Bitcoin nudged higher, with BTC dominance up 1.46% to 58.7 percent, while the Altcoin Index held at 46. Liquidations across majors reached $886M in 24 hours, a reminder of just how levered the tape has become.

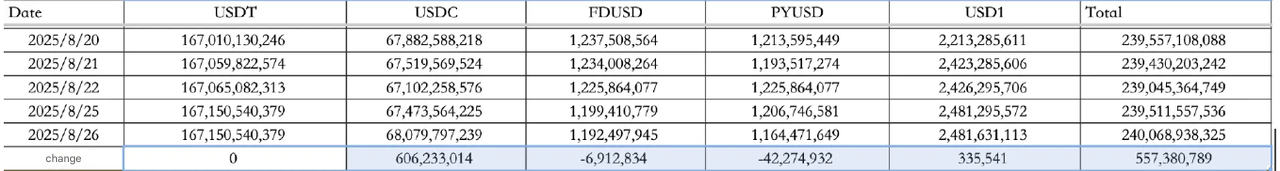

Stablecoin flows offered support. On August 26, the basket saw $557M of inflows, driven by USDC’s $606M gain.

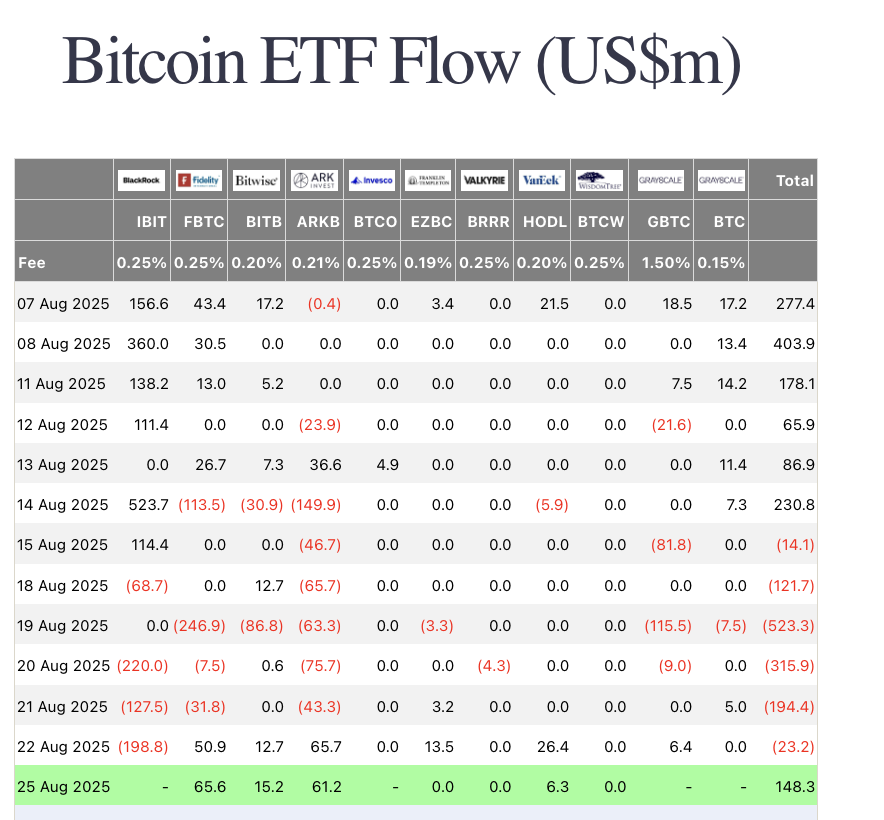

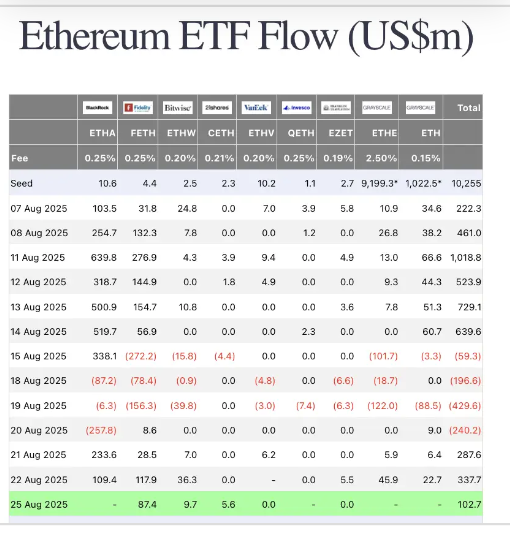

That lifted the total circulating stable supply to $240.069B. ETF prints looked healthy too: on August 25, even without BlackRock numbers, BTC ETFs added $148M and ETH ETFs pulled in $102M.

According to Glassnode data, the cycle timing now runs only 2–3 months behind the 2017 and 2021 peaks. That has cycle-watchers buzzing about whether Q4 will repeat the prior blow-off patterns.

Macro and policy

Trump announced the formal dismissal of Fed Governor Lisa Cook, citing “dishonest conduct in financial matters.” The political optics were messy. Former Treasury Secretary Larry Summers called it “unprecedented” pressure on the independence of U.S. institutions.

Fed-watchers warned it could trigger short-term panic in risk markets, though Nick Timiraos noted the real aim was obvious: pressure to cut rates.

Elsewhere, Trump said the U.S. would no longer allocate new funding for Ukraine. Friday’s core PCE print is the next key macro catalyst.

WLFI unlock mechanics

The WLFI Lockbox is live. Holders can already move allocations into the contract to prepare for unlock. The claim window opens September 1 at 8:00 a.m. Eastern Time, with 20 percent of early allocations available on day one.

The remaining 80 percent will unlock over time. The concern in some corners is that if WLFI trades poorly out of the gate, it could drag down sentiment for the entire “VC coin” basket.

Market movers and whales

A dormant Bitcoin whale moved 269,485 ETH worth $1.25B into the ETH2 beacon chain, staking it for yield. At the same time, one large institution fully exited a July ETH buy: unloading 10,425 ETH for $49.7M USDT, turning $98.3M into $150M in a matter of weeks.

Fidelity published a new digital asset outlook, painting Ethereum as a long-term technology platform with three scenarios:

-

A bull case where smart contracts become global coordination infrastructure.

-

A base case where Ethereum enhances existing systems but faces capped adoption.

-

A bear case where it remains stuck in cyclical speculation.

Solana treasuries form

Bloomberg reported that several funds are raising $1B to build the largest Solana-exclusive treasury, with the Solana Foundation already giving the green light. Sharps Technology also announced an over $400M private placement to establish a Solana vault, and Pantera is raising $1.25B for Solana financial products.

Onchain data shows the FTX/Alameda staking wallet still holds 4.73M SOL, worth $953M, with transfers regularly hitting around the 10th of each month.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry highlights

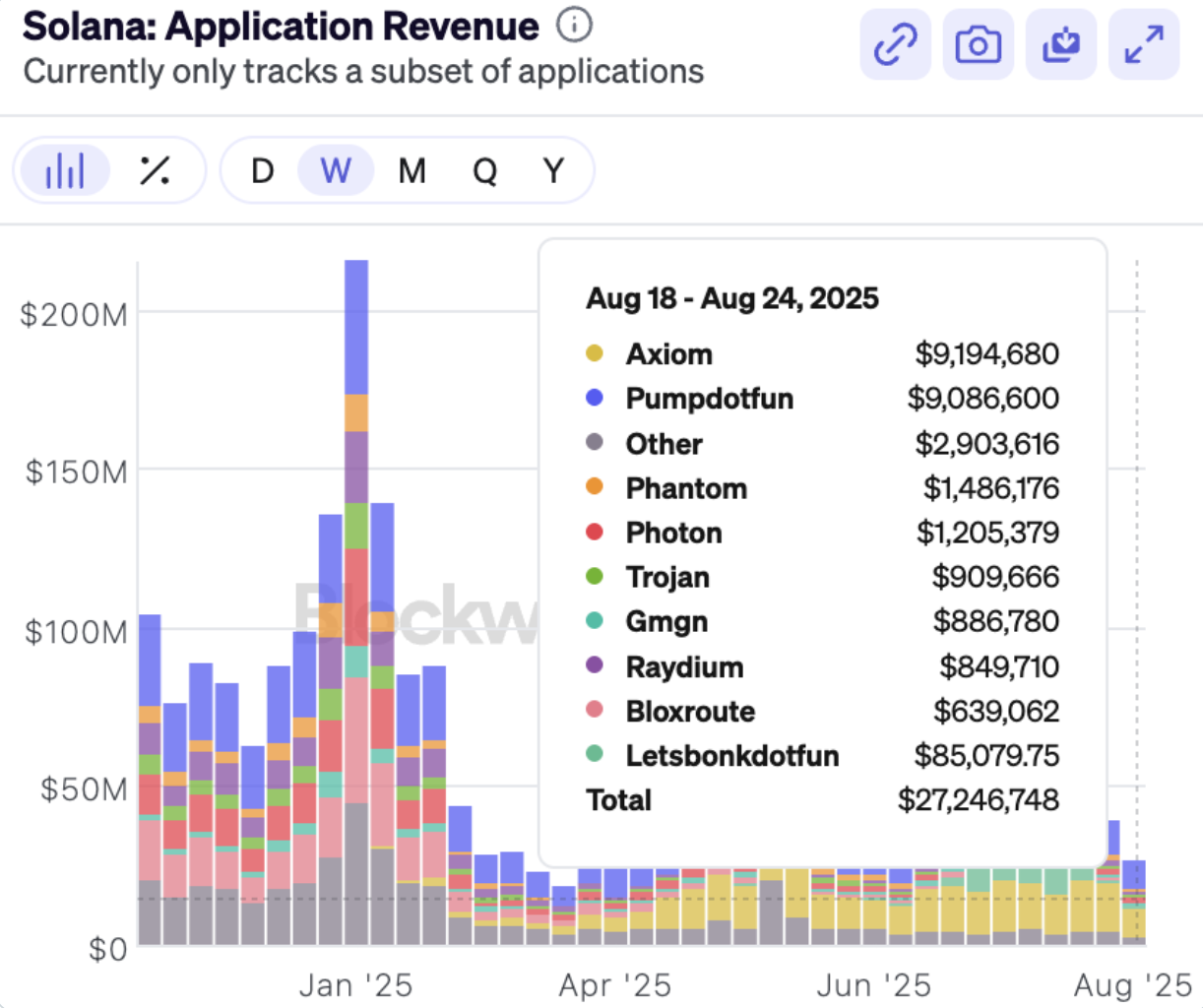

Weekly revenue tallies show memecoin launchboards are still churning. Pump-style platforms earned over $9M each, with one venue accounting for nearly 90% of the total.

Elsewhere, aggregator DEX fees are going live, with 0.85% handling charges applied to meme-pair swaps from August 25.

Alpha watch

Linea’s TGE is imminent. Traders are watching closely because a weak WLFI listing could dent sentiment for VC-backed launches more broadly, but Linea’s fundamentals suggest it has breathing room. Positioning early is seen as optionality, not obligation.

A new football-themed chain game is trending onchain, with early adopters showing gains. Whether it sustains is unclear, but the meta is back in play-to-earn style experiments.

Veteran trader 0xENAS believes the “extended cycle” that began in January 2023 has entered its final stage. He argues marginal global buyers have already capitulated into the market, pushing BTC and ETH to new highs.

With his HTF ETHBTC target of 0.04 already hit, he has flipped his strategy from offensive to defensive. In his words: no more Martingale doubling, even if that means missing the last parabolic runs.

Finally, JLP yield strategies are gaining traction. These liquidity-pool vaults are posting attractive returns with managed leverage, but users caution that the mechanics are complex. Due diligence is required before chasing the headline APYs.