Wall Street caught a bid, but digital assets did the opposite, printing a classic wick and fade setup as risk appetite stayed defensive. BTC dominance edged up to 59.79%, while the Fear and Greed Index sat at 16, still deep in "extreme fear".

Liquidity told the louder story. The stablecoin complex saw a -$739.41M net change on the day, led by USDC flowing out at $688.79M and USDT at -$45.25M, leaving total stablecoin supply to be at $270.2B. When the "cash lane" leaks this hard, rallies tend to become selective, fast.

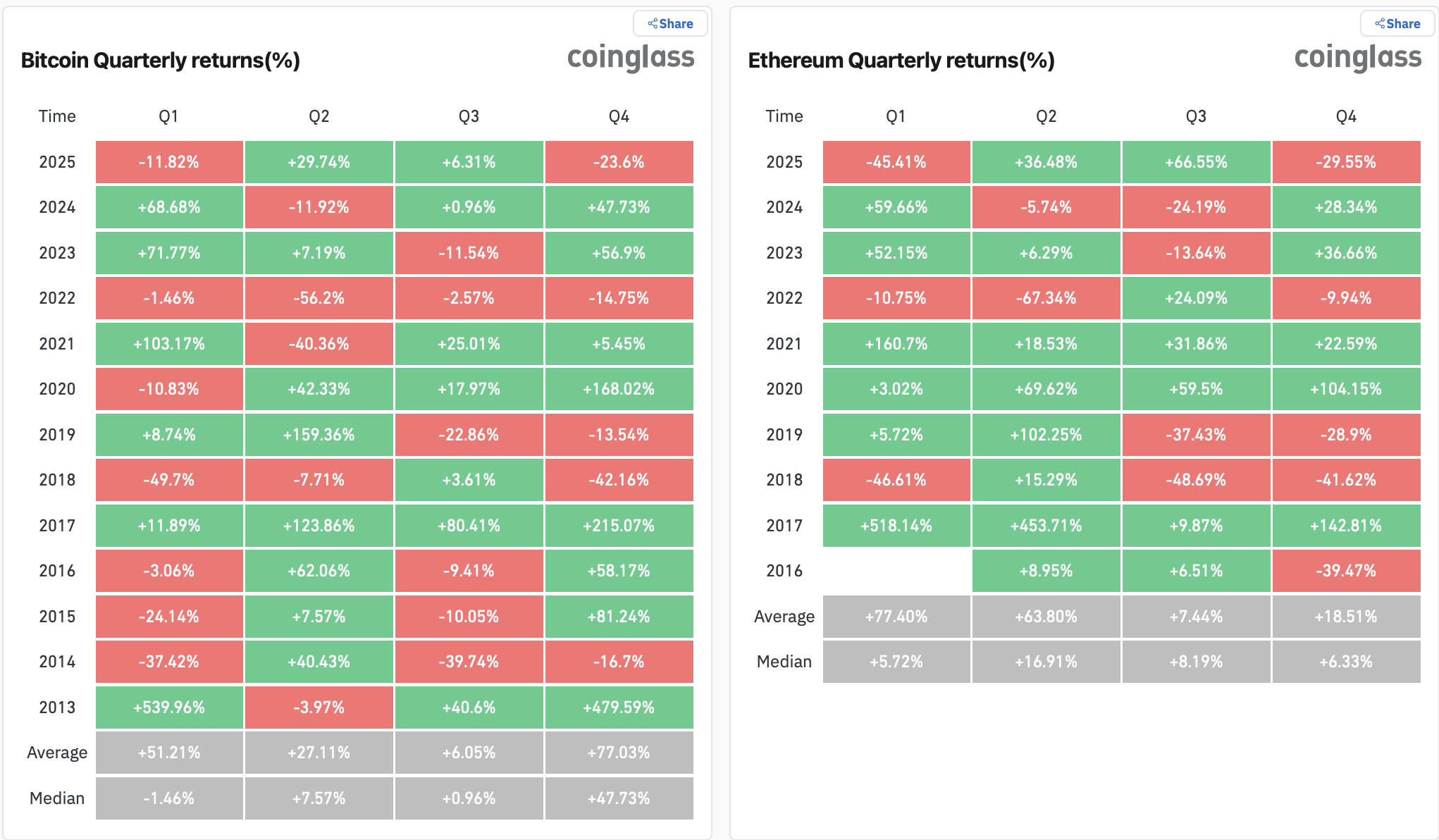

Zooming out, the drawdown scoreboard is still heavy: BTC is down 23.6% in Q4 to date, while ETH is down 29.55%. Historically, that puts this quarter among the rougher stretches for both majors.

Traditional markets

US stocks were firmly green today:

-

The Dow lifted 0.14%

-

The S&P 500 gained 0.79%

-

The Nasdaq rose 1.38%

The divergence matters because it shows positioning is not "risk-on everywhere", it is more like "risk-on where the data is easy to believe".

That data point was inflation. The latest print showed November CPI at 2.7% YoY, below the 3.1% expectation, though several analysts flagged distortion risks tied to data collection disruptions.

Macro policy updates

U.S. policy headlines stayed loud and market-relevant. President Trump signaled aggressive housing reforms and reiterated a large tax cut push, claiming households could see $11,000 to $20,000 in annual savings.

On the regulatory lane, the Senate confirmed Michael Selig to lead the CFTC and Travis Hill to lead the FDIC, reinforcing expectations that the CFTC could take a larger role in how digital asset activity is supervised once market structure work is finalized. After Selig is sworn in, he will succeed Acting Chair Caroline Fan, who has led a series of policy initiatives supporting cryptocurrency during her tenure as Acting Chair.

Industry highlights

Tokenized settlement goes more public

JPMorgan's tokenized deposit product JPM Coin (JPMD) was reported as moving from its internal network to Base (an Ethereum L2) to better support onchain payments, collateral, and margin workflows. If this trend sticks, it is less about "bank experiments" and more about plumbing upgrades.

Stablecoin builders are getting funded

Circle introduced the Arc Builders Fund, earmarking capital and an investor network to back early teams building real world financial applications on Arc. This is another signal that stablecoins are shifting from narrative to infrastructure.

Prediction markets keep merging with wallets

Phantom began rolling out access to Kalshi-powered prediction markets, allowing participation using Solana ecosystem assets and Phantom's CASH stablecoin.

Distribution is the point here: when financial primitives land inside mainstream wallets, adoption friction drops.

Alpha watch

Aster's airdrop mechanics tighten

Stage 4 ends on December 22, 2025 at 7:59 (UTC+8). Eligibility checks open on January 14, 2026, with claims from January 28, 2026.

The allocation is 1.5% of total supply with a 3 month vesting choice: claim immediately for 50% (the remaining 50%is forfeited and burned), or wait approximately 3 months for 100% of the allocation.

Tokenized equities volume milestone

A major venue reported cumulative tokenized stock volume above $500M, concentrated on mega-cap names like Tesla, Nvidia, Apple, and Meta.

Buidlpad Vaults (yield product)

Buidlpad launches its new product Buidlpad Vaults, offering 8% APR, and supporting USDT, ETH, and BNB across multiple networks. It has a total cap of $20M and a per-asset per-account cap of $100,000. It is only open to Buidlpad ICO contributors who have completed address binding.

Deposits run from December 20 to 25, with maturity on January 25, 2026. Redemption and reinvestment is supported, and continued deposits enjoy the existing 8% return rates.

Concluding note

Today's signal is simple: equities rallied on a softer CPI print, but digital assets stayed constrained by real liquidity leakage.

With -$739.41M in stablecoin outflows and fear still pinned at 16, upside can still show up, but it is likely to be narrow, headline-driven, and quick to fade unless the "cash lane" stabilizes.