The market moved broadly, continuing its corrective rhythm. The Fear & Greed Index dropped to 27, while the Altcoin Season index hovered at 26, reflecting persistent caution. Analysts note that if sentiment slips below 20, it could mark a short-term bottoming zone for contrarian entries.

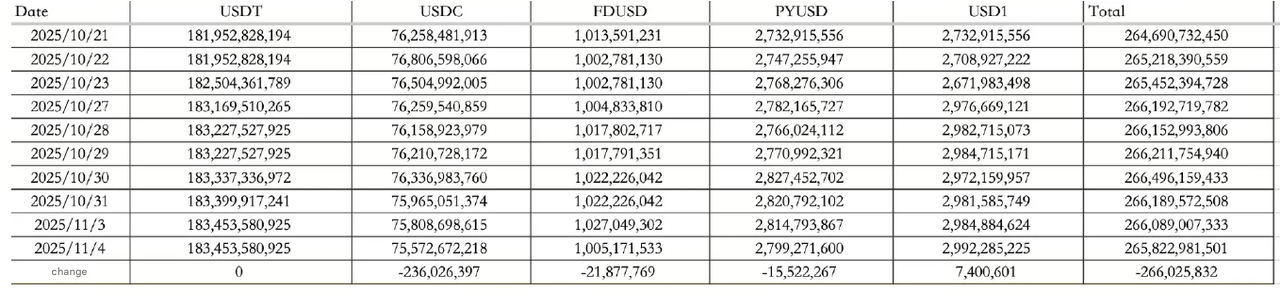

Stablecoin flows turned negative, with a net outflow of $266.03M on November 4. USDC alone saw $236.03M in outflows, bringing total stablecoin capitalization to $265.82B. Historically, such outflows tend to lag price reactions by a few days, suggesting near-term softness in liquidity conditions.

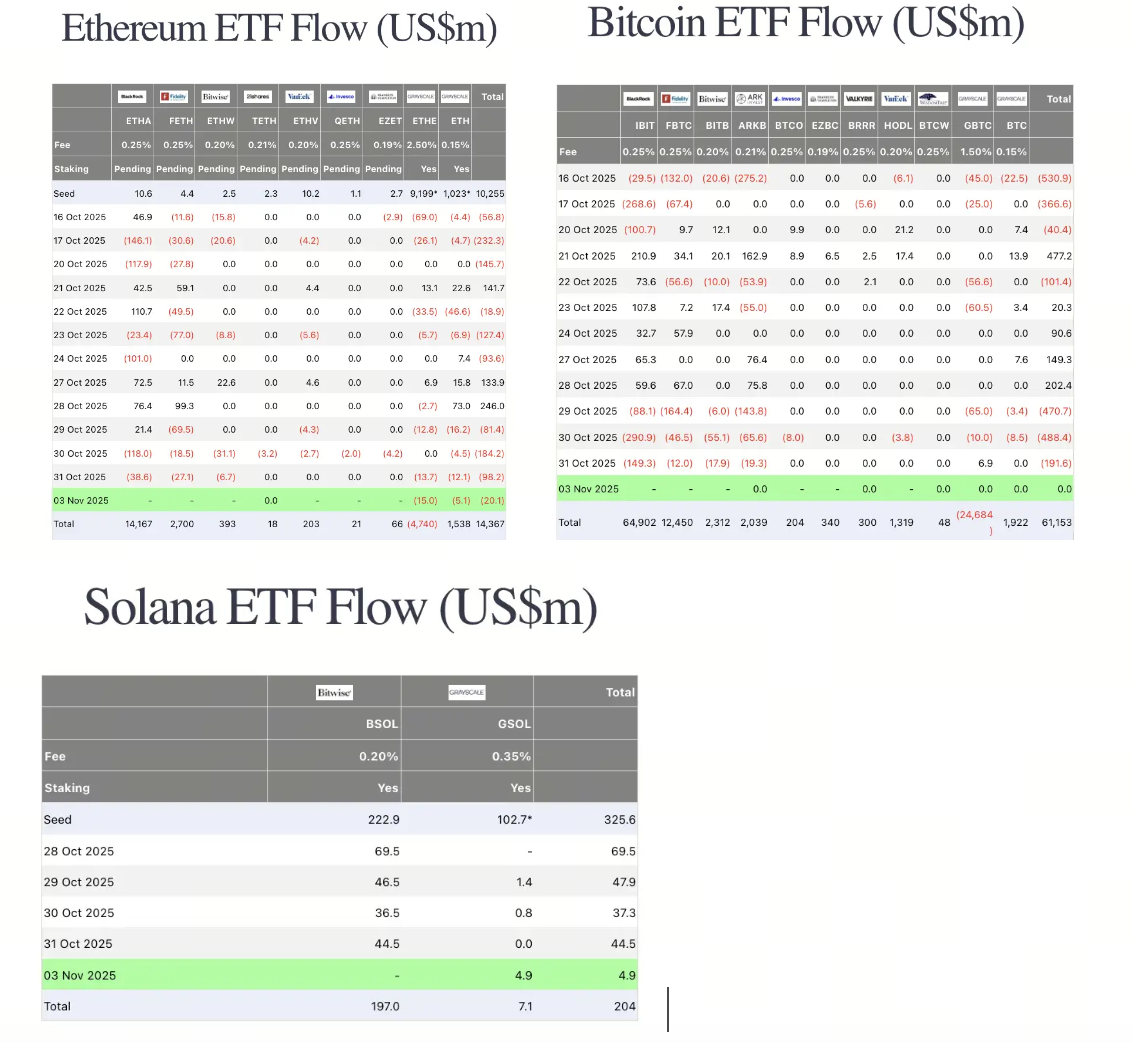

ETF data showed muted activity: BTC ETF net flows stood flat, ETH ETF recorded a $20.1M outflow, while Solana ETF registered a modest $4.9M inflow, reflecting steady investor rotation into alt-exposure.

Traditional markets and macro tone

Wall Street closed mixed overnight:

-

The Dow Jones fell 0.48%, while the Nasdaq rose 0.46% and the S&P 500 gained 0.17%.

-

Bond yields and the dollar inched higher, with the 10-year Treasury yield up 0.66% to 4.11% and the DXY rising 0.11% to 99.99.

-

Gold retreated 0.37% to $3,987.42, extending its correction as rate-cut bets remained uncertain.

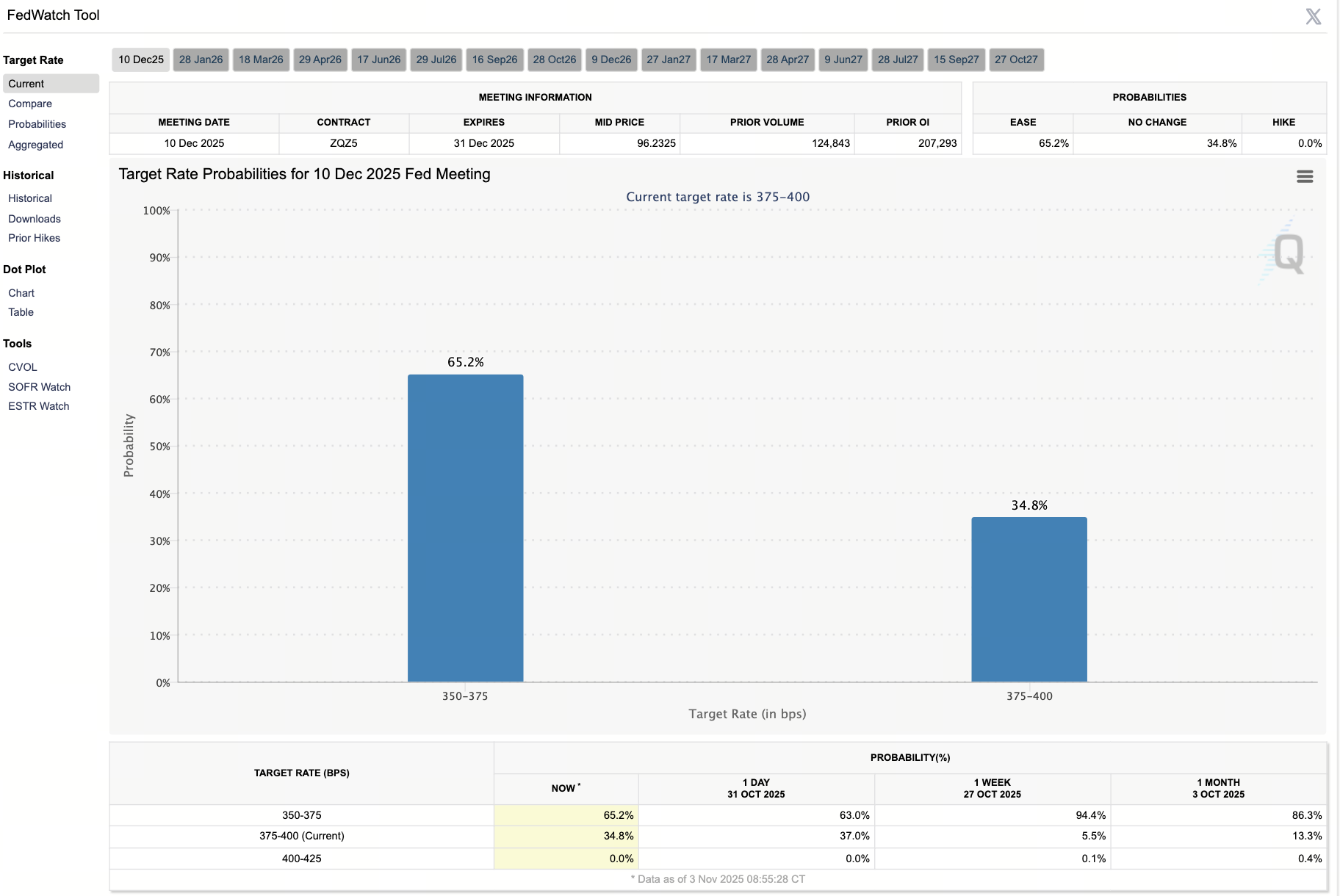

According to CME FedWatch, markets now price in a 65.2% probability of a rate cut at the next meeting.

Policy optimism resurfaced after U.S. and China trade representatives reaffirmed cooperation plans. President Trump said maintaining strong ties with China "makes America better," while Treasury Secretary Besent clarified that the U.S. has no intention to decouple from China, signaling a softer diplomatic tone ahead of year-end negotiations.

Industry highlights

Whale streak breaks:

The so-called "100% win-rate whale" has finally closed all BTC longs at a loss, erasing previous profits. His net PnL flipped from +33M to –17.6M USD, marking the end of a high-profile run and highlighting growing trader stress amid volatile conditions.

DeFi setback:

Security exploits hit again as Balancer confirmed losses exceeding $116.6M, adding to its historical cumulative damage above $21M from previous flash-loan and front-end attacks.

Giggle collapses:

After briefly spiking above $110, GIGGLE plunged to $60.64 following confusion over whether the token was officially affiliated with the Giggle Fund. Market skepticism intensified after a senior figure clarified the token was not officially issued, triggering a rapid sell-off.

Institutional flows:

-

SOL Strategies expanded holdings to 526,513 SOL (~CAD 137M), with 8,000 SOL deployed into LaineSOL for DeFi staking at an annualized yield of 8.01%.

-

ZOOZ Strategy Ltd. saw shares plunge over 34% pre-market to a $228M valuation, even as it launched a $50M share buyback plan.

-

Animoca Brands announced plans to pursue a reverse merger listing on Nasdaq, signaling renewed investor appetite for blockchain-linked equities.

How to start trading Solana

Solana isn't just fast, it's lightning. From meme launches to serious DeFi, SOL is where the action lives. If you're ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Alpha watch

-

Whales take heavy losses: One prominent wallet reportedly liquidated $4.3M in holdings, posting an estimated $3.6M realized loss. Individual token breakdowns include –$2.5M on a single position and nearly –$1M tied to another retail-linked wallet.

-

Prediction market momentum: Polymarket set a new record in October with 477,850 monthly active traders, up 93.7% MoM, surpassing its previous January high of 462,600. The rebound marks a sharp recovery from August's trough of 227,420, confirming growing retail participation in on-chain prediction markets.