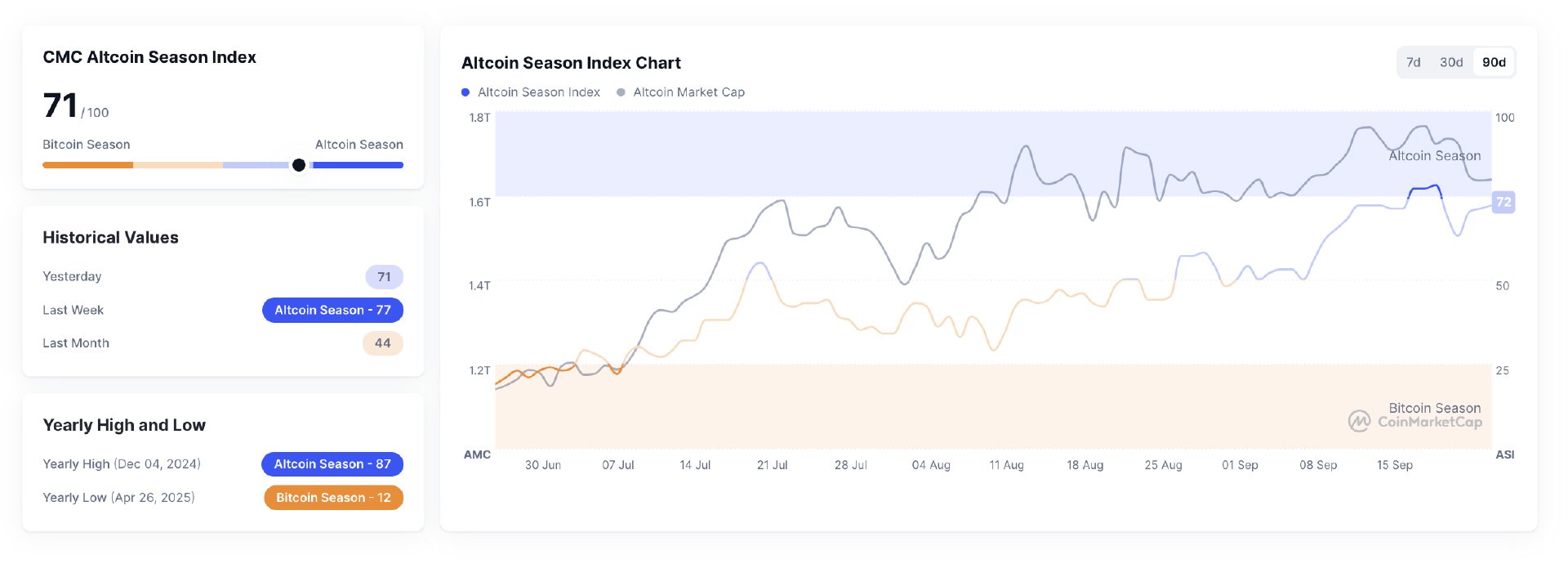

Bitcoin’s market share ticked up, with BTC dominance rising 0.1% to 58.72%, while the Altcoin Index held at 71. That keeps rotation hopes alive even as BTC consolidates.

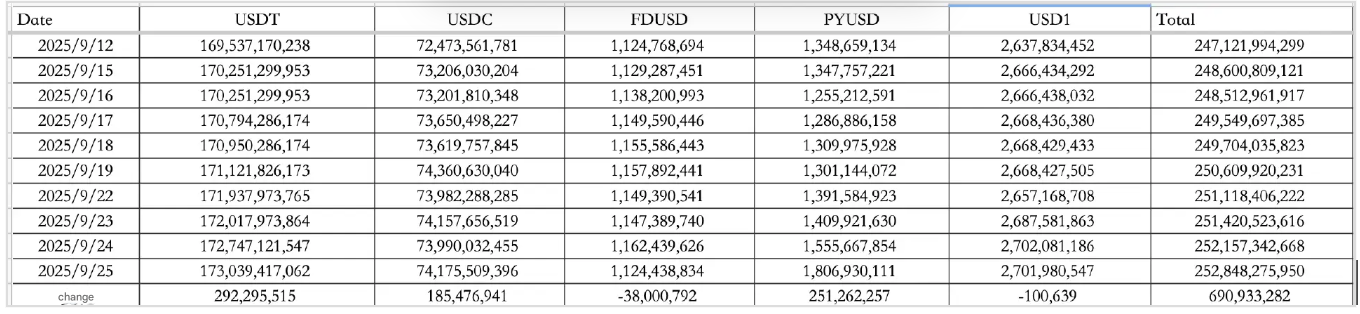

Stablecoins supplied the juice. On September 25, inflows totaled $690.93M, including $292.30M into USDT and $185.48M into USDC, bringing the total supply to $252.845B, another record high.

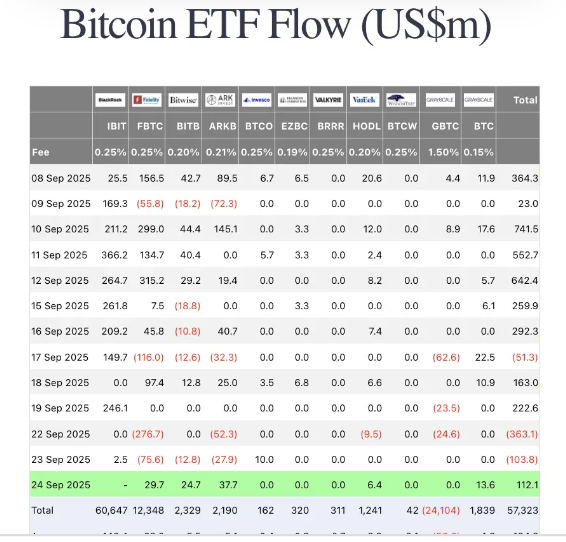

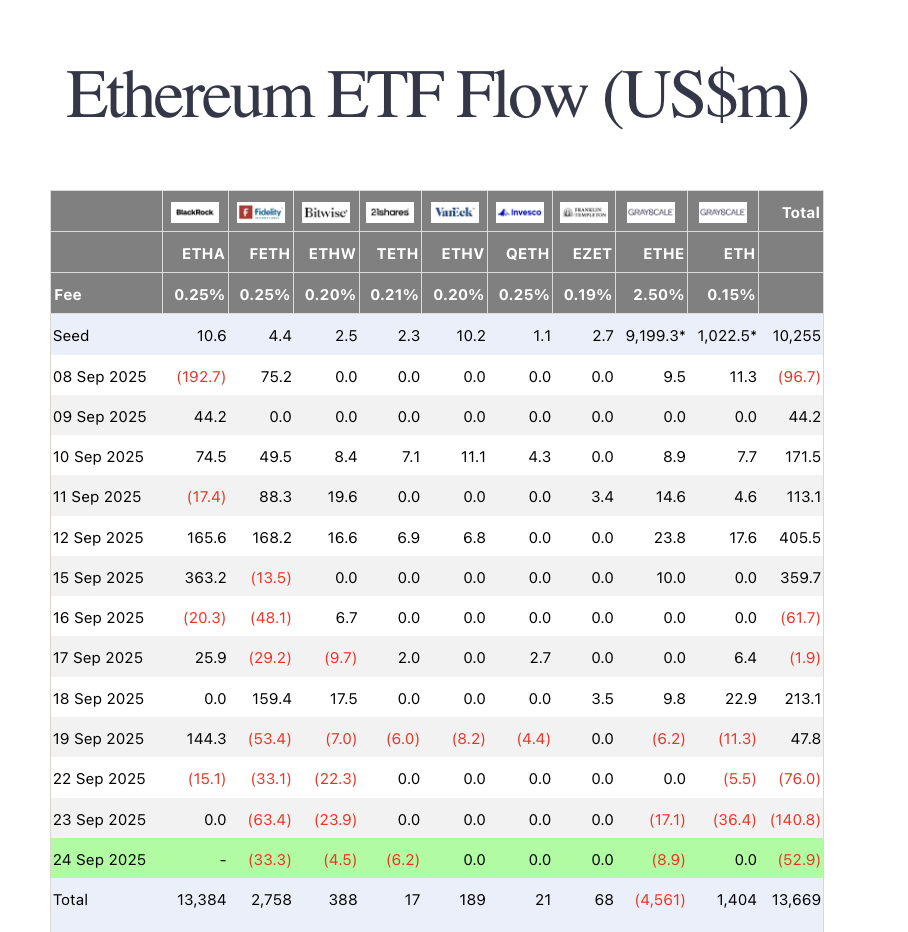

ETF flows split. On the same day, excluding BlackRock prints, BTC ETFs added $112M, while ETH ETFs lost $53M.

Macro and policy

U.S. equities slipped, with the Dow down 0.37%, Nasdaq off 0.33%, and S&P 500 lower by 0.28%. Alibaba stole headlines, jumping 8.19% after announcing a ¥380B ($52B) AI infrastructure push, with its new Qwen3-Max model surpassing GPT-5-Chat in benchmarks

.

Bond markets and the dollar held firm, with the 10-year Treasury at 4.137% and the DXY up 0.64% to 97.81. Gold dropped 0.77% to $3,743.10.

Meanwhile, the U.S. government is staring down its first shutdown since 2018–19. President Trump canceled a key meeting with Democratic leaders, raising risks of a September 30 lapse. Treasury Secretary Bessent added that rates are already “too tight” and need to come down.

Tether’s $500B ambition

Bloomberg reported that Tether is in talks on a deal that could value the stablecoin issuer at $500B, which would make it the world’s most valuable private company.

If closed, the deal would catapult Chairman Giancarlo Devasini’s net worth to nearly $224B, ranking him the fifth richest globally, behind Musk, Ellison, Zuckerberg, and Bezos and ahead of Warren Buffett.

Market movers and industry

Tom Lee called Ethereum the “truly neutral chain,” predicting Wall Street and the White House will favor ETH as the backbone for AI and robotics token economies. He forecast BTC at $200K–$250K and ETH at $10K–$12K by year-end, arguing ETH is entering a “supercycle” lasting up to 15 years.

Meanwhile, CZ’s posts are sparking pumps, with tokens like SafePal (SFP) spiking over 60% after he flagged its portfolio connection.

In the perpetuals race, CZ said “the Perp DEX era has arrived,” pointing to growing participation and long-term survival only for top builders.

Elsewhere, Aster’s daily trading volume hit $33.45B: triple Hype’s, while Hype itself slid from $59 to $44.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Alpha watch

The day’s Alpha board lit up with XPL’s scheduled airdrop. A total of 100M XPL (1% of supply) was distributed proportionally to holders from Aug 20–Sep 24 snapshots, with rewards landing directly in spot accounts starting September 25.

Gate’s XPL Launchpad priced allocations at $0.35 with tiered distribution. Pre-market quotes hovered near $0.70, setting up for 2x day-one liquidity if demand holds.

Elsewhere, Kamino’s PYUSD pools remain subsidized, Melee raised $3.5M to build a Solana-native prediction market, and Aster confirmed Rh-point adjustments to ensure fair airdrop distribution.