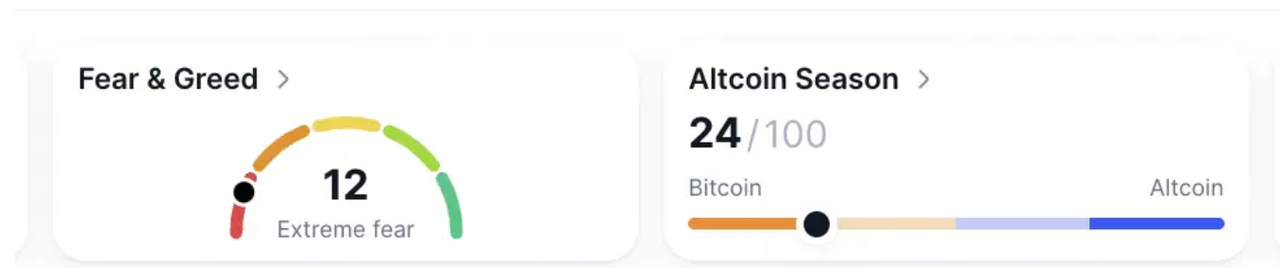

Markets entered the week in extreme fear, with capital showing clear risk aversion.

The Fear and Greed Index printed 12, with the Altcoin index moving to 24. BTC dominance held at 59.29%, and traders continued to allocate defensively.

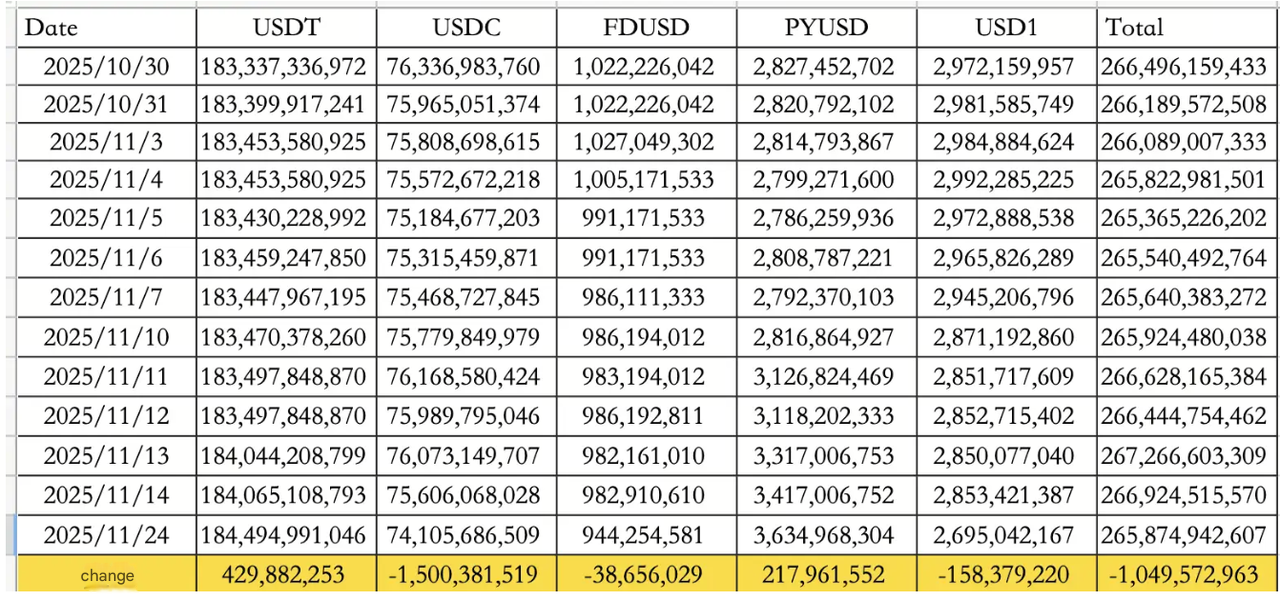

On the other hand, stablecoins posted a sharp $1.05B outflow between November 14 and 24.

USDT saw a mild $429.88M inflow, but this was overshadowed by $1.50B in USDC withdrawals. Total stablecoin supply now stands at $265.87B.

Across social channels, increased attention fell on WLFI and USD1, flagged as the only stablecoins with realistic chances of leapfrog, cross lane growth, a point highlighted by several major investors.

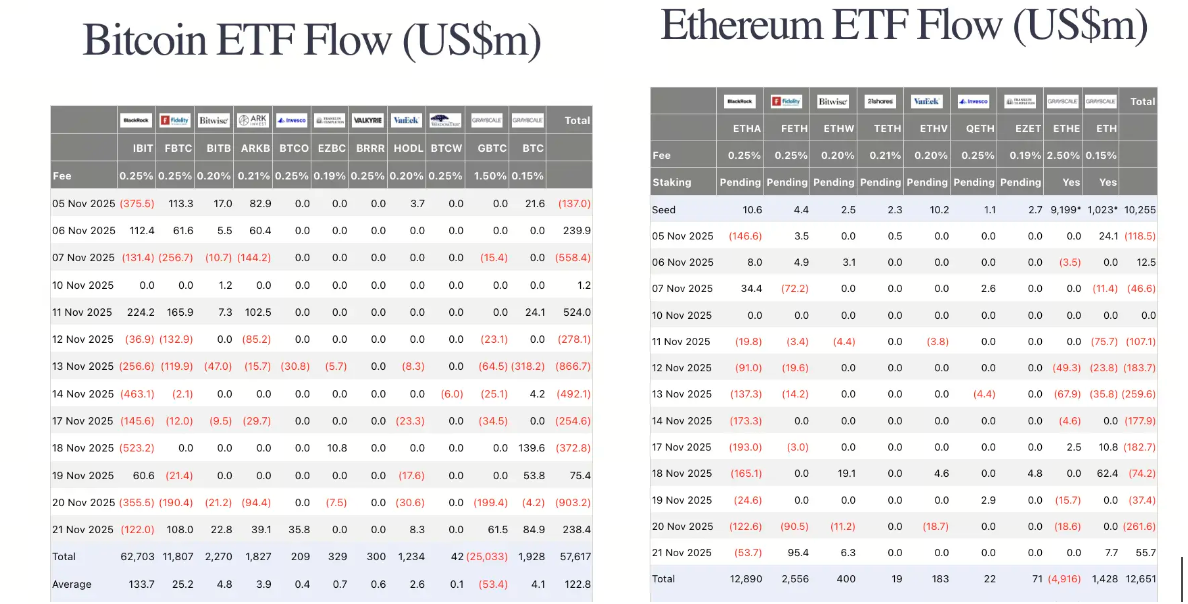

ETF activity remained a bright spot, with BTC ETF recording inflows of $57.62B and ETH ETF recording inflows of $12.65B since the start of November.

Additionally, the US SOL spot ETF recorded 19 consecutive days of inflows since launching on October 28, reaching a cumulative $510M.

Traditional markets

After a volatile week, US equities recovered modestly as dip buyers returned across major indices.

Wall Street:

-

Dow Jones gained 1.08%

-

Nasdaq advanced 0.88%

-

S&P 500 added 0.98%

Bonds and dollar:

The US 10-year Treasury yield declined by 0.47% to 4.07%, while the Dollar Index inched higher by 0.05% to $100.25.

Gold:

Spot gold edged lower by 0.29 %, closing at $4060.70.

Macro policy updates

CME FedWatch data shows rate cut expectations holding firm, with 69.4% probability assigned to the next policy move being a cut.

In Washington, the Treasury reported that the recent government shutdown inflicted $11B in permanent GDP losses. Markets interpreted this as another sign of lingering fiscal fragility, adding caution to short term positioning.

Industry highlights

X officially activated its new always-on location visibility feature, a move that quickly ignited conversations on privacy and OSINT style transparency for public accounts.

Following the sale on a major exchange, Monad confirmed that its mainnet is scheduled to go live next Monday, adding momentum to one of the year's most closely watched emerging ecosystems.

Alpha watch

ARC interaction activity continued through the weekend, with early participants tracking on chain tasks for potential future eligibility.

Separately, trader commentary highlighted a renewed focus on three major sectors:

-

L1 allocation led by ETH

-

BTC and BCH as structural hedges

-

Trading ecosystems anchored by BNB and Aster

One notable remark emphasized WLFI, described as equivalent to USD1 on BNB, calling USD1 the only stablecoin with a realistic shot at cross lane leapfrogging competitors. This narrative gained traction as stablecoin liquidity continued to retreat.

Concluding note

The market sits at an important inflection point. Extreme fear, rising policy uncertainty, and accelerating stablecoin outflows paint a cautious picture. Yet ETF strength, ongoing ecosystem growth, and emerging stablecoin narratives like WLFI and USD1 show that capital is still selectively active.

With the next Fed decision drawing closer and the MSTR MSCI ruling set for January, liquidity conditions will remain the key driver to watch this week.