Crypto markets remain subdued as fear deepens. The Fear & Greed Index is edging back toward the extreme fear zone, showing increased investor hesitation. Bitcoin dominance rose over the week to 60.48%, signaling capital rotation toward BTC.

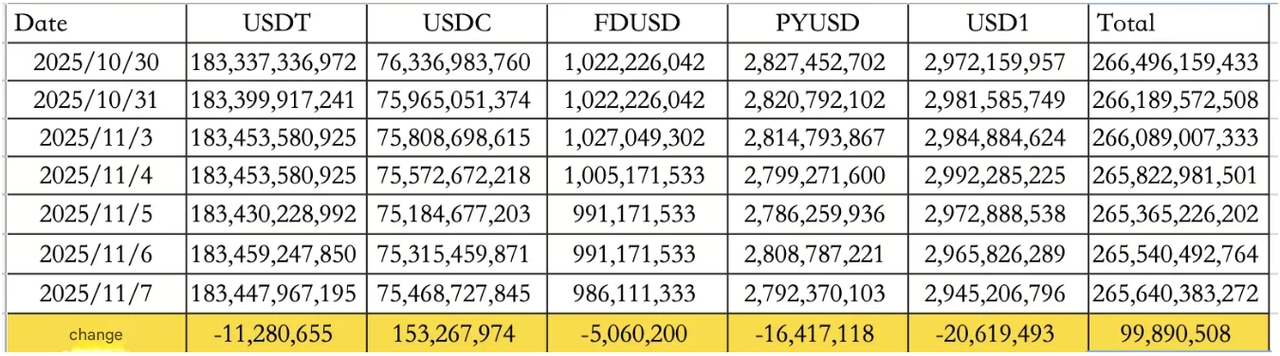

Stablecoin movements reflected mixed sentiment. On November 7, net inflows reached $99.89M, led by USDC inflows of $153.27M and offset by USDT outflows of $11.28M. The total stablecoin market cap now stands at $265.64B.

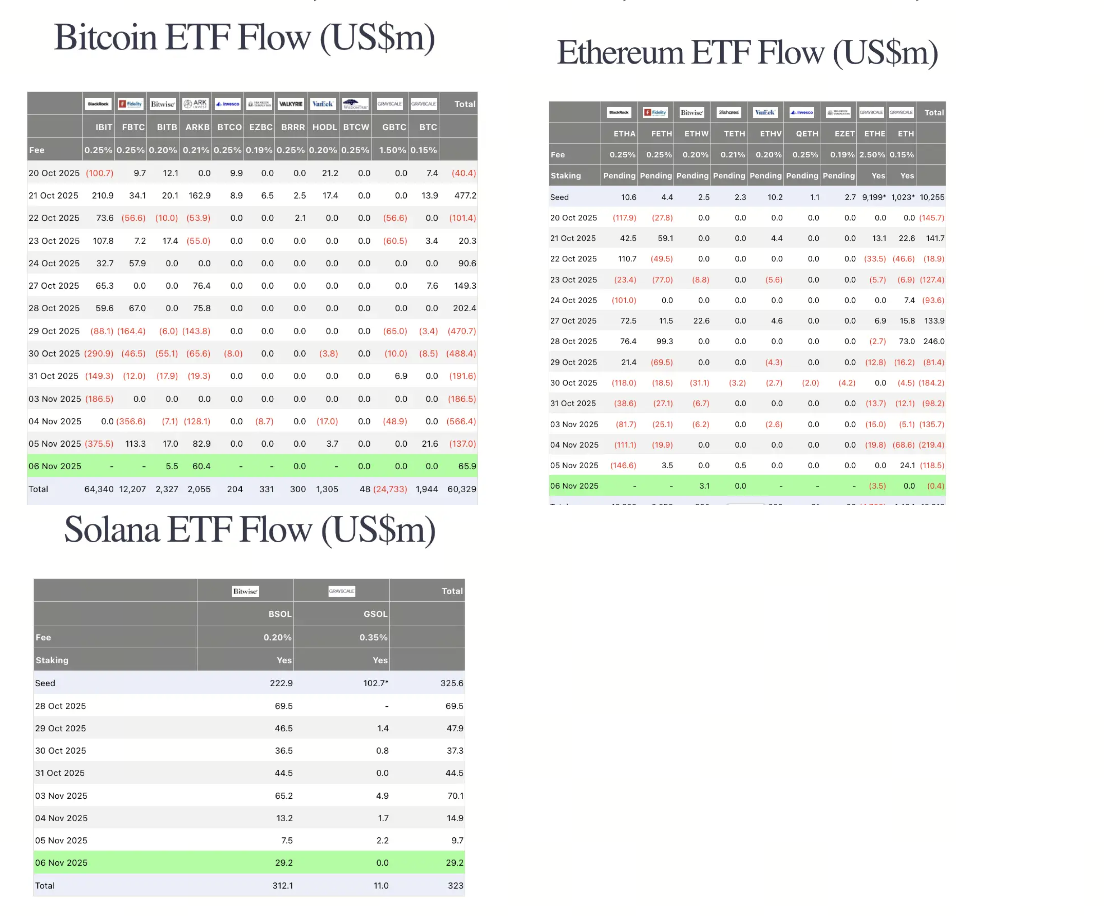

ETF activity stayed weak. On November 5, BTC ETFs saw inflows of $137M, ETH ETFs lost $118.5M, while SOL ETFs gained $9.7M, reflecting continued institutional interest in Solana-related products.

Meanwhile, Tether expanded its Bitcoin reserves by 961 BTC valued at $97.34M, bringing total holdings to 87,290 BTC, worth approximately $8.84B.

Traditional markets

Wall Street ended in the red overnight:

-

The Dow Jones dropped 0.84%

-

The Nasdaq fell 1.90%

-

The S&P 500 declined 1.12%

Tech leaders led losses, with NVIDIA down 3.65% and Tesla down 3.60%.

The 10-year U.S. Treasury yield climbed 0.29% to 4.09%, while the U.S. Dollar Index edged up 0.07% to 99.78. Gold slipped 0.06% to $4,000.35, reflecting continued investor caution across asset classes.

At Xpeng's technology day, its humanoid robot "IRON" captured attention for its lifelike agility, drawing comparisons to Tesla’s Optimus. Meanwhile, Tesla shareholders approved Elon Musk's record $1T compensation plan, reinforcing his ambition to steer Tesla toward AI and robotics expansion.

Macro policy highlights

Recently, at the U.S. Business Forum in Miami, Donald Trump called for renewed leadership in the crypto sector, declaring that "America should become the Bitcoin superpower". He announced an executive order to end the federal "war on crypto" and pledged to establish the United States as the center of global blockchain innovation.

Analysts noted this pivot could signal a friendlier policy environment for crypto markets, potentially supporting risk sentiment ahead of 2025.

Separately, UBS estimated that if the Supreme Court rules Trump's previous tariff policy illegal, the U.S. government could owe $140B in refunds, or roughly 7.9% of the FY2025 budget deficit. This would boost consumer purchasing power and may open space for rate cuts, supporting equities and digital assets alike.

Industry highlights

Institutions remain cautiously optimistic. Liquid Capital founder Yi Lihua forecasted only a 20% chance of deep correction, a 50% chance of range-bound trading, and a 30% chance of a breakout rally toward $5,000 for ETH by year-end. He pointed to the coming policy reopening, rate-cut expectations, and AI sector momentum as potential drivers.

JPMorgan analysts, led by Nikolaos Panigirtzoglou, projected Bitcoin could climb to $170,000 within 6–12 months, citing reduced leverage and improved volatility relative to gold. The report noted that Bitcoin's open interest-to-market cap ratio has normalized following heavy liquidations earlier in October.

On-chain metrics further confirmed accumulation, as whales and issuers like Tether continue to increase exposure despite market fear.

How to start trading Bitcoin

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Alpha watch

Market observers flagged two recurring cycle indicators. Historically, ZEC surges have preceded bear phases, while XRP rallies often signal early bull momentum. XRP's latest $500M fundraising may hint at strategic positioning ahead of broader recovery.

Meanwhile, temporary stablecoin transaction disruptions overnight left many users unable to complete transfers. However, deposits linked to verified KYC accounts are expected to process successfully once network stability returns.

Concluding note

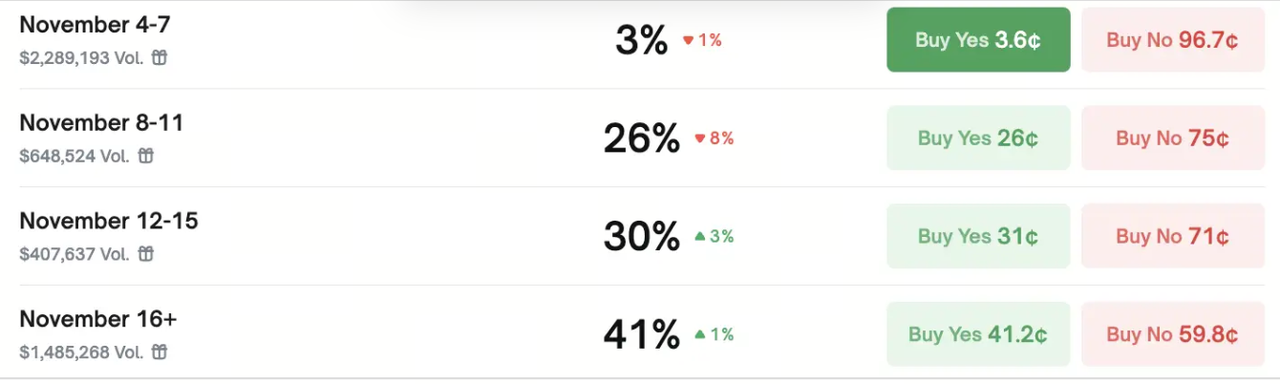

Market sentiment remains muted as investors wait for the government's reopening, likely after November 16.

Until then, liquidity may stay thin and volatility subdued. Yet, with pro-crypto political support rising and institutional accumulation ongoing, the stage is set for a potential rebound once macro uncertainty clears.