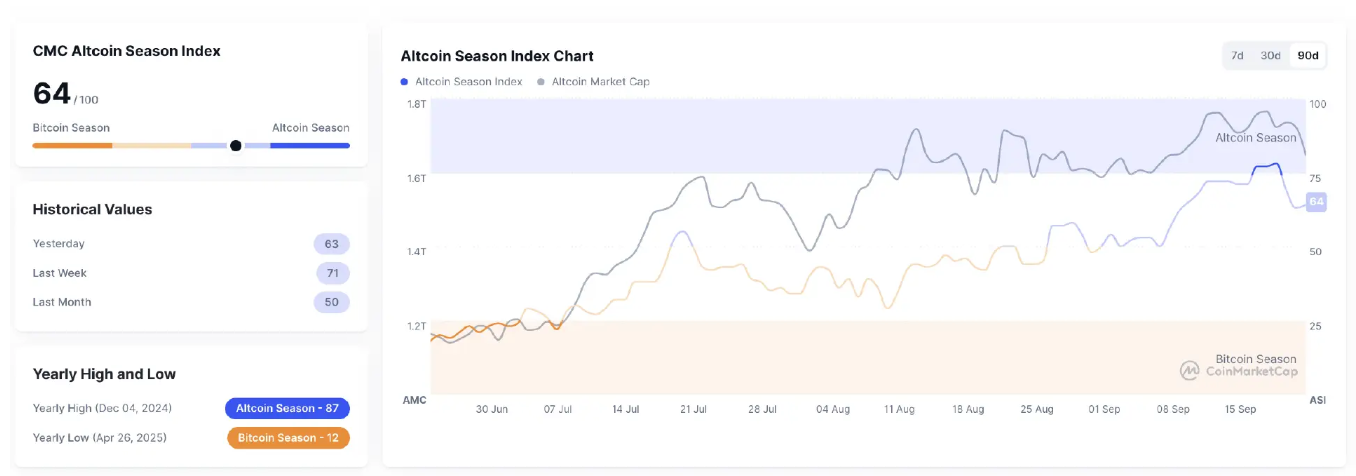

Bitcoin’s share of the market rose, with BTC dominance up 0.94% to 58.51%, while the Altcoin Index hit 64, spiking as high as 78 intraday. That’s the strongest alt reading in weeks, a sign rotation is back in play.

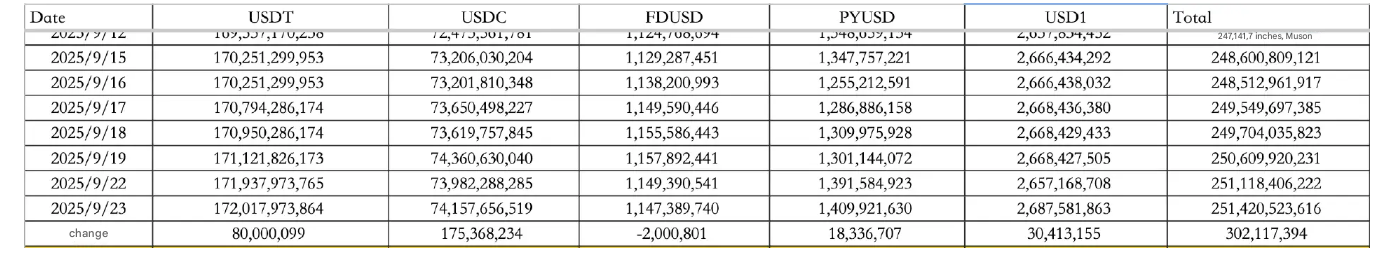

Stablecoins confirmed the momentum. On September 23, inflows totaled $302.12M, with $80M into USDT and $175.37M into USDC, lifting the total supply to $251.421B.

The flipside: liquidations surged. The market saw $1.7B in forced unwindings, the largest single-day wipeout since 2021.

Macro and policy

U.S. equities closed firmer, with the Dow up 0.14%, Nasdaq up 0.70%, and S&P 500 up 0.44%. Treasuries sold off, the 10-year yield up 0.34% to 4.147%, while the dollar index fell to 97.28. Gold spiked 1.8% to $3,753.01 in a two-day surge.

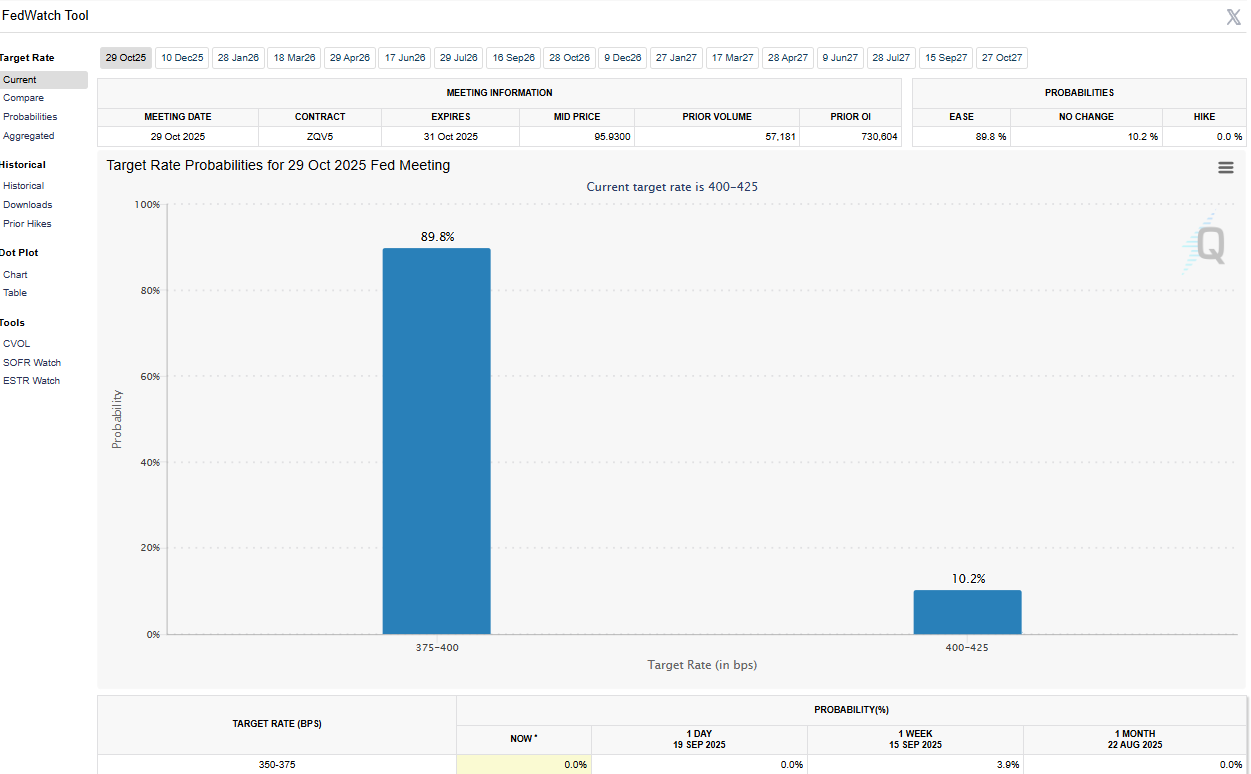

Rate-cut bets remain firm. CME FedWatch data shows an 89.8% chance of a 25 bp cut at the next FOMC meeting.

Elsewhere, the CFTC named Aptos Labs CEO Avery Ching to its Global Market Advisory Committee, a nod to crypto-native representation in U.S. policy discussions.

Solana: treasury momentum builds

Institutional treasury plays continue to cluster around Solana. HSDT announced it now holds 760,190 SOL, with an average cost basis of $231, plus over $335M in cash for future buys.

Separately, Fragmetric Labs and DFDV plan to acquire a Korean-listed company to launch the first Solana treasury in Korea, marking an expansion of the treasury model into Asia.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Institutions and whales

-

Arthur Hayes sold 96,600 HYPE, citing the looming November 2025 linear unlock of 237.8M HYPE tokens, which will release nearly $500M/month for two years. Analysts call it the token’s “Damocles sword”.

-

Metaplanet added 5,419 BTC at $632M, taking its holdings to 25,555 BTC.

Industry highlights

Analysts warn the treasury financing frenzy may have peaked. With treasury company net asset discounts widening, forced selling could trigger chain reactions, especially if BTC retraces sharply.

Meanwhile, an old address that bought 3.624M APX in 2023 for $226K resurfaced, converting them into ASTER tokens now worth $5.62M — a 25x return.

Elsewhere:

-

0G briefly broke $7, with spot premiums hitting nearly 200% in Korea and Binance futures funding rates plunging to -2%.

-

Plasma unveiled “Plasma One,” a stablecoin-backed debit card promising 10%+ yields, 4% cashback, and zero-fee USDT transfers, available in 150 countries.

Alpha watch

-

Aster’s Season 2 airdrop distributes 4% of supply, ending October 5 at 23:59.

-

Kamino’s PYUSD farms continue to attract yield hunters.

-

Stable, a USDT-focused Layer 1, confirmed support for PayPal’s PYUSD stablecoin, with backing from PayPal Ventures.