has a sizable chunk sitting off venue.

More revealing is the pivot into Ether: the same stack accumulated 416,598 ETH with a current value of about 1.98 billion dollars, went long 135,263 ETH on perpetuals for about 642 million dollars in notional, and now shows total ETH exposure of 551,861 ETH or roughly 2.62 billion dollars.

Of the spot trove, 275,500 ETH (about 1.30 billion dollars) is already staked. Translation: a big seller of old BTC is now a big, yield‑oriented holder of ETH.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Treasury wave: five “microstrategy” plays incoming

A new cluster of Asia‑led corporate treasury vehicles is set to come online: five microstrategy‑style entities, three focused on ETH and two on SOL.

The pattern is familiar. Treasury buys become collateral, collateral attracts stables, and looped yield turns balance sheets into market participants.

If even a subset of these go live at size, onchain lending markets and LST demand get a fresh bid.

WLFI: launch details locked, volatility before day one

World Liberty Financial (WLFI) is scheduled to go live on Ethereum on September 1. The plan reads as follows: early supporters from the 0.015 and 0.05 dollar rounds unlock 20 percent on day one, while the remaining 80 percent unlock cadence will be decided by community vote.

Founders, advisors, and partner allocations do not unlock at launch. Trading and the 20 percent claim window open at 8:00 p.m. Beijing time on September 1.

The token dropped yesterday on fresh FUD, which raises the odds of a whipsaw around the listing. Net, the structure looks designed to limit immediate team supply while testing market depth on day one.

A separate discourse flared around WLFI and Aave allocations. One side cites a previously passed “Aave V3 instance” governance item and a back‑of‑the‑envelope estimate that would imply a material WLFI grant to a DAO treasury.

The other side flatly denies that a seven percent WLFI allocation was ever part of the deal and labels circulating screenshots as false. Until a canonical allocation schedule is posted in public governance, treat those numbers as unconfirmed.

NFTs and tokenized equity: Penguins chase an IPO

Pudgy Penguins aims to complete an IPO by 2027. Management signaled record 2025 revenue near 50 million dollars and said it is working with financial advisors to improve institutional access to both the PENGU token and the NFT line.

If the timeline slips, they are open to a tokenized‑stock alternative so investors can trade exposure onchain.

Prediction markets: Vitalik’s rate insight

Vitalik Buterin argued that mainstream prediction markets rarely pay interest on posted dollars, which makes them unattractive for hedgers who can earn around 4 percent elsewhere.

He expects volumes and use‑cases to expand meaningfully once markets incorporate interest, because hedgers will no longer be penalized for tying up capital to reduce risk.

Alpha and housekeeping

-

Plasma deposits: based on the current pre‑market indication and an allocation model of one percent of tokens against one billion in deposits, the next deposit window screens at roughly a six percent return. That math assumes a similar deposit scale and the quoted pre‑market level. If either moves, so does the estimate.

-

Account prep: set up a batch of active accounts on a major L2 ecosystem with linked socials so you are eligible for future snapshots.

-

Cycle risk: veteran traders Eugene and Vida both called this the tail end of the bull and recommend progressively de‑risking to protect principal.

-

Altcoin filter: if you rotate, focus on names that have survived at least one full cycle, run cash‑flowing, growing businesses, and ship products you actually use and understand.

-

Security: a widely shared list of scam KOL networks is making the rounds. Prune aggressively to reduce noise and phishing risk.