Bitcoin held ground, with BTC dominance at 58.23%, while the Altcoin Index is holding at its strongest level yet at 71. That is a clear rotation signal as alts pull flows even as BTC consolidates.

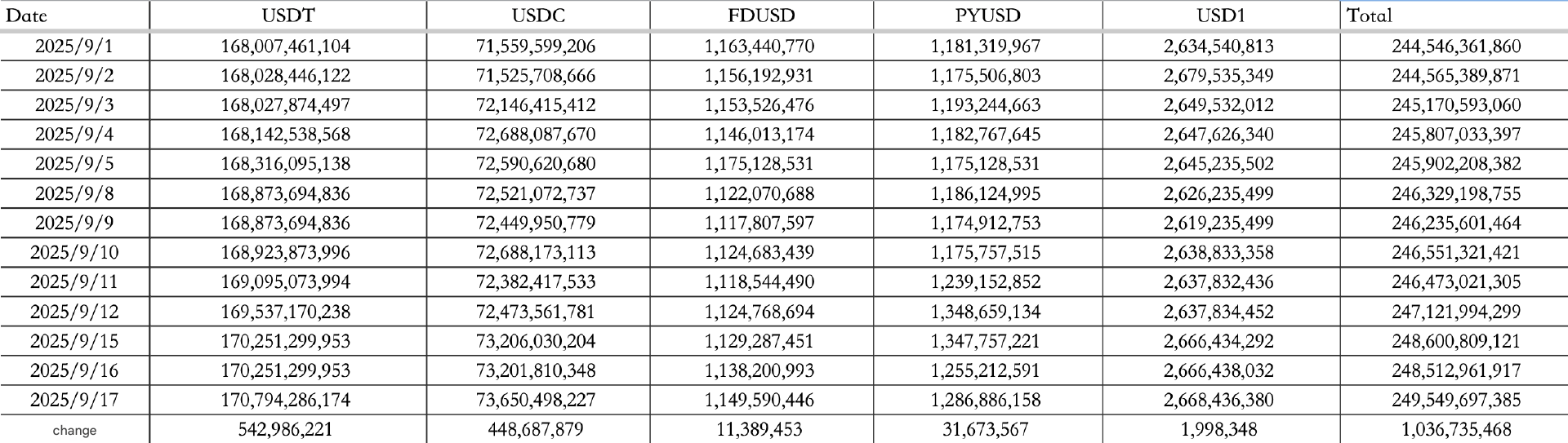

Stablecoins showed major demand. On September 17, inflows hit $1.037B, with $542.98M into USDT and $448.68M into USDC, lifting the total supply to $249.55B.

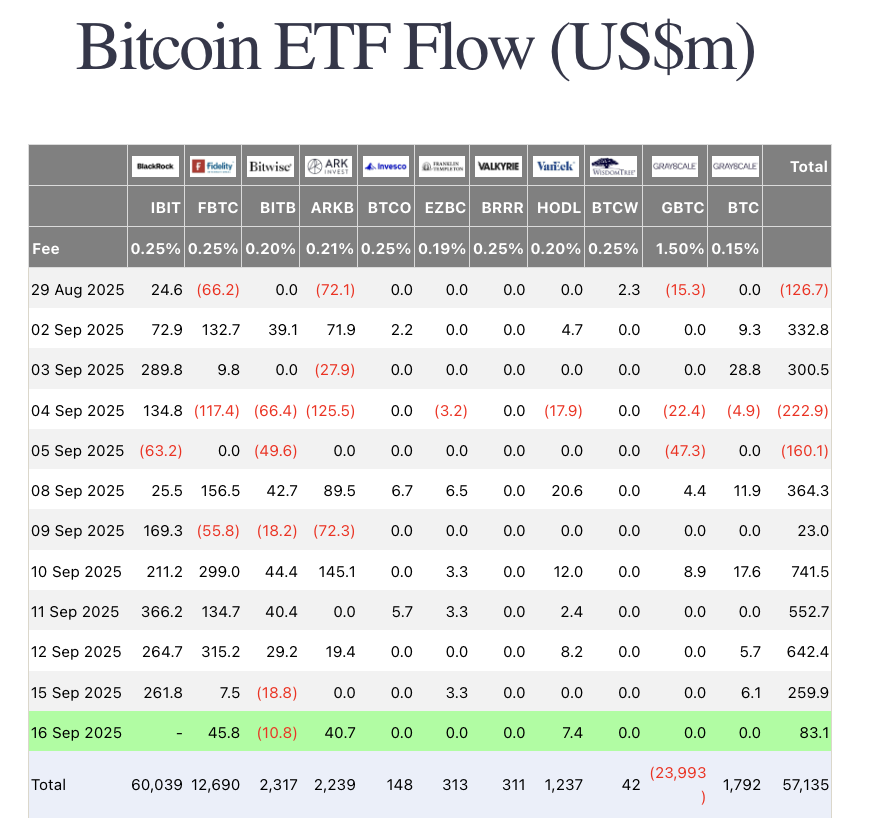

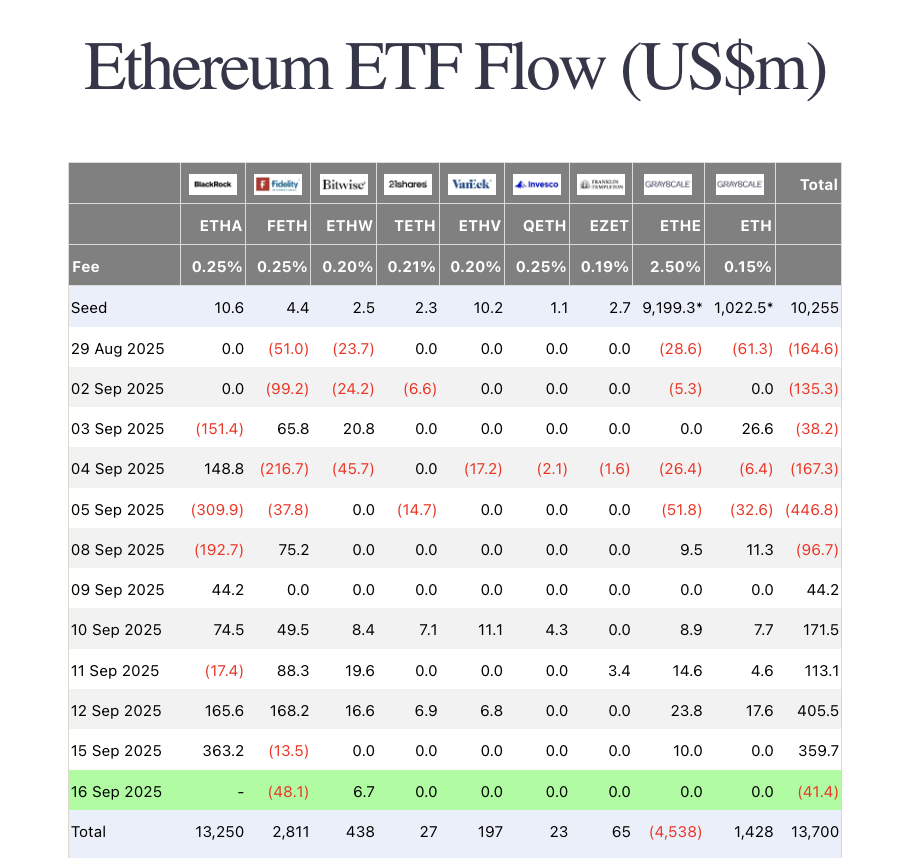

ETF flows split. On September 16, excluding BlackRock’s data, BTC ETFs took in $83.1M, while ETH ETFs saw $41.4M outflows.

Macro and policy

Markets were mixed. The Dow fell 0.27%, Nasdaq slipped 0.07%, and S&P 500 eased 0.13%. Treasuries and the dollar softened, with the 10-year yield down 0.15% to 4.03%, and the DXY off 0.71% to 96.71. Gold gained 0.29% to $3,690.76.

In policy news, Stephen Miran was confirmed as Fed governor, securing one of 12 votes ahead of this month’s critical FOMC meeting.

Solana: treasuries on the march

Solana treasury plays keep stacking. Helius raised $500M in a fresh round backed by Pantera and Summer Capital, with industry heavyweights Li Lin and Zhu Junwei involved.

Forward Industries is not stopping either. Kyle Samani said the firm will raise more capital to expand its Solana vault, aiming to be not just the top Solana treasury but the world’s leading digital asset treasury. Within 5–10 years, Samani wants it listed as a $50B+ permanent capital vehicle.

Current league tables show:

-

Forward Industries (FORD): 6.822M SOL, worth $1.61B.

-

Sharps Technology (STSS): 2.14M SOL, worth $500M.

-

DeFi Development (DFDV): 2.028M SOL, worth $477.1M.

The momentum underscores why Solana has become the focal point for institutional balance sheets.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry highlights

The Plasma vault round sold out in minutes, with 152 wallets splitting a $200M cap, averaging $1.31M per address. Lock-up terms are two months with projected yields of 25–30%, split across XPL, SyrupUSDT, and Plasma DeFi incentives.

Freya Protocol announced that all revenues from its USD1 pools will be matched with buybacks, adding fuel to the stablecoin’s ecosystem.

Elsewhere, Bitget launched its “Unified Exchange (UEX)” concept on its 7th anniversary, pledging to merge CEX, DEX, stocks, ETFs, gold, and FX under one roof.

Alpha watch

Yield hunters flagged Kamino’s PYUSD subsidy program, which is paying 14.89% APY.

Analysts are also rotating research back to edgeX, lighter, and StandX, calling them this cycle’s “perp L2s,” reminiscent of the last bull’s “big four”.

Falcon Finance confirmed the creation of the independent FF Foundation, which will assume full governance over FF tokens.

And in prediction markets, Polymarket launched an earnings product, letting traders bet on whether companies beat or miss profit expectations, without exposure to share price volatility.