The markets showed signs of renewed strength, supported by steady capital inflows and renewed DeFi momentum.

The Fear & Greed Index stood at 29, showing mild fear, while the Altcoin Season Index held at 30.

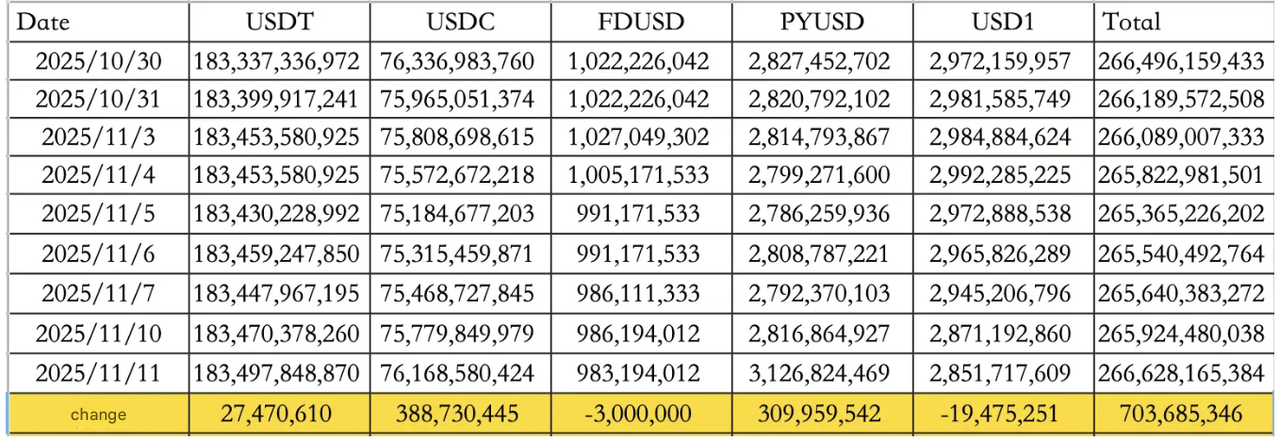

Stablecoins saw net inflows of $703.69M, led by USDC (+$388.73M) and USDT (+$27.47M), pushing total supply to $266.63B

Whale activity remains aggressive, with one major wallet adding 14,742 ETH, bringing its total long exposure to 54,742 ETH (~$193M) with a 9.47% gain. Another large holder purchased 23,501 ETH (~$82.63M) after previous rounds of profit-taking and re-entry, signaling strong conviction on Ethereum's mid-term trend.

Traditional markets

Wall Street rallied overnight after news of the the U.S. government reopening.

-

Dow Jones rose 0.81%

-

Nasdaq rose 2.27%

-

S&P 500 rose 1.54%

Treasury yields edged higher, with the 10-year rate up 0.66% to 4.12%, while the U.S. Dollar Index (DXY) held firm at 99.67 (+0.05%).

Gold rose 0.42% to $4,131.81, reflecting moderate hedging demand as macro uncertainty eased.

Macro policy updates

The U.S. Senate formally passed a continuing funding bill, providing financing until November 30 to avert a government shutdown.

The vote passed 60–40, clearing a key hurdle before final House approval and President Trump’s signature. If signed by Wednesday, the federal government will fully reopen, unlocking access to roughly $1T in TGA (Treasury General Account) funds.

This major development eased market anxiety significantly, and could support short-term liquidity rotation back into risk assets.

Industry highlights

Uniswap dominated headlines with a governance proposal to activate protocol fee sharing and introduce a UNI burn mechanism.

The move will destroy 100M UNI from the treasury, driving token prices up over 40% within hours. If approved, the plan could set a new precedent for on-chain revenue redistribution across DeFi protocols.

Meanwhile, a major exchange announced plans to launch a token sale platform next week, debuting with Monad (MON) as its first ICO-style listing.

The platform will algorithmically allocate tokens to ensure fairer distribution and discourage rapid resale within 30 days of issuance.

Each new asset is expected to be listed on the main exchange roughly once per month.

Alpha watch

Ping's C402.markets launch

-

Following its test phase, Ping officially activated C402.markets on Nov 11 at 2:00 UTC, allowing token issuers to mint directly on-chain.

-

The event marks another step in the growth of on-chain token infrastructure and liquidity distribution.

Concluding note

DeFi narratives have re-entered the spotlight, led by Uniswap’s structural overhaul and a steady rise in stablecoin inflows.

With U.S. fiscal stability temporarily restored and risk sentiment improving, crypto assets could see a short-term recovery if ETH whales sustain their accumulation and on-chain volumes continue to expand.