Stablecoin activity leaned constructive, with total inflows at $466.72M, driven by $98.29M USDT and $281.37M USDC, bringing aggregate supply to $271.40B.

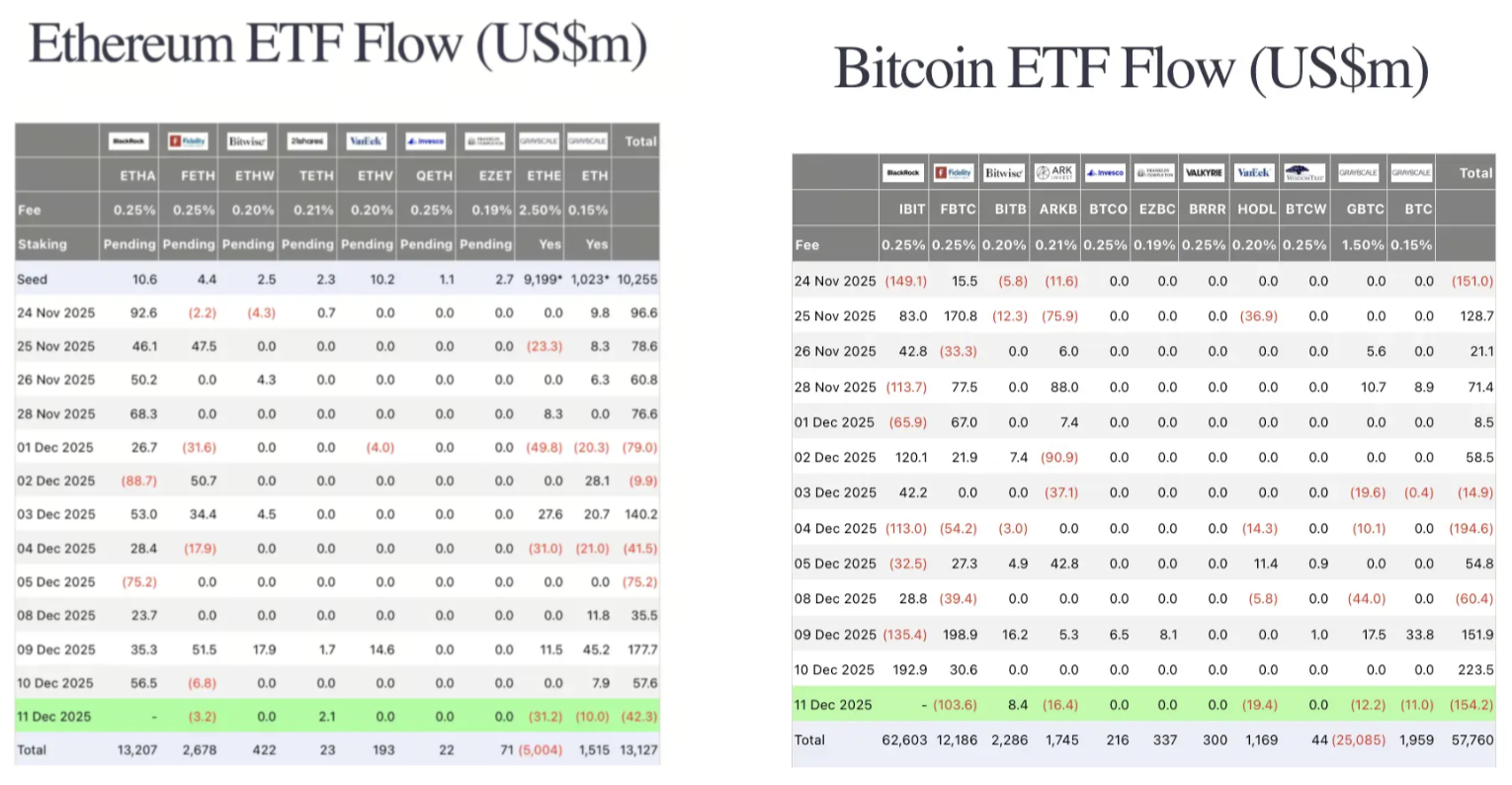

ETF participation softened again. On December 11, excluding data from one of the largest issuers, ETH ETFs recorded $42.3M in outflows and similarly, BTC ETFs saw $154.2M in outflows.

Traditional markets

Wall Street delivered a mixed performance:

-

The Dow rose 1.34%

-

The Nasdaq slipped 0.25%

-

The S&P 500 added 0.21%

Rates firmed slightly:

-

The U.S. 10Y yield climbed to 4.16%, up 0.05%, while the Dollar Index ticked up 0.06% to 98.39.

-

Gold eased 0.11% to $4,274.22

Macro policy updates

U.S. senators will continue negotiations on the Market Structure Bill today, followed by an afternoon meeting at the White House with representatives from several industry heavyweights. Later, senior executives from major banks are set to meet senators to discuss whether stablecoin issuers should be restricted from paying interest to affiliated entities, along with other unresolved policy items.

A pivotal regulatory development arrived as U.S. regulators granted a no action letter to the Depository Trust & Clearing Corporation (DTCC), enabling the institution to custody and confirm tokenized stocks and debt instruments on chain for a three-year pilot. This approval marks one of the most direct steps toward transitioning parts of traditional security infrastructure into blockchain-based rails.

Industry highlights

A large U.S. platform is preparing to introduce prediction markets and tokenized equity products on December 17. The equity component is being built in-house, signaling a push toward deeper vertical integration within regulated U.S. boundaries.

Meanwhile, a major global venue has launched a USD1 trading segment, rolling out USD1 pairs for key assets alongside zero fee incentives for selected participant tiers. USD1 is also being adopted as a unified collateral asset across derivatives as older pegged assets undergo conversion at a 1:1 rate.

Stablecoin adoption continues to gather pace:

-

a16z's latest annual review shows $46T in stablecoin transaction volume for 2024, surpassing PayPal's throughput by 20 times and approaching 3 times that of Visa.

-

The report highlights tokenized treasuries, equities, and commodities as the next major phase of growth, with decentralized payment systems expected to see broad usage by 2026.

Institutional pilots are accelerating:

-

JPMorgan recently issued a commercial paper on Solana, marking one of the first deployments of short term debt on a public blockchain.

-

Bitwise emphasized that Solana's performance improvements enable applications to tap into the final layer of network capacity, unlocking marginal liquidity and scale that rival networks have yet to match.

Beyond markets, SpaceX is drawing attention again. Reports indicate the company is targeting a June to July 2026 IPO at a valuation near $1.50T, with $250B to $300B in planned fundraising. With a valuation of around 100x price to sales, the listing is shaping up to be one of the most closely watched debates in traditional and emerging finance.

Alpha watch

Morpho has enabled borrowing against Polymarket positions, allowing market participants to turn predictive exposure into collateral for additional strategies.

Meanwhile, Sei Network announced an official collaboration with Xiaomi. Future Xiaomi devices will come preloaded with a crypto payment app developed by the Sei team, placing blockchain infrastructure directly at the mobile OS layer for the first time in this ecosystem.

A major offshore venue drew widespread attention through offering 10% APR on flexible USDT products under its simplified savings line, despite tightening USD yields elsewhere.

Concluding note

Liquidity continues to rebuild through stablecoins while ETF flows remain cautious, leaving markets in a holding pattern as regulatory signals sharpen.

With tokenization gaining formal approval, and ecosystem partnerships accelerating, conditions point toward a market that is gradually preparing for its next expansion cycle. Near term volatility does little to change the broader setup as innovation pipelines strengthen and policy clarity inches forward.