Bitcoin’s dominance slipped 0.35% to 58.39%, hinting at a modest cooling in its grip on the market, while the Altcoin Index saw a slight increase to 56.

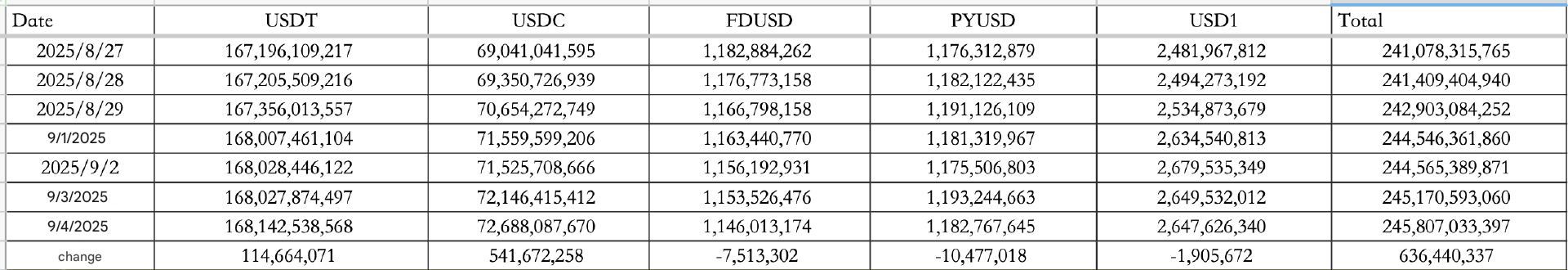

Stablecoin activity was strong on September 4, with net inflows of $636M. USDT contributed $115M and USDC led with $542M, bringing the total stablecoin supply to $245.81B.

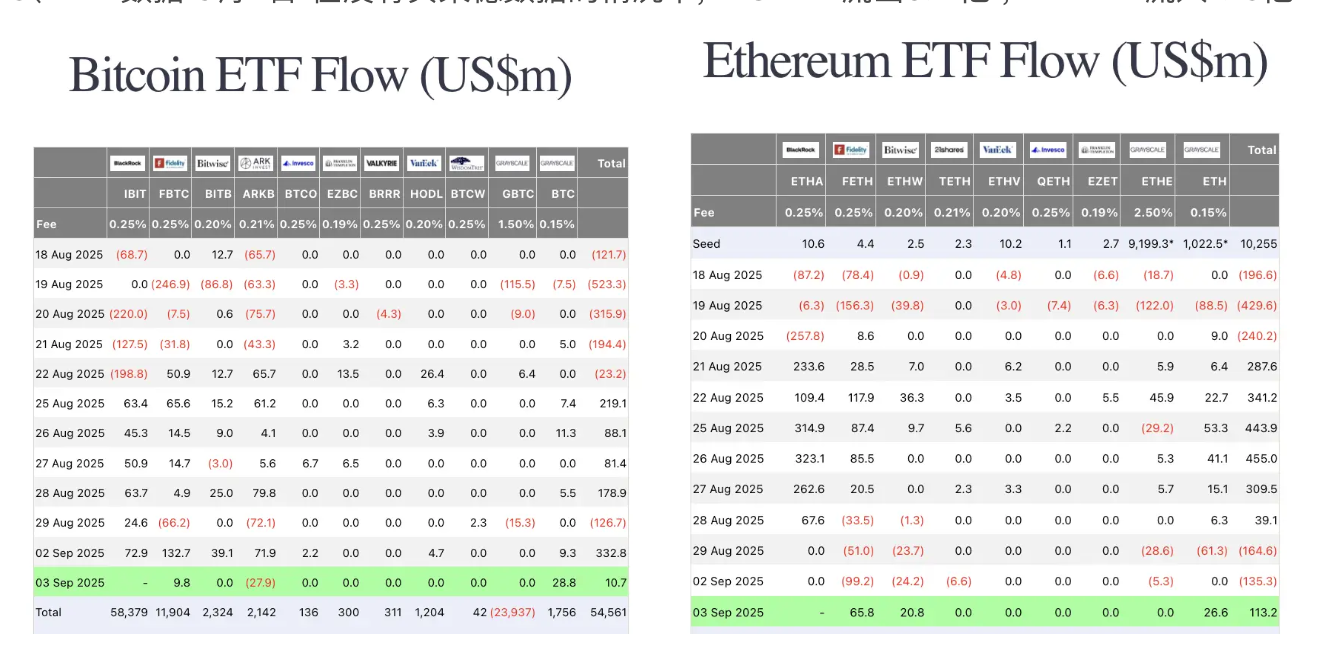

ETF flows were split. Without BlackRock data included, BTC ETFs posted $11 million in outflows while ETH ETFs attracted $113 million in inflows.

ETF flows were split. Without BlackRock data included, BTC ETFs posted $11 million in outflows while ETH ETFs attracted $113 million in inflows.

Macro and policy

U.S. equities closed mixed. The Dow slipped 0.05%, while the Nasdaq gained 1.02%, and the S&P 500 advanced 0.51%. U.S. Treasury yields eased, with the 10-year falling 1.13% to about 4.22%.

The dollar index softened 0.16% to 98.18, while gold climbed 0.78% to $3,561.54.

Ray Dalio of Bridgewater Associates issued a sharp warning in recent interviews. He compared America’s trajectory to the 1930s, cautioning of rising authoritarianism and an unsustainable fiscal deficit. He also likened current risks to a potential “economic heart attack” driven by high debt and servicing costs.

SEC and CFTC greenlight spot trading

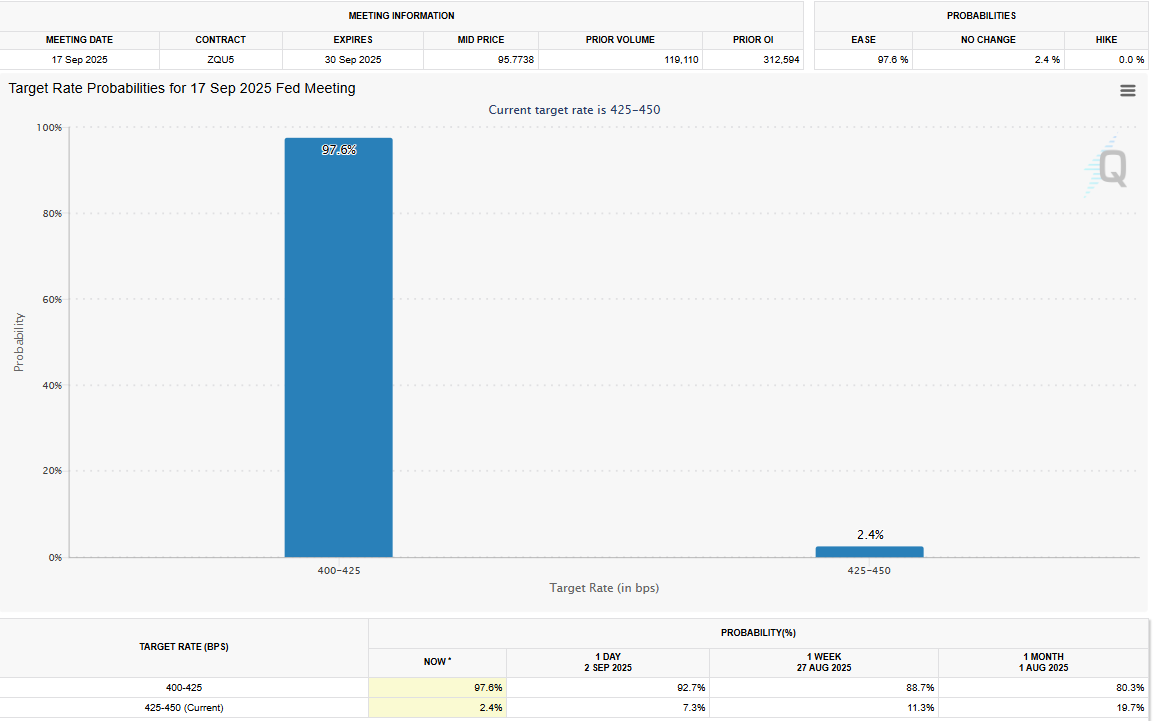

The Federal Reserve remains in focus. July job openings dropped to their lowest level since September 2024, with the openings-to-unemployed ratio falling below 1 for the first time since early 2021.

Markets now price in a 97.6% probability of a 25-basis-point rate cut.

Separately, the Fed announced it will host a conference on DeFi, stablecoins, AI in payments, and financial tokenization.

On the regulatory front, both the SEC and CFTC have approved spot trading for Bitcoin and Ethereum across major U.S. exchanges, a landmark move signaling deepening integration of crypto into traditional markets.

Trump-backed miner makes its market debut

American Bitcoin, backed by Eric Trump and Donald Trump Jr., has completed its merger with Gryphon Digital Mining and is now trading on Nasdaq under the ticker “ABTC.” Donald Trump Jr. hailed the debut as the start of a “new era” for U.S. Bitcoin mining and accumulation.

Galaxy Digital brings tokenized stocks to Solana

Galaxy Digital announced it will launch tokenized $GLXY shares on Solana. This marks the first time a Nasdaq-listed company has registered tokenized stock on a major public blockchain, available to approved KYC investors.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry highlights

Polymarket secured CFTC approval to operate legally in the U.S., giving the prediction market platform a major regulatory win.

In trading circles, attention turned to a trader known as @Techno_Revenant, who once bagged $38.77M from liquidating XPL traders but is now bleeding red.

His 1x long on XPL made up over 70% of all long positions on Hyperliquid and flipped hard. What was a $10M unrealized profit is now a $3.67M floating loss, with his $26M position riding the XPL pullback straight into the danger zone.

Meanwhile, Linea announced that its airdrop claim window will run from September 10 to December 9, with all tokens fully unlocked.