Global markets rallied overnight as optimism around tech and AI stocks reignited risk appetite. Bitcoin held firm with BTC dominance at 59.58%, while the Altcoin Index dipped to 26, showing continued caution toward smaller caps.

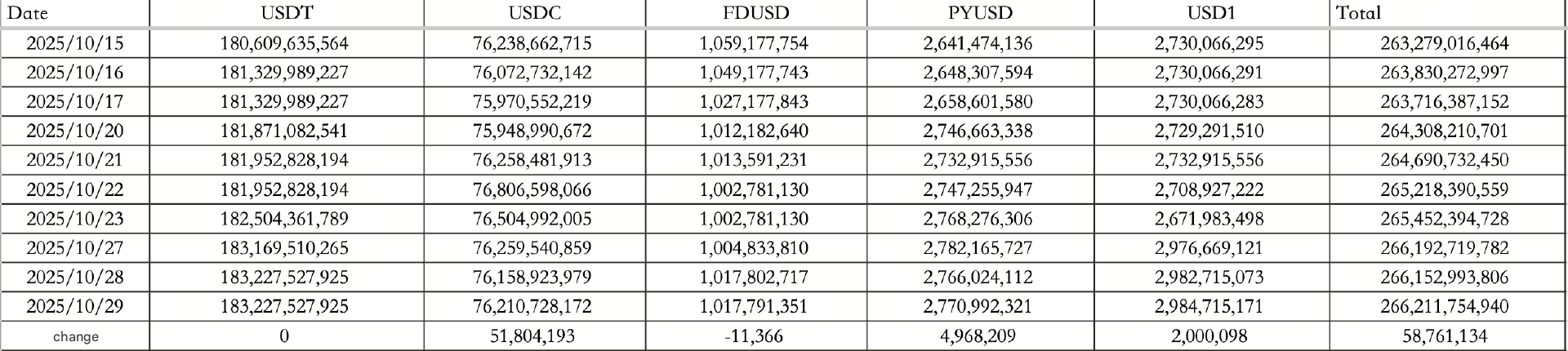

Stablecoin flows stayed positive. On October 29, inflows totaled $58.76M, led by $51.80M into USDC, bringing the total stablecoin supply to $266.21B.

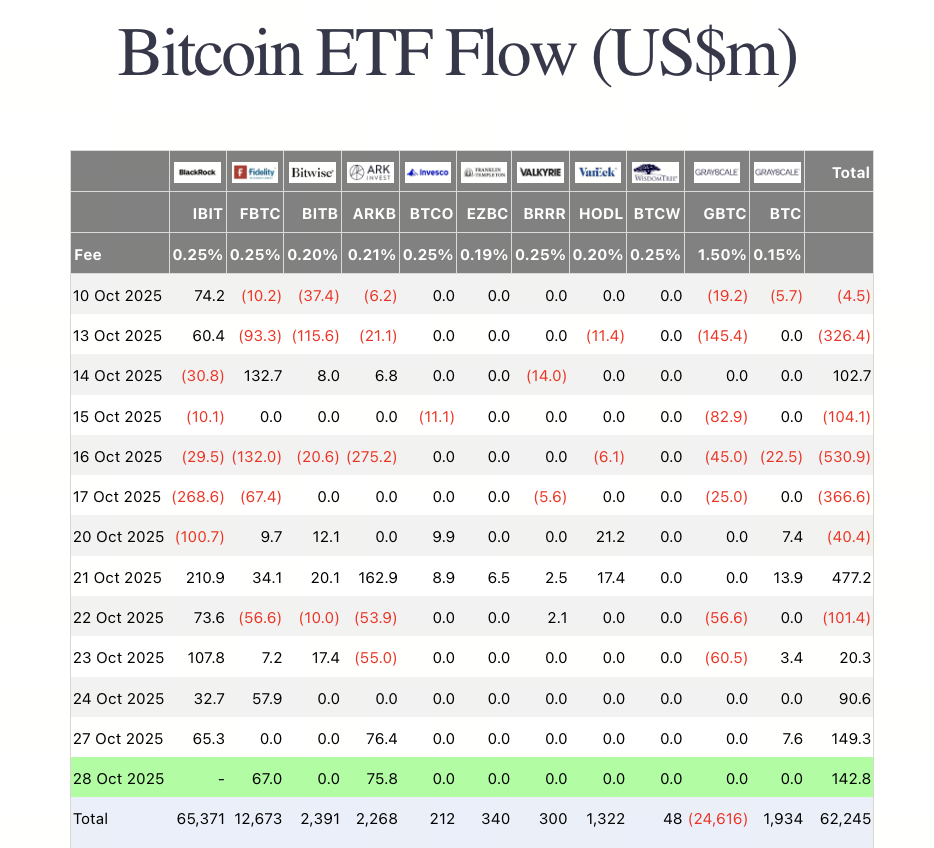

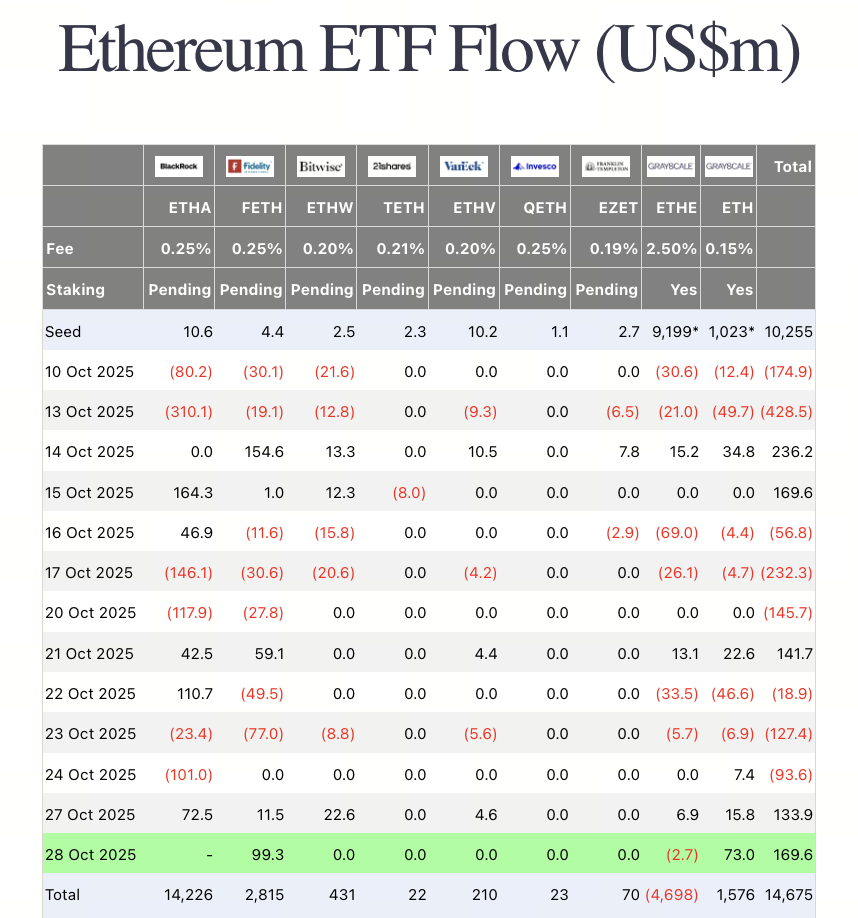

ETF demand surged again. On October 28, excluding BlackRock data, BTC ETFs saw $142.8M in inflows, while ETH ETFs brought in $169.6M.

Macro and policy

Wall Street sets new records

U.S. equities soared to fresh all-time highs, powered by renewed AI momentum. The Dow gained 0.34%, Nasdaq rose 0.80%, and the S&P 500 added 0.23%.

NVIDIA jumped 4.98% to $201.03, pushing its market cap close to $4.9T, after CEO Jensen Huang unveiled a sweeping AI integration roadmap spanning finance, logistics, and healthcare.

The 10-year Treasury yield edged up 0.13% to 3.98%, while the dollar index slipped 0.04% to 98.69. Gold climbed 0.58% to $3,975.27.

Washington gridlock continues

The U.S. government shutdown dragged into its 13th failed vote, as the Senate once again blocked the 2025 Fiscal Year Funding Act by a 54–45 margin. Without the required 60 votes, the government remains closed, marking one of the longest shutdowns in recent history.

Meanwhile, President Trump escalated rhetoric against Fed Chair Jerome Powell, calling him “either incompetent or malicious,” and said Powell would be replaced “within months.”

Elsewhere, Commerce Secretary Rutenik confirmed the U.S. will sign a $490B investment deal in Japan, backed by SoftBank’s $25B commitment, alongside pledges from Toshiba, Carrier, Kinder Morgan, Mitsubishi Electric, TDK, and Fujikura.

Industry highlights

Bitwise’s Solana staking ETF ($BSOL) debuts with $69.5M inflow

Bitwise launched its long-awaited Solana staking ETF ($BSOL), attracting $69.5M in day-one inflows and reaching $220M in total assets, already half the size of REX Shares’ $SSK ETF launched in July.

The fund distributes staking rewards (~7% APY) to investors and marks a major institutional step toward on-chain yield integration.

Western Union enters crypto

Western Union joined the race for blockchain payments, announcing a strategic partnership with Anchorage to issue a stablecoin on Solana by 2026. The firm will also roll out a digital asset wallet network for cross-border transfers.

Monad airdrop live

Monad officially opened its MON airdrop allocation page, allowing users to check eligibility and claim status. The move ended weeks of speculation following snapshot leaks earlier this month.

OpenAI restructures toward IPO

OpenAI completed a corporate reorganization, simplifying its structure and separating the nonprofit foundation from its for-profit subsidiary. CEO Sam Altman said, “Given our capital needs, an IPO is the most likely path forward.”

Solana x402 hackathon kicks off

The Solana x402 Hackathon officially began, focusing on AI + cross-chain scaling. Backed by Solana Foundation and Trends.fun, the event encourages developers to build infrastructure bridging Solana and Base ecosystems.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Alpha watch

-

Opinion Protocol raised $5M in a round backed by YZi Labs. When asked about YZi’s involvement, CZ clarified: “We’re a minor investor, but we’ll do our best to add strategic value.”

-

Aster continues to impress, generating $1.5–2.5M in daily revenue, which analysts say still prices it at a deep discount relative to Hyperliquid valuations.

-

Aster confirmed that all S3 buybacks will be executed fully on-chain, with S3 airdrops to follow once the repurchase phase concludes.

-

Animoca Brands acquired $AERO, locking all holdings into veAERO governance. The firm cited AerodromeFi’s 50%+ DEX TVL dominance on Base as a “strategic foothold.”

-

Polymarket plans to relaunch in the U.S. within weeks, focusing initially on sports prediction markets timed with the NFL and NBA seasons.