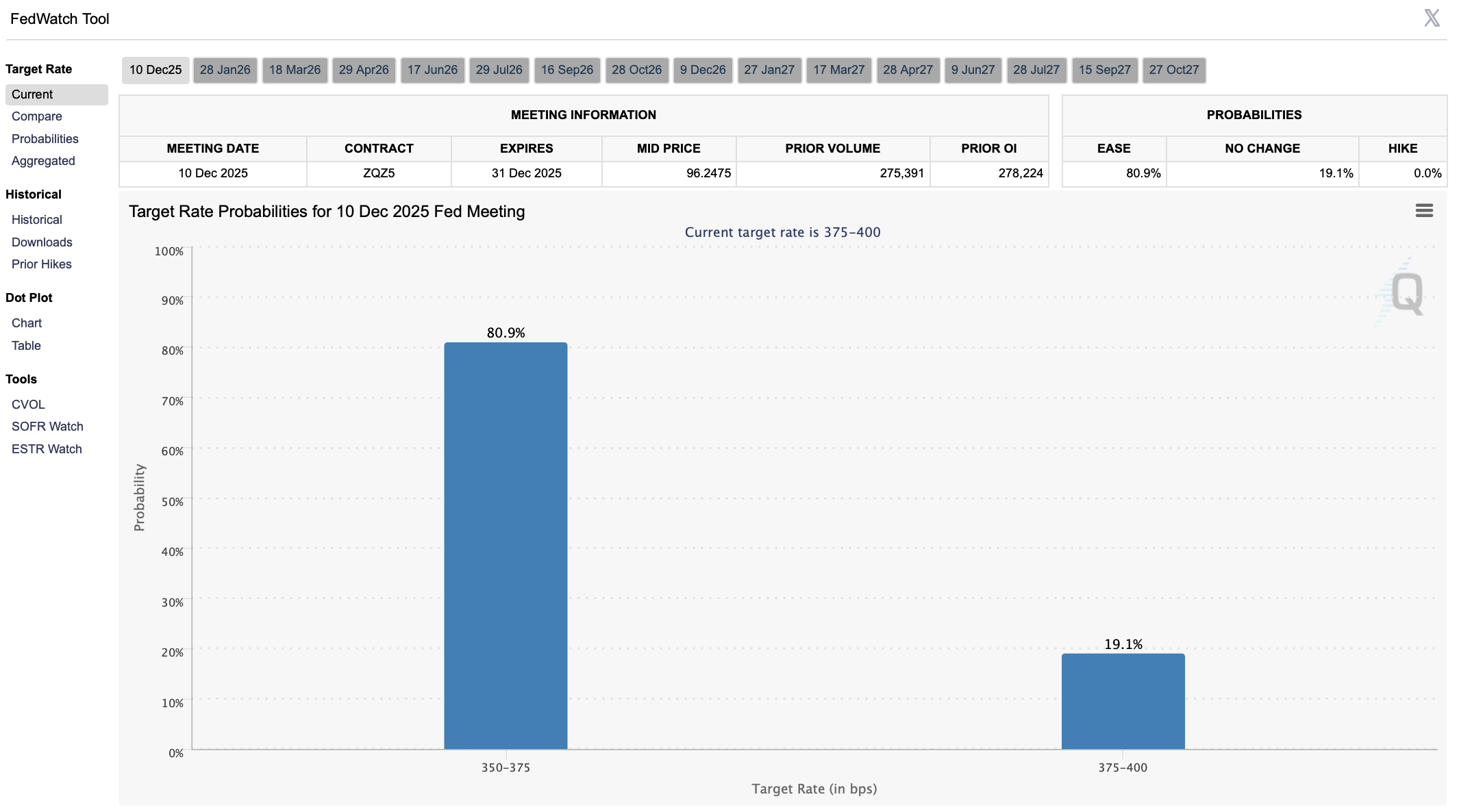

Markets opened the week with improved sentiment as CME data showed an 80.9% probability of a December rate cut, following dovish remarks from key Fed officials.

Bitcoin dominance slipped 0.15% to 58.68%, reflecting rotation into altcoins and stablecoins. The Altcoin Season Index printed 23, signaling early but incomplete rotation into alternatives alongside the BTC pullback.

The Fear and Greed Index registered 15, deep in extreme fear territory, yet stablecoin flows suggest accumulation rather than exit.

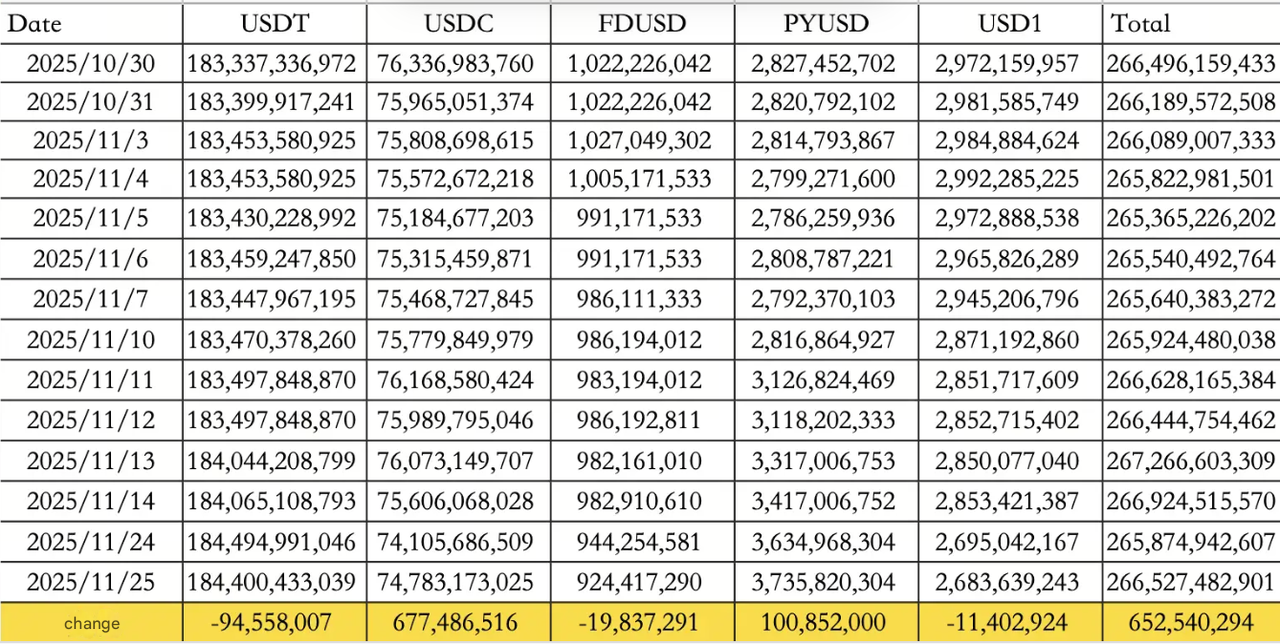

Total stablecoin inflows on November 25 reached $652.54M, powered by USDC inflows of $677.49M and USDT outflow of $94.56M, lifting circulating supply to $266.53B.

ETF participation remained active.

On 24 November, Ethereum ETFs recorded $5.5M in net inflows, while Bitcoin ETFs saw outflows of $5.8M.

Bloomberg analysts noted that more than 100 spot ETFs may launch within six months, including XRP, DOGE, and LINK filings already in the queue.

Traditional markets

Wall Street:

-

The Dow gained 0.44%

-

The S&P 500 rose 1.50%,

-

The Nasdaq surged 2.69%

Bonds and dollar:

The US 10-year yield ticked up 0.07% to 4.03% and the Dollar Index slipped 0.02% to 100.16.

Gold:

Spot gold climbed 1.57% to $4157.26 from November 24 to 25.

Corporate momentum also shaped sentiment. Amazon announced up to $50B in new AI and supercomputing infrastructure investment for US agencies. Alphabet explored licensing its Tensor AI chips to firms including Meta. The announcement lifted Alphabet and Broadcom after hours, while Nvidia and AMD pulled back.

Macro policy updates

The Bureau of Economic Analysis cancelled the Q3 GDP release previously planned for October 30. Meanwhile, September PCE and personal income data will be published on December 5 at 2PM UTC.

Geopolitically, the highlighted phone call between President Xi and President Trump reiterated China's position on Taiwan and emphasized cooperation, helping stabilize regional macro sentiment.

Industry highlights

Pump.fun transferred $405M USDC into Kraken, followed shortly by $466M USDC moving from Kraken to Circle, suggesting likely institutional off ramp flows tied to its June private sale of PUMP at $0.004, now below issue price.

MON suffered a temporary flash drop to $0.0205, down roughly 18% from its $0.025 ICO valuation.

A major exchange confirmed plans to pursue a Nasdaq IPO after completing its merger, marking one of Asia’s most ambitious exchange listing strategies this cycle.

Alpha watch

A key event this week is Hyperliquid's first token unlock, scheduled for November 29 at 7:30AM UTC. The unlock totals 9.92M HYPE, valued at $312M, representing 2.66% of circulating supply.

A major exchange has begun clawbacks of improper Alpha airdrop gains, with several accounts reportedly frozen for more than $10,000 each.

StandX launched its mainnet today at 8AM UTC. All locked DUSD automatically migrated to Perp wallets, where participants will continue earning points even without trading; withdrawals open November 27.

Concluding note

Rising expectations for rate cuts, climbing stablecoin inflows, and accelerating ETF launches provided a counterbalance to extreme fear readings.

Yet BTC's rebound remains noticeably weak, a point echoed by analysts who warn this increases the chance of retesting lower levels. With a busy macro calendar ahead and major unlock events approaching, liquidity positioning will continue to shape near term volatility.