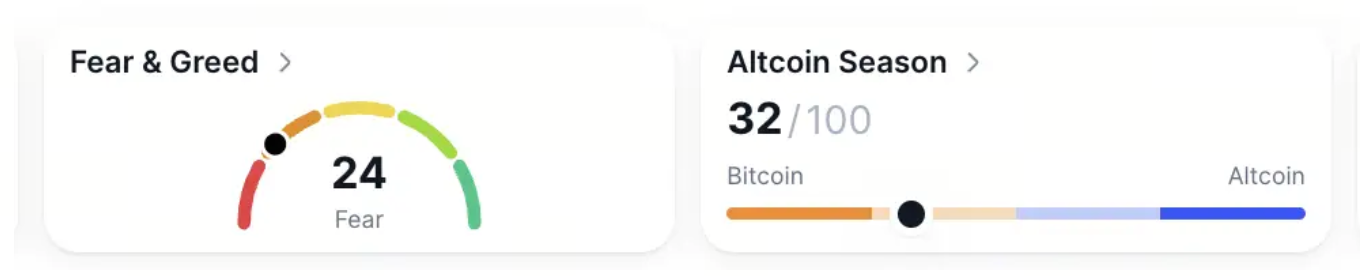

The Fear and Greed Index rose slightly to 24, up from last week’s deep fear levels. Bitcoin’s dominance climbed 0.02% to 59.91%, signaling that capital is consolidating around major assets while altcoins remain range-bound.

The Altcoin season index has also risen to 32.

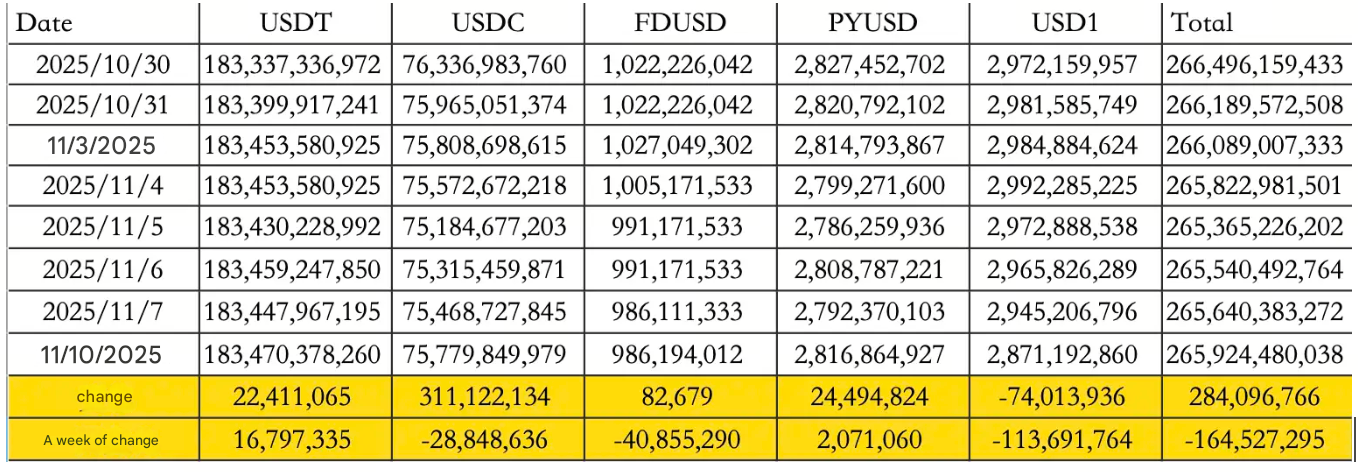

Consolidating a week of changes, stablecoins recorded a net outflow of $164.53M, driven by $28.85M exiting USDC and $16.79M flowing into USDT. The total circulating stablecoin supply now stands at $265.92B, showing minor contraction but retaining robust liquidity levels.

Consolidating a week of changes, stablecoins recorded a net outflow of $164.53M, driven by $28.85M exiting USDC and $16.79M flowing into USDT. The total circulating stablecoin supply now stands at $265.92B, showing minor contraction but retaining robust liquidity levels.

Bitcoin’s market cap share ticked higher to 59.91%, maintaining dominance over altcoins. Traders are watching for potential bullish divergence in BTC as fear levels ease and macro tailwinds strengthen.

Macro policy highlights

Markets Rebound on Shutdown Deal and Stimulus Buzz

Markets roared back to life as dual catalysts hit over the weekend. President Trump announced that every American, excluding high-income earners, will receive a minimum $2,000 dividend, while reports confirmed that Republicans and Democrats reached a deal to end the over 40-day government shutdown.

The double boost ignited a broad market rebound, with crypto and equities rallying on expectations of fresh liquidity.

Analysts estimate that reopening the U.S. government could inject around $54.2B in liquidity if operations resume by November 16, reversing weeks of suppressed spending and delayed payments.

Longer loans, tokenized collateral, and market integration

In parallel, the Trump administration introduced a 50-year fixed-rate mortgage program, aimed at expanding long-term home affordability and stabilizing credit markets.

Meanwhile, insiders at the Commodity Futures Trading Commission (CFTC) confirmed that the agency is finalizing a tokenized collateral framework, expected to launch early next year. The proposal would allow stablecoins to be used as accepted collateral for derivatives trading in U.S. clearinghouses.

The pilot will include enhanced transparency rules covering large position disclosures, transaction volume reporting, and operational risk events; a major step toward integrating blockchain liquidity into regulated markets.

Industry highlights

Capriole Investments founder Charles Edwards reported that a wave of early Bitcoin whales, wallets inactive since before 2018, are selling large holdings. Data showed multiple transactions exceeding $100M, with a few surpassing $500M, marking the heaviest on-chain movement from legacy wallets in years.

However, on-chain analyst Willy Woo cautioned against interpreting every movement as selling. He noted that some activity stems from address upgrades, custody rotations, and treasury restructurings, rather than liquidation.

How to start trading Bitcoin

Bitcoin’s the OG: still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Alpha watch

PingObserver launches Mintpad on X402 Protocol

PingObserver announced that its Mintpad platform, built on the X402 protocol, will officially launch on November 11 at 10pm. The launchpad will default to pairing all new tokens with $PING, providing built-in liquidity and utility for the native token. Future updates will add USDC pairing options.

The launch mechanism is inspired by Pump-style fair minting, using Uniswap v4 for liquidity provisioning on the Base network. Distribution will allocate 49% of tokens for fair minting, 49% for automated LP, and 2% to developers. All early mint proceeds in USDC will automatically convert into $PING for pairing, deepening ecosystem integration.

Opinion launches new trading event

Prediction market platform Opinion announced a new campaign: traders with $200 in eligible trading volume will share 10,000 Opinion Points.

Concluding note

Trump’s twin announcements of $2,000 cash payments and a reopening deal fueled optimism across global markets. With liquidity on the verge of release and regulatory clarity building around stablecoins, the stage is set for a relief rally.

Institutional sentiment has shifted cautiously bullish, and retail participation is likely to return once the government officially reopens and funds start to flow.