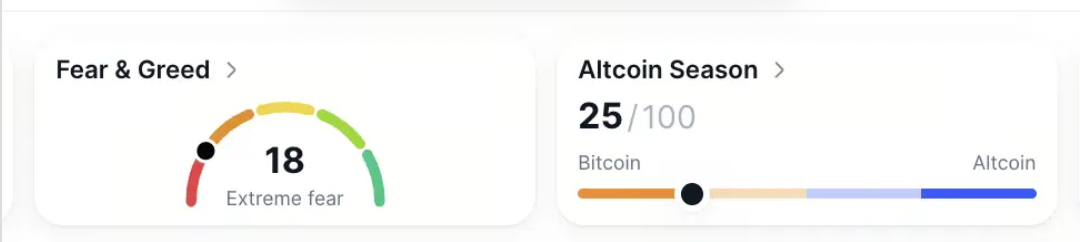

1Markets held steady today as BTC dominance climbed to 59.09%, extending its gradual lead over alternatives despite sentiment staying below 20 on the Fear and Greed Index. The Altcoin Index remained at 25, mirroring broad sentiments of caution.

Stablecoin momentum stood out, adding fresh liquidity while fear held firm.

Total inflows reached $675.36M, led by $568.93M of USDC and $32.75M of USDT, bringing circulating supply to $267.81B.

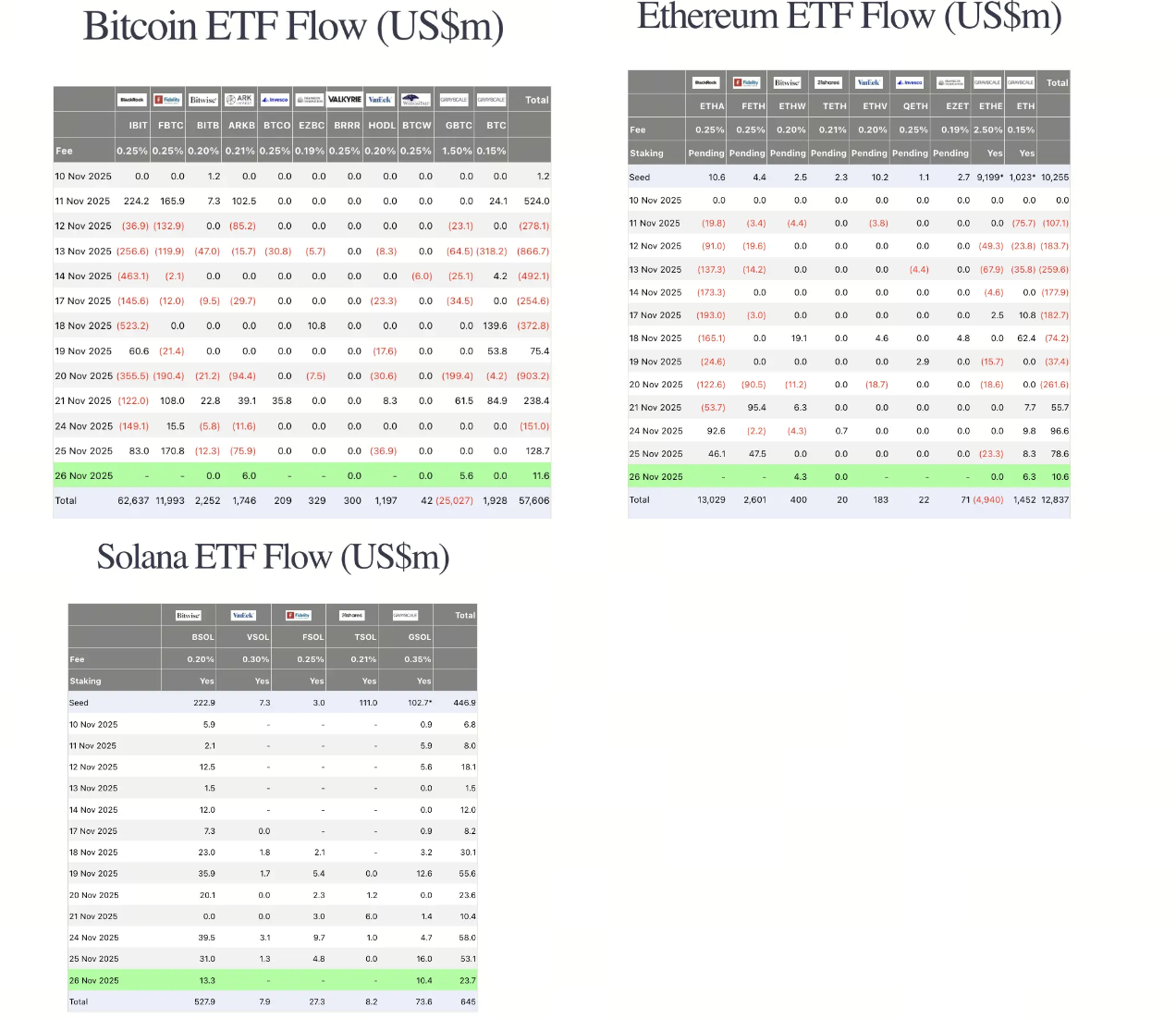

ETF appetite also improved. On 25 November, BTC ETFs recorded $128.7M of inflows, ETH ETFs brought in $78.6M, and SOL ETFs added $53.1M.

A key highlight from the morning session was renewed interest in structured BTC exposure, with multiple institutions beginning to roll out BTC structured products for the first time. This theme appeared repeatedly across research notes today, signalling early-stage demand for derivative-based yield profiles.

Traditional markets

US equities advanced overnight:

-

The Dow Jones up 0.67%

-

The Nasdaq up 0.82%

-

The S&P 500 up 0.69%

Bond yields softened as the 10Y Treasury yield fell to 3.99%, down 0.20%, while the Dollar Index slipped 0.10% to 99.46. Gold eased 0.12% to $4157.17.

Macro policy updates

A notable headline came from S&P Global Ratings, which downgraded Tether's ability to maintain its dollar peg to the lowest tier, warning that sustained BTC volatility could expose collateralisation risks.

While previous assessments were already near the bottom tier, today's adjustment reinforces a structural concern that regulators and policymakers have repeatedly echoed this quarter.

Industry highlights

A standout development came from pump.fun, which publicly refuted rumours of outflows earlier this week.

However, on-chain trackers showed the team moved 75M USDC into a major exchange, bringing their cumulative transfers from 15 November to 480M USDC. Shortly after, 69.26M USDC flowed from the exchange to Circle, the issuer of USDC.

Japan's Metaplanet also returned to the headlines. The firm borrowed additional capital by pledging some of its BTC holdings, bringing its cumulative loans to $230M, which it continues to use to acquire more BTC.

Separately, a major corporate move in Korea caught attention after Naver agreed to acquire Dunamu, operator of Upbit, via an all stock transaction valued at $10.3B.

Alpha watch

A widely circulated interview with Jeff Yass, founder of SIG and a major market maker for Kalshi, resurfaced today, laying out why prediction markets could reshape policymaking. His four core points stood out:

-

Their potential to reduce geopolitical conflict.

-

Their ability to quantify policy decisions.

-

Their relevance to insurance innovation.

-

Their advantage as a counter consensus mechanism .

Prediction markets also received strong commercial validation. Robinhood disclosed that this segment has become one of its fastest growing revenue lines, with 1M+ users trading over 9B contracts since March.

Concluding note

Sentiment may not have budged today, but flows tell a different story. ETFs continue to attract fresh inflows, institutions increased leveraged exposure, and stablecoin supply expanded sharply.

With policy pressure rising around stablecoin oversight and new corporate moves across Asia, markets appear poised for a more active December if volatility picks up from current compressed levels.