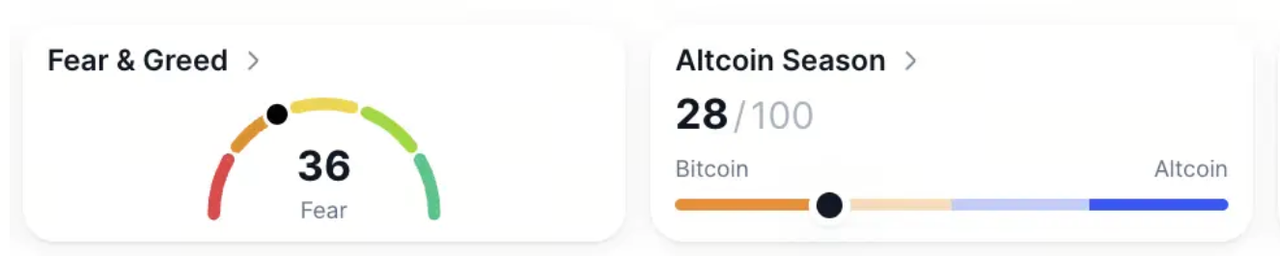

Crypto sentiment remained cautious at the start of November, with the Fear and Greed Index rising slightly to 36 and the Altseason Index holding at 28.

Despite the mixed tone, privacy-focused tokens stole the spotlight, surging across major markets as traders rotated toward assets with stronger anonymity narratives.

Stablecoins continued to show resilience. On November 3, total stablecoin flows saw a net outflow of $100.57M, but the picture was more nuanced beneath the surface.

USDT recorded a $53.66M inflow while USDC saw $156.35M in outflows, keeping the total stablecoin supply steady at $266.09B.

Macro backdrop

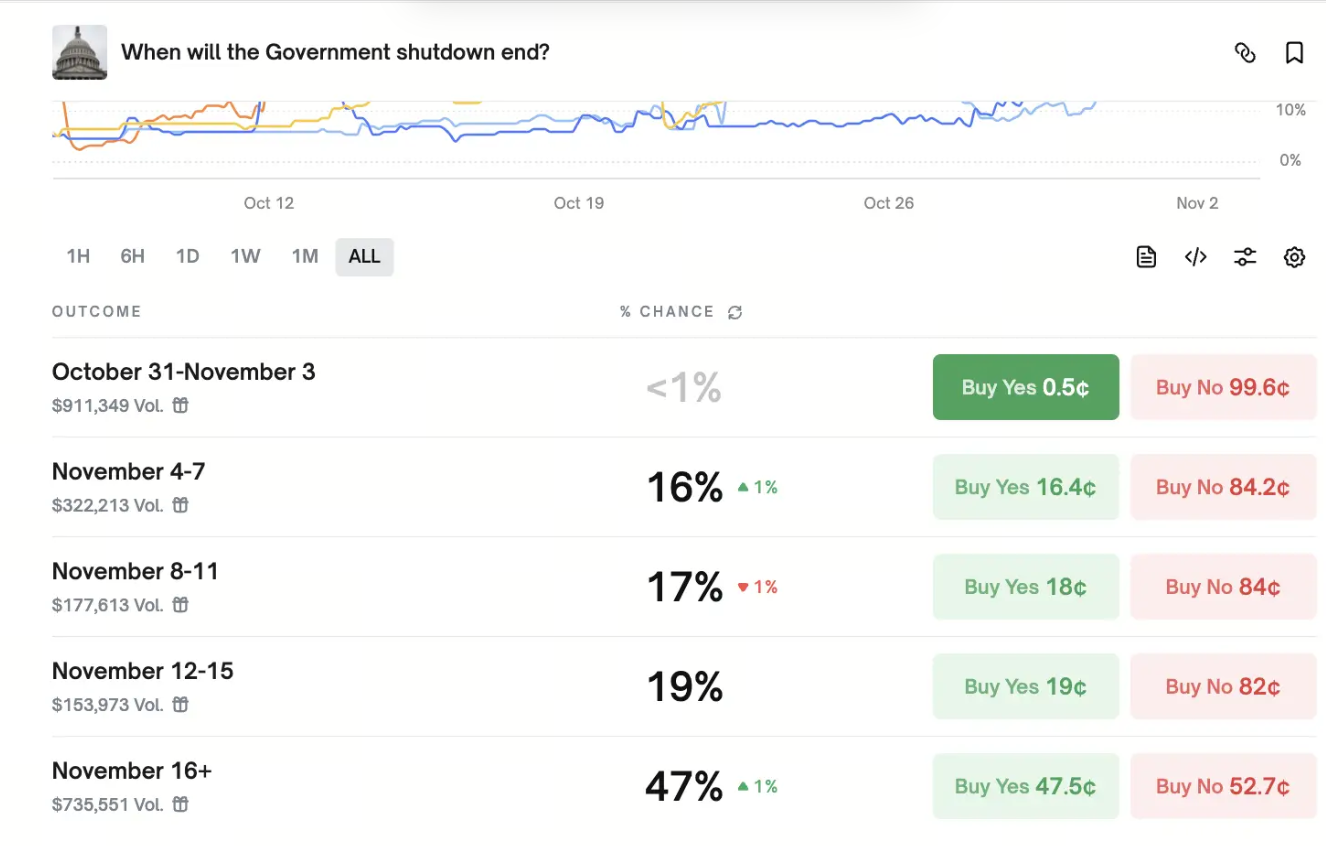

The U.S. government shutdown remains unresolved, entering what could soon become the longest in American history if it surpasses the 35-day record.

According to data from prediction market Polymarket, odds now favor a resolution around November 16 or later.

The continued shutdown has raised concerns about delayed macro data releases, potentially affecting the Federal Reserve's communication timeline for its December policy meeting.

Market participants are watching for signs that liquidity support could extend further if the impasse drags on.

Whale and institutional moves

A well-known whale dubbed the "100 Percent Win Rate Trader" placed new long positions worth roughly $380M, setting bids at $184 for SOL and between $40 and $41.3 for HYPE.

The trader's historical accuracy has drawn significant attention across social channels, with observers watching closely to see whether this setup marks the start of another major swing move.

Industry highlights

Vitalik sparks ZK sector rally

Ethereum co-founder Vitalik Buterin made waves by publicly endorsing ZK-related projects, sending the ZK sector soaring. Tokens tied to zero-knowledge proof infrastructure doubled within 24 hours following his comments.

CZ's Aster bet shakes up the market

CZ also turned heads after publicly stating he purchased $2M worth of Aster tokens. In follow-up remarks, he compared Aster's early-stage potential to what BNB represented eight years ago.

The statement triggered a rally before profit-taking emerged, with some large traders flipping bearish. One address, holding $51.56M in Aster short positions on Hyperliquid, opened at an average entry price of $1.20.

Interestingly, Aster's 24-hour protocol revenue now exceeds Hyperliquid's and its 30-day revenue is closing the gap, indicating strong user traction despite short-term volatility.

Monad airdrop nears claim deadline

Monad also entered the spotlight as its airdrop claim window neared closure, set to end on November 3 at 9pm. The project’s distribution model, which relies on a time-window and task-based structure, has been widely discussed as a potential blueprint for future token launches.

Gate launches CrossEx for institutional traders

In another major development, Gate unveiled CrossEx, a cross-exchange clearing and settlement platform. The service allows institutional and quantitative traders to manage accounts and collateral across multiple exchanges through a unified interface.

It supports cross-margin sharing, profit-and-loss netting, and aggregated volume tracking, significantly improving capital efficiency and execution speeds across connected venues.

XRP ETF Launch could be imminent

Separately, ETF Store President Nate Geraci predicted that the first U.S. spot XRP ETFs could launch within the next two weeks. His comments come as regulatory sentiment toward digital assets improves, particularly after the SEC’s recent settlement with Ripple earlier this year.

How to start trading XRP

XRP moves where regulation meets innovation. Known for its speed and efficiency in cross-border payments, XRP powers one of the most established blockchain ecosystems in the market. Whether you're trading short-term swings or looking for long-term exposure, Toobit gives you the edge with seamless Spot, Futures, and advanced trading tools.

Alpha and on-chain insights

Pump.fun continued its aggressive buyback of PUMP tokens, spending 7,453.81 SOL (about $1.395M) in the past 24 hours. Since the buyback program began on July 15, the platform has repurchased roughly $160.80M worth of PUMP tokens, reducing total supply by 10.04%.

Market participants are now speculating that the next phase may introduce a formalized burn mechanism or liquidity redistribution plan.