Bitcoin dominance rose 0.69 points to 58.75%, while the Altcoin Index held at 41, signaling a modest tilt back toward BTC.

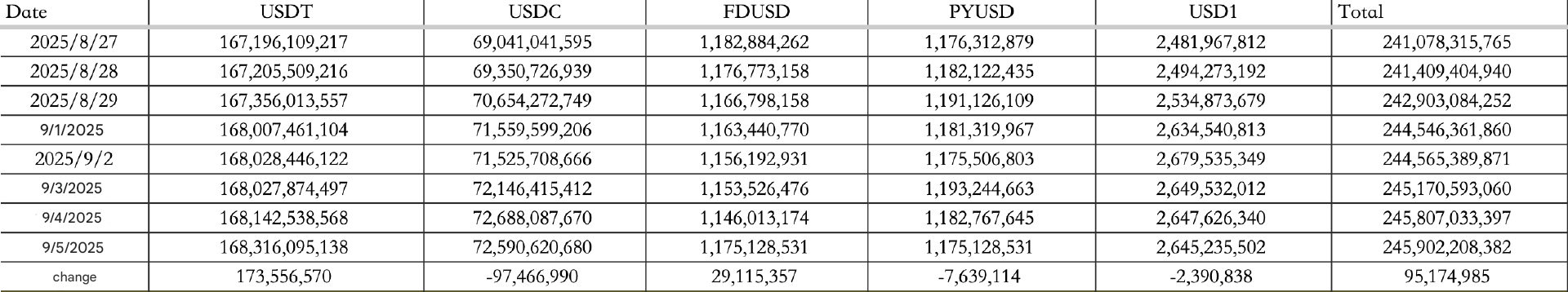

Stablecoins recorded net inflows of $95M on September 5, with USDT adding $173M even as USDC saw $97M in outflows, bringing the total stablecoin market to $245.90B.

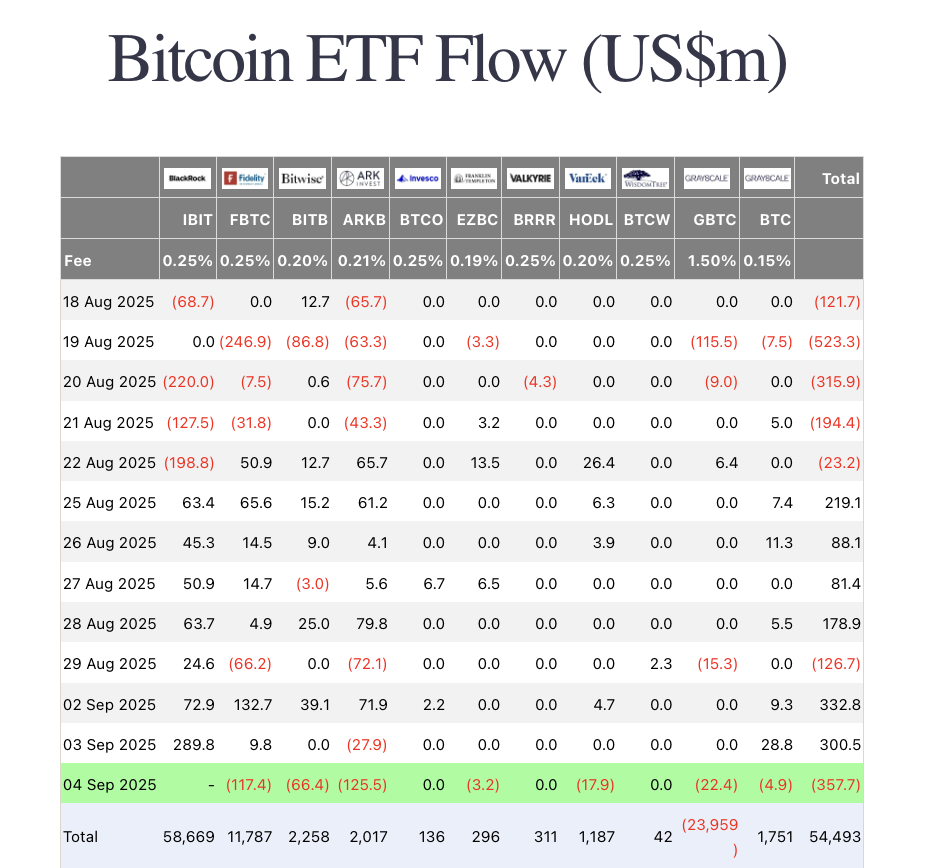

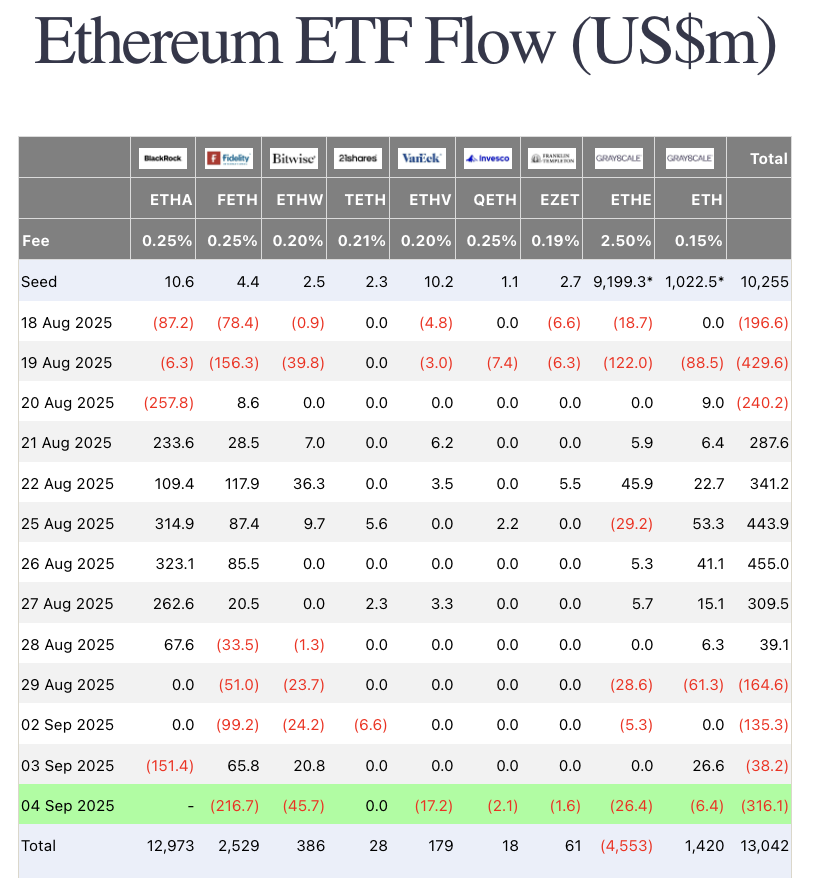

On the ETF front, September 4 data showed $358M flowing out of Bitcoin ETFs and $316M leaving Ethereum ETFs, excluding figures from BlackRock.

Macro and policy

U.S. equities closed stronger, with the Dow up 0.77%, the Nasdaq rising 0.98%, and the S&P gaining 0.83%. Treasury yields pulled back, with the 10-year dropping 1.33% to 4.16%, while the dollar index inched up to 98.17. Gold remained steady at $3,555.30.

The Federal Reserve faced renewed scrutiny, with politically driven investigations into board members raising questions about its independence. This tension has added fuel to gold’s strength as investors seek safety.

Meanwhile, the SEC unveiled an ambitious agenda that includes new rules for crypto issuance and sales, potential exemptions and safe harbors, and a framework that could allow digital assets to trade on national exchanges.

The regulator also hinted at reducing Wall Street’s disclosure burdens. Notably, the SEC has withdrawn lawsuits against major exchanges, signaling a shift in tone.

Regulatory spotlight

NASDAQ has tightened scrutiny on companies holding large crypto reserves. Firms are now required to seek shareholder approval before issuing new shares to purchase tokens, with noncompliance risking delisting or suspended trading.

Stablecoin milestones and WLFI mayhem

Wyoming unveiled its first state-backed stablecoin, the Frontier Stable Token (FRNT), set to launch on the Hedera network.

Backed by USD and short-term Treasuries with a 2% reserve buffer, its interest income will go toward the state’s education fund.

In a dramatic turn, World Liberty Financial, supported by the Trump family, blacklisted Justin Sun’s wallet after he transferred $9M in WLFI tokens.

The move froze 545M unlocked tokens and 2.4B locked tokens. WLFI prices had already begun sliding hours before the transfer.

How to start trading WLFI

WLFI is the new kid on the block, built to shake up the tokenized finance game. If you want in early, Toobit gives you the simplest way to trade WLFI. Spot, Futures, and the full suite of tools are ready to go.

Tokenization takes shape

Ondo Global Markets is rolling out tokenized versions of more than 100 U.S. stocks and ETFs, deployed on Ethereum.

Backed 1:1 with traditional assets and held by SEC-registered brokers, the platform targets non-U.S. accredited investors and promises around-the-clock on-chain trading. Future expansion is planned for BNB Chain and Solana.

Singapore-based BlockSpaceForce and Mainnet Capital have launched a $100M hedge fund focused on digital asset treasury companies (DATs) and related crypto firms.

Early investments include Kindly MD, Inc. (NAKA), SharpLink Gaming Inc. (SBET), and SUI Group Holdings Ltd. (SUIG). The fund emphasizes Bitcoin, Ethereum, Chainlink, and Solana as core assets.

Meanwhile, one institution disclosed it had purchased 196,141 Solana (SOL) at an average price of $202.76, raising its total holdings to 2,027,817 SOL valued at about $427M.