Crypto markets stayed cautious despite positive macro headlines.

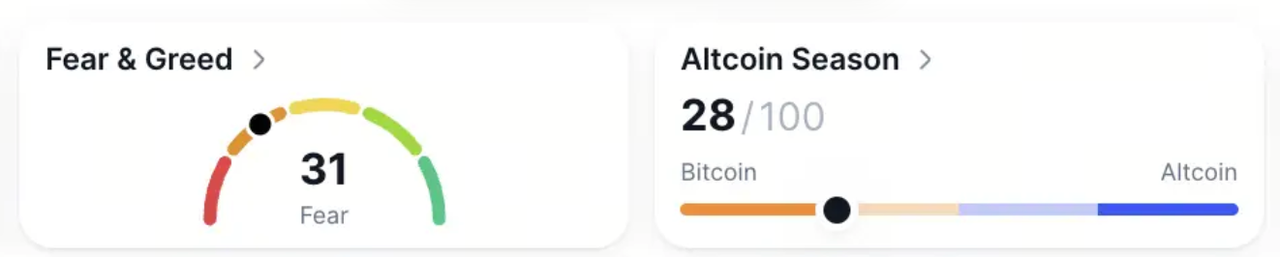

The Fear & Greed Index fell to 31, with the altcoin index at 28, underscoring continued investor unease.

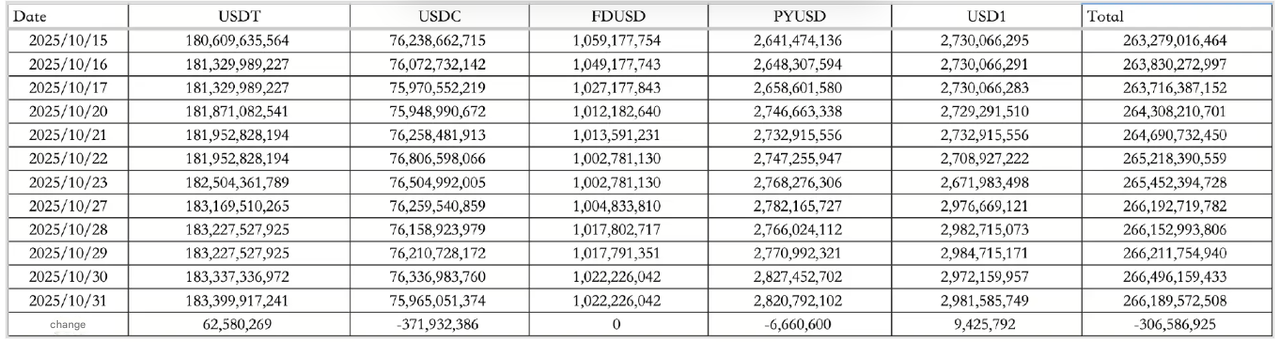

Stablecoin flows saw a net outflow of $306.59M on October 31, as USDT recorded $62.58M in inflows offset by $371.93M in USDC redemptions, keeping the total circulating supply near $266.19B.

On October 30, major ETFs closed with mixed performance: BTC ETFs saw $189.5M in outflows, ETH ETFs lost $60M, while SOL ETFs gained $37.3M as institutional interest in Solana held firm.

Traditional markets

US equities ended lower overnight:

-

Dow Jones fell by 0.23%, the S&P 500 by 0.99%, and the Nasdaq dropping the most out of three by 1.57%

-

10-year Treasury yield rose by 0.37% to 4.09%

-

U.S. Dollar Index strengthened by 0.31% to 99.43

-

Gold surged 2.58% to $4,030.90, reflecting renewed demand for safe-haven assets

Despite the pullback, according to the Kobeissi Letter, nearly 60% of global stock markets have hit record highs over the 21 days. The S&P 500 alone has set 37 all-time highs this year, the 3rd highest winning streak since 2017. This positive growth signaled robust risk appetite even amid market volatility.

Macro policy highlights

Just yesterday, the U.S. Department of Commerce confirmed that the 24% reciprocal tariffs on Chinese goods will remain suspended for one year, while the 10% "fentanyl tariff" on Chinese exports will be fully removed. Beijing responded by extending its counter-tariff exemptions, signaling cooling in trade relations, with both parties reaching a tariff truce.

This announcement comes as markets digest the Fed's 25-basis-point rate cut. Treasury Secretary Bessent applauded the move but criticized the central bank's outdated inflation modeling, hinting that a leadership change at the Fed could be announced before Christmas.

Industry highlights

The Ethereum Foundation set December 3 for its next hard fork, "Fusaka", which will implement PeerDAS (data availability sampling) and raise block gas limits from 30M to 150M, expanding throughput for L2 ecosystems.

Meanwhile, whale wallet 0xc2a, holding over $362M in long positions, saw unrealized losses widen to $17.36M after 14 consecutive profitable trades.

Aster Network's TVL stood at $1.69B, generating daily buybacks between $1.25–1.4M, sustaining steady DeFi engagement.

Alpha watch

Momentum (MMT) was unveiled as the second Prime Sale Pre-TGE project, with subscriptions capped at 7 BNB per user between 5–7 pm. (UTC+8). Eligible participants must use Alpha Points to join, and tokens will be airdropped at TGE.

Elsewhere, Solana DeFi continued its quiet rise, with ByReal data showing new protocols entering the top 10 by TVL, though launchpad sentiment cooled after KaitoAI's last offering fell 74% post-launch, signaling that easy profits are waning in this cycle.

How to start trading Solana

Solana isn't just fast, it's lightning. From meme launches to serious DeFi, SOL is where the action lives. If you're ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.